UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

| x

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 |

| For

the quarterly period ended March 31, 2014 |

or

| o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

| For

the transition period from _____________to ______________ |

Commission

File Number: 000-52444

JBI,

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

90-0822950 |

| (State

or other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification No.) |

20

Iroquois Street

Niagara

Falls, NY 14303

(Address

of principal executive offices) (Zip Code)

(716)

278-0015

(Registrant’s

telephone number, including area code)

Not Applicable

(Former

name, former address and former fiscal year, if changed since last report)

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x

No o

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

x No o

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

¨ |

Accelerated

filer |

¨ |

| Non-accelerated filer |

¨ |

Smaller reporting

company |

x |

| (Do not check if

a smaller reporting company) |

|

|

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes o

No x

As of July

30, 2014, there were 114,500,943 shares of Common Stock, $0.001 par value per share, issued and outstanding.

JBI

Inc.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

Quarterly Report on Form 10-Q (the “Report”) contains “forward looking statements” within the meaning

of applicable securities laws. Such statements include, but are not limited to, statements with respect to the Company’s

beliefs, plans, strategies, objectives, goals and expectations, including expectations about the future financial or operating

performance of the Company and its projects, capital expenditures, capital needs, government regulation of the industry, environmental

risks, limitations of insurance coverage, and the timing and possible outcome of regulatory matters, including the granting of

patents and permits. Words such as “expect”, “anticipate”, “intend”, “attempt”,

“may”, “will”, “plan”, “believe”, “seek”, “estimate”,

and variations of such words and similar expressions are intended to identify such forward looking statements. These statements

are not guarantees of future performance and involve assumptions, risks and uncertainties that are difficult to predict.

These

statements are based on and were developed using a number of factors and assumptions including, but not limited to: stability

in the U.S. and other foreign economies; stability in the availability and pricing of raw materials, energy and supplies; stability

in the competitive environment; the continued ability of the Company to access cost effective capital when needed; and no unexpected

or unforeseen events occurring that would materially alter the Company’s current plans. All of these assumptions

have been derived from statements currently available to the Company including information obtained by the Company from third

party sources. Although management believes that these assumptions are reasonable, these assumptions may prove to be incorrect

in whole or in part. As a result of these and other factors, actual results may differ materially from those expressed, implied

or forecasted in such forward looking statements, which reflect the Company’s expectations only as of the date hereof.

Factors

that could cause actual results or outcomes to differ materially from the results expressed, implied or forecasted by the forward looking

statements include risks associated with general business, economic, competitive, political and social uncertainties; risks associated

with changes in project parameters as plans continue to be refined; risks associated with failure of plant, equipment or processes

to operate as anticipated; risks associated with accidents or labor disputes; risks associated in delays in obtaining governmental

approvals or financing, or in the completion of development or construction activities; risks associated with financial leverage

and the availability of capital; risks associated with the price of commodities and the inability of the Company to control commodity

prices; risks associated with the regulatory environment within which the Company operates; risks associated with litigation including

the availability of insurance; and risks posed by competition. These and other factors that could cause actual results or outcomes

to differ materially from the results expressed, implied or forecasted by the forward looking statements are discussed in more

detail in the section entitled “Risk Factors” in Part IA of the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2013 as filed with the Securities and Exchange Commission on June 4, 2014.

The Company

does not intend to, and the Company disclaims any obligation to, update any forward looking statements, whether written or

oral, or whether as a result of new information, future events or otherwise, except as required by law.

Unless

otherwise noted, references in this registration statement to “JBI” the “Company,” “we,” “our”

or “us” means JBI, Inc., a Nevada corporation.

PART I – FINANCIAL INFORMATION

| Item

1. |

Financial

Statements |

| JBI, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| AS OF MARCH 31, 2014 AND DECEMBER 31, 2013 |

| | |

| |

|

| ASSETS | |

| |

|

| | |

March 31, 2014 | |

December 31, 2013 |

| | |

(UNAUDITED) | |

|

| | |

| |

|

| CURRENT ASSETS | |

| |

|

| Cash and cash equivalents | |

$ | 86,663 | | |

$ | 203,949 | |

| Cash held in attorney trust (Note 2) | |

| 11,974 | | |

| 12,637 | |

| Restricted cash (Note 2) | |

| 100,147 | | |

| 100,122 | |

| Accounts receivable, net of allowance of $91,710 (2013 - $91,710) | |

| 20,426 | | |

| 80,814 | |

| Inventories, net (Note 4) | |

| 140,183 | | |

| 147,120 | |

| Prepaid expenses and other current assets | |

| 138,633 | | |

| 76,305 | |

| TOTAL CURRENT ASSETS | |

| 498,026 | | |

| 620,947 | |

| | |

| | | |

| | |

| PROPERTY, PLANT AND EQUIPMENT, NET | |

| 6,961,240 | | |

| 7,184,008 | |

| | |

| | | |

| | |

| Deposits (Note 2) | |

| 1,484,908 | | |

| 1,484,453 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 8,944,174 | | |

$ | 9,289,408 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 1,583,897 | | |

$ | 1,510,611 | |

| Accrued expenses | |

| 944,817 | | |

| 851,532 | |

| Customer advances | |

| 26,120 | | |

| 26,120 | |

| Accrued lease obligation – current (Note 10) | |

| 79,428 | | |

| 83,466 | |

| Long-Term Debt, mortgage payable and capital leases – current (Note 9) | |

| 22,034 | | |

| 23,618 | |

| TOTAL CURRENT LIABILITIES | |

| 2,656,296 | | |

| 2,495,347 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES | |

| | | |

| | |

| Asset retirement obligations (Note 2) | |

| 30,533 | | |

| 30,306 | |

| Accrued lease obligation (Note 10) | |

| 364,982 | | |

| 383,388 | |

| Long-Term Debt, mortgage payable and capital leases (Note 9) | |

| 2,668,576 | | |

| 2,532,079 | |

| TOTAL LONG-TERM LIABILITIES | |

| 3,064,091 | | |

| 2,945,773 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 5,720,387 | | |

| 5,441,120 | |

| | |

| | | |

| | |

| STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Preferred stock, Series B, par $0.001; 2,300,000 shares authorized, convertible into 16,100,000 shares of Common Stock, 2,204,100 shares issued and outstanding | |

| 2,204 | | |

| 2,204 | |

| | |

| | | |

| | |

| Common stock, par $0.001; 150,000,000 authorized, 94,592,243 shares issued and outstanding (2013 – 90,692,243) | |

| 94,493 | | |

| 90,692 | |

| Common stock subscribed not issued, 4,100,000 shares | |

| 4,100 | | |

| — | |

| | |

| | | |

| | |

| Preferred stock, Series A, par $0.001; 1,000,000 authorized, 1,000,000 shares issued and outstanding | |

| 1,000 | | |

| 1,000 | |

| Additional paid in capital | |

| 65,993,817 | | |

| 64,872,659 | |

| Accumulated deficit | |

| (62,871,837 | ) | |

| (61,118,267 | ) |

| TOTAL STOCKHOLDERS' EQUITY | |

| 3,223,787 | | |

| 3,848,288 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | |

$ | 8,944,174 | | |

$ | 9,289,408 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| The accompanying notes are an integral part of the condensed consolidated financial statements. |

| JBI, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| FOR THE THREE MONTHS ENDED MARCH 31, 2014 AND 2013 |

| (UNAUDITED) |

| | |

| |

|

| | |

For the Three Months Ended |

| | |

March 31, 2014 | |

March 31, 2013 |

| | |

| |

|

| | |

| |

|

| Sales | |

| |

|

| P2O | |

$ | 18,718 | | |

$ | 129,888 | |

| Other | |

| — | | |

| 14,920 | |

| Total sales | |

| 18,718 | | |

| 144,808 | |

| | |

| | | |

| | |

| Cost of sales | |

| | | |

| | |

| P2O | |

| 23,804 | | |

| 128,864 | |

| Other | |

| 129 | | |

| 8,460 | |

| Total cost of sales | |

| 23,933 | | |

| 137,324 | |

| | |

| | | |

| | |

| Gross profit (loss) | |

| (5,215 | ) | |

| 7,485 | |

| | |

| | | |

| | |

| Operating expenses | |

| | | |

| | |

| Selling general and administrative expenses | |

| | | |

| | |

| Selling general and administrative- Professional Fees | |

| 613,348 | | |

| 425,543 | |

| Selling general and administrative- Compensation | |

| 408,776 | | |

| 692,346 | |

| Selling general and administrative- Other | |

| 535,681 | | |

| 1,049,260 | |

| Depreciation of property, plant and equipment and accretion of long-term liability | |

| 268,526 | | |

| 184,755 | |

| Research and development expenses | |

| 9,084 | | |

| 109,046 | |

| Total operating expenses | |

| 1,835,415 | | |

| 2,460,950 | |

| | |

| | | |

| | |

| Loss from operations | |

| (1,840,630 | ) | |

| (2,453,465 | ) |

| | |

| | | |

| | |

| Other expenses | |

| | | |

| | |

| Loss from disposal of assets | |

| 22 | | |

| — | |

| Interest income (expense), net | |

| (101,802 | ) | |

| 2,076 | |

| Other income, net | |

| — | | |

| 1,338 | |

| Total other expenses | |

| (101,780 | ) | |

| 3,414 | |

| | |

| | | |

| | |

| Loss before income taxes | |

| (1,942,410 | ) | |

| (2,450,051 | ) |

| | |

| | | |

| | |

| Current and future income tax expense (Note 8) | |

| — | | |

| — | |

| | |

| | | |

| | |

| Net loss from continuing operations | |

| (1,942,410 | ) | |

| (2,450,051 | ) |

| Net income (loss) from discontinued operations (note 15) | |

| 188,840 | | |

| (264,470 | ) |

| | |

| | | |

| | |

| Net loss | |

$ | (1,753,570 | ) | |

$ | (2,714,521 | ) |

| | |

| | | |

| | |

| Deemed Dividends | |

| 851,826 | | |

| — | |

| Net loss attributable to common stockholders | |

| (2,605,396 | ) | |

| (2,714,521 | ) |

| | |

| | | |

| | |

| Earnings (loss) per share | |

| | | |

| | |

| Basic and dilutive - from continuing operations | |

$ | (0.02 | ) | |

$ | (0.03 | ) |

| Basic and dilutive - from discontinued operations | |

| ** | | |

| N/A | |

| | |

| | | |

| | |

| Weighted average number of shares outstanding | |

| | | |

| | |

| Basic and dilutive (Note 2) | |

| 91,528,243 | | |

| 89,873,320 | |

| | |

| | | |

| | |

| ** Less than $.01 | |

| | | |

| | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| The accompanying notes are an integral part of the condensed consolidated financial statements. |

| JBI, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| FOR THE THREE MONTHS ENDED MARCH 31, 2014 AND 2013 |

| (UNAUDITED) |

| | |

For the Three Months Ended |

| | |

March 31, 2014 | |

March 31, 2013 |

| | |

| |

|

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| |

|

| Net loss from continuing operations | |

$ | (1,942,410 | ) | |

$ | (2,450,051 | ) |

| Net income (loss) from discontinued operations | |

| 188,840 | | |

| (264,470 | ) |

| Items not affecting cash: | |

| | | |

| | |

| Depreciation of property plant and equipment and accretion of long-term liability | |

| 268,525 | | |

| 184,755 | |

| Other income | |

| (480 | ) | |

| (6,164 | ) |

| Accrued interest expense | |

| 90,000 | | |

| — | |

| Non-cash stock based compensation | |

| 719,090 | | |

| 260,745 | |

| Non-cash items impacting discontinued operations | |

| 967 | | |

| — | |

| Working capital changes: | |

| | | |

| | |

| Cash held in attorney trust | |

| 663 | | |

| 168,456 | |

| Accounts receivable | |

| 60,388 | | |

| 95,567 | |

| Inventories | |

| 6,937 | | |

| (49,797 | ) |

| Prepaid expenses and other current assets | |

| (62,328 | ) | |

| 52,448 | |

| Accounts payable | |

| 73,284 | | |

| (921,075 | ) |

| Accrued expenses | |

| 93,285 | | |

| (46,286 | ) |

| Other long-term liabilities and customer advances | |

| — | | |

| (57 | ) |

| | |

| | | |

| | |

| NET CASH USED IN OPERATING ACTIVITIES | |

| (503,239 | ) | |

| (2,976,015 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Property, plant and equipment additions | |

| (18,405 | ) | |

| (285,330 | ) |

| Deposits for property, plant and equipment | |

| — | | |

| (739,177 | ) |

| Changes attributable to discontinued operations | |

| (5,622 | ) | |

| — | |

| | |

| | | |

| | |

| NET CASH USED IN INVESTING ACTIVITIES | |

| (24,027 | ) | |

| (1,024,507 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Preferred Stock – Series B proceeds, net | |

| — | | |

| 3,998,292 | |

| Proceeds from sale of common stock and warrants | |

| 409,980 | | |

| — | |

| | |

| | | |

| | |

| NET CASH PROVIDED BY FINANCING ACTIVITIES | |

| 409,980 | | |

| 3,998,292 | |

| | |

| | | |

| | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | |

| (117,286 | ) | |

| (2,230 | ) |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | |

| 203,949 | | |

| 3,965,720 | |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | |

| 86,663 | | |

| 3,963,490 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information | |

| | | |

| | |

| Cash paid for income taxes | |

$ | — | | |

$ | — | |

| Cash paid for interest | |

$ | 5,602 | | |

$ | 5,602 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| The accompanying notes are an integral part of the condensed consolidated financial statements. |

NOTE

1 - ORGANIZATION

JBI,

Inc. (the “Company” or “JBI”) was originally incorporated as 310 Holdings, Inc. (“310”) in

the State of Nevada on April 20, 2006. 310 had no significant activity from inception through 2009. In April

2009, John Bordynuik, the Company’s former CEO and current Chief of Technology, purchased 63% of the issued and outstanding

shares of 310. During 2009, the Company changed its name to JBI, Inc. and began operations of its main business operation,

Plastic2Oil (“P2O”). Plastic2Oil is a combination of proprietary technologies and processes developed by

JBI which convert waste plastics and waste oil into fuel. As of the date of this Report, JBI has built three processors

which are located at its Niagara Falls, NY facility (the “Niagara Falls Facility”).

On August

24, 2009, the Company acquired Javaco, Inc. (“Javaco”), a distributor of electronic components, including home theater

and audio video products. In July 2012, the Company closed Javaco and sold substantially all its inventory and fixed

assets. The operations of Javaco have been classified as discontinued operations for all periods presented (Note 15).

In September

2009, the Company acquired Pak-It, LLC (“Pak-It”). Pak-It operated a bulk chemical processing, mixing,

and packaging facility. It also developed and patented a delivery system that packages condensed cleaners in small

water-soluble packages. During 2011, the Company initiated a plan to sell certain operating assets of Pak-It and subsequently

sold Pak-It in February 2012, with an effective date of January 1, 2012. The operations of Pak-It have been classified

as discontinued operations for all periods presented (see Note 15).

In December

2010, the Company entered into a twenty year lease for a recycling facility in Thorold, Ontario. During the period,

the Company determined that it would no longer operate the facility and shut down all operations. The assets and operations

related to the recycling facility have been reclassified as discontinued operations for all periods presented (Note 15).

The Company

had to shut down its fuel production late in the fourth quarter of 2013 due to severe cold weather that caused damage to condensers

and other components of it’s processors. Management estimates that the repair of the processors will require

the expenditure of between $175,000 and $200,000. As of the date of this report the Company lacked the working capital or access

to bank credit to make these repairs. The Company is reviewing our financing options, including the sale of shares of its

common stock or other securities, in order to allow us to obtain sufficient funds to make the required repairs and resume operation

of its processors. Management currently anticipates that the processors will remain idle at least until the third quarter

of 2014. During the idle period, we significantly reduced our headcount by furloughing its operations personnel but retained

a small team to perform general repairs and maintenance on the processors. Once the processors are repaired, we expect a small

increase in its headcount in order to resume normal operations.

Going

Concern

These

condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted

in the United States of America ("US GAAP"), which contemplates continuation of the Company as a going concern

which assumes the realization of assets and satisfaction of liabilities and commitments in the normal course of business. The

Company has experienced negative cash flows from operations since inception, and has a working capital deficiency of

$2,158,270 and an accumulated deficit of $62,871,837 as of March 31, 2014. Management’s assessment of potential

liquidity problems, working capital issues and negative cash flows from operations raise substantial doubt about its ability

to continue as a going concern and to operate in the normal course of business. To date, the Company has funded

its activities primarily from equity financings and, to a much lesser extent, debt financing and cash from operations. A

portion of such financings was funded by officers and directors of the Company. (See Note 13).

The Company

will continue to require substantial funds to resume fuel production and to continue the expansion of its P2O business in order

to achieve significant commercial production, and to significantly increase sales and marketing efforts. Management’s plans

in order to meet its operating cash flow requirements include financing activities such as private placements of its common and/

or preferred stock and issuances of debt and/ or convertible debt instruments.

While

the Company believes that it will be successful in obtaining the necessary financing to fund its operations, meet regulatory requirements

and achieve commercial production goals, there are no assurances that the Company will be successful in obtaining such financing

or that the Company will succeed in its future operations. The condensed consolidated financial statements do not include any

adjustments relating to the recoverability and classification of recorded asset amounts or amounts of liabilities that might be

necessary should the Company be unable to continue in existence.

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Interim Financial

Statements

The

accompanying unaudited condensed consolidated financial statements have been prepared in accordance with Generally Accepted Accounting

Principles (“GAAP”) in the United States of America (“U.S.”) as promulgated by the Financial Accounting

Standards Board (“FASB”) Accounting Standards Codification (“ASC”) and with the rules and regulations

of the U.S Securities and Exchange Commission (“SEC”) for interim financial information. The unaudited condensed consolidated

financial statements reflect all normal recurring adjustments, which, in the opinion of management, are considered necessary for

a fair presentation of the results for the periods shown. The results of operations for the periods presented are not necessarily

indicative of the results expected for the full fiscal year or for any future period. The information included in these unaudited

condensed consolidated financial statements should be read in conjunction with Management’s Discussion and Analysis and

Results of Operations contained in this report and the audited consolidated financial statements and accompanying notes included

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013.

Basis

of Consolidation

The condensed

consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Plastic2Oil of NY#1,

LLC, JBI (Canada) Inc., JBI CDE Inc., JBI Re One Inc., JBI Re#1 Inc., Plastic2Oil Marine Inc., Javaco, Pak-It and Plastic2Oil

Land Inc. All intercompany transactions and balances have been eliminated on consolidation. Amounts in the

condensed consolidated financial statements are expressed in US dollars. Javaco and Pak-It have also been consolidated; however,

as mentioned their operations are classified as discontinued operations (Note 15).

Estimates

The preparation

of financial statements in conformity with generally accepted accounting principles of the United States (“US GAAP”)

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure

of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from these estimates. Significant estimates include amounts for impairment

of property, plant and equipment, estimating reserves and determining accruals related to discontinued operations, projecting

future cash flows from property, plant and equipment, carrying value of inventory, share based compensation, asset retirement

obligations, inventory obsolescence, accrued liabilities, accounts receivable exposures, discount rate used in the determination

of the fair value of the senior secured notes for purposes of performing the relative fair value calculation to allocate the proceeds

between the notes and the warrants included in the subscription for the Notes, and the discount rate used to calculate the present

value of the accrued lease liability.

Cash

and Cash Equivalents

The Company

considers all highly liquid investments with maturities of three months or less at the time of purchase to be cash equivalents.

Restricted

Cash

Restricted

cash relates to cash on deposit, which secures the Company’s letter of credit with a banking institution, related to a fuel

sales bond.

Cash

Held in Attorney Trust

The amount

held in trust represents retainer payments the Company has made to law firms which were being held on its behalf for the payment

of future services.

Accounts

Receivable

Accounts

receivable represent unsecured obligations due from customers under terms requesting payments upon receipt of invoice up to thirty

days, depending on the customer. Accounts receivable are non-interest bearing and are stated at the amounts billed

to the customer net of an allowance for uncollectible accounts. Customer balances with invoices beyond agreed

upon terms are considered delinquent. Payments of accounts receivable are applied to the specific invoices identified on the customer

remittance, or if unspecified, are applied to the earliest unpaid invoice.

The

allowance for uncollectible accounts reflects management’s best estimate of amounts that may not be collected based on an

analysis of the age of receivables and the credit standing of individual customers. The allowances for uncollectible

accounts as of March 31, 2014 and December 31, 2013 was $91,710.

Inventories

Inventories,

which consist primarily of plastics, costs to process the plastic and processed fuel are stated at the lower of cost or market. The

Company uses an average costing method in determining cost. Inventories are periodically reviewed for use and

obsolescence, and adjusted as necessary.

Property,

Plant and Equipment

Property,

plant and equipment are recorded at cost. Depreciation is provided using the straight-line method over the estimated

useful lives of the various classes of assets, and capital leased assets are given useful lives coinciding with the asset classification

they are classified as. These lives are as follows:

| Leasehold

improvements |

lesser

of useful life or term of the lease |

| Machinery and office

equipment |

3-15 years |

| Furniture and fixtures |

7 years |

| Office and industrial

buildings |

25 years |

Gains

and losses on depreciable assets retired or sold are recognized in the statements of operations in the period of disposal. Repairs

and maintenance expenditures are expensed as incurred and expenditures that increase the value or useful life of the asset are

capitalized.

Construction

in Process

The Company

capitalizes customized equipment built to be used in the future day to day operations at cost. Once complete and available for

use, the cost for accounting purposes is transferred to property, plant and equipment, where normal depreciation rates are applied.

Impairment

of Long-Lived Assets

The Company

reviews for impairment of long-lived assets on an asset by asset basis when events or circumstances change in the business or

the use of the long-lived asset that indicate that the carrying value of such assets may not be recoverable. Impairment is recognized

on properties held for use when the expected undiscounted cash flows for a property are less than its carrying amount at which

time the property is written-down to fair value. Properties held for sale are recorded at the lower of the carrying amount or

the expected sales price less costs to sell. The sale or disposal of a “component of an entity” is treated as discontinued

operations. The operating properties sold by the Company typically meet the definition of a component of an entity and as such

the revenues and expenses associated with sold properties are reclassified to discontinued operations for all periods presented

(Note 15).

Asset

Retirement Obligation

The fair

value of the estimated asset retirement obligation is recognized in the consolidated balance sheets when identified and a reasonable

estimate of fair value can be made. The asset retirement cost, equal to the estimated fair value of the asset retirement

obligation, is capitalized as part of the cost of the related long-lived asset. The balance of the asset retirement obligation

is determined through an assessment made by the Company’s engineers of the total costs expected to be incurred by the Company

when closing a facility. The total estimated cost is then discounted using the current market rates to determine the

present value of the asset as of the date of this valuation of the asset retirement obligation. As of the date of the

creation of the asset retirement obligation, the Company determined the present value of the obligation using a discount rate

equal to 2.96%. The present value of the asset retirement obligation is then capitalized on the balance sheet and is

depreciated over the asset’s estimated useful life and is included in depreciation and accretion expense on the condensed

consolidated statements of operations. Increases in the asset retirement obligation resulting from the passage of time are recorded

as accretion of asset retirement obligation in the condensed consolidated statements of operations. Actual expenditures incurred

are charged against the accumulated obligation. As of March 31, 2014 and December 31, 2013, the Company recorded asset

retirement obligations of $30,533 and $30,306, respectively. These costs include disposal of plastic and other non-hazardous

waste, site closing labor and testing and sampling of the site upon closure.

Environmental

Contingencies

The Company

records environmental liabilities at their undiscounted amounts on the condensed consolidated balance sheets as other current

or long-term liabilities when environmental assessments indicate that remediation efforts are probable and the costs can be reasonably

estimated. These costs may be discounted to reflect the time value of money if the timing of the cash payments is fixed or reliably

determinable and extends beyond a current period. Estimates of our liabilities are based on currently available facts, existing

technology and presently enacted laws and regulations, taking into consideration the likely effects of other societal and economic

factors, and include estimates of associated legal costs. These amounts also consider prior experience in remediating contaminated

sites, other companies’ clean-up experience and data released by the Environmental Protection Agency (EPA) or other organizations.

The Company’s estimates are subject to revision in future periods based on actual costs or new circumstances. The Company

capitalizes costs that benefit future periods and recognizes a current period charge in operation and maintenance expense when

clean-up efforts do not benefit future periods.

The Company

evaluates any amounts paid directly or reimbursed by government sponsored programs and potential recoveries or reimbursements

of remediation costs from third parties including insurance coverage separately from the Company’s liability. Recovery is

evaluated based on the creditworthiness or solvency of the third party, among other factors. When recovery is assured, the Company

records and reports an asset separately from the associated liability on the condensed consolidated balance sheets. No amounts

for recovery have been accrued to date.

Deposits

Deposits

represent payments made to vendors for fabrication of key pieces of property, plant and equipment that have been made in accordance

with the Company’s agreements to purchase such equipment. Payments are made to these vendors as progress is made

on the fabrication of the equipment, with final payments made when the equipment is delivered. Until the Company has

possession of the equipment, all payments made to these vendors are classified as deposits on assets. Deposits were

$1,484,908 and $1,484,453 as of March 31, 2014 and December 31, 2013, respectively.

Leases

The Company

has entered into various leases for equipment. At the inception of a lease, the Company evaluates whether it is operating or capital

in nature. Operating leases are recorded as expense in the appropriate periods of the lease. Capital leases

are classified as property, plant and equipment and the related depreciation is recorded on the assets. Also, the debt

related to the capital lease is included in the Company’s short- and long-term debt obligations, in accordance with the

lease agreement.

Revenue

Recognition

The Company

recognizes revenue when it is realized or realizable and collection is reasonably assured. The Company considers revenue

realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists,

(ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable,

and (iv) collectability is reasonably assured.

P2O sales

are recognized when a customer takes possession of the fuel since at that stage the customer has completed all prior testing necessary

for their acceptance of the fuel. At the time of possession the customer has arranged for transportation of the fuel and the sales

price either has been set in its purchase contract or negotiated prior to the time of pick up through the issuance of a

purchase order. The Company negotiates the pricing of the fuel based on the quality of the product and the type of fuel being

sold (e.g.. Naphtha, Fuel Oil No. 6 or Fuel Oil No. 2).

Shipping

and Handling Costs

The Company’s

shipping and handling costs were $11,204 and $13,357 for the three-month periods ended March 31, 2014 and 2013, respectively. Shipping

and handling costs are capitalized to inventory and expensed to cost of sales when the related inventory is sold for all periods

presented.

Advertising

costs

The Company

expenses advertising costs as incurred. Advertising costs were $490 and $2,865 for the three-month periods ended March 31, 2014

and 2013, respectively. These expenses are included in selling, general and administrative expenses in the condensed consolidated

statements of operations.

Research

and Development

The Company

is engaged in research and development activities. Research and development costs are charged as an operating expense of the Company

as incurred. For the three month periods ended March 31, 2014 and 2013, the Company expensed $9,084 and $109,046, respectively,

for research and development costs. Components of the processors that are fabricated or purchased with research and

development plans and then used on the processor in production are capitalized into the cost of the processor and depreciated

over the remaining life of the processor.

Foreign

Currency Translation

The condensed

consolidated financial statements have been translated into U.S. dollars in accordance with Financial Accounting Standards Board

(“FASB”) Accounting Standards Codification (“ASC”) Topic 830. All monetary items have been translated

using the exchange rates in effect at the balance sheet date. All non-monetary items have been translated using the historical

exchange rates at the time of transactions. Amounts included in the condensed consolidated statement of operations have been translated

using the average exchange rate for the periods. For the three months ended March 31, 2014 and 2013, the Company recognized foreign

exchange gains of $967 and losses of $11,657, respectively. These amounts are included as selling, general and administrative

expenses in the condensed consolidated statements of operations.

Accounting for Uncertainty

in Income Taxes

The

Company applies the provisions of ASC Topic 740-10-25, Income Taxes – Overall – Recognition (“ASC

Topic 740-10-25”) with respect to the accounting for uncertainty of income tax positions. ASC Topic 740-10-25 clarifies

the accounting for uncertainty in income taxes recognized in a company’s financial statements and prescribes a recognition

threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected

to be taken in a tax return. ASC Topic 740-10-25 also provides guidance on derecognition, classification, interest and penalties,

accounting in interim periods, disclosure and transition. As of March 31, 2014, tax years since December 31, 2008 remain open

for IRS audit. The Company has received no notice of audit from the Internal Revenue Service for any of the open tax years.

Loss

Per Share

The

financial statements include basic and diluted per share information. Basic net loss per share is computed by dividing

net loss by the weighted average number of shares of common stock outstanding during the period. Diluted net loss

per share is computed by dividing net loss by the weighted average number of shares of common stock and potentially

outstanding shares of common stock during each period. Common stock equivalents are excluded from the computation of

diluted loss per share when their effect is anti-dilutive. For the three month periods ended March 31, 2014 and 2013,

potential dilutive common stock equivalents consisted of 16,100,000 shares underlying preferred stock Series B, 11,150,100

shares underlying common stock warrants, and 6,511,334 shares underlying stock options, which were not included in

the calculation of the diluted loss per share,.

Segment

Reporting

The Company

operates in two reportable segments. ASC 280-10, "Disclosures about Segments of an Enterprise and Related Information",

establishes standards for the way that public business enterprises report information about operating segments in their consolidated

financial statements. Operating segments are components of an enterprise about which separate financial information is available

that is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and in assessing performance.

Our operating segments include plastic to oil conversion (Plastic2Oil), which includes our fuel sales, and Data Recovery and Migration,

our magnetic tape reading segment. Our chief operating decision maker is the Company’s Chief Executive Officer. (See Note

14)

Concentrations

and Credit Risk

Financial

instruments which potentially expose the Company to concentrations of credit risk consist principally of cash and cash equivalents

and accounts receivable. The Company’s policy is to place our cash and cash equivalents with high credit quality financial

institutions that are insured by the FDIC, however, account balances may at times exceed insured limits. The Company extends

limited credit to its customers based upon their creditworthiness and establishes an allowance for doubtful accounts based upon

the credit risk of specific customers, historical trends and other pertinent information. The Company also routinely

makes an assessment of the collectability of the short term note receivable and determines its exposure for non-performance based

on the specific holder and other pertinent information.

Fair

Value of Financial Instruments

Fair

value is defined under FASB ASC Topic 820 as the exchange price that would be received for an asset or paid to transfer a liability

(an exit price) in the principal or the most advantageous market for an asset or liability in an orderly transaction between participants

on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize

the use of unobservable inputs. The standard describes a fair value hierarchy based on the levels of inputs, of which the first

two are considered observable and the last unobservable, that may be used to measure fair value. The levels are as

follows:

| • |

Level

1 - Quoted prices in active markets for identical assets or liabilities; |

| • |

Level

2 - Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets

or liabilities; quoted prices in markets that are not active; or other inputs that are observable or corroborated by observable

market data or substantially the full term of the assets or liabilities; and |

| • |

Level

3 - Unobservable inputs that are supported by little or no market activity and that are significant to the value of the assets

or liabilities |

The carrying

amounts of cash and cash equivalents, cash held in attorney trust, restricted cash, accounts receivable, accounts payable, accrued

expenses, and current portion of mortgage and capital leases approximate their fair values because of the short-term nature of

these items.

Summary

The Company

believes the above discussion addresses its most critical accounting policies, which are those that are most important to the

portrayal of the financial condition and results of operations and require management’s most difficult, subjective, or complex

judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

NOTE

3 - RECENTLY ISSUED ACCOUNTING STANDARDS AND RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

Recently

Adopted Accounting Pronouncements

There

are no recently adopted accounting pronouncements that impact the Company’s financial statements.

Recently

Issued Accounting Pronouncements

In

April 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No.

2014-08, "Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued

Operations and Disclosures of Disposals of Components of an Entity" ("ASU 2014-08"). ASU 2014-08 limits the requirement

to report discontinued operations to disposals of components of an entity that represents strategic shