TIDMBMS

RNS Number : 0902F

Braemar Shipping Services PLC

25 October 2018

BRAEMAR SHIPPING SERVICES PLC

("Braemar", the "Company" or the "Group")

25 October 2018

Unaudited interim results for the six months ended 31 August

2018

Shipbroking and Financial Divisions Driving Growth

Braemar Shipping Services plc (LSE: BMS), a leading

international provider of broking, financial, consultancy,

technical and other services to the shipping, marine, energy,

offshore and insurance industries, today announces unaudited

half-year results for the six months ended 31 August 2018.

Underlying results* Reported results

--------------------------

H1 2018/19 H1 2017/18** Change H1 2018/19 H1 2017/18**

GBPm GBPm % GBPm GBPm

------------------------- ----------- ------------- ------- ----------- -------------

Revenue 71.6 64.5 11% 71.6 64.5

Operating profit/(loss) 2.8 2.5 12% (3.3) 0.7

Profit/(loss) before

tax 2.5 2.3 11% (3.8) 0.5

Earnings/(loss)

per share 6.53p 5.96p 10% (18.71)p 0.18p

Dividend per share 5.0p 5.0p - 5.0p 5.0p

------------------------- ----------- ------------- ------- ----------- -------------

OPERATIONAL KEY POINTS

-- Shipbroking division achieved a strong performance and

increased its forward order book by 5% to $46.0 million from the

year end position. Compared to the first half last year, the

forward order book has grown by 9.5%. Subsequent to the half year,

a dry bulk fleet was successfully delivered.

-- New Financial division performed ahead of management's

expectations, with a good pipeline of sizeable advisory and

refinancing mandates which we expect will bear fruit in the coming

year.

-- Technical division continued to face tough trading,

especially in the Offshore market where recovery was slower than

expected.

-- Logistics division was slightly behind the prior year, after weaker summer activity.

-- Disposal of loss making Braemar Response was successfully

completed on 9 October 2018, after the reporting period, for total

cash consideration of GBP0.8 million.

FINANCIAL KEY POINTS

-- Improving performances in Shipbroking and Financial divisions

continued to drive the Group's underlying trading.

-- Revenue in the first half was GBP71.6 million (interim

2017/18: GBP64.5 million), a rise of 11%.

-- Underlying* operating profit increased by 12% to GBP2.8

million (interim 2017/18: GBP2.5 million), before one-off

acquisition related charges of GBP6.1 million (interim 2017/18:

GBP1.8 million) - the increase relates to the acquisition of

Braemar NAVES in September 2017 and Braemar Atlantic in February

2018.

-- 10% increase in underlying* basic EPS of 6.53p (interim 2017/18: 5.96p).

-- Significant one-off costs incurred in the period predominately due to Board changes.

-- Unchanged interim dividend of 5.0p per share.

* Underlying measures above are before non-recurring specific

items, including acquisition-related charges.

**H1 2017/18 underlying and reported results have been

re-presented to reflect the reclassification of Braemar Response

following the decision to divest the business.

Reconciliation of underlying profit before tax to reported

(loss)/profit before tax:

H1 2018/19 H1 2017/18

Underlying profit before GBP2.5m GBP2.3m

tax

Acquisition related charges GBP(6.1)m GBP(1.8)m

Acquisition related finance GBP(0.2)m -

costs

----------- -----------

Reported (loss)/profit GBP(3.8)m GBP0.5m

before tax

----------- -----------

Acquisition related charges includes costs directly associated

with the purchase of Braemar NAVES Corporate Finance GmbH and

Braemar Atlantic Brokers Securities Holdings Limited as well as the

run off of the equity-based retention programme established during

the acquisition of ACM Shipping Group plc.

David Moorhouse CBE, Chairman of Braemar, commenting on the

results and the outlook said:

"An improving performance in our Shipbroking and Financial

divisions continued to drive the Group's results. We expect a

stronger second half performance compared with the first half of

our financial year supported by an increased forward order book in

Shipbroking and a strong pipeline in our Financial division."

"The changes to the composition of the Group over the last year

make it better equipped to deliver higher value-added services in

cyclical and volatile markets."

"We expect to meet market expectations for the current financial

year, dependent on the timing of certain large shipping finance

projects concluding during the period, as currently planned."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, contact:

Braemar Shipping Services

James Kidwell, Chief Executive Tel +44 (0) 20 3142 4100

James Hayward, Interim Finance Director Tel +44 (0) 20 3142 4100

Stockdale Securities

Robert Finlay / Antonio Bossi / Henry Tel +44 (0) 20 7601 6100

Willcocks

Buchanan

Charles Ryland / Stephanie Watson Tel +44 (0) 20 7466 5000

/ Matilda Abraham

Notes to Editors:

Alternative Profit Measures ("APMs")

Braemar uses APMs as key financial indicators to assess the

underlying performance of the Group. Management considers the APMs

used by the Group to better reflect business performance and

provide useful information to investors and other interested

parties. Our APMs include underlying operating profit and

underlying earnings per share. Explanations of these terms and

their calculation are shown in summary above and in detail in our

Operating and Financial Review.

About Braemar Shipping Services plc

Braemar Shipping Services plc is a leading international

provider of knowledge and skill-based services to the shipping,

marine, energy, offshore and insurance industries. Founded in 1972,

Braemar employs approximately 750 people in more than 60 locations

worldwide across its Shipbroking, Technical, Logistics and

Financial divisions.

Braemar joined the Official List of the London Stock Exchange in

November 1997 and trades under the symbol BMS.

For more information, including our investor presentation, visit

www.braemar.com

INTERIM ANNOUNCEMENT - SIX MONTHSED 31 AUGUST 2018

CHAIRMAN'S STATEMENT

Results

An improving performance in our Shipbroking and Financial

divisions continues to drive the Group's improving results,

partially offset by the Technical division where recovery was slow.

Revenue for the period increased 11% to GBP71.6 million compared

with GBP64.5 million in the first half of 2017/18. Underlying

operating profit from continuing operations was up by 12% to GBP2.8

million compared with GBP2.5 million in the first half of 2017/18.

The reported loss before tax was GBP3.8 million compared with a

profit of GBP0.5 million in the first half of 2017/18, which

reflects the recognition of deferred accounting charges following

the Group's acquisitions of Braemar NAVES and Braemar Atlantic

which completed in the prior year. Underlying earnings per share

grew 10% to 6.53 pence compared with 5.96 pence in the first half

of 2017/18 and the reported loss per share was 18.71 pence compared

with earnings of 0.18 pence per share in the first half of

2017/18.

Trading

The Shipbroking division achieved a solid performance during the

first half of 2018/19. Revenue increased by 14% versus the same

period in the prior year, with underlying operating profit also up

14%. Our forward order book has increased by $2.0 million since the

start of the year, and this along with the successful sale of a

fleet in September is expected to underpin our full year

performance.

The Financial division performed ahead of management's

expectations and has an encouraging pipeline of mandates. The

division is increasingly involved in advisory and refinancing

business, with less demand for restructuring services. This gives

rise to enhanced upside potential driven by material success fees,

which is likely to make the division's results fluctuate more than

has generally been the case.

The Technical division reported an underlying operating loss of

GBP0.7 million versus a loss in the comparative period of GBP0.2

million and a full year profit of GBP0.7 million in 2017/18. We

expected a more sustained market recovery, which has yet to be

evident, especially in the Offshore industry. We are working on

ways to improve the financial performance.

The Logistics division delivered a profit for the period

slightly below the equivalent 2017/18 period, reflecting a quieter

market over the summer.

Dividend

The Board has declared an interim dividend of 5.0 pence per

share (Full year 2017/18: 15.0p). The interim dividend will be paid

on Friday 14 December 2018 to shareholders on the register at the

close of business on Friday 2 November 2018. The last date for

Dividend Reinvestment Plan (DRIP) elections will be Friday 23

November 2018.

Board of Directors

As announced on 5 September 2018, Mark Tracey stood down from

the board of directors effective from 26 September 2018. The Board

would like to thank Mark for his contribution to Braemar.

As I announced on 3 October 2018, I intend to stand down on 31

December 2018. The Nominations Committee is leading the process to

appoint a new non-executive Chairman and an announcement will be

made in due course.

Colleagues

The calibre of our people is at the centre of what we do and it

is their hard work and creativity that enables Braemar to build our

brand and reputation to develop our business. The Board would like

to thank our staff for their efforts on behalf of the Group.

Outlook

The changes that the management team has made to the composition

of the Group over the last year make it better equipped to deliver

higher value-added services in cyclical and volatile markets.

We expect to meet market expectations for the current financial

year, dependent on the timing of certain large shipping finance

projects concluding during the period, as currently planned.

David Moorhouse CBE

Chairman

24 October 2018

OPERATING AND FINANCIAL REVIEW

The trading performance in our major business units for the six

months ended 31 August 2018 is detailed below.

SHIPBROKING

H1 2018/19 H1 2017/18 FY 2017/18

--------------------- ---------------- ---------------- ---------------

Revenue GBP34.7 million GBP30.4 million GBP61.8 million

Underlying operating GBP3.9 million GBP3.5 million GBP7.7 million

profit

The Shipbroking division performed well during the first half

with most sectors being more profitable compared with the same

period last year.

The physical broking markets continued to be characterised by

historically low tanker and offshore rates and a healthy

improvement in the dry cargo market. Our total forward order book

grew to $46.0 million from $44.0 million at the start of the year.

Approximately $21.7 million of this is deliverable in the second

half of the year.

We are starting to see the benefits from our strategic broking

recruitment in dry cargo, securities and specialised tankers and

intend to continue recruiting selectively to further enhance the

business.

Tankers

As expected, tanker freight rates remained low during our first

half. Although the number of vessels scrapped increased, the market

remained over-tonnaged which continued to suppress freight rates.

The upcoming 2020 low sulphur fuel regulations for ships means we

are seeing upgrades to refineries and we believe it is likely that

this will translate into new shipping opportunities.

Within the last few weeks, VLCC rates have increased

significantly. The initial catalyst was bad weather, but the fact

that long term rates have risen is indicative of other factors,

such as an increase in OPEC production and the re-imposition of

Iranian sanctions for which replacement barrels will increase tonne

miles.

The LNG tanker market saw a significant recovery in spot freight

rates as new production comes on stream. Demand for shipping is

likely to exceed available tonnage over the next few years,

although the number of speculative orders for newbuilds for beyond

2020 is expected to re-balance the market over time.

The LPG market experienced further deliveries of new tonnage,

which continued to put pressure on freight rates and restrict the

demand for time charters. However our teams performed well, holding

their fixing volumes and earnings.

The chemical tanker market has experienced a slowdown over

recent months with a tonnage surplus on many routes. Arbitrage

windows gave short-lived regional opportunities, but not enough to

sustain increased freight rates. However, we are witnessing

increased activity after a difficult summer, indicating a more

positive outlook and some charterers are already considering longer

term contracts.

Offshore

The market continued to be impacted by vessel overcapacity and

low global oil and gas exploration activity. The higher oil price

is taking time to drive increased spend in exploration and

production although we are seeing more enquiries. If the oil price

remains stable at these levels, then we expect more projects to

commence, which should improve demand.

Dry Cargo

The dry cargo market rose significantly during the last six

months with the Baltic Dry Index ("BDI") moving from 1,192 points

at the end of February 2018 to 1,597 at the end of August 2018, a

rise of 34%. This growth has been predominantly in the Capesize

sector, which is mostly associated with shipments of iron ore to

China. Commodity demand remains strong across the various sectors,

especially in the minor bulks. Chinese domestic iron ore production

has declined significantly, replaced by higher grade ore from

Australia and Brazil which has stimulated demand for Cape

shipping.

New building deliveries across all vessel sizes were lower but

these are forecast to increase in 2019 and 2020 when recent

ordering is delivered.

Sale and Purchase

The team concluded a higher volume of second hand and demolition

vessel transactions at a higher average commission compared to the

same period last year. As expected, most vessel sales were dry bulk

carriers reflecting the upward trend in that market.

Our second half will benefit from the delivery of a fleet of 13

dry bulk vessels which completed in September and October 2018.

Despite weak tanker freight rates, which led to a reduced number of

quality tanker vessels being sold, our team managed to increase

tanker Sale and Purchase activity compared with last year.

The challenges facing the shipyards have meant that the total

number of new build orders placed so far this year have been

significantly lower compared with last year, but despite this, we

have secured multiple VLCC new builds adding to our forward order

book.

Demolition sales for the period were similar to last year.

