U.

S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-KSB

[X]

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

fiscal year ended

December 31,

2007

[X]

TRANSITIONAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period from ___________ to _____________

Commission

File Number:

000-32917

PROTOKINETIX,

INC.

(Name of

small business issuer as specified in its charter)

|

Nevada

|

94-3355026

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

Suite

1500-885 West Georgia Street

Vancouver,

British Columbia Canada V6C 3E8

________________________________________________________________________

(Address

of principal executive offices, including zip

code)

|

Registrant’s

telephone number, including area

code:

604-687-9887

Securities

registered pursuant to Section 12(b) of the

Act:

None

Securities

registered pursuant to Section 12(g) of the

Act:

$.001 par value common

stock

___________________

Check

whether the issuer (1) filed all reports required to be filed by

Section 13 or 15(d) of the Exchange Act of 1934 during the past 12 months

(or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past

90 days.Yes

X

No

Check if

disclosure of delinquent filers pursuant to Item 405 of Regulation S-B is not

contained in this form, and no disclosure will be contained, to the best of

registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-KSB or any amendment to

this Form 10-KSB. [ ]

The

issuer’s revenues for the most recent fiscal year were $0.

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates of the registrant was approximately $16,464,950 based upon the

closing price of our common stock which was $0.33 on April 10,

2008. Shares of common stock held by each officer and director and by

each person or group who owns 10% or more of them outstanding common stock

amounting to 620,000 shares have been excluded in that such persons or groups

may be deemed to be affiliates. This determination of affiliate status is not

necessarily a conclusive determination for other purposes.

As of

April 10, 2008, there were 50,513,788 shares of our common stock were issued and

outstanding.

Documents

Incorporated by Reference: None.

Transitional

Small Business Disclosure Format: No.

INTRODUCTION

The

following discussion should be read in conjunction with our audited financial

statements and notes thereto. Because we desire to take advantage of,

the "safe harbor" provisions of the Private Securities Litigation Reform Act of

1995, we caution readers regarding certain forward looking statements in the

following discussion and elsewhere in this report and in any other statement

made by, or on our behalf, whether or not in future filings with the Securities

and Exchange Commission. Forward looking statements are statements

not based on historical information and which relate to future operations,

strategies, financial results or other developments. Forward looking

statements are necessarily based upon estimates and assumptions that are

inherently subject to significant business, economic and competitive

uncertainties and contingencies, many of which are beyond our control and many

of which, with respect to future business decisions, are subject to change.

These uncertainties and contingencies can affect actual results and could cause

actual results to differ materially from those expressed in any forward looking

statements made by, or our behalf. We disclaim any obligation to

update forward looking statements.

Forward

looking statements involve known and unknown risks, uncertainties and other

factors that may cause our actual results, levels of activity, performance, or

achievements to be materially different from any future results, levels of

activity, performance, or achievement expressed or implied by such

forward-looking statements. In some cases, you can identify forward-looking

statements by terminology such as "may," "will," "should," "could," "intend,"

"expects," "plan," "anticipates," "believes," "estimates," "predicts,"

"potential," or "continue" or the negative of such terms or other comparable

terminology. Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee future results,

levels of activity, performance, or achievements. Moreover, neither we nor any

other person assumes responsibility for the accuracy and completeness of such

statements.

WE ARE A

DEVELOPMENT STAGE BUSINESS AND AN INVESTMENT IN OUR COMPANY IS

EXTREMELY

RISKY.

TABLE

OF CONTENTS

FORM

10-KSB ANNUAL REPORT

_________________________

PROTOKINETIX,

INC.

|

Section

|

Heading

|

|

Part

I

|

|

|

Item

1

|

Description

of Business

|

|

Item

2

|

Description

of Property

|

|

Item

3

|

Legal

Proceedings

|

|

Item

4

|

Submission

of Matters to a Vote of Security Holders

|

|

Part

II

|

|

|

Item

5

|

Market

for the Registrant's Common Equity and Related Stockholder

Matters

|

|

Item

6

|

Management's

Discussion and Analysis of Financial Condition and Results of Operations

or Plan of Operation

|

|

Item

6A

|

Quantitative

and Qualitative Disclosures About Market Risk

|

|

Item

7

|

Financial

Statements

|

|

Item

8

|

Changes

in and Disagreements on Accounting and Financial

Disclosure

|

|

Item

8A

|

Controls

and Procedures

|

|

Item

8B

|

Other

Information

|

|

Part

III

|

|

|

Item

9

|

Directors,

Executive Officers, Promoters and Control Persons, Compliance with Section

16(a) of the Exchange Act

|

|

Item

10

|

Executive

Compensation

|

|

Item

11

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

|

Item

12

|

Certain

Relationships and Related Transactions

|

|

Part

IV

|

|

|

Item

13

|

Exhibits

and Reports on Form 8-K

|

|

Item

14

|

Principal

Accountant Fees and Services

|

|

|

Certifications

and Signatures

|

PART

I

ITEM

1. DESCRIPTION

OF THE BUSINESS

Important

Disclosures and Disclaimers

.

Please

note that ProtoKinetix, Inc. (the "Company") is a research and product

development stage company that has not yet sold

any

products. The Company had $0 in revenues for the year ended December

31, 2007.

It

is important to understand that although the Company (as is discussed below) is

focused on various promising scientific and business development efforts, to

date, we have not yet marketed a product. Ongoing testing of the AAGP™ molecule

with three amino acids joined to a monosaccharide by a gemdifluride bond

continues to show that there is significant promise in the field of medicine of

preserving cells, tissue and organs from various stresses. The antiaging

properties and the protective effect of AAGP™ also is of significant interest to

the cosmetic and skin care industries. Tests have confirmed that the AAGP™

molecule improves the harvest of cells from cryopreservation by 30% to 120%. We

believe there is a market for AAGP™ to preserve cells, particularly various stem

cells, and we will continue testing with potential customers. At the same time

we are taking steps to improve the manufacturing process to reduce costs and

improve purity and biochemical activity.

Our

progress to date has been achieved notwithstanding the inherent risks relating

to the science, applications, market opportunities and commercial relationships.

The progress of the business has and will continue to be dependant on having

appropriate human and sufficient financial resources which have and will be

uncertain.

About

ProtoKinetix

ProtoKinetix

owns the world-wide rights to a family of anti-aging glycoproteins, trademarked

as AAGPs™. In scientific tests AAGPs™ have demonstrated the ability to

enhance the health and extend the life of biologically sensitive cells which

have been subjected to severe stress conditions under laboratory controlled test

conditions. AAGPs™ are stable and non-toxic.

