UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| x | ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2014

| o | TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from _____ to ______________

Commission

File No: 000-51465

United

American Petroleum Corp.

(Exact

name of registrant as specified in its charter)

| Nevada | |

20-1904354 |

(State or other jurisdiction of

incorporation or organization) | |

(I.R.S. Employer Identification No.) |

9600

Great Hills Trail, Suite 150W, Austin, TX 78759 |

| (Address

of principal executive offices) (Zip Code) |

| |

| Registrant’s

telephone number, including area code: (512) 852-7888 |

| |

|

| Securities

registered under Section 12(b) of the Act: None. |

| |

|

| Securities

registered pursuant to section 12(g) of the Act: |

| |

Common

Stock, Par Value $.001

(Title of Class) |

Indicate

by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate

by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated file, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer o |

Accelerated

filer o |

| |

|

Non-accelerated

filer o

(Do

not check if a smaller

reporting company) |

Smaller

reporting company x |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

The

aggregate market value of the registrant’s shares of common stock held by non-affiliates of the registrant on June 30, 2014, the

last business day of the registrant’s most recently completed second fiscal quarter was $283,922.

As

of April 8, 2015, there were 321,867,911 shares of the issuer’s $.001 par value common stock issued and outstanding.

TABLE

OF CONTENTS

PART

I

Item

1. Business.

Our

Business. United American Petroleum Corp., a Nevada corporation (the “Company”, “we”, “us,”

or “our”), is engaged in the acquisition, exploration, development and production of oil and gas properties. Our principal

business is the acquisition of leasehold interests in petroleum and natural gas rights, either directly or indirectly, and the

exploitation and development of properties subject to these leases. Our primary focus is to develop our properties that have potential

for near-term production. We also provide operational expertise for several third party well owners out of our operational base

in Austin, Texas. We currently have proved reserves in the State of Texas.

Our

Subsidiaries

United

Operating, LLC. On January 13, 2011, we formed our wholly-owned subsidiary, United Operating, LLC, a Texas limited liability

company, for the purpose of operating certain interests that we acquired. United Operating, LLC, has not undergone bankruptcy,

receivership, or any similar proceeding.

UAP

Management, LLC. On January 13, 2011, we formed our wholly-owned subsidiary, UAP Management, LLC, a Texas limited liability

company, for the purpose of managing the Gabriel Interests in Bastrop County, Texas. UAP Management, LLC, has not undergone bankruptcy,

receivership, or any similar proceeding.

Item

1A. Risk Factors.

In

addition to the other information in this filing, the following risk factors should be considered carefully in evaluating our

business before purchasing any of our shares of common stock. A purchase of our common stock is speculative in nature and involves

many risks. No purchase of our common stock should be made by any person who is not in a position to lose the entire amount of

his investment.

Risks

Related to our Business:

We

have a limited history operating in the oil and gas industry. As a result, it is difficult for potential investors to evaluate

our business and prospects.

We

entered the oil and gas business in December 2009. Our limited operating history makes it difficult for potential investors to

evaluate our business or prospective operations. Since our formation, we have generated only limited revenues. As an early stage

company, we are subject to all the risks inherent in the financing, expenditures, operations, complications and delays

inherent in a new business. Accordingly, our business and success faces risks from uncertainties faced by developing companies

in a competitive environment. There can be no assurance that our efforts will be successful or that we will ultimately be able

to attain profitability.

We

have a history of net losses which will continue and which may negatively impact our ability to achieve our business objectives.

For

fiscal years 2014 and 2013, we had revenue of $621,548 and $736,613 and a net loss of $836,234 and $1,349,568, respectively. We

cannot guarantee that our future operations will result in net income. We may not be able to operate profitability on a quarterly

or annual basis in the future and we will likely continue to have net losses for the foreseeable future. If our revenues grow

more slowly than we anticipate or our operating expenses exceed our expectations, our operating results will suffer.

We

will need additional financing to execute our business plan.

The

revenues from our current operations are not sufficient to support our operating costs and anticipated drilling programs. We will

need substantial additional funds to:

| ● |

effectuate

our business plan; |

| |

|

| ● |

fund

the acquisition, exploration, development and production of oil and natural gas in the future; |

| |

|

| ● |

fund

future drilling programs; and |

| |

|

| ● |

hire

and retain key employees. |

We

may seek additional funds through public or private equity or debt financing, via strategic transactions, and/or from other sources.

There are no assurances that future funding will be available on favorable terms or at all. If additional funding is not obtained,

we may need to reduce, defer or cancel drilling programs, planned initiatives, or overhead expenditures to the extent necessary.

The failure to fund our operating and capital requirements could have a material adverse effect on our business, financial condition

and results of operations.

Our

auditors have expressed substantial doubt regarding our ability to continue operations as a “going concern.” Investors

may lose all of their investment if we are unable to continue operations and generate revenues, or if we do not raise sufficient

funds.

We

will seek to raise additional funds to meet our working capital needs principally through the additional sales of our securities.

However, we cannot guarantee that we will be able to obtain sufficient additional funds when needed, or that such funds, if available,

will be obtainable on terms satisfactory to us. If we do not raise sufficient funds, we may not be able to continue in business.

As a result, our auditors believe that substantial doubt exists about our ability to continue operations as a going concern.

Our

exploration appraisal and development activities are subject to many risks which may affect our ability to profitably extract

oil reserves or achieve targeted returns. In addition, continued growth requires that we acquire and successfully develop

additional oil reserves.

Oil

exploration may involve unprofitable efforts, not only from dry wells, but from wells that are productive but do not produce sufficient

net revenues to return a profit after drilling, operating and other costs. Completion of a well does not assure a profit on the

investment or recovery of drilling, completion and operating costs. In addition, drilling hazards or environmental damage could

greatly increase the cost of operations, and various field operating conditions may negatively affect the production from successful

wells. These conditions include delays in obtaining governmental approvals or consents, shut-ins of connected wells resulting

from extreme weather conditions, insufficient storage or transportation capacity or other geological and mechanical conditions.

While diligent well supervision and effective maintenance operations can contribute to maximizing production rates over time,

production delays and declines from normal field operating conditions cannot be eliminated and can be expected to negatively affect

revenue and cash flow levels to varying degrees.

Our

ability to successfully market and sell oil is subject to a number of factors that are beyond our control, and that may adversely

impact our ability to produce and sell oil, or to achieve profitability.

The

marketability and price of oil that may be acquired or discovered by us will be affected by numerous factors beyond our control.

Our ability to market our oil may depend upon our ability to acquire space on pipelines that deliver oil to commercial markets. We

may be affected by deliverability uncertainties related to the proximity of our reserves to pipelines and processing facilities,

by operational problems with such pipelines and facilities, and by government regulation relating to price, taxes, royalties,

land tenure, allowable production, the export of oil and by many other aspects of the oil business.

Our

revenues and future growth and the carrying value of our oil properties are substantially dependent on prevailing prices of oil.