Securities

Atlantic Brokers Holdings Limited, which was acquired at the end

of the last financial year, was successfully integrated as a

regulated coal desk, Braemar Atlantic Securities. The subsequent

addition of a dry Forward Freight Agreement ("FFA") broking team

further complemented our broking services and the desk now has a

team of 12 brokers across coal and dry FFAs.

The dry FFA derivatives market grew as the physical market

improved. However, the coal derivative market has been relatively

subdued so far this year. We continue to be the leading physical

broker for certain markets.

FINANCIAL

FY 2017/18

H1 2018/19 H1 2017/18 (5 months)

--------------------- --------------- ------------ ---------------

Revenue: GBP4.4 million - GBP3.7 million

Underlying operating GBP1.7 million - GBP1.8 million

profit:

Braemar's newest division, Financial, was created following the

acquisition of NAVES in September 2017. The business provides

maritime related corporate finance advice to international clients

covering finance advisory, M&A, asset brokerage,

interim/pre-insolvency management and financial management

including loan servicing.

The division performed ahead of our expectations, adding

significant value to the Group as a whole. The division shifted the

mix of its business towards more refinancing and financial advisory

work, with less emphasis on its traditional restructuring business.

We are optimistic for the next 12 months as the positioning of the

division in the international markets has been successful and the

advisory work on behalf of large buyers of shipping loan portfolios

offers significant potential for further transaction activity.

The division has completed a record first six months of revenue

and the positioning of the firm increased significantly through the

successful completion of high profile refinancing transactions,

where it worked in conjunction with the Shipbroking and Technical

divisions in order to provide a full-service shipping offering. Our

new London office is integrating well with the wider Group and we

are establishing a presence for the Financial division in

Singapore.

TECHNICAL

H1 2018/19 H1 2017/18 FY 2017/18

--------------------- ----------------- ----------------- ----------------

Revenue: GBP16.7 million GBP17.7 million GBP34.6 million

Underlying operating GBP(0.7) million GBP(0.2) million GBP0.7 million

(loss)/profit:

The markets that the Technical Services businesses operate in

continue to be tough, and the division reported a trading loss for

the six months to 31 August 2018. The results across the division's

business lines have been quite variable. Notably, we are not yet

seeing any significant increase in activity in the Energy

Exploration and Production sectors following the recent increase in

the oil price, which is a driver of demand for our Offshore

business.

We expect to see an improvement in performance in the second

half of the year, driven by a mix of recent contract awards,

continued cost management and selective recruitment.

The performance of the division in the first half of 2018/19 by

business line was as follows:

Adjusting

Braemar Adjusting, our energy loss adjusting business, continued

to perform well, with an encouraging volume of new claims being

awarded, despite the low level of overall incidents reported.

Performance in the Far East continued to exceed expectations and

other offices performed largely in line with the prior period. We

are continuing to recruit personnel with complementary skillsets to

broaden the level of expertise.

Marine

Braemar Marine, which specialises in hull and machinery damage

surveying and marine consultancy, experienced a fall in turnover

and underlying trading in the period. The level of casualty claims

in the Marine sector has declined and has impacted this division's

performance. Some encouraging project awards in the UK and improved

activity in the USA were offset by lower activity levels in the

Middle East and in Asia.

Engineering

Braemar Engineering, our consultant engineering and naval

architecture business, is project orientated (mainly in the LNG

sector) and saw an improvement in trading activity compared with

the first half of 2017/18. The team successfully concluded the

newbuild supervision of an LNG carrier, working in conjunction with

our shipbroking team, and has an interesting pipeline of projects

and potential opportunities.

Offshore

Braemar Offshore, our marine warranty surveying and engineering

consultancy business located in the Asia Pacific region, continued

to be adversely affected by project delays and very competitive

pricing, in common with all regional service providers to the

energy sector. This has impacted both the level of activity and

average fees for Braemar Offshore. Mobile rig activity levels are

continuing to show approximately 55% utilisation, although there

was a slight increase within the last few months. Some recent

contract wins are anticipated to deliver an improved performance in

the mid-term, and we are managing costs to improve results.

LOGISTICS

H1 2018/19 H1 2017/18 FY 2017/18

--------------------- ---------------- ---------------- ----------------

Revenue: GBP15.9 million GBP16.4 million GBP33.2 million

Underlying operating GBP0.5 million GBP0.6 million GBP0.8 million

profit:

Port Agency

Trading was in line with expectations and we retained our

position as market leader in the UK, with a particularly good

performance from our global hub management operations. Overseas, we

established two new offices (Gibraltar and New Jersey), the set up

costs of which were borne in the first half. We anticipate that the

second half of the year will show an improved performance as these

offices start to deliver.

Freight Forwarding

Revenue fell short of our expectations with reduced activity

across several key clients as well as operational issues in the

Port of Felixstowe. We won new business from a number of customers

who came on stream late in our first half, which should deliver

more in the key trading period up to Christmas.

OTHER OPERATING COSTS

Central costs H1 2018/19 H1 2017/18 FY 2017/18

--------------- ----------------- ----------------- -----------------

Central costs: GBP(2.6) million GBP(1.4) million GBP(2.9) million

The Group incurred costs of GBP0.2 million in the period as a

result of one-off IT consulting costs.

Central costs include GBP0.8 million of one-off costs related to

Board changes. Following a competitive tender process in September

and October 2018, the Group intend to appoint BDO as their external

auditor for the year ending 28 February 2019.

Specific items H1 2018/19 H1 2017/18 FY 2017/18

---------------------- ----------------- ----------------- -----------------

Acquisition-related GBP(9.1) million

charges GBP(6.1) million GBP(1.8) million

We have separately identified certain items that are not part of

the ongoing trade of the Group. These specific items are material

in both size and/or nature and we believe may distort understanding

of the underlying performance of the business. The majority of

these costs relate to acquisitions completed in previous financial

years. These are primarily non-cash and driven by the accounting

requirements of IFRS 3, Business Combinations.

The Group incurred GBP4.4 million of costs which are directly

linked to the acquisition of Braemar NAVES. They include GBP0.9

million of intangible asset amortisation and GBP3.5 million of

non-cash post-acquisition consideration payable to certain sellers

under the terms of the acquisition agreement. The Braemar NAVES

acquisition agreement included substantial payments to the working

vendors which are conditional on their continuing employment.