Since

2005, ProtoKinetix has primarily focused on scientific research, but the company

has recently been in the process of directing major efforts to the practical

side of commercial validation. The commercial applications for AAGPs™ in large

markets such as skincare/cosmetic products and targeted health care solutions

are numerous, and ProtoKinetix is currently working with researchers, business

leaders and advisors and commercial entities to bring AAGP™ to

market.

Background

Native

AFGP Compound

AFGP

(Anti-Freeze Glycoprotein) is found in nature as a compound produced by some

fish, insects, reptiles, bacteria and plants that enable survival in freezing

temperatures.

One of

the many accomplishments from pioneering research of the U.S. Antarctic Program

was the discovery, in the early sixties, that fish living year-long in subzero

temperature are extremely resistant to freezing. The substances that

prevent these fish from freezing were isolated, characterized and designated as

antifreeze glycoproteins or AFGP. Various kinds of AFGP were isolated

from many species of fishes, and in some amphibians, plants and

insects. All of the AFGPs share a common characteristic that prevents

ice crystals from growing and connecting to each other. Research has

also confirmed a cell membrane stabilizing characteristics of native

AFGP.

There has

been much scientific research done in an attempt to synthetically replicate

AFGPs in research institutions because the protective properties of AFGPs could

have commercial applications, primarily in food and crop preservation at

freezing temperatures. The native antifreeze glycoproteins are very large

molecules that are often made up of a repeating series of smaller molecules,

glycoproteins. Glycoproteins are often very biologically active, but they are

inherently quite unstable. The oxygen-glycosidic link is readily cleaved by

glycosidases, resulting in a low bio-availability of these glycoconjugate based

molecules.

Scientific

research prior to AAGP has focused on building a stable and more efficient

compound with a strong bond.

AAGP™

– The Core Technology of ProtoKinetix

AAGP™

Invention

Dr.

Geraldine Castelot-Deliencourt, along with Dr. Jean-Charles Quirion at the

Research Institute of Organic Chemistry in Rouen, France, developed a patented

process to stabilize the oxygen-glycosidic bond in these sugar based molecules.

This patented process replaces the weaker oxygen bond with a C-F2 mimetic. The

resultant molecules are biologically active and stable over a pH range of 2 to

13. They are not broken down by glycosidases.

AAGP™ Toxicity

Tests

Tests

have shown cells that have been exposed to AAGP™ at low and high concentrations

have remained viable. A common viability test used on cell cultures using trypan

blue dye exclusion method has been used to show AAGP™ non-toxicity.

AAGP™ Stability

Tests

AAGP™

molecules have remained stable when subjected to three tests:

|

1.

|

pH

ranging from a strong acid level of 1.8 (stronger than stomach acid) to a

strong alkali level of 13.8. (the pH scale is calibrated from 1, highly

acidic, to 14, highly alkali);

|

|

2.

|

Enzymatic

action using protease, which targets the amino acid bonds, and

glycosidase, which targets the amino acid bonds, and glycosidase, which

targets the sugar molecules; and

|

|

3.

|

Temperatures

ranging from -196°C (cryopreservation) to +37°C (body

temperature).

|

Stress Tests on 12 Different

Cell Lines

Cell

lines are selected for their high level of sensitivity. Cell lines are also

selected for their potential role in adding value in medical applications,

enhancing health and extending life. All tests are designed to explore how cells

from different cell lines act biologically in the presence of AAGP™ when

subjected to health and life threatening inflammatory stress conditions

and agents.

Cells Lines

Tested

|

§

Stem

cells (human)

|

§

Adult

skin fibroblast cells

|

|

§

Whole

blood cells

|

§

Heart

cells (cardiac myocites)

|

|

§

Blood

Platelet cells

|

§

Liver

cells (hepatocites)

|

|

§

Heart

tissue

|

§

Embryonic

skin fibroblast cells

|

|

§

Hela

(cancer) cells

|

§

Islet

cells (pancreatic)

|

|

§

Kidney

(KB and vero) cells

|

§

Stem

cells (mouse)

|

Stress Conditions and

Agents

Temperature

|

§

|

temperatures

ranging from -80° C to +37°

|

UV-C

Radiation

|

§

|

harsh

sterilizing radiation

|

|

§

|

254

nanometer wavelength

|

Oxidation

|

§

|

hydrogen

peroxide (H2O20

|

Starvation

|

§

|

serum

free culture media

|

|

§

|

food/growth/nutrients

factors (fetal bovine serum)

withheld

|

Inflammation

|

§

|

Interleukin

1 Beta, a standard agent for stimulating inflammation in cell

testing

|

|

§

|

All

of the above tests are also considered to cause

inflammation

|

Bio-Screening Control Lab

Testing

AAGP™

testing is conducted to international standards in outsourced research

laboratories in North America and Europe. All tests are designed to explore both

the safety and effectiveness of AAGP™ when challenged to enhance the health

and extend the life of cells.

Test

Results Summary

Cells

that were tested in the presence of AAGP™ had a higher survival and viability

rate than the controls. The overall effect of AAGP™ is to protect, preserve and

in some cases to repair. Anti-inflammatory effects appear to be at work,

although the mechanism and pathways of action are not yet

determined. AAGP™ appears to enhance heath and extend cell

life.

The test

results are considered preliminary. The limited number of samples and extent of

the tests are designed to investigate the potential attributes of AAGP™ and

should not be considered as statistically or scientifically conclusive.

Notwithstanding, we feel the results are sufficient to justify further tests by

commercial entities in health care.

AAGP™

Commercial Applications

The

extent of the value of the ProtoKinetix family of AAGPs™ is being investigated

by companies and the Company is targeting commercial entities specializing in

regenerative medicine, cellular and tissue therapies, organ transplantation,

trauma, blood product banking, anti- inflammation and cosmetics/skin

care.

Skincare and

Cosmetics

Industry

sources estimate that the skincare market in the USA, including both mass and

prestige, will reach $7.2 billion by 2010, driven in part by expected

double-digit growth of anti-aging products, which is likely to become the second

largest category behind hand & body lotions in the industry.

According

to the Johnson and Johnson 2003 Annual Report, the global skin care and

cosmetics market is already running easily in the tens of billions at some $43

billion dollars per year.

In the

skin care business it’s about healthier, younger looking skin. The two major

causes of dry, wrinkled, less elastic or even diseased skin are inflammation and

oxidation. The main culprits are the sun (UV rays and free radicals) and other

environmental and physiological stresses that also cause inflammation and

oxidation.

When

AAGP™ is combined with Coenzyme Q10 a powerful anti-oxidant effect is achieved

that not only protects but also seems to help the cells repair previously

existing damage. In vitro laboratory tests have shown the AAGP™ molecules can

protect in vitro skin cells from damage and death that would otherwise occur

from UV rays and free radicals. To the extent of the laboratory tests conducted,

AAGP™ appears to protect in vitro skin cells from cold temperatures, oxidation,

UV irradiation and pH variations.

Health

Care

Acute

medical problems are increasingly reliant on, and benefit from, solutions that

can deal with the fundamental factors of inflammation and oxidation. Both are

well-known causes of life-threatening conditions and diseases, and accelerated

aging. In addition many acute medical problems are benefiting from cell

therapies and transplantation of cells, tissues and time sensitive

organs.

Health

Care Applications of AAGP™ fall into two main categories: (i) harvesting,

storage and transplanting cells, tissues and organs; and (ii) treatments for

conditions and disease caused by stress factors, including UV radiation,

oxidation and inflammation. These are all areas that expand into many

sub-categories of existing and future health care solutions.

Intellectual

Property

Because

it is difficult and costly to protect our proprietary rights, we may not be able

to ensure their protection. Our commercial success will depend in part on

maintaining patent protection and trade secret protection for our products, as

well as successfully defending these patents against third-party challenges. We

will only be able to protect our technologies from unauthorized use by third

parties to the extent that valid and enforceable patents or trade secrets cover

them.

The

patent positions of pharmaceutical and biotechnology companies can be highly

uncertain and involve complex legal and factual questions for which important

legal principles remain unresolved. No consistent policy regarding the breadth

of claims allowed in pharmaceutical or biotechnology patents has emerged to date

in the United States. The patent situation outside the United States is even

more uncertain. Changes in either the patent laws or in interpretations of

patent laws in the United States and other countries may diminish the value of

our intellectual property. Accordingly, we cannot predict the breadth of claims

that may be allowed or enforced in our patents or in third-party

patents.

Patents

As of the

date of this Report, our development agents, including the parties we have

licensed AAGP™ technologies from, have applied to receive patents for

technologies we have licensed and continue to primarily base our research

efforts on. At present, we have engaged the patent law firm of Cabinet-Moutard

of Versaille, France, and have filed a number of international patent

applications. These patent applications include:

WO

2004/014928 A2 (19 February 2004)

PCT Int.

Appl. (2006), 87 pp. WO2006059227 A1 20060608 AN 2006:538719

Patent

application: Fr 03 May 2006, 06 03952

Consistent

with our agreements with the licensors of various technologies we license, we

have no finished commercial product or products, and have received no final

patents awards or FDA approvals for any product or diagnostic

procedures. We are focused on the research and development of one

primary compound known as AAGP™, which we have filed a trademark application

for.

Subject

to our available financial resources, our intellectual property strategy

is: (1) to pursue licenses, trade secrets, and know-how within our

primary research areas, and (2) to develop and acquire proprietary positions to

reagents and new platforms for the development of products related to these

technologies.

Trade

Secrets and Know-How

The

Company has developed a substantial body of trade secrets and know-how relating

to the development, use and manufacture of AAGP™, including but not limited to

the optimization of materials for efforts, and how to maximize sensitivity,

speed-to-result, specificity, stability, purity and

reproducibility.

Super

Antibody and Catalytic Antibody Platform Technologies

The

Company continues to own the rights to both the Super Antibody and the Catalytic

Antibody platform technologies. The Company plans to, as a secondary priority

and subject to available resources, search for a patentable receptor sites that

exist on cancer cells.

Competition

The

markets that the Company is focusing on are multi-billion dollar international

industries. They are intensely competitive. Many of the

Company’s competitors are substantially larger and have greater financial,

research, manufacturing, and marketing resources.

Industry

competition in general is based on the following:

|

§

|

Scientific

and technological capability;

|

|

§

|

The

ability to develop and market products and

processes;

|

|

§

|

The

ability to obtain FDA or other required regulatory

approvals;

|

|

§

|

The

ability to manufacture products that meet applicable FDA requirements,

(i.e. FDA’s Quality System Regulations) see Governmental Regulation

section;

|

|

§

|

Access

to adequate capital;

|

|

§

|

The

ability to attract and retain qualified personnel;

and

|

|

§

|

The

availability of patent protection.

|

The

Company believes its scientific and technological capabilities are

significant.

The

Company’s ability to develop its research is in large measure dependent on

having sufficient and additional resources and/or collaborative

relationships.

The

Company’s access to capital is more challenging, relative to most of its

competitors. This is a competitive disadvantage. The

Company believes however that its access to capital may increase as it gets

closer to the development of a commercially viable product.

The

Company believes that its research has enabled it to attract and retain

qualified consultants. Because of the greater financial resources of

many of its competitors, the Company may not be able to complete effectively for

the same individuals to the extent that a competitor uses its substantial

resources to attract any such individuals.

Governmental

Regulation

The

Company’s AAGPs™ have commercial applications in markets and circumstances that

fall under government regulations ranging from none to limited to

extensive.

Although

there is no such immediate need to make any regulatory filing in the United

States or other jurisdictions, the Company has limited or no experience with

regard to obtaining FDA or other required regulatory approvals. The Company

intends to retain the services of appropriately experiences consultants. For

this reason, should our research efforts continue to show promise, we will need

to hire consultants to assist the Company with such governmental

regulations.

As the

Company continues to conduct research and testing programs, in collaboration

with commercial entities, to expand and confirm the potential medical

applications of AAGP™ in the a number of fields, including regenerative

medicine, cell therapy, blood products, transplants and skin care/cosmetics, the

Company intends to utilize the regulatory expertise of others, whether they are

consultants or commercial entities involved on collaborative development

programs with the Company.

The

following discussion relates to factors that may come into play when and if the

Company has a commercially viable product in an area which requires regulatory

approval. These products may be regulated by the European regulatory

agencies, FDA, U.S. Department of Agriculture, certain state and local agencies,

and/or comparable regulatory bodies in other countries (collectively, these

agencies shall be referred to as the "Agencies"). Government

regulation affects almost all aspects of development, production, and marketing,

including product testing, authorizations to market, labeling, promotion,

manufacturing, and record keeping. The FDA and U.S. Department of

Agriculture regulated products require some form of action by that agency before

they can be marketed in the United States, and, after approval or clearance, the

products must continue to comply with other FDA requirements applicable to

marketed products. Both before and after approval or clearance,

failure to comply with the FDA’s requirements can lead to significant penalties.

The Company's proposed AAGP™ products will require government regulatory

approval as a biologic agent. Such regulatory approval will be granted only

after the appropriate preclinical and clinical studies are conducted to confirm

efficacy and safety.

Every

company that manufactures biologic products or medical devices distributed in

the United States must comply with the FDA’s Quality System

Regulations. These regulations govern the manufacturing process,

including design, manufacture, testing, release, packaging, distribution,

documentation, and purchasing. Compliance with the Quality System

Regulations is required before the FDA will approve an application. These

requirements also apply to marketed products. Companies are also

subject to other post-market and general requirements, including compliance with

restrictions imposed on marketed products, compliance with promotional

standards, record keeping, and reporting of certain adverse reactions or

events. The FDA regularly inspects companies to determine compliance

with the Quality System Regulations and other post-approval

requirements. Failure to comply with statutory requirements and the

FDA’s regulations can lead to substantial penalties, including monetary

penalties, injunctions, product recalls, seizure of products, and criminal

prosecution.

The

Clinical Laboratory Improvement Act of 1988 prohibits laboratories from

performing in vitro tests for the purpose of providing information for the

diagnosis, prevention or treatment of any disease or impairment of, or the

assessment of, the health of human beings unless there is in effect for such

laboratories a certificate issued by the U.S. Department of Health and Human

Services applicable to the category of examination or procedure

performed. Although a certificate is not required for ProtoKinetix,

ProtoKinetix considers the applicability of the requirements of the Clinical

Laboratory Improvement Act in the potential design and development of its

products.

The

Company is also subject to regulations in foreign countries governing products,

human clinical trials and marketing, and may need to obtain approval or

evaluations by international public health agencies, such as the World Health

Organization, in order to sell products in certain

countries. Approval processes vary from country to country, and the

length of time required for approval or to obtain other clearances may in some

cases be longer than that required for U.S. governmental

approvals. The extent of potentially adverse governmental regulation

affecting ProtoKinetix that might arise from future legislative or

administrative action cannot be predicted.

Environmental

Laws

To date,

the Company has not encountered any costs relating to compliance with any

environmental laws.

ITEM

2. DESCRIPTION

OF PROPERTY

The

Company does not own any real property. The Company is currently

paying a rental fee where it is located.

ITEM

3. LEGAL

PROCEEDINGS

There are

currently no legal matters pending.

ITEM

4. SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS

No

shareholder meetings were held during the year ended December 31,

2007.

PART

II

|

ITEM

5.

|

MARKET

FOR THE REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS

|

Trades of

our common stock are subject to Rule 15g-9 of the Securities and Exchange

Commission, known as the Penny Stock Rule. This rule imposes

requirements on broker/dealers who sell securities subject to the rule to

persons other than established customers and accredited

investors. For transactions covered by the rule, brokers/dealers must

make a special suitability determination for purchasers of the securities and

receive the purchaser’s written agreement to the transaction prior to

sale. The Securities and Exchange Commission also has rules that

regulate broker/dealer practices in connection with transactions in "penny

stocks." Penny stocks generally are equity securities with a price of

less than $5.00 (other than securities registered on certain national securities

exchanges or quoted on the NASDAQ system, provided that current price and volume

information with respect to transactions in that security is provided by the

exchange or system). The Penny Stock Rules requires a broker/ dealer,

prior to a transaction in a penny stock not otherwise exempt from the rules, to

deliver a standardized risk disclosure document prepared by the Commission that

provides information about penny stocks and the nature and level of risks in the

penny stock market. The broker/dealer also must provide the customer

with current bid and offer quotations for the penny stock, the compensation of

the broker/dealer and its salesperson in the transaction, and monthly account

statements showing the market value of each penny stock held in the customer’s

account. The bid and offer quotations, and the broker/dealer and

salesperson compensation information, must be given to the customer orally or in

writing prior to effecting the transaction and must be given to the customer in

writing before or with the customer’s confirmation. These disclosure

requirements have the effect of reducing the level of trading activity in the

secondary market for our common stock. As a result of these rules,

investors may find it difficult to sell their shares.

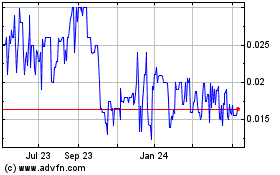

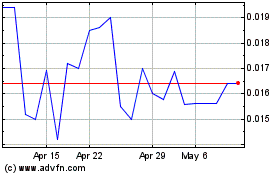

The Company's Common Stock is quoted

on the over-the-counter market and

quoted on the National Association

of Securities Dealers Electronic Bulletin

Board ("OTC Bulletin Board") under the

symbol "PKTX". The high and low bid prices for the Common Stock, as

reported by the National Quotation Bureau, Inc., are indicated for the periods

described below. Such prices are inter-dealer prices without retail

markups, markdowns or commissions, and may not necessarily represent actual

transactions.

|

2007

|

Low

|

High

|

|

First

Quarter

|

$.36

|

$.50

|

|

Second

Quarter

|

.32

|

.45

|

|

Third

Quarter

|

.24

|

.42

|

|

Fourth

Quarter

|

.10

|

.26

|

|

|

|

|

|

2006

|

Low

|

High

|

|

First

Quarter

|

$.65

|

$.68

|

|

Second

Quarter

|

.62

|

.65

|

|

Third

Quarter

|

.51

|

.57

|

|

Fourth

Quarter

|

.40

|

.46

|

Holders

As of

April 10, 2008, there were approximately 60 shareholders of record of the

company's Common Stock.

Dividends

We have

never paid cash dividends and have no plans to do so in the foreseeable

future. Our future dividend policy will be determined by our board of

directors and will depend upon a number of factors, including our financial

condition and performance, our cash needs and expansion plans, income tax

consequences, and the restrictions that applicable laws, our current preferred

stock instruments, and our future credit arrangements may then

impose.

Recent

Sales of Unregistered Securities; Use of Proceeds From Registered

Securities

There

have been no sales of unregistered securities during calendar 2007 which would

be required to be disclosed pursuant to Item 701 of Regulation S-B, except for

the following:

On

January 2, 2007, we issued 84,906 common shares to two consultants in connection

with a consulting agreement. These issuances were made in lieu of cash payments

for services rendered and were considered exempt transactions under Section 4(2)

of the Securities Act of 1933, as amended.

On

January 8, 2007, we issued 133,928 common shares to two consultants in

connection with a consulting agreement. These issuances were made in lieu of

cash payments for services rendered and were considered exempt transactions

under Section 4(2) of the Securities Act of 1933, as amended.

On March

20, 2007, we issued 104,652 common shares to two consultants in connection with

a consulting agreement. These issuances were made in lieu of cash payments for

services rendered and were considered exempt transactions under Section 4(2) of

the Securities Act of 1933, as amended.

On April

16, 2007, we issued 187,500 common shares to two consultants in connection with

a consulting agreement. These issuances were made in lieu of cash payments for

services rendered and were considered exempt transactions under Section 4(2) of

the Securities Act of 1933, as amended.

On June

11, 2007, we issued 112,500 common shares to two consultants in connection with

a consulting agreement. These issuances were made in lieu of cash payments for

services rendered and were considered exempt transactions under Section 4(2) of

the Securities Act of 1933, as amended.

On July

11, 2007, we issued 100,000 common shares to a consultant in connection with a

consulting agreement. These issuances were made in lieu of cash payments for

services rendered and were considered exempt transactions under Section 4(2) of

the Securities Act of 1933, as amended.

On July

18, 2007, we issued 191,812 common shares to two consultants in connection with

a consulting agreement. These issuances were made in lieu of cash payments for

services rendered and were considered exempt transactions under Section 4(2) of

the Securities Act of 1933, as amended.

On August

15, 2007, we issued a total of 860,000 common shares to several directors,

officers and consultants in connection with services provided by such directors,

officers and consultants. These issuances were made in lieu of cash payments for

services rendered and were considered exempt transactions under Section 4(2) of

the Securities Act of 1933, as amended.

On

September 17, 2007, we issued a total of 1,400,000 common shares to several

consultants in connection with services provided by such directors, officers and

consultants. These issuances were made in lieu of cash payments for services

rendered and were considered exempt transactions under Section 4(2) of the

Securities Act of 1933, as amended

On

September 17, 2007, we issued 116,275 common shares to two consultants in

connection with a consulting agreement. These issuances were made in lieu of

cash payments for services rendered and were considered exempt transactions

under Section 4(2) of the Securities Act of 1933, as amended.

On

October 10, 2007, we issued 250,000 common shares to two consultants in

connection with a consulting agreement. These issuances were made in lieu of

cash payments for services rendered and were considered exempt transactions

under Section 4(2) of the Securities Act of 1933, as amended.

On

December 4, 2007, we issued 535,716 common shares to two consultants in

connection with a consulting agreement. These issuances were made in lieu of

cash payments for services rendered and were considered exempt transactions

under Section 4(2) of the Securities Act of 1933, as amended.

On

December 19, 2007, we issued 100,000 common shares to a former director in

connection with services provided to the Company. These issuances were made in

lieu of cash payments for services rendered and were considered exempt

transactions under Section 4(2) of the Securities Act of 1933, as

amended.

On

February 8, 2008, we issued 278,846 common shares to a consultant in connection

with a consulting agreement. These issuances were made in lieu of cash payments

for services rendered and were considered exempt transactions under Section 4(2)

of the Securities Act of 1933, as amended.

On March

20, 2008, we issued a total of 1,700,000 common shares to several investors in

connection with a private placement for a total sales price of $255,000. These

issuances were considered exempt transactions under Section 4(2) of the

Securities Act of 1933, as amended.

On March

26, 2008, we issued 90,500 common shares to two consultants in connection with a

consulting agreement. These issuances were made in lieu of cash payments for

services rendered and were considered exempt transactions under Section 4(2) of

the Securities Act of 1933, as amended.

Warrants

During

2007, in lieu of payment for advisory services rendered to the Company, the

Company issued the following parties warrants to purchase common shares of the

Company's stock:

|

|

|

Date

|

|

Number

of

|

|

Exercise

|

|

Closing

price

|

|

Expiration

|

|

|

|

Issued

|

|

Warrants

|

|

Price

|

|

on

Issuance

|

|

Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simon

Shah

|

|

6/1/2007

|

|

350,000

|

|

$ 0.50

|

|

$ 0.41

|

|

6/1/2012

|

|

Ravi

Chiruvolu

|

|

6/1/2007

|

|

250,000

|

|

$ 0.50

|

|

$ 0.41

|

|

6/1/2012

|

|

Chardan

Capital Markets

|

|

6/1/2007

|

|

350,000

|

|

$ 0.50

|

|

$ 0.41

|

|

6/1/2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bruce

Dorfman

|

|

7/12/2007

|

|

500,000

|

|

$ 0.50

|

|

$ 0.35

|

|

7/12/2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fred

Whittaker

|

|

8/1/2007

|

|

400,000

|

|

$ 0.50

|

|

$ 0.35

|

|

8/1/2012

|

|

Maximilien

Arella

|

|

8/1/2007

|

|

400,000

|

|

$ 0.50

|

|

$ 0.35

|

|

8/1/2012

|

|

Mark

Ralston

|

|

8/1/2007

|

|

2,050,000

|

|

$ 0.50

|

|

$ 0.35

|

|

8/1/2012

|

|

Blair

Henderson

|

|

8/1/2007

|

|

250,000

|

|

$ 0.50

|

|

$ 0.35

|

|

8/1/2012

|

|

Grant

Young

|

|

8/1/2007

|

|

1,500,000

|

|

$ 0.50

|

|

$ 0.35

|

|

8/1/2012

|

|

Dr.

John Todd

|

|

8/1/2007

|

|

500,000

|

|

$ 0.50

|

|

$ 0.35

|

|

8/1/2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Randy

Anderson

|

|

12/1/2007

|

|

250,000

|

|

$ 0.20

|

|

$ 0.16

|

|

12/1/2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wall

Street Communications

|

|

12/4/2007

|

|

250,000

|

|

$ 0.12

|

|

$ 0.15

|

|

12/4/2009

|

|

Wall

Street Communications

|

|

12/4/2007

|

|

250,000

|

|

$ 0.24

|

|

$ 0.15

|

|

12/4/2009

|

|

Wall

Street Communications

|

|

12/4/2007

|

|

250,000

|

|

$ 0.36

|

|

$ 0.15

|

|

12/4/2009

|

|

Wall

Street Communications

|

|

12/4/2007

|

|

250,000

|

|

$ 0.50

|

|

$ 0.15

|

|

12/4/2009

|

Disclosure

Related to Form S-8 Issuances

Prior to

issuing any common shares under Form S-8, the Company requests and receives an

executed verification from all issuees stating that the issuee is a natural

person and that: (a) the shares being issued are not being provided to create or

sustain a market for the Company's securities, and (b) that the shares are not

being issued as a part of a capital raising transaction. All

consultants to the Company are required to provide work product as a part of and

condition to their relationship with the Company. Consultant work

product is delivered in accordance with the terms and conditions of each

respective Consultant’s agreement.