Our ability to borrow and to obtain additional capital on attractive terms is also substantially dependent upon oil and natural

gas prices. Prices for oil and natural gas are subject to large fluctuations in response to relatively minor changes in the

supply of and demand for oil, market uncertainty and a variety of additional factors beyond our control. These factors include

economic conditions, in the United States and Canada, the actions of the Organization of Petroleum Exporting Countries, governmental

regulation, political stability in the Middle East and elsewhere, the foreign supply of oil, the price of foreign imports and

the availability of alternative fuel sources. Any substantial and extended decline in the price of oil would have an adverse effect

on our borrowing capacity, revenues, profitability and cash flows from operations.

Volatile

oil prices make it difficult to estimate the value of producing properties for acquisition and often cause disruption in the market

for oil producing properties, as buyers and sellers have difficulty agreeing on such value. Price volatility also makes it difficult

to budget for and project the return on acquisitions and development and exploitation projects.

Our

reserve estimates are subject to numerous uncertainties and may be inaccurate.

We

currently have proved reserves in Texas. We rely on independent third party petroleum engineering firms to calculate reserve estimates.

There are numerous uncertainties inherent in estimating quantities of oil and natural gas reserves and cash flows to be derived

therefrom, including many factors beyond our control. In general, estimates of economically recoverable oil and gas reserves and

the future net cash flows therefrom are based upon a number of variable factors and assumptions, such as historical production

from the properties, production rates, ultimate reserve recovery, timing and amount of capital expenditures, marketability of

our products, royalty rates, the assumed effects of regulation by governmental agencies and future operating costs, all of which

may vary from actual results. All such estimates are to some degree speculative, and classifications of reserves are only attempts

to define the degree of speculation involved. For those reasons, estimates of the economically recoverable reserves attributable

to any particular group of properties, classification of such reserves based on risk of recovery and estimates of future net revenues

expected therefrom prepared by different engineers, or by the same engineers at different times, may vary. Our actual production,

revenues, taxes and development and operating expenditures with respect to our reserves will vary from estimates thereof and such

variations could be material.

Estimates

of proved or unproved reserves that may be developed and produced in the future are often based upon volumetric calculations and

upon analogy to similar types of reserves rather than actual production history. Estimates based on these methods are generally

less reliable than those based on actual production history. Subsequent evaluation of the same reserves based upon production

history and production practices will result in variations in the estimated reserves and such variations could be material.

We

cannot guarantee that title to our properties does not contain a defect that may materially affect our interest in those properties.

It

is our practice in acquiring significant oil leases or interest in oil leases to retain lawyers to fully examine the title to

the interest under the lease. In the case of minor acquisitions, we rely upon the judgment of oil lease brokers or landmen to

examine records in the appropriate governmental office before attempting to place under lease a specific interest. We believe

that this practice is widely followed in the oil industry. Nevertheless, there may be title defects which affect lands comprising

a portion of our properties which may adversely affect us.

Our

properties are held in the form of leases and working interests in operating agreements and leases. If the specific requirements

of such licenses, leases and working interests are not met, the lease or working interest may terminate or expire.

All

of our properties are held under interests in oil and gas leases and working interests in operating agreements and leases. If

we fail to meet the specific requirements of each lease or working interest, especially future drilling and production requirements,

the lease may be terminated or otherwise expire. We cannot be assured that we will be able to meet our obligations under each

lease and working interest. The termination or expiration of our working interest relating to any lease would harm our business,

financial condition and results of operations.

Competition

in the oil and gas industry is highly competitive and there is no assurance that we will be successful in acquiring properties

or leases.

The

oil and gas industry is intensely competitive. We compete with numerous individuals and companies, including many major oil and

gas companies, which have substantially greater technical, financial, and operational resources and staff. Accordingly, there

is a high degree of competition for desirable oil and gas leases, suitable properties for drilling operations, and necessary drilling

equipment, as well as for access to funds. We cannot predict if the necessary funds can be raised or that any projected work will

be completed. Desirable acreage may not become available or if it is available for leasing, that we may not be successful in acquiring

the leases.

The

marketability of natural resources will be affected by numerous factors beyond our control which may result in us not receiving

an adequate return on invested capital to be profitable or viable.

The

marketability of natural resources which may be acquired or discovered by us will be affected by numerous factors beyond our control.

These factors include market fluctuations in oil and gas pricing and demand, the proximity and capacity of natural resource markets

and processing equipment, governmental regulations, land tenure, land use, regulation concerning the importing and exporting of

oil and gas, and environmental protection regulations. The exact effect of these factors cannot be accurately predicted, but the

combination of these factors may result in us not receiving an adequate return on invested capital to be profitable or viable.

Oil

and gas operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess

of those anticipated, causing an adverse effect on us.

Our

operations are subject to regulation at the federal, state and local levels, including regulation relating to matters such as

the exploration for and the development, production, marketing, pricing, transmission and storage of oil, as well as environmental

and safety matters. Failure to comply with applicable regulations could result in fines or penalties being owed to third parties

or governmental entities, the payment of which could negatively impact our financial condition or results of operations. Our operations

are subject to significant laws and regulations, which may negatively affect our ability to conduct business or increase our costs.

Extensive federal, state and local laws and regulations relating to health and environmental quality in the United States affect

nearly all of our operations. These laws and regulations set various standards regulating various aspects of health and environmental

quality, provide for penalties and other liabilities for the violation of these standards, and in some circumstances, establish

obligations to remediate current and former facilities and off-site locations.

Environmental

legislation provides for, among other things, restrictions and prohibitions on spills, releases or emissions of various substances

produced in association with oil operations. The legislation also requires that wells and facility sites be operated, maintained,

abandoned and reclaimed to the satisfaction of the applicable regulatory authorities. Compliance with such legislation can require

significant expenditures and a breach may result in the imposition of fines and penalties, some of which may be material. Environmental

legislation is evolving in a manner expected to result in stricter standards and enforcement, larger fines and liability and potentially

increased capital expenditures and operating costs. The discharge of oil or other pollutants into the air, soil or water may give

rise to liabilities to governments and third parties and may require us to incur costs to remedy such discharge. No assurance

can be given that environmental laws will not result in a curtailment of production or a material increase in the costs of production,

development or exploration activities or otherwise adversely impact our financial condition, results of operations or prospects.

We could incur significant liability for damages, clean-up costs and/or penalties in the event of discharges into the environment,

environmental damage caused by us or previous owners of our property or non-compliance with environmental laws or regulations.

In addition to actions brought by governmental agencies, we could face actions brought by private parties or citizens groups.

Moreover,

we cannot predict what legislation or regulations will be enacted in the future or how existing or future laws or regulations

will be administered, enforced or made more stringent. Compliance with more stringent laws or regulations, or more vigorous enforcement

policies of the regulatory agencies, could require us to make material expenditures for the installation and operation of systems

and equipment for remedial measures, all of which could have a material adverse effect on our financial condition or results of

operations.