The Group also incurred GBP1.4 million of costs directly linked

to the acquisition of Braemar Atlantic. GBP1.3 million of this

relates to consideration paid on the completion date which is

charged to the Income Statement over a three year claw-back

period.

Foreign exchange

The US dollar exchange rate relative to sterling strengthened

from US$1.40/GBP1 at 1 March 2018 to US$1.30/GBP1 at 31 August

2018. A significant proportion of the Group's revenue is earned in

US dollars.

At 31 August 2018, the Group held forward currency contracts to

sell US$11.5 million at an average rate of $1.3937:GBP1 and options

over a further US$11.5 million at an average rate of

$1.3937:GBP1.

Balance sheet

Net assets at 31 August 2018 were GBP83.8 million (31 August

2017: GBP97.0 million; 28 February 2018: GBP93.7 million). The

Group paid dividends totalling GBP3.1 million in the period and

purchased 250,000 shares at a cost of GBP0.6 million into its

Employee Share Ownership Plan.

Trade and other receivables increased by GBP6.4 million to

GBP59.0 million compared with GBP52.6 million at 28 February 2018.

Trade and other payables have increased by GBP4.5 million to

GBP45.9 million compared to GBP41.5 million at 28 February

2018.

The Group continued to invest in global IT infrastructure with

our focus being on improved business management tools to facilitate

cross business working and improved client service. In the period,

the Group capitalised GBP0.9 million of property, plant &

equipment and computer software (31 August 2017: GBP0.4

million).

Borrowings and cash

At the balance sheet date, the Group had bank facilities

totalling GBP40.0 million, made up of a revolving credit facility

of GBP25.0 million and an accordion facility of GBP15.0 million

provided by HSBC. The Group also has access to global cash

management arrangements, notably in our regional hubs of UK,

Germany and Singapore.

Net debt (excluding convertible loan notes) was GBP9.3 million

at 31 August 2018 compared with net cash of GBP6.2 million at 31

August 2017 and net debt of GBP2.4 million at 28 February 2018.

We would expect the second half of the year to generate more

cash from underlying operations than the first half due to the

timing of bonus and dividend payments.

Disposal of discontinued operation

On 9 October 2018 and after the reporting date, the Group

successfully concluded the sale of Braemar Response which was loss

making and which has been accounted for under discontinued

operations for the period. The consideration for the disposal

comprises an initial cash payment of GBP0.4 million with a further

GBP0.4 million payable twelve months from the date of

completion.

Taxation

The effective underlying rate of corporation tax on profits was

20.0% (interim 2017/18: 22.5%). The effective rate of tax is higher

than the UK standard rate of corporation tax as a result of

disallowed business expenses, the effect of tax deducted on

repatriating cash from overseas and higher overseas corporate tax

rates.

Braemar Shipping Services plc

Condensed Consolidated Income Statement

Period ended 31 Period ended 31 August

August 2018 2017

unaudited unaudited Year ended

28 Feb

Specific Specific 2018 Audited

Underlying items Total Underlying items Total Total

Continuing GBP'000 GBP'000

operations Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ------ ----------- ---------- ---------- --------------- ---------- --------- --------------

Revenue 4 71,637 - 71,637 64,480 - 64,480 133,409

Cost of sales (11,332) - (11,332) (12,490) - (12,490) (24,767)

--------------------- ------ ----------- ---------- ---------- --------------- ---------- --------- --------------

Gross profit 60,305 - 60,305 51,990 - 51,990 108,642

Operating expense

--------------------- ------ ----------- ---------- ---------- --------------- ---------- --------- --------------

Other operating

costs (57,544) - (57,544) (49,530) - (49,530) (100,471)

Acquisition-related

expenditure 5 - (6,070) (6,070) - (1,775) (1,775) (9,067)

--------------------- ------ ----------- ---------- ---------- --------------- ---------- --------- --------------

(57,544) (6,070) (63,614) (49,530) (1,775) (51,305) (109,538)

Operating

profit/(loss) 4 2,761 (6,070) (3,309) 2,460 (1,775) 685 (896)

Finance income 112 - 112 20 - 20 95

Finance costs (348) (229) (577) (213) - (213) (713)

Profit/(loss) before

taxation 2,525 (6,299) (3,774) 2,267 (1,775) 492 (1,514)

Taxation 6 (505) 241 (264) (510) 233 (277) (877)

--------------------- ------ ----------- ---------- ---------- --------------- ---------- --------- --------------

Profit/(loss) for

the period/year

from continuing

operations 2,020 (6,058) (4,038) 1,757 (1,542) 215 (2,391)

--------------------- ------ ----------- ---------- ---------- --------------- ---------- --------- --------------

Loss for the

period/year

from discontinued

operations - (1,747) (1,747) - (162) (162) (503)

--------------------- ------ ----------- ---------- ---------- --------------- ---------- --------- --------------

Profit/(loss) for

the period/year

attributable to

equity shareholders

of the parent 2,020 (7,805) (5,785) 1,757 (1,704) 53 (2,894)

--------------------- ------ ----------- ---------- ---------- --------------- ---------- --------- --------------

Earnings per

ordinary

share 7

Basic - underlying

operations 6.53p 5.96p 21.14p

Diluted - underlying

operations 6.01p 5.37p 19.51p

Basic - total (18.71)p 0.18p (9.70)p

Diluted - total (18.71)p 0.16p (9.70)p

--------------------- ------ ----------- ---------- ---------- --------------- ---------- --------- --------------

Braemar Shipping Services plc

Condensed Consolidated Statement of Comprehensive Income

Unaudited Unaudited Audited

Six months Six months

to to Year ended

31 Aug 31 Aug 28 Feb

2018 2017 2018

GBP'000 GBP'000 GBP'000

--------------------------------------- ----- ----------- ----------- -----------

(Loss)/profit for the period/year (5,785) 53 (2,894)

Other comprehensive income/(expense)

Items that will not be reclassified

to profit or loss:

Actuarial gain on employee

benefit schemes - net of tax - - 339

Items that are or may be reclassified

to profit or loss:

Foreign exchange differences

on retranslation of foreign

operations 552 (2,668) (3,674)

Cash flow hedges - net of tax (542) 621 808

---------------------------------------- ---- ----------- ----------- -----------

Total comprehensive expense

for the period/year attributable

to the equity shareholders of

the parent (5,775) (1,994) (5,421)