ITEM

6. MANAGEMENT'S

DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

This

discussion and analysis should be read in conjunction with the accompanying

Financial Statements and related notes. Our discussion and analysis

of our financial condition and results of operations are based upon our

financial statements, which have been prepared in accordance with accounting

principles generally accepted in the United States. The preparation of financial

statements in conformity with accounting principles generally accepted in the

United States of America requires us to make estimates and assumptions that

affect the reported amounts of assets and liabilities, disclosure of any

contingent liabilities at the financial statement date and reported amounts of

revenue and expenses during the reporting period. On an on-going basis we review

our estimates and assumptions. Our estimates were based on our historical

experience and other assumptions that we believe to be reasonable under the

circumstances. Actual results are likely to differ from those estimates under

different assumptions or conditions, but we do not believe such differences will

materially affect our financial position or results of operations. Our critical

accounting policies, the policies we believe are most important to the

presentation of our financial statements and require the most difficult,

subjective and complex judgments, are outlined below in "Critical Accounting

Policies," and have not changed significantly.

In

addition, certain statements made in this report may constitute "forward-looking

statements." These forward-looking statements involve known or

unknown risks, uncertainties and other factors that may cause the actual

results, performance, or achievements of the Company to be materially different

from any future results, performance or achievements expressed or implied by the

forward-looking statements. Specifically, 1) our ability to obtain

necessary regulatory approvals for our products; and 2) our ability to

increase revenues and operating income, is dependent upon our ability to develop

and sell our products, general economic conditions, and other factors. You can

identify forward-looking statements by terminology such as "may," "will,"

"should," "expects," "intends," "plans," "anticipates," "believes," "estimates,"

"predicts," "potential," "continues" or the negative of these terms or other

comparable terminology. Although we believe that the expectations reflected-in

the forward-looking statements are reasonable, we cannot guarantee future

results, levels of activity, performance or achievements.

Critical

Accounting Policies

Our

critical and significant accounting policies, including the assumptions and

judgments underlying them, are disclosed in the Notes to the Financial

Statements. These policies have been consistently applied in all

material respects and address such matters as revenue recognition and

depreciation methods. The preparation of the financial statements in

conformity with generally accepted accounting principles in the United States

requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reported period. Actual results

could differ from those estimates. The accounting treatment of a

particular transaction is specifically dictated by accounting principles,

generally accepted in the United States of America, with no need for

management’s judgment in their application. There are also areas in

which management’s judgment in selecting any viable alternative would not

produce a materially different result. See our audited financial

statements and notes thereto which contain accounting policies and other

disclosures required by accounting principles, generally accepted in the United

States of America.

Plan

of Operation

Our

current operations are centered around the Company's relationships with various

research and development consultants who are conducting research on behalf of

the company at discrete and established laboratories in various parts of the

world. The Company intends to continue these efforts throughout

2008.

Sales

and Marketing

The

Company is currently not selling or marketing any products.

Liquidity

and Capital Resources

At

December 31, 2007, we had $37,350 in cash and $147,350 in total current

assets. As of the date of this report, we require additional capital

investments or borrowed funds to meet cash flow projections and carry forward

our business objectives. There can be no assurance that we will be

able to raise capital from outside sources in sufficient amounts to fund our new

business.

The

failure to secure adequate outside funding would have an adverse affect on our

plan of operation and results therefrom and a corresponding negative impact on

shareholder liquidity.

Inflation

Although

management expects that our operations will be influenced by general economic

conditions, we do not believe that inflation had a material effect on our

results of operations during the year ending December 31, 2007.

Going

Concern

The

accompanying financial statements have been prepared in conformity with

generally accepted accounting principles, which contemplate continuation of the

Company as a going concern. The history of losses and the inability

for the Company to make a profit from selling a good or service has raised

substantial doubt about our ability to continue as a going concern. In spite of

the fact that the current cash obligations of the Company are relatively

minimal, given the cash position of the Company, we have very little cash to

operate. We intend to fund the Company and attempt to meet corporate obligations

by selling common stock. However the Company's common stock is at a

low price and is not actively traded.

Results

of Operations for the Year Ended December 31, 2007.

We had $0

in net revenues.

We had a

$2,728,269 net loss from operations for 2007.

Our

expenses in 2007 were $2,728,269 which consisted of $418,724 in professional

legal and accounting expenses. We operate the company by hiring outside

consultants to assist us with management, strategic planning, organization and

daily operations. These professional consulting fees amounted to

$1,134,276. These professional consulting services related to

marketing and investment banking services including financing, capitalization

and merger opportunities. Additional professional consulting fees have been

included in product research and development totaling $996,538.

ITEM

6A QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We face

exposure to fluctuations in the price of our common stock due to the very

limited cash resources we have. For example, the Company has very

limited resources to pay legal and accounting professionals. If we

are unable to pay a legal or accounting professional in order to perform various

professional services for the company, it may be difficult, if not impossible,

for the Company to maintain its reporting status under the '34 Exchange

Act. If the Company felt that it was likely that it would not be able

to maintain its reporting status, it would make a disclosure by filing a Form

8-K with the SEC. In any case, if the Company was not able to

maintain its reporting status, it would become "delisted" and this would

potentially cause an investor or an existing shareholder to lose all or part of

his investment.

ITEM

7. FINANCIAL

STATEMENTS

C O N T E N T S

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FINANCIAL

STATEMENTS

BALANCE SHEET

STATEMENT OF

OPERATIONS

STATEMENTS OF

STOCKHOLDERS' EQUITY

STATEMENTS OF CASH

FLOWS

NOTES TO FINANCIAL

STATEMENTS

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the

Board of Directors and Shareholders

ProtoKinetix,

Incorporated

We have

audited the accompanying balance sheet of ProtoKinetix, Incorporated

(a development stage company) ("the Company") as of December 31, 2007,

and the related statements of operations, stockholders' equity (deficit), and

cash flows for the years ended December 31, 2007 and 2006, and for the

period from December 23, 1999 (date of inception) to December 31,

2007. These financial statements are the responsibility of the

Company's management. Our responsibility is to express an opinion on

these financial statements based on our audits.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require

that we plan and perform the audit to obtain reasonable assurance about whether

the financial statements are free of material misstatement. The

Company has determined that it is not required to have, nor were we engaged to

perform, an audit of its internal control over financial

reporting. Our audits included consideration of internal control over

financial reporting as a basis for designing audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the Company's internal control over financial

reporting. Accordingly, we express no such opinion. An

audit includes examining, on a test basis, evidence supporting the amounts and

disclosures in the financial statements. An audit also includes

assessing the accounting principles used and significant estimates made by

management, as well as evaluating the overall financial statement

presentation. We believe that our audits provide a reasonable basis

for our opinion.

In our

opinion, the financial statements referred to above present fairly, in all

material respects, the financial position of ProtoKinetix, Incorporated (a

development stage company) as of December 31, 2007, and the results of its

operations and its cash flows for the years ended December 31, 2007 and 2006,

and for the period from December 23, 1999 (date of inception) through

December 31, 2007, in conformity with accounting principles generally

accepted in the United States.

The

accompanying financial statements have been prepared assuming the Company will

continue as a going concern. As discussed in Note 1 to the

financial statements, the Company has experienced recurring losses from

operations since inception, has a working capital deficit, and has a deficit

accumulated during the development stage. These conditions raise

substantial doubt about the Company's ability to continue as a going

concern. Management's plans regarding these matters are also

described in Note 1. The financial statements do not include any

adjustments that might result from the outcome of this uncertainty.

/s/

PETERSON SULLIVAN PLLC

April 10,

2008

Seattle,

Washington

PROTOKINETIX,

INCORPORATED

BALANCE

SHEET

December 31,

2007

|

|

|

|

|

ASSETS

|

|

|

Current

Assets

|

|

|

|

Cash

|

$ 37,350

|

|

|

Prepaid

expenses

|

110,000

|

|

|

Total

current assets

|

147,350

|

|

Computer

equipment, net of accumulated depreciation of $2,963

|

426

|

|

|

|

|

|

|

$ 147,776

|

|

|

|

|

|

LIABILITIES

AND STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

Current

Liabilities

|

|

|

|

Accounts

payable

|

$ 108,825

|

|

|

Convertible

note payable

|

300,000

|

|

|

|

|

|

Total

current liabilities

|

408,825

|

|

Stockholders'

Equity (Deficit)

|

|

|

|

Common

stock, $.0000053 par value; 100,000,000 common

|

|

|

|

|

shares

authorized; 48,444,442 shares issued and outstanding

|

262

|

|

|

Common

stock issuable; 1,190,000 shares

|

6

|

|

|

Additional

paid-in capital

|

19,323,715

|

|

|

Deficit

accumulated during the development stage

|

(19,585,032)

|

|

|

|

|

|

|

(261,049)

|

|

|

|

|

|

|

$ 147,776

|

PROTOKINETIX,

INCORPORATED

STATEMENTS

OF OPERATIONS

December 31,

2007

For the

Years Ended December 31, 2007 and 2006, and for the Period from

December

23, 1999 (Date of Inception) to December 31, 2007

|

|

|

|

|

|

|

|

|

|

Cumulative

|

|

|

|

|

|

|

|

|

|

|

During

the

|

|

|

|

|

|

|

|

|

|

|

Development

|

|

|

|

|

|

|

2007

|

|

2006

|

|

Stage

|

|

Revenues

|

$ -

|

|

$ 2,000

|

|

$ 2,000

|

|

Expenses

|

|

|

|

|

|

|

|

Licenses

|

|

|

|

|

3,379,756

|

|

|

Professional

fees

|

418,724

|

|

386,095

|

|

3,231,512

|

|

|

Consulting

fees

|

1,134,276

|

|

1,196,124

|

|

10,368,079

|

|

|

Research

and development

|

996,538

|

|

180,709

|

|

1,797,429

|

|

|

General

and administrative

|

166,731

|

|

192,836

|

|

706,628

|

|

|

Interest

|

12,000

|

|

11,869

|

|

60,162

|

|

|

|

|

|

|

2,728,269

|

|

1,967,633

|

|

19,543,566

|

|

|

|

|

|

Loss

from continuing operations

|

(2,728,269)

|

|

(1,965,633)

|

|

(19,541,566)

|

|

Discontinued

Operations

|

|

|

|

|

|

|

|

Loss

from operations of the discontinued segment

|

-

|

|

-

|

|

(43,466)

|

|

|

|

|

|

Net

loss

|

$

(2,728,269)

|

|

$(1,965,633)

|

|

$(19,585,032)

|

|

Net

Loss per Common Share (basic and

|

|

|

|

|

|

|

|

fully

diluted)

|

$ (0.06)

|

|

$ (0.05)

|

|

|

|

Weighted

average number of common

|

|

|

|

|

|

|

|

shares

outstanding

|

45,749,464

|

|

43,233,617

|

|

|

PROTOKINETIX,

INCORPORATED

STATEMENTS

OF STOCKHOLDERS' EQUITY (DEFICIT)

For the

Period from December 23, 1999 (Date of Inception) to December 31,

2007

|

|

|

|

|

|

|

|

|

|

|

|

Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

|

|

|

|

|

|

Common

Stock

|

Additional

|

Stock

|

During

the

|

|

|

|

|

Common

Stock

|

|

Issuable

|

Paid-in

|

Subscriptions

|

Development

|

|

|

|

|

Shares

|

|

Amount

|

|

Shares

|

|

Amount

|

Capital

|

Receivable

|

Stage

|

Total

|

|

Issuance

of common stock, December 1999

|

9,375,000

|

|

$ 50

|

|

-

|

|

$ -

|

$ 4,950

|

$ -

|

$ -

|

$ 5,000

|

|

Net

loss for period

|

|

|

|

|

|

|

|

|

|

(35)

|

(35)

|

|

Balance,

December 31, 2000

|

9,375,000

|

|

50

|

|

-

|

|

-

|

4,950

|

-

|

(35)

|

4,965

|

|

Issuance

of common stock, April 2001

|

5,718,750

|

|

30

|

|

|

|

|

15,220

|

|

|

15,250

|

|

Net

loss for year

|

|

|

|

|

|

|

|

|

|

(16,902)

|

(16,902)

|

|

Balance,

December 31, 2001

|

15,093,750

|

|

80

|

|

-

|

|

-

|

20,170

|

-

|

(16,937)

|

3,313

|

|

Net

loss for year

|

|

|

|

|

|

|

|

|

|

(14,878)

|

(14,878)

|

|

Balance,

December 31, 2002

|

15,093,750

|

|

80

|

|

-

|

|

-

|

20,170

|

-

|

(31,815)

|

(11,565)

|

|

Issuance

of common stock for services:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July

2003

|

2,125,000

|

|

11

|

|

|

|

|

424,989

|

|

|

425,000

|

|

|

August

2003

|

300,000

|

|

2

|

|

|

|

|

14,998

|

|

|

15,000

|

|

|

September

2003

|

1,000,000

|

|

5

|

|

|

|

|

49,995

|

|

|

50,000

|

|

|

October

2003

|

1,550,000

|

|

8

|

|

|

|

|

619,992

|

|

|

620,000

|

|

Issuance

of common stock for licensing rights

|

14,000,000

|

|

74

|

|

|

|

|

2,099,926

|

|

|

2,100,000

|

|

Common

stock issuable for licensing rights

|

|

|

|

|

2,000,000

|

|

11

|

299,989

|

|

|

300,000

|

|

Shares

cancelled on September 30, 2003

|

(9,325,000)

|

|

(49)

|

|

|

|

|

49

|

|

|

-

|

|

Net

loss for year

|

|

|

|

|

|

|

|

|

|

(3,662,745)

|

(3,662,745)

|

|

Balance,

December 31, 2003

|

24,743,750

|

|

131

|

|

2,000,000

|

|

11

|

3,530,108

|

-

|

(3,694,560)

|

(164,310)

|

|

Issuance

of common stock for services:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March

2004

|

1,652,300

|

|

9

|

|

|

|

|

991,371

|

|

|

991,380

|

|

|

May

2004

|

500,000

|

|

3

|

|

|

|

|

514,997

|

|

|

515,000

|

|

|

July

2004

|

159,756

|

|

1

|

|

|

|

|

119,694

|

|

|

119,695

|

|

|

August

2004

|

100,000

|

|

1

|

|

|

|

|

70,999

|

|

|

71,000

|

|

|

October

2004

|

732,400

|

|

4

|

|

|

|

|

479,996

|

|

|

480,000

|

|

|

November

2004

|

650,000

|

|

4

|

|

|

|

|

454,996

|

|

|

455,000

|

|

|

December

2004

|

255,000

|

|

1

|

|

|

|

|

164,425

|

|

|

164,426

|

|

Common

stock issuable for AFGP license

|

|

|

|

|

1,000,000

|

|

5

|

709,995

|

|

|

710,000

|

|

Common

stock issuable for Recaf License

|

|

|

|

|

400,000

|

|

2

|

223,998

|

|

|

224,000

|

|

Warrants

granted (for 3,450,000 shares) for services,

|

|

|

|

|

|

|

|

|

|

|

|

|

October

2004

|

|

|

|

|

|

|

|

1,716,253

|

|

|

1,716,253

|

|

Options

granted for services, October 2004

|

|

|

|

|

|

|

|

212,734

|

|

|

212,734

|

|

Stock

subscriptions receivable

|

|

|

|

|

1,800,000

|

|

10

|

329,990

|

(330,000)

|

|

-

|

|

Warrants

exercised:

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

August

2004

|

|

|

|

|

50,000

|

|

|

15,000

|

|

|

15,000

|

|

|

October

2004

|

|

|

|

|

600,000

|

|

3

|

134,997

|

|

|

135,000

|

|

|

December

2004

|

|

|

|

|

1,000,000

|

|

5

|

224,995

|

|

|

225,000

|

|

Options

exercised, December 2004

|

|

|

|

|

100,000

|

|

1

|

29,999

|

|

|

30,000

|

|

Net

loss for year

|

|

|

|

|

|

|

|

|

|

(6,368,030)

|

(6,368,030)

|

|

Balance,

December 31, 2004

|

28,793,206

|

|

$ 154

|

|

6,950,000

|

|

$ 37

|

$9,924,547

|

$

(330,000)

|

$(10,062,590)

|

$(467,852)

|

PROTOKINETIX,

INCORPORATED

STATEMENTS

OF STOCKHOLDERS' EQUITY

(Continued)

For the

Period from December 23, 1999 (Date of Inception) to December 31,

2007

|

|

|

|

|

|

|

|

|

|

|

Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

|

|

|

|

|

|

|

Common

Stock

|

Additional

|

Stock

|

During

the

|

|

|

|

|

|

Common

Stock

|

Issuable

|

|

|

Paid-in

|

Subscriptions

|

Development

|

|

|

|

|

|

Shares

|

|

Amount

|

Shares

|

|

Amount

|

Capital

|

Receivable

|

Stage

|

|

Total

|

|

Issuance

of stock subscriptions receivable

|

-

|

|

$ -

|

-

|

|

$ -

|

$ -

|

$ 240,000

|

$ -

|

|

$ 240,000

|

|

Issuance

of common stock for licensing rights

|

2,000,000

|

|

11

|

(2,000,000)

|

|

(11)

|

|

|

|

|

-

|

|

Issuance

of stock for warrants exercised

|

2,050,000

|

|

10

|

(2,050,000)

|

|

(10)

|

|

|

|

|

-

|

|

Options

exercised,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

February

2005

|

|

|

|

35,000

|

|

1

|

10,499

|

|

|

|

10,500

|

|

|

May

2005

|

200,000

|

|

1

|

|

|

|

59,999

|

|

|

|

60,000

|

|

Note

payable conversion, February 2005

|

|

|

|

285,832

|

|

1

|

85,749

|

|

|

|

85,750

|

|

Issuance

of common stock for Note payable conversion

|

|

|

|

|

|

|

|

|

|

|

|

|

April

2005

|

285,832

|

|

1

|

(285,832)

|

|

(1)

|

|

|

|

|

-

|

|

|

May

2005

|

353,090

|

|

2

|

|

|

|

105,925

|

|

|

|

105,927

|

|

Issuance

of common stock for AFGP license

|

1,000,000

|

|

5

|

(1,000,000)

|

|

(5)

|

|

|

|

|

-

|

|

Issuance

of common stock for stock subscriptions received

|

1,400,000

|

|

6

|

(1,400,000)

|

|

(6)

|

|

90,000

|

|

|

90,000

|

|

Issuance

of stock for options exercised

|

135,000

|

|

2

|

(135,000)

|

|

(2)

|

|

|

|

|

-

|

|

Issuance

of common stock for services:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April

2005

|

30,000

|

|

1

|

|

|

|

14,999

|

|

|

|

15,000

|

|

|

May

2005

|

3,075,000

|

|

15

|

|

|

|

3,320,985

|

|

|

|

3,321,000

|

|

|

June

2005

|

50,000

|

|

1

|

|

|

|

50,499

|

|

|

|

50,500

|

|

|

August

2005

|

(250,000)

|

|

(1)

|

|

|

|

(257,499)

|

|

|

|

(257,500)

|

|

|

August

2005

|

111,111

|

|

1

|

(92,593)

|

|

(1)

|

15,000

|

|

|

|

15,000

|

|

|

October

2005

|

36,233

|

|

1

|

(36,233)

|

|

(1)

|

-

|

|

|

|

-

|

|

|

November

2005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

November

2005

|

311,725

|

|

2

|

(245,000)

|

|

(1)

|

36,249

|

|

|

|

36,250

|

|

|

December

2005

|

1,220,000

|

|

8

|

|

|

|

756,392

|

|

|

|

756,400

|

|

Common

stock issuable for services rendered

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June

2005

|

|

|

|

200,000

|

|

1

|

149,999

|

|

|

|

150,000

|

|

|

August

2005

|

|

|

|

36,233

|

|

1

|

21,739

|

|

|

|

21,740

|

|

|

September

2005

|

|

|

|

125,000