Exploratory

drilling involves many risks and we may become liable for pollution or other liabilities, which may have an adverse effect on

our financial position.

Drilling

operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages,

labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labor,

and other risks are involved. We may become subject to liability for pollution or hazards against which we cannot adequately insure

or that we may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position

and operations.

Our

exploration and development activities will depend in part on the evaluation of data obtained through geophysical testing and

geological analysis, as well as test drilling activity.

The

results of geophysical testing and geological analysis are subjective, and we cannot guarantee that the exploration and development

activities we conduct based on positive analysis will produce oil or gas in commercial quantities or costs. As we perform developmental

and exploratory activities, further data required for evaluation of our oil and gas interests will become available. The exploration

and development activities that will be undertaken by us are subject to greater risks than those associated with the acquisition

and ownership of producing properties. The drilling of development wells, although generally consisting of drilling to reservoirs

believed to be productive, may result in dry holes or a failure to produce oil or gas in commercial quantities. Moreover, any

drilling of exploratory wells is subject to significant risk of dry holes.

Because

we are small and have limited access to additional capital, we may have to limit our exploration activity, which may result in

a loss of investment.

We

have a small asset base and limited access to additional capital. Accordingly, we must limit our exploration activity. As such,

we may not be able to complete an exploration program that is as thorough as our management would like. In that event, existing

reserves may go undiscovered. Without finding reserves, we cannot generate revenues and investors may lose their investment.

Seasonal

weather conditions and other factors could adversely affect our ability to conduct drilling activities.

Our

operations could be adversely affected by seasonal weather conditions and wildlife restrictions on federal leases. In some areas,

certain drilling and other oil and gas activities can only be conducted during limited times of the year, typically during the

summer months. This would limit our ability to operate in these areas and could intensify competition during those times for drilling

rigs, oil field equipment, services, supplies and qualified personnel, which may lead to periodic shortages. These constraints

and the resulting shortages or high costs could delay our operations and materially increase our operating and capital costs,

which could have a material adverse effect upon us and our results of operations.

We

depend on the services of third parties for material aspects of our operations, including drilling operators, and accordingly

if we cannot obtain certain third party services, we may not be able to operate.

We

rely on third parties to operate some of the assets in which we possess an interest. The success of our oil operations, whether

considered on the basis of drilling operations or production operations, will depend largely on whether the operator of the property

properly fulfills our obligations. As a result, our ability to exercise influence over the operation of these assets or their

associated costs may be limited. Our performance will therefore depend upon a number of factors that may be outside of our full

control, including the timing and amount of capital expenditures, the operator’s expertise and financial resources, the

approval of other participants, the selection of technology, and risk management practices. The failure of third party operators

and their contractors to perform their services in a proper manner could adversely affect our operations.

We will

need additional financing to continue and grow our operations, which financing may not be available on acceptable terms or at

all.

We will

need to raise additional funds to fund our operations or grow our business. Additional financing may not be available on terms

or at times favorable to us, or at all. If adequate funds are not available when required or on acceptable terms, we may be unable

to continue and grow our operations. In addition, such additional financing transactions, if successful, may result in additional

dilution of our stockholders. They may also result in the issuance of securities with rights, preferences, and other characteristics

superior to those of the common stock and, in the case of debt or preferred stock financings, may subject us to covenants that

restrict our ability to operate our business freely.

The

loss or unavailability of our key personnel for an extended period of time could adversely affect our business operations and

prospects.

Our

success depends in large measure on certain key personnel, including Michael Carey, our President and Chief Executive Officer

and Ryan Hudson, our Secretary and Chief Operating Officer. The loss of the services of Mr. Carey and/or Mr. Hudson could significantly

hinder our operations. The competition for qualified personnel in the oil industry is intense and there can be no assurance

that we will be able to continue to attract and retain all personnel necessary for the development and operation of our business.

The

costs and effects of litigation, investigations, or similar matters could adversely affect our financial position and result of

operations.

We

may be involved from time to time in a variety of litigation, investigations, or similar matters arising out of our business.

Our insurance may not cover all claims that may be asserted against us, and any claims asserted against us, regardless of merit

or eventual outcome, may harm our reputation. If the ultimate judgments or settlements in any litigation or investigation significantly

exceed insurance coverage, they could adversely affect our financial position and results of operations. In addition, we may be

unable to obtain appropriate types or levels of insurance in the future.

We

are subject to the reporting requirements of federal securities laws, which will be expensive.

We

are a public reporting company in the U.S. and, accordingly, subject to the information and reporting requirements of the Exchange

Act and other federal securities laws, and the compliance obligations of the Sarbanes-Oxley Act. The costs of preparing and filing

annual and quarterly reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”

or “Commission”) and furnishing audited reports to stockholders will cause our expenses to be higher than they would

be if we remained a privately held company.

Failure

to maintain the adequacy of our internal controls could impair our ability to provide accurate financial statements and comply

with the requirements of the Sarbanes-Oxley Act, which could cause our stock price to decrease substantially.

We

have committed limited personnel and resources to the development of the external reporting and compliance obligations that are

required of a public company. If our financial and managerial controls, reporting systems, or procedures fail, we may not be able

to provide accurate financial statements on a timely basis or comply with the Sarbanes-Oxley Act of 2002 as it applies to us.

Risks

Related to Our Common Stock

The

exercise of outstanding warrants may cause immediate and substantial dilution to our existing stockholders.

If

the price per share of our common stock at the time of conversion of our convertible promissory notes, and exercise of any warrants,

options, or any other convertible securities is in excess of the various conversion or exercise prices of these convertible securities,

conversion or exercise of these convertible securities would have a dilutive effect on our common stock. As of December 31, 2014,

we had warrants to purchase up to 2,800,000 shares of our common stock at an exercise price of $1.00 per share. Further, any additional

financing that we secure may require the granting of rights, preferences or privileges senior to those of our common stock and

which result in additional dilution of the existing ownership interests of our common stockholders.

Our

common shares are thinly traded, and you may be unable to sell at or near ask prices or at all if you need to sell your shares

or otherwise desire to liquidate such shares.

We

cannot predict the extent to which an active public market for our common stock will develop or be sustained due to a number of

factors, including the fact that we are a small company that is relatively unknown to stock analysts, stock brokers, institutional

investors, and others in the investment community that generate or influence sales volume, and that even if we came to the attention

of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or

recommend the purchase of our shares until

such

time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity

in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity

that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a

broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels

will be sustained.

The

market price for our common stock may be particularly volatile given our status as a relatively small company with a thinly traded

“float” and lack of significant revenues that could lead to wide fluctuations in our share price. You may be unable

to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Stockholders

should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns

of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often

related to the promoter or issuer; (2) manipulation of prices through pre-arranged matching of purchases and sales and false and

misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by

inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5)

the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level,

along with the resulting inevitable collapse of those prices and with consequent investor losses. The occurrence of these

patterns or practices could increase the volatility of our share price.