----------------------------------------- --- ----------- ----------- -----------

Braemar Shipping Services plc

Condensed Consolidated Balance Sheet

Unaudited Unaudited Audited

As at As at As at

31 Aug 31 Aug 28 Feb

2018 2017 2018

Assets Notes GBP'000 GBP'000 GBP'000

---------------------------------- ------ ---------- ---------- --------

Non-current assets

Goodwill 89,441 77,624 88,961

Other intangible assets 2,927 2,196 3,393

Property, plant and equipment 3,067 3,802 3,322

Investments 1,356 1,353 1,356

Deferred tax assets 3,105 3,734 3,120

Other receivables 307 344 300

---------------------------------- ------ ---------- ---------- --------

100,203 89,053 100,452

Current assets

Trade and other receivables 9 59,023 51,384 52,605

Derivative financial instruments - - 159

Assets held for sale 14 654 2,508 2,865

Cash and cash equivalents 5,027 6,200 5,424

---------------------------------- ------ ---------- ---------- --------

64,704 60,092 61,053

Total assets 164,907 149,145 161,505

---------------------------------- ------ ---------- ---------- --------

Liabilities

Current liabilities

Derivative financial instruments 513 76 -

Trade and other payables 45,917 44,956 41,462

Short term borrowings 14,307 - 7,873

Current tax payable 903 1,090 1,858

Provisions 353 572 320

Convertible loan notes

and deferred consideration 998 - 366

Liabilities directly associated

with assets classified

as held for sale 14 - 377 766

62,991 46,774 52,645

Non-current liabilities

Deferred tax liabilities 982 866 999

Provisions 521 465 424

Convertible loan notes

and deferred consideration 13,420 - 10,341

Pension deficit 3,185 4,022 3,437

---------------------------------- ------ ---------- ---------- --------

18,108 5,353 15,201

Total liabilities 81,099 52,127 67,846

Total assets less total

liabilities 83,808 97,018 93,659

---------------------------------- ------ ---------- ---------- --------

Equity

Share capital 10 3,144 3,018 3,144

Share premium 10 55,805 52,510 55,805

Shares to be issued (2,470) (1,289) (2,701)

Other reserves 11 26,095 26,904 26,085

Retained earnings 1,234 15,875 11,326

---------------------------------- ------ ---------- ---------- --------

Total equity 83,808 97,018 93,659

---------------------------------- ------ ---------- ---------- --------

Braemar Shipping Services plc

Condensed Consolidated Statement of Cash Flows

Unaudited Unaudited Audited

Six months Six months

to to Year ended

31 Aug 28 Feb

2018 31 Aug 2017 2018

Notes GBP'000 GBP'000 GBP'000

------------------------------------- ------ ----------- ------------ -----------

Cash flows from operating activities

Cash (used in)/generated from

operations 16 (2,004) 3,461 3,704

Interest received 112 20 95

Interest paid (577) (213) (619)

Tax paid (190) (724) (119)

Net cash generated (used in)/from

operating activities (2,659) 2,544 3,061

--------------------------------------------- ----------- ------------ -----------

Cash flows from investing

activities

Purchase of property, plant and equipment

and computer software (945) (380) (995)

Acquisition of businesses,

net of cash acquired (112) (382) (5,933)

Other long-term assets (7) 40 110

-----------

Net cash used in investing

activities (1,064) (722) (6,818)

------------------------------------- ------ ----------- ------------ -----------

Cash flows from financing

activities

Proceeds from borrowings 6,434 - 11,537

Repayment of borrowings - (622) (4,285)

Dividends paid 8 (3,076) (1,473) (2,974)

Gift to ESOP for purchase

of own shares (644) (850) (1,073)

-----------

Net cash from/(used in) financing

activities 2,714 (2,945) 3,205

------------------------------------- ------ ----------- ------------ -----------

Decrease in cash and cash

equivalents (1,009) (1,123) (552)

Cash and cash equivalents

at beginning of the period/year 5,424 7,674 7,674

Reclassified as held for sale - (150) (144)

Foreign exchange differences 612 (201) (1,554)

------------------------------------- ------ ----------- ------------ -----------

Cash and cash equivalents

at end of the period/year 5,027 6,200 5,424

------------------------------------- ------ ----------- ------------ -----------

Braemar Shipping Services plc

Condensed Consolidated Statement of Changes in Equity

Shares

Share Share to be Other Retained Total

capital premium issued reserves earnings equity

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ------ --------- --------- -------- ---------- ---------- --------

At 1 March 2018 3,144 55,805 (2,701) 26,085 11,326 93,659

Change in accounting

policy on adoption

of IFRS 9 1 - - - - (1,081) (1,081)

Revised 1 March

2018 3,144 55,805 (2,701) 26,085 10,245 92,578

Loss for the period - - - - (5,785) (5,785)

Foreign exchange

differences - - - 552 - 552

Cash flow hedges

- net of tax - - - (542) - (542)

----------------------- ------ --------- --------- -------- ---------- ---------- --------

Total comprehensive

income - - - 10 (5,785) (5,775)

----------------------- ------ --------- --------- -------- ---------- ---------- --------

Dividends paid 8 - - - - (3,076) (3,076)

Purchase of shares - - (644) - - (644)

ESOP shares allocated - - 875 - (875) -

Credit in respect

of share option

schemes - - - - 725 725

----------

Balance at 31

August 2018 3,144 55,805 (2,470) 26,095 1,234 83,808

----------------------- ------ --------- --------- -------- ---------- ---------- --------

At 1 March 2017 3,018 52,510 (2,962) 28,951 18,655 100,172

Profit for the

period - - - - 53 53

Foreign exchange

differences - - - (2,668) - (2,668)

Cash flow hedges

- net of tax - - - 621 - 621

----------------------- ------ --------- --------- -------- ---------- ---------- --------

Total comprehensive

income - - - (2,047) 53 (1,994)

----------------------- ------ --------- --------- -------- ---------- ---------- --------

Dividends paid 8 - - - - (1,473) (1,473)

Purchase of shares - - (850) - - (850)

ESOP shares allocated - - 2,523 - (2,523) -

Credit in respect

of share option

schemes - - - - 1,163 1,163

----------

Balance at 31

August 2017 3,018 52,510 (1,289) 26,904 15,875 97,018

----------------------- ------ --------- --------- -------- ---------- ---------- --------

Braemar Shipping Services plc

Unaudited Notes to The Financial Information

For the Six Months Ended 31 August 2018

1. General information

Braemar Shipping Services plc (the "Company") is a Public

Limited Company incorporated and domiciled in England and Wales.

The interim condensed consolidated financial statements for the six

months ended 31 August 2018 comprise the Company, its subsidiaries

and the employee share ownership trust (together referred to as the

"Group"). The address of the Company's registered office is One

Strand, Trafalgar Square, London, WC2N 5HR, United Kingdom. The

interim condensed consolidated financial statements of the Group

were authorised for issue in accordance with a resolution of the

directors on 24 October 2018.

These interim condensed consolidated financial statements do not

comprise statutory accounts within the meaning of Section 434 of

the Companies Act 2006, but have been reviewed by KPMG LLP, the

Group's auditor. The audited statutory accounts for the year ended

28 February 2018 have been delivered to the Registrar of Companies

in England and Wales. The report of the auditors on those accounts

was unqualified, did not contain an emphasis of matter paragraph

and did not contain any statements under Section 498 of the

Companies Act 2006. The interim condensed consolidated financial

statements have been prepared on a going concern basis.

Forward-looking statements

Certain statements in this interim report are forward-looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, we can give no

assurance that these expectations will prove to be correct. Because

these statements involve risks and uncertainties, actual results

may differ materially from those expressed or implied by these

forward-looking statements. We undertake no obligation to update

any forward-looking statements whether as a result of new

information, future events or otherwise.

Accounting estimates and critical judgements

The preparation of interim financial statements in conformity

with IFRSs requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and

expenses. Actual results may differ from these estimates. In

preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were consistent with those that applied to

the consolidated financial statements as at and for the year ended

28 February 2018.

2. Basis of preparation and statement of compliance

The condensed consolidated interim financial information for the

six months ended 31 August 2018 has been prepared in accordance

with the Disclosure Guidance and Transparency Rules of the

Financial Conduct Authority and with IAS 34, 'Interim financial

reporting' as adopted by the European Union. The interim condensed

consolidated financial report should be read in conjunction with

the Group's Annual Report 2018 for the year ended 28 February 2018,

which have been prepared in accordance with IFRSs as adopted by the

European Union.

3. Accounting policies

Changes in accounting policies

The accounting policies adopted in the preparation of these

interim condensed consolidated financial statements are consistent

with those of the Annual Report for the year ended 28 February

2018, as included in those annual financial statements.

The Group has re-presented results in relation to the

discontinued operations for the period ended 31 August 2017,

following the Group's decision to dispose of these operations.

During the period, a number of amendments to existing accounting

standards became effective. These have been considered by the

directors the impact on the Group's interim condensed consolidated

financial statements is as follows:

IFRS 9, 'Financial instruments', became effective from 1 January

2018 and applies to the classification and measurement of financial

assets and financial liabilities, impairment provisioning and hedge

accounting. The Group has considered the impact in respect of trade

receivables on the newly introduced expected credit losses model

which IFRS 9 applies and has adopted the simplified approach to

measuring expected credit losses which uses a lifetime expected

loss allowance for all trade receivables. Management have grouped

trade receivables on shared credit risk characteristics and the

days past due. The group will need to apply an expected credit loss

("ECL") model when calculating impairment losses on its trade and

other receivables. This will result in increased impairment

provisions and greater judgement due to the need to factor in

forward looking information when estimating the appropriate amount

of provisions. In applying IFRS 9 the group must consider the

probability of a default occurring over the contractual life of its

trade receivables and contracts asset balances on initial

recognition of those assets. Applying the new ECL model has

resulted in an adjustment to the opening reserves, as noted in the

Statement of Changes in Equity.

IFRS 15, 'Revenue from contracts with customers', became

effective from 1 January 2018. This standard deals with revenue

recognition and establishes principles for reporting useful

information to users of financial statements about the nature,

amount, timing and uncertainty of revenue and cash flows arising

from an entity's contracts with customers. The Group, in the prior

year, completed an impact assessment analysis for all divisions and

revenue streams, including an analysis of revenue recognition

policy compared to the requirements of IFRS 15. In the majority of

cases the requirements of IFRS 15, performance obligations are

fully satisfied at a point in time. There has been no material

impact on the Group's financial statements from the application of

IFRS 15. The Group continues to disaggregate revenue over

Shipbroking, Technical, Logistics and Financial. All revenue is

deemed to relate to revenue from contracts with customers.

As at the date of authorisation of these interim financial

statements, the following standards and interpretations were in

issue but not yet effective (and in some cases had not yet been

adopted by the EU). The Group has not applied these standards and

interpretations in the preparation of these financial

statements.

- IFRIC 23 'Uncertainty over income tax treatments', effective

from 1 January 2019 and not yet endorsed by the EU.

- IFRS 16, 'Leases', effective from 1 January 2019. This

standard requires lessees to recognise a lease liability reflecting

future lease payments and a 'right-of-use asset' for virtually all

lease contracts. The Group continues to assess the full impact of

IFRS 16 and at present it is not yet possible to reasonably

quantify its effects. The potential impact is expected to be

significant given that the Group had non-cancellable net operating

lease commitments of GBP17.0 million as at 28 February 2018. This

implementation may have a material impact upon the Group's reported

performance, Statement of Financial Position and operating cash

flows.

The impact on the Group's financial statements of the future

adoption of these and other new standards and interpretations is

still under review and further disclosure will be provided in the

annual report for the year ending 28 February 2019.

4. Segmental information

The Group's reportable segments are trading divisions that are

managed separately due to a combination of factors including the

variety of services provided and method of service delivery.

The reportable segments reflect the way financial information is

reviewed by the Group's Chief Operating Decision Maker ("CODM").

The CODM for the Group is the Board of Directors.

Revenue Results

H1 2018/19 H1 2017/18 FY 2017/18 H1 2018/19 H1 2017/18 FY 2017/18

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ----------- ----------- ----------- ----------- ----------- -----------

Shipbroking 34,702 30,356 61,846 3,945 3,468 7,742

Technical 16,667 17,705 34,579 (699) (151) 722

Logistics 15,869 16,419 33,237 461 574 777

Financial 4,399 - 3,747 1,661 - 1,785

Trading segments revenue/results 71,637 64,480 133,409 5,368 3,891 11,026

----------------------------------- ----------- ----------- ----------- ----------- ----------- -----------

Central costs (2,607) (1,431) (2,855)

----------------------------------- ----------- ----------- ----------- ----------- ----------- -----------

Underlying operating profit 2,761 2,460 8,171

----------------------------------- ----------- ----------- ----------- ----------- ----------- -----------

Acquisition related expenditure (6,070) (1,775) (9,067)

Operating (loss)/profit (3,309) 685 (896)

----------------------------------- ----------- ----------- ----------- ----------- ----------- -----------

Finance expense - net (465) (193) (618)

----------------------------------- ----------- ----------- ----------- ----------- ----------- -----------

(Loss)/profit before taxation (3,774) 492 (1,514)

Taxation (264) (277) (877)

(Loss)/profit for the period/year

from continuing operations (4,038) 215 (2,391)

----------------------------------- ----------- ----------- ----------- ----------- ----------- -----------

Loss for the period/year

from discontinued operations (1,747) (162) (503)

----------------------------------- ----------- ----------- ----------- ----------- ----------- -----------

(Loss)/profit for the period/year (5,785) 53 (2,894)

----------------------------------- ----------- ----------- ----------- ----------- ----------- -----------

The Group does not allocate income tax expense or interest to

reportable segments. Treasury management is managed centrally.

Assets and liabilities information is reported internally in

total and not by reportable segment and, accordingly, no

information is provided in this note on assets and liabilities

split by reportable segment.

5. Specific items

During the period/year, the Group incurred the following

acquisition-related items:

Six months Six months

to to Year ended

31 Aug 31 Aug 28 Feb

2018 2017 2018

GBP'000 GBP'000 GBP'000

------------------------------------------------------------ ----------- ----------- -----------

Acquisition-related items

- Amortisation charge of intangible

assets (1,040) (92) (2,378)

Acquisition related expenditure

* Group share retention plan directly attributable to

the acquisition of ACM Shipping Group plc (82) (547) (608)

* Acquisition of NAVES Corporate Finance GmbH (3,533) (905) (5,071)

* Acquisition of Atlantic Brokers Holdings Limited (1,387) - (594)

- Other acquisition-related costs (28) (231) (416)

------------------------------------------------------------ ----------- ----------- -----------

(6,070) (1,775) (9,067)

------------------------------------------------------------ ----------- ----------- -----------

6. Taxation

Current tax expense for the interim periods presented is the

expected tax payable on the taxable net income for the period,

calculated as the estimated average annual effective income tax

rate applied to the pre-tax income of the interim period. Current

tax for current and prior periods is classified as a current

liability to the extent that it is unpaid. Amounts paid in excess

of amounts owed are classified as a current asset.

The amount of deferred tax provided is based on the expected

manner of realisation or settlement of the carrying amount of

assets and liabilities, using tax rates that are enacted or

substantively enacted at the balance sheet date.

The Group's consolidated effective tax rate for the six months

ended 31 August 2018 was 20% (six months ended 31 August 2017:

22.5%), which primarily reflects the Group's effective tax rate for

the year ended 28 February 2018.

7. Earnings per share

Six months Six months Year ended

to 31 Aug to 31 Aug 28 Feb

2018 2017 2018

Total operations GBP'000 GBP'000 GBP'000

------------------------------------- -------- ----------- --------------------

(Loss)/profit for the period/year

attributable to equity holders of

the parent (5,785) 53 (2,894)

------------------------------------- -------- ----------- --------------------

pence pence pence

------------------------------------- -------- ----------- --------------------

Basic (loss)/earnings per share (18.71) 0.18 (9.70)

Effect of dilutive share options - (0.02) -

Diluted (loss)/earnings per share (18.71) 0.16 (9.70)

------------------------------------- -------- ----------- --------------------

Underlying operations

----------------------------------------- ------- ---------------- -------

Profit for the period/year attributable

to equity shareholders of the parent 2,020 1,757 6,313

----------------------------------------- ------- ---------------- -------

pence pence pence

----------------------------------------- ------- ---------------- -------

Basic earnings per share 6.53 5.96 21.14

Effect of dilutive share options (0.52) (0.59) (1.63)

Diluted earnings per share 6.01 5.37 19.51

----------------------------------------- ------- ---------------- -------

Earnings per share from underlying operations for the

comparative period ended 31 August 2017 has been restated following

the re-presentation of Braemar Response as a discontinued

operation.

Where any potential ordinary shares would have the effect of

decreasing a loss per share, they have not been treated as

dilutive.

8. Dividends

The following dividends were paid by the Group:

Six months Six months

to to Year ended

31 Aug 31 Aug 28 Feb

2018 2017 2018

GBP'000 GBP'000 GBP'000

-------------------------------------- ----------- ----------- -----------

Ordinary shares of 10 pence each

Final of 10.0 pence per share (2017:

5.0 pence per share) 3,076 1,473 1,473

Interim of 5.0 pence per share paid - - 1,501

3,076 1,473 2,974

-------------------------------------- ----------- ----------- -----------

The Board has declared an interim dividend of 5.0 pence per

share. The interim dividend will be paid on Friday 14 December 2018

to shareholders on the register at the close of business on Friday

2 November 2018.

9. Trade and other receivables

As at As at As at

31 Aug 31 Aug 28 Feb

2018 2017 2018

GBP'000 GBP'000 GBP'000

----------------------------------- -------- -------- --------

Trade receivables 44,237 38,893 37,909

Provision for impairment of trade

receivables (5,865) (5,220) (4,629)

----------------------------------- -------- -------- --------

38,372 33,673 33,280

Other receivables 8,071 4,724 7,571

Accrued income 8,522 9,744 9,494

Prepayments 4,058 3,243 2,260

----------------------------------- -------- -------- --------

59,023 51,384 52,605

----------------------------------- -------- -------- --------

The Directors consider that the carrying amounts of trade

receivables approximate to their fair value.

10. Share capital

Number of Ordinary Share

shares Shares Premium Total

(thousands) GBP'000 GBP'000 GBP'000

-------------- ------------ --------- -------- --------

At 1 March

2018 31,436 3,144 55,805 58,949

At 31 August

2018 31,436 3,144 55,805 58,949

--------------- ------------ --------- -------- --------

At 1 March

2017 30,173 3,018 52,510 55,528

At 31 August

2017 30,173 3,018 52,510 55,528

--------------- ------------ --------- -------- --------

11. Other reserves

Capital Total

redemption Merger Translation Hedging other

reserve reserve reserve reserve reserves

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ------------ --------- ------------ --------- ----------

At 1 March 2018 396 21,346 4,217 126 26,085

Cash flow hedges

- Fair value losses in

the period - - - (542) (542)

Foreign exchange differences - - 552 - 552

At 31 August 2018 396 21,346 4,769 (416) 26,095

------------------------------ ------------ --------- ------------ --------- ----------

Capital Total

redemption Merger Translation Hedging other

reserve reserve reserve reserve reserves

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 March 2017 396 21,346 7,891 (682) 28,951

Cash flow hedges

- Fair value gains in

the period - - - 621 621

Foreign exchange differences - - (2,668) - (2,668)

At 31 August 2017 396 21,346 5,223 (61) 26,904

------------------------------ ------------ --------- ------------ --------- ----------

All other reserves are attributable to the equity holders of the

parent company.

12. Contingencies

From time to time the Group may be engaged in litigation in the

ordinary course of business. The Group carries professional

indemnity insurance. There are currently no liabilities expected to

have a material adverse financial impact on the Group's

consolidated results or net assets.

13. Related parties

The Group's related parties are unchanged from 28 February 2018

and there have been no significant related party transactions in

the six months ended 31 August 2018.

For further information about the Group's related parties,

please refer to the Group's Annual Report 2018 for the year ended

28 February 2018.

14. Events after the reporting date

On 9 October 2018, the Group sold the entire share capital of

Braemar Response Limited. This is in line with the Group's decision

to divest the business, having classified the operations as

discontinued for the financial year ended 28 February 2018. The

sale is for a total consideration of GBP774,000 which comprises an

initial cash payment of GBP400,000 with a further GBP374,000

payable within twelve months of completion.

The carrying value of the assets held for sale has accordingly

been decreased to its fair value less costs to sell of GBP0.7

million as at 31 August 2018, with a corresponding impairment loss

of GBP1.2 million being recognised in the Income Statement within

the loss for the period from discontinued operations.

15. Principal risks

The Directors consider that the principal risks and

uncertainties that could have a material effect on the Group's

performance are unchanged from those identified on pages 34 to 37

of the Annual Report 2018. These include risks associated with

macroeconomic changes, financial liquidity, management bandwidth,

the failure to attract and retain skilled individuals, inadequate

financial capacity to execute growth plans, the threat of

technological changes, currency fluctuations, implementation of

inappropriate reward structures, poor communications, legal or

regulatory breach and cyber crime.

The Group holds professional indemnity insurance to an amount

considered adequate for its size and potential exposure.

16. Reconciliation of operating profit to net cash flow from

operating activities

Unaudited Unaudited Audited

Six months Six months

to to Year ended

31 Aug 31 Aug 28 Feb

2018 2017 2018

GBP'000 GBP'000 GBP'000

--------------------------------------- ----- ----------- ------------------- -----------

(Loss)/profit before tax for the

period/year (3,774) 492 (1,514)

Loss before tax for the period/year

from discontinued operations (1,747) (209) (595)

Adjustments for:

- Depreciation of property,

plant and equipment (continuing) 518 563 1,165

- Depreciation of property,

plant and equipment (discontinued) 11 22 39

- Amortisation of computer

software 200 323 583

Specific items:

- Amortisation of other intangible

assets 1,040 92 2,378

- Other specific items 5,030 1,683 6,689

Finance income (112) (20) (95)

Finance expense 577 213 713

Share based payments (excluding

restricted share plan) 726 621 1,131

Net foreign exchange (gains)/losses

& financial instruments 542 163 (809)

Changes in working capital:

- Trade and other receivables (7,499) 4,130 4,950

- Trade and other payables 6,502 (3,633) (3,717)

Contribution to defined benefit

pension scheme (225) (283) (450)

Provisions 120 (183) (399)

----------------------------------------------- ----------- ------------------- -----------

Cash generated from operations

before acquisition and disposal

related activities 1,909 3,974 10,069

Movement in net assets held

for sale 975 (513) (515)

Acquisition fees paid (203) - (2,870)

Amounts due to acquisition-related

retention payments (4,685) - (2,980)

----------------------------------------------- ----------- ------------------- -----------

Cash (used in)/generated from

operations after acquisition-related

activities (2,004) 3,461 3,704

----------------------------------------------- ----------- ------------------- -----------

Statement of Directors' responsibilities

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU;

-- the interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period; and any changes in the related party

transactions described in the last annual report that could do

so.

By order of the Board

David Moorhouse CBE, Chairman Peter Mason, Company Secretary

INDEPENDENT REVIEW REPORT TO BRAEMAR SHIPPING SERVICES PLC

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 August 2018 which comprises the condensed

consolidated income statement, condensed consolidated statement of

comprehensive income, condensed consolidated balance sheet,

condensed consolidated statement of changes in equity, and

condensed consolidated statement of cash flows and the related

explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

August 2018 is not prepared, in all material respects, in

accordance with IAS 34 Interim Financial Reporting as adopted by

the EU and the Disclosure Guidance and Transparency Rules ("the

DTR") of the UK's Financial Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. We read the other information contained in the

half-yearly financial report and consider whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the Directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

The annual financial statements of the group are prepared in

accordance with International Financial Reporting Standards as

adopted by the EU. The directors are responsible for preparing the

condensed set of financial statements included in the half-yearly

financial report in accordance with IAS 34 as adopted by the

EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the DTR of the UK FCA. Our review has been

undertaken so that we might state to the company those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company for our

review work, for this report, or for the conclusions we have

reached.

Jonathan Downer

for and on behalf of KPMG LLP

Chartered Accountants

15 Canada Square

London

E14 5GL

24 October 2018

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR USAVRWVARUAA

(END) Dow Jones Newswires

October 25, 2018 02:00 ET (06:00 GMT)

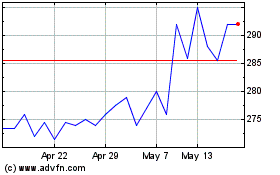

Braemar (LSE:BMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Braemar (LSE:BMS)

Historical Stock Chart

From Jul 2023 to Jul 2024