Volatility

in our common stock price may subject us to securities litigation.

The

market for our common stock is characterized by significant price volatility when compared to seasoned issuers, and we expect

that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs

have often initiated securities class action litigation against a company following periods of volatility in the market price

of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial

costs and liabilities and could divert management’s attention and resources.

We

do not anticipate paying any cash dividends.

We

presently do not anticipate that we will pay any dividends on any of our capital stock in the foreseeable future. The payment

of dividends, if any, would be contingent upon our revenues and earnings, if any, capital requirements, and general financial

condition. The payment of any dividends will be within the discretion of our Board of Directors. We presently intend to retain

all earnings, if any, to implement our business plan; accordingly, we do not anticipate the declaration of any dividends in the

foreseeable future.

Because

we may be subject to the “penny stock” rules, the level of trading activity in our stock may be reduced which may

make it difficult for investors to sell their shares.

Broker-dealer

practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by

the Securities and Exchange Commission. Penny stocks, like shares of our common stock, generally are equity securities with a

price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on NASDAQ. The penny

stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a

standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny

stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the

compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker,

the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account

statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who

sell these securities to persons other than established customers and “accredited investors” must make a special written

determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement

to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in

the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult

to sell their shares.

We will

need additional capital, and the sale of additional shares or other equity securities could result in additional dilution to our

stockholders.

We

believe that our current cash and cash equivalents and anticipated cash flow from operations will not be sufficient to meet our

anticipated cash needs for the near future. We will require additional cash resources due to changed business conditions or other

future developments, including any investments or acquisitions we may decide to pursue. If our resources are insufficient to satisfy

our cash requirements, we will seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional

equity securities could result in additional dilution to our stockholders. The incurrence of additional indebtedness would result

in increased debt service obligations and could result in operating and financing covenants that would restrict our operations.

We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all.

The

Company has established preferred stock which can be designated by the Company’s directors without shareholder approval

and has established Series B Preferred Stock, which gives the holders majority voting power over the Company.

The

Company has 10,000,000 shares of preferred stock authorized and 1,000 shares of Series B Preferred Stock designated. As of the

filing date of this report, the Company has 1,000 Series B Preferred Stock shares issued and outstanding, which shares are held

by Michael Carey, the Company’s Chief Executive Officer, President and Director (500 shares), and Ryan Hudson, the Company’s

Chief Operating Officer, Secretary and Director (500 shares). The Series B Preferred Stock have no dividend rights, no liquidation

preference, no redemption rights and no conversion rights. The Series B Preferred Stock have the right, voting in aggregate, to

vote on all shareholder matters (including, but not limited to, at every meeting of the stockholders of the Company and upon any

action taken by stockholders of the Company with or without a meeting) equal to fifty-one percent (51%) of the total vote (the

“Super Majority Voting Rights”). Additionally, we are not allowed to adopt any amendments to our Bylaws, Articles

of Incorporation, as amended, make any changes to the Certificate of Designations establishing the Series B Preferred Stock, or

effect any reclassification of the Series B Preferred Stock, without the affirmative vote of at least 66 2/3% of the outstanding

shares of the Series B Preferred Stock.

Our

Board of Directors has the authority, without stockholder approval, to issue preferred stock with terms that may not be beneficial

to common stockholders and may grant voting powers, rights and preference that differ from or may be superior to those of our

shares of common stock.

Our

articles of incorporation allow us to issue 10,000,000 shares of preferred stock without any vote or further action by our stockholders.

Our Board of Directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our Board

of Directors also has the authority to issue preferred stock without further stockholder approval, including large blocks of preferred

stock. As a result, our Board of Directors could authorize the issuance of a series of preferred stock that would grant to holders

the preferred right to our assets upon liquidation, the right to receive dividend payments before dividends are distributed to

the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption of

our common stock.

Item

1B. Unresolved Staff Comments.

Not

applicable to smaller reporting companies.

Item

2. Properties.

Our

Facilities. As of December 31, 2014, we maintain our corporate offices for approximately $200 per month on a month to month

basis. We also maintain our operational offices of approximately 1,600 square feet for $1,500 per month on a month to month basis.

We believe our current office space and facilities are sufficient to meet our current and future needs.

Our

Properties. We own interests in the following oil and gas properties in Texas:

The

Marcee 1 Interest. We own a 100% working interest and operating interest in the Marcee 1 Tract, which is located in the Eagle

Ford Shale formation on approximately 112 acres of land in Gonzalez County, Texas (“Marcee

1

Tract”). We currently have one non-producing well and enough space to further offset wells if it is determined they will

be profitable.

The

Eagle Ford Shale formation in South Texas runs from the US-Mexico border north of Laredo in a narrow band extending northeast

for several hundred miles to just north of Houston. It is located directly below the Austin Chalk. The average thickness of the

Eagle Ford Shale is about 475 feet. The formation produces both natural gas and oil, but we believe the oil-producing and gas

condensate areas are most attractive at this time.

The

Lozano Interest. We own a 100% working interest and operating interest in the Hector Lozano Tract, which is located on approximately

110 acres, located in Frio County, Texas (“Lozano Tract”). The Lozano Tract is a producing asset with three wells

with proven reserves. The production from the Lozano wells is mature and we believe the wells are likely to continue to produce

with slow decline for the foreseeable future. All three wells produced an average of 3.2 barrels of oil per day during 2014.

Historically these wells have produced a total of 5-12 barrels of oil per day.

The

Lozano Tract lies in the Western Gulf province, an area that covers 116,599 sq. mi., allowing extensive data on several hundred

thousand oil and gas wells. So far, 2,518 significant oil and gas fields comprising 3,883 reservoirs have been discovered in the

region.

For

the past 20 years, the oil industry has had huge success in the county due to oil-extraction technology that permits horizontal

drilling extending the primary producing formations such as the Olmos B and Olmos D sands, which range in depth from 3,100 feet

to 3,600 feet. The Austin Chalk, Navarro and Anacacho formations are also abundant in the area.

Nearby

the Lozano Tract, the untapped reserves in the region have been demonstrated by the Kinder Morgan-operated Yates Oil Field, which

has yielded over 1.4 billion barrels and is expected to produce a further 1 billion barrels. Also nearby are the plays of the

Bigfoot (6miles) and Pearsall fields.

The

Western Gulf Province is divided into 48 hydrocarbon plays; 3 plays in the Jurassic, 15 in Cretaceous and 30 plays in Tertiary

rocks. All but 3 plays are conventional. The Austin Mid-Dip Oil play was removed from the conventional list and divided into 3

plays (4747, 4748 and 4749) and the oil was assessed as an unconventional resource.

The

Welder Interest. We own a 59.61% working interest in the Welder Tract, which is located on approximately 550 acres, located

in Duval County, Texas. The Welder Tract has 43 wells. The Welder Tract wells are currently producing an average of 8 barrels

per day. In February 2014 we sold the acreage of the Welder Tract, but we maintain our interest in the well.

The

Walker Smith Interests. We own a 10.43% working interest in the Walker Smith and Walker Smith #21D tracts and a 40.39% working

interest in the Walker Smith #22D Tract (the “Walker Smith Interests”), which are located on approximately 275 acres,

located in Wilbarger County, Texas. The Walker Smith wells did not produce economically significant quantities during 2014.

The

Merrick Davis Interests. We own a 62.22% working interest in the Merrick Davis #16 and Merrick Davis #17 tracts and a 19.72%

working interest in the Merrick Davis tract (hereinafter all three tracts will be referred to as “Merrick Davis Interests”),

which are located on approximately 320 acres, located in Shackelford County, Texas. The Merrick Davis Interests have six wells

producing an average of 0.6 barrels per day.

The

Bailey, Rogers and Fohn Interests. We own a 65.00% working interest in the Baily, Rogers and Fahn tracts (the “BRF Interests”),

which are located on approximately 1000 acres, located in Medina County, Texas. The wells are currently producing an average of

2.3 barrels per day.

The

Gabriel and Rosser Interests. On January 28, 2011, we acquired certain oil and gas interests located in Bastrop County, Texas,

(“Gabriel Interests”) from Gabriel Rosser, LP (“Gabriel”). The Gabriel Interests include Gabriel’s

undivided 50.83% working interest and 39.14% revenue interest in the Gabriel 3, 4, 5, 9,

15,

Rosser #2 and #4 and Koi #1 wells. At the time of our acquisition of the Gabriel Interests, all wells were not producing. The

Gabriel Interests comprise over 400 acres, with approximately 10 wells that were shut in. As of the date of this report,

Rosser 4 is producing about 2 barrels of oil per day. We are currently equipping Gabriel 3 to produce with pumping unit. Expecting

it will have the same level of production as Rosser 4, 2 barrels of oil per day.

The

McKenzie State Well Interests. On November 30, 2011, we acquired one hundred percent (100%) of the working interest in the

McKenzie State Well No. 1, located in Pecos County, Texas from McKenzie Oil Corp. (“McKenzie”) in exchange for

an aggregate cash sum of $550,000 and 50,000 shares of our common stock. The Company has performed workover procedures on certain

wells in the McKenzie and production has commenced on one well, which is currently producing an average total of 3.4 barrels per

day. In addition to the production from this current zone, several additional horizons (which are productive in the area)

have been identified in the McKenzie well, which could be tested and potentially produced in the future.

The

McKinney Interests. We own a 7.04% working interest in the McKinney #3B, #5B, #6B and #11B tracts and a 5.40% working interest

in the McKinney #4B tract (hereinafter all tracts will be referred to as the “McKinney Interests”). Each tract has

one wellbore and our working interest is for the wellbores on each tract. The wellbores are located in Navarro County, Texas.

These wells are currently producing an average total of 0.25 barrels per day.

Company

Reserve Estimates. Our proved reserve information as of December 31, 2014 and 2013 was estimated by Mire and Associates, Inc.

(“Mire”), independent petroleum engineers. In accordance with SEC guidelines contained in Item 1202(a)(8) of SEC Regulation

S-K and Mire’s estimates of future net revenues from our properties, the PV-10 and standardized measure thereof were determined

to be economically producible under existing economic conditions. These guidelines require the use of the 12-month average price

for each product, calculated as the unweighted arithmetic average of the first-day-of-the-month price for the period January 1,

2014 through December 31, 2014, except where such guidelines permit alternate treatment, including the use of fixed and determinable

contractual price escalations.

The technical

persons at Mire are responsible for preparing the reserves estimates presented herein and ensuring that they meets the requirements

regarding qualifications, independence, objectivity, and confidentiality set forth in the Standards Pertaining to the Estimating

and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers.

Mire is

an independent petroleum engineering firm specializing in the technical and financial evaluation of oil and gas assets. Mire’s

report was prepared under the direction of Kurt Mire, principal consultant and owner of Mire. Mr. Mire earned a B.S. degree in

Petroleum Engineering from the University of Louisiana at Lafayette and has more than 25 years of experience in production engineering,

field operations and management, reservoir engineering, acquisitions and divestments. Mire and its employees have no interest

in our Company or in our properties, were not employed by our Company on a contingent fee basis and were objective in determining

our reserves.

Additional

information regarding our oil and gas properties and reserve information can be found in Note 14 to the audited financial statements

for the years ended December 31, 2014 and 2013, attached hereto.

Our

Acreage and Wells. We own mineral interests leases on the following productive wells, developed acreage and undeveloped acreage

in Texas. Other properties outside of Texas have been excluded from this table. Productive wells are producing wells and wells

mechanically capable of production. A gross well is a well in which a working interest is owned. The number of gross wells is

the total number of wells in which a working interest is owned. The number of net wells is the sum of the fractional working interests

owned in gross wells expressed as whole numbers and fractions thereof. Wells with multiple completions are counted as one well

in the table below.

| | |

December 31, 2014 | | |

December 31, 2013 | |

| | |

Oil | | |

| | |

Gas | | |

| | |

Oil | | |

| | |

Gas | | |

| |

| | |

Gross | | |

Net | | |

Gross | | |

Net | | |

Gross | | |

Net | | |

Gross | | |

Net | |

| United States - Texas | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross & Net Productive Wells | |

| 43 | | |

| 19 | | |

| — | | |

| — | | |

| 46 | | |

| 19 | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross & Net Developed Acreage | |

| 1,473 | | |

| 824 | | |

| 882 | | |

| 178 | | |

| 3,125 | | |

| 824 | | |

| 882 | | |

| 178 | |

| Gross & Net Undeveloped Acreage | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Production.

For the year ended December 31, 2014, we had production from our Lozano, Marcee, McKinney, and Gabriel Rosser leases located

in nine Texas counties: Bastrop, Duval, Erath, Frio, Gonzalez, Medina, Navarro, Pecos and Shackleford. The Company produced approximately

8,907 barrels and 0 Mcf on a net basis.

Drilling

Activity. During the fiscal year ended December 31, 2014, the Company drilled the surface casing on Gabriel 17. Currently

the well is not completed. No drilling was performed during the year ended December 31, 2013.

Delivery

Commitments. We are not obligated to provide a fixed and determinable quantity of oil or gas in the near future under existing

contracts or agreements in Texas.

Item

3. Legal Proceedings.

None.

Item

4. Mine Safety Disclosures.

Not

applicable.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

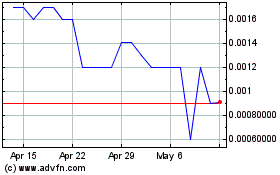

Market

Information. Our common stock, par value $.001, is quoted on the OTC Bulletin Board and OTCQB under the symbol “UAPC”.

For the periods indicated, the following table sets forth the high and low bid prices per share of our common stock. These prices

represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

| | |

High | | |

Low | |

| Fiscal Year 2014 | |

| | | |

| | |

| First Quarter | |

$ | 0.012 | | |

| 0.0025 | |

| Second Quarter | |

| 0.008 | | |

| 0.0023 | |

| Third Quarter | |

| 0.0029 | | |

| 0.0008 | |

| Fourth Quarter | |

| 0.0024 | | |

| 0.0004 | |

| | |

High | | |

Low | |

| Fiscal Year 2013 | |

| | | |

| | |

| First Quarter | |

$ | 0.15 | | |

$ | 0.07 | |

| Second Quarter | |

| 0.14 | | |

| 0.07 | |

| Third Quarter | |

| 0.12 | | |

| 0.02 | |

| Fourth Quarter | |

| 0.04 | | |

| 0.0027 | |

Reports

to Security Holders. We are a reporting company with the SEC. The public may read and copy any materials filed with the Securities

and Exchange Commission at the Security and Exchange Commission’s Public Reference Room at 100 F Street, N.E., Washington,

D.C. 20549. The public may also obtain information on the operation of the Public Reference Room by calling the Securities and

Exchange Commission at 1-800-SEC-0330. The Securities and Exchange Commission maintains an Internet site that contains reports,

proxy and information statements, and other information regarding issuers that file electronically with the Securities and Exchange

Commission. The address of that site is http://www.sec.gov.

We

also make our SEC reports available on our Web site at http://www.unitedamericanpetroleum.com.

Holders.

On April 11, 2014, we had approximately 97,418,383 shares of common stock issued and outstanding held by 28 stockholders of

record. The number of stockholders of record does not include beneficial owners of our common stock, whose shares are held in

the names of various dealers, clearing agencies, banks, brokers and other fiduciaries.

Dividends.

We currently anticipate that we will not declare or pay cash dividends on our common stock in the foreseeable future. We will

pay dividends on our common stock only if and when declared by our Board of Directors. Our Board of Directors’ ability to

declare a dividend is subject to restrictions imposed by Nevada law. In determining whether to declare dividends, the Board of

Directors will consider these restrictions as well as our financial condition, results of operations, working capital requirements,

future prospects and other factors it considers relevant.

On

September 13, 2013, the Company’s Board of Directors approved the Company’s 2013 Stock Plan for Officers, Directors,

and Consultants (the “2013 Plan”). The 2013 Plan provided for the issuance of a total of up to 2,000,000 shares of

common stock, options, restricted share units, share appreciation rights and other share based awards to acquire common stock

to employees, directors and consultants. No options were issued under the 2013 Plan during the year ended December 31, 2013.

| Plan Category | |

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights | | |

Weighted-average

exercise price of

outstanding options,

warrants and rights | | |

Number of securities

available for future

issuance under equity

compensation plans

(excluding those in first

column) | |

| Equity compensation plans approved by security holders | |

| — | | |

| — | | |

| — | |

| Equity compensation plans not approved by security holders | |

| — | | |

| — | | |

| 1,436,000 | |

| Total | |

| — | | |

| — | | |

| 1,436,000 | |

Recent

Sales of Unregistered Securities.

On

(a) January 31, 2013, the Company sold a Note to JMJ Financial in the initial amount of $50,000; and (b) February 19, 2013, the

Company sold a $103,500 Convertible Note to Asher Enterprises, Inc. (“Asher”), each in transactions exempt from registration

as provided by Section 4(a)(2) and Rule 506 of Regulation D of the Securities Act. JMJ Financial and Asher are “accredited

investors,” as such term is defined in Rule 501(a) of Regulation D of the Securities Act. The sale of the Note and Convertible

Note did not involve a public offering and were made without general solicitation or general advertising. JMJ and Asher acquired

the securities for investment purposes only and not with a view to or for sale in connection with any distribution thereof.

During

2014, we issued the following shares to JMJ Financial pursuant to conversion requests under its Note:

| Date | |

Shares | | |

Price | | |

Amount | |

| 1/7/2014 | |

| 2,800,000 | | |

| 0.00228 | | |

$ | 6,380 | |

| 6/9/2014 | |

| 3,000,000 | | |

| 0.00110 | | |

$ | 3,300 | |

| 6/27/2014 | |

| 4,600,000 | | |

| 0.00115 | | |

$ | 5,290 | |

| 7/16/2014 | |

| 4,800,000 | | |

| 0.00075 | | |

$ | 3,600 | |

| 7/29/2014 | |

| 5,000,000 | | |

| 0.00055 | | |

$ | 2,750 | |

| 8/12/2014 | |

| 5,300,000 | | |

| 0.00050 | | |

$ | 2,650 | |

| 8/27/2014 | |

| 6,200,000 | | |

| 0.00045 | | |

$ | 2,790 | |

| 9/12/2014 | |

| 6,500,000 | | |

| 0.00045 | | |

$ | 2,925 | |

| 9/22/2014 | |

| 7,100,000 | | |

| 0.00040 | | |

$ | 2,840 | |

| 10/2/2014 | |

| 7,900,000 | | |

| 0.00040 | | |

$ | 3,160 | |

| 10/13/2014 | |

| 8,300,000 | | |

| 0.00035 | | |

$ | 2,995 | |

| 10/28/2014 | |

| 8,250,000 | | |

| 0.00025 | | |

$ | 2,062 | |

| 11/11/2014 | |

| 8,310,000 | | |

| 0.00020 | | |

$ | 1,662 | |

| 11/20/2014 | |

| 14,600,000 | | |

| 0.00020 | | |

$ | 2,920 | |

| 12/1/2014 | |

| 14,256,650 | | |

| 0.00020 | | |

$ | 2,851 | |

| Total | |

| 106,916,650 | | |

| | | |

$ | 48,175 | |

During

2014, we issued the following shares to Asher pursuant to conversion requests under its Convertible Note:

| Date | |

Shares | | |

Price | | |

Amount | |

| 1/2/2014 | |

| 2,235,294 | | |

| 0.0017 | | |

$ | 3,800 | |

| 1/7/2014 | |

| 2,757,895 | | |

| 0.0019 | | |

$ | 5,240 | |

| 1/13/2014 | |

| 2,750,000 | | |

| 0.0018 | | |

$ | 4,950 | |

| 6/4/2014 | |

| 2,758,824 | | |

| 0.0017 | | |

$ | 4,690 | |

| 6/16/2014 | |

| 4,860,000 | | |

| 0.0025 | | |

$ | 12,150 | |

| 6/24/2014 | |

| 4,843,750 | | |

| 0.0016 | | |

$ | 7,750 | |

| 7/7/2014 | |

| 5,630,000 | | |

| 0.0015 | | |

$ | 8,445 | |

| 7/14/2014 | |

| 5,629,167 | | |

| 0.0012 | | |

$ | 6,755 | |

| 7/18/2014 | |

| 5,631,818 | | |

| 0.0011 | | |

$ | 6,195 | |

| 7/23/2014 | |

| 7,090,909 | | |

| 0.0010 | | |

$ | 7,800 | |

| 7/25/2014 | |

| 5,526,596 | | |

| 0.0009 | | |

$ | 5,195 | |

| 7/25/2014 | |

| 1,643,617 | | |

| 0.0000 | | |

$ | 1,545 | |

| 8/5/2014 | |

| 7,173,611 | | |

| 0.0007 | | |

$ | 5,165 | |

| 8/7/2014 | |

| 7,169,118 | | |

| 0.0007 | | |

$ | 4,875 | |

| 8/19/2014 | |

| 7,169,231 | | |

| 0.0006 | | |

$ | 4,660 | |

| 8/26/2014 | |

| 7,161,765 | | |

| 0.0007 | | |

$ | 4,870 | |

| 9/2/2014 | |

| 7,171,875 | | |

| 0.0006 | | |

$ | 4,590 | |

| 9/8/2014 | |

| 7,172,414 | | |

| 0.0006 | | |

$ | 4,160 | |

| 9/10/2014 | |

| 7,172,414 | | |

| 0.0006 | | |

$ | 4,160 | |

| 9/16/2014 | |

| 12,236,364 | | |

| 0.0005 | | |

$ | 6,730 | |

| 9/18/2014 | |

| 12,235,849 | | |

| 0.0005 | | |

$ | 6,485 | |

| 9/22/2014 | |

| 2,055,556 | | |

| 0.0000 | | |

$ | 1,110 | |

| Total | |

| 128,076,067 | | |

| | | |

$ | 121,320 | |

The

sale of the Convertible Note did not involve a public offering and were made without general solicitation or general advertising.

JMJ and Asher acquired the securities for investment purposes only and not with a view to or for sale in connection with any distribution

thereof. Neither the Convertible Note nor the underlying shares of common stock issuable upon the conversion thereof have been

registered under the Securities Act. in reliance upon the exemption set forth in Sections 3(a)(9), 4(a)(1) and 4(a)(2) of the

Securities Act.

Item

6. Selected Financial Data.

Not

applicable.

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward

Looking Statements

This

Annual Report of United American Petroleum Corp. on Form 10-K contains forward-looking statements, particularly those identified

with the words, “anticipates,” “believes,” “expects,” “plans,” “intends”,

“objectives” and similar expressions. These statements reflect management’s best judgment based on factors known at

the time of such statements. The reader may find discussions containing such forward-looking statements in the material set forth

under “Management’s Discussion and Analysis and Plan of Operations,” generally, and specifically therein under the

captions “Liquidity and Capital Resources” as well as elsewhere in this Annual Report on Form 10-K. Actual events

or results may differ materially from those discussed herein. The forward-looking statements specified in the following information

have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable.

Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred

from those forward-looking statements. The assumptions used for purposes of the forward-looking statements specified in the following

information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative,

industry, and other circumstances. As a result, the identification and interpretation of data and other information and their

use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent

that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly,

no opinion is expressed on the achievability of those forward-looking statements. No assurance can be given that any of the assumptions

relating to the forward-looking statements specified in the following information are accurate, and we assume no obligation to

update any such forward-looking statements.

Critical

Accounting Policy and Estimates. Our Management’s Discussion and Analysis of Financial Condition and Results of Operations

section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted

in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including

those related to revenue recognition, accrued expenses, financing operations, and contingencies and litigation. Management bases

its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that

are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the

appropriate carrying value of certain assets and liabilities which are not readily apparent from other sources.

Oil

and Gas Properties

The

Company follows the full cost method of accounting for its investments in oil and gas properties. Under the full cost method,

all costs associated with the exploration of properties are capitalized into appropriate cost centers within the full cost pool.

Internal costs that are capitalized are limited to those costs that can be directly identified with acquisition, exploration,

and development activities undertaken and do not include any costs related to production, general corporate overhead, or similar

activities. Cost centers are established on a country-by-country basis.

Capitalized

costs within the cost centers are amortized on the unit-of-production basis using proved oil and gas reserves. The cost of investments

in unproved properties and major development projects are excluded from capitalized costs to be amortized until it is determined

whether or not proved reserves can be assigned to the properties. Until such a determination is made, the properties are assessed

annually to ascertain whether impairment

has

occurred. The costs of drilling exploratory dry holes are included in the amortization base immediately upon determination that

the well is dry.

For

each cost center, capitalized costs are subject to an annual ceiling test, in which the costs shall not exceed the cost center

ceiling. The cost center ceiling is equal to i) the present value of estimated future net revenues computed by applying current

prices of oil and gas reserves (with consideration of price changes only to the extent provided by contractual arrangements) to

estimated future production of proved oil and gas reserves as of the date of the latest balance sheet presented, less estimated

future expenditures (based on current costs) to be incurred in developing and producing the proved reserves computed using a discount

factor of ten percent and assuming continuation of existing economic conditions; plus ii) the cost of properties not being amortized;

plus iii) the lower of cost or estimated fair value of unproven properties included in the costs being amortized; less iv) income

tax effects related to differences between the book and tax basis of the properties. If unamortized costs capitalized within a

cost center, less related deferred income taxes, exceed the cost center ceiling, the excess is charged to expense and separately

disclosed during the period in which the excess occurs.

Share-Based

Compensation

The

Company accounts for share-based compensation in accordance with Accounting Standards Codification subtopic 718-10, Stock Compensation

(“ASC 718-10”). This requires the measurement and recognition of compensation expense for all share-based payment

awards made to employees and directors, including employee stock options and employee stock purchases related to an Employee Stock

Purchase Plan based on the estimated fair values.

As

of December 31, 2014, there were no outstanding employee stock options.

Recent

Accounting Pronouncements

There

were various updates recently issued, most of which represented technical corrections to the accounting literature or application

to specific industries and are not expected to a have a material impact on the Company’s financial position, results of operations

or cash flows.

Overview.

United American Petroleum Corp. (“we” or the “Company”), formerly Forgehouse, Inc., was incorporated

in the State of Nevada on November 19, 2004. On December 31, 2010, we entered into and closed an Agreement and Plan of Merger

(“Merger Agreement”) with our then newly formed wholly-owned subsidiary, United PC Acquisition Corp., a Nevada corporation

(“Merger Sub”), and United American Petroleum Corp., a Nevada Corporation (“United”) (the “Merger

Transaction”), pursuant to which Merger Sub merged with and into United with United surviving, making United our wholly-owned

subsidiary. Immediately thereafter and pursuant to the Merger Agreement, United merged with and into the Company, with the Company

surviving and we changed our name to “United American Petroleum Corp.” In connection with the Merger Transaction,

we assumed all of United’s contractual obligations and acquired certain oil and gas properties of United located in Texas.

The Merger Transaction was deemed to be a reverse acquisition, where the Company (the legal acquirer) is considered the accounting

acquiree and United (the legal acquiree) is considered the accounting acquirer. The Company is deemed a continuation of the business

of United, and the historical financial statements of United became the historical financial statements of the Company.

Recent

Events

Our

Business. We are engaged in the acquisition, exploration, development and production of oil and gas properties. Our principal

business is the acquisition of leasehold interests in petroleum and natural gas rights, either directly or indirectly, and the

exploitation and development of properties subject to these leases. Our primary focus is to develop our properties that have potential

for near-term production. We also provide operational expertise for several third-party well owners out of our operation base

in Austin, Texas. We currently have proved reserves in the State of Texas.

The

following discussion of our financial condition and results of operations should be read in conjunction with our financial statements

for the period ended December 31, 2014, together with notes thereto, which are included in this Annual Report.

Results

of operations for the twelve months ended December 31, 2014, as compared to the twelve months ended December 31, 2013.

Revenues.

We had total revenues of $621,548 for the twelve months ended December 31, 2014, which were generated from oil and gas sales

of $563,622 and administrative revenue of $57,926. This was a $115,065 decrease from total revenues of $736,613 for the twelve

months ended December 31, 2013, which were generated from oil and gas sales of $704,704 and administrative revenue of $31,909.

Our oil and gas revenues decreased $141,082, a 25.03% decrease from the year before.

Our

administrative revenues, as presented within this report for the years ended December 31, 2014 and 2013, are administrative fees

charged through United Operating, LLC, our wholly-owned subsidiary, to third party well owners for properties which the company

owns no portion of for managing and accounting for the development and production of their oil and gas property interests. Administrative

revenues increased during fiscal year 2014 from administrative revenues in fiscal year 2013 due to an increase in operation fees

charged to well interest owners.

The

following table sets forth the revenue and production data for the twelve months ended December 31, 2014 and 2013.

| | |

TWELVE MONTHS | | |

TWELVE MONTHS | | |

| | |

| |

| | |

ENDED DECEMBER | | |

ENDED DECEMBER | | |

INCREASE | | |

% INCREASE | |

| | |

31, 2014 | | |

31, 2013 | | |

(DECREASE) | | |

(DECREASE) | |

| REVENUES | |

| | | |

| | | |

| | | |

| | |

| Oil and Gas Revenues | |

$ | 563,622 | | |

$ | 704,704 | | |

$ | (141,082 | ) | |

| -20 | % |

| Administrative revenues | |

| 57,926 | | |

| 31,909 | | |

| 26,017 | | |

| 82 | % |

| Total Revenues | |

| 621,548 | | |

| 736,613 | | |

| (115,065 | ) | |

| -16 | % |

| | |

| | | |

| | | |

| | | |

| | |

| PRODUCTION: | |

| | | |

| | | |

| | | |

| | |

| Total production (Barrel of Oil Equivalent) | |

| 6,161 | | |

| 7,123 | | |

| (962 | ) | |

| -14 | % |

| Barrels of Oil Equivalent per day | |

| 16.88 | | |

| 19.52 | | |

| (5 | ) | |

| -27 | % |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| AVERAGE SALES PRICES: | |

| | | |

| | | |

| | | |

| | |

| Price per Barrel of Oil Equivalent | |

$ | 91.48 | | |

$ | 98.93 | | |

$ | (7 | ) | |

| -8 | % |

During

the twelve months ended December 31, 2014, we decreased our barrels of oil per day (BOPD) produced to an average of 16.88 BOPD

from 19.52 BOPD for the twelve months ended December 31, 2013.

Operating

Expenses. The following table sets forth information relating to our operating expenses for the twelve months ended December

31, 2014 and 2013.

| | |

TWELVE MONTHS | | |

TWELVE MONTHS | | |

| | |

| |

| | |

ENDED DECEMBER | | |

ENDED DECEMBER | | |

INCREASE | | |

% INCREASE | |

| | |

31, 2014 | | |

31, 2013 | | |

(DECREASE) | | |

(DECREASE) | |

| LEASE OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Lease operating expenses | |

$ | 372,998 | | |

$ | 768,847 | | |

$ | (395,849 | ) | |

| -51 | % |

| Workover expenses | |

| 7,189 | | |

| 127,122 | | |

| (119,933 | ) | |

| -94 | % |

| Legal, title and administrative well expenses | |

| 28,204 | | |

| 32,013 | | |

| (3,805 | ) | |

| -12 | % |

| Total Lease Operating expenses | |

| 408,391 | | |

| 927,982 | | |

| (515,582 | ) | |

| -56 | % |

| | |

| | | |

| | | |

| | | |

| | |

| DEPLETION AND ACCRETION EXPENSE | |

| | | |

| | | |

| | | |

| | |

| Depreciation, depletion, amortization and accretion expense | |

| 109,178 | | |

| 112,239 | | |

| (3,061 | ) | |

| -3 | % |

| | |

| | | |

| | | |

| | | |

| | |

| BAD DEBT EXPENSE | |

| | | |

| | | |

| | | |

| | |

| Bad debt expense | |

| 67,977 | | |

| 226,986 | | |

| (159,009 | ) | |

| 100 | % |

| | |

| | | |

| | | |

| | | |

| | |

| LEGAL SETTLEMENT LOSS | |

| | | |

| | | |

| | | |

| | |

| Legal settlement loss | |

| — | | |

| 93,526 | | |

| (93,526 | ) | |

| 100 | % |

| | |

| | | |

| | | |

| | | |

| | |

| GENERAL AND ADMINISTRATIVE EXPENSES | |

| | | |

| | | |

| | | |

| | |

| SEC related general and administrative expenses | |

$ | 305,394 | | |

$ | 248,940 | | |

$ | 56,457 | | |

| 23 | % |

| Employee and officer expenses | |

| 298,409 | | |

| 312,665 | | |

| (14,256 | ) | |

| -5 | % |

| Other general and administrative | |

| 96,725 | | |

| 188,052 | | |

| (91,327 | ) | |

| -49 | % |

| Total General and Administrative expenses | |

| 700,527 | | |

| 749,657 | | |

| (49,130 | ) | |

| -7 | % |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| TOTAL OPERATING EXPENSES | |

| 1,286,073 | | |

| 2,110,390 | | |

| (567,775 | ) | |

| -27 | % |

| | |

| | | |

| | | |

| | | |

| | |

For

the twelve months ended December 31, 2014, our total operating expenses were $1,286,073, which consisted of lease operating expenses

of $408,391, accretion expense of $63,334, depletion expense of $45,844, and general and administrative expenses of

$700,527. By comparison, for the twelve months ended December 31, 2013, our total operating expenses were $2,110,390, which

consisted of lease operating expenses of $927,982, accretion expense of $12,745, depletion expense of $99,494, legal settlement

loss of $93,526 and general and administrative expenses of $749,657.

For

the twelve months ended December 31, 2014, we incurred lease and well operating expenses of $372,994 compared to $768,847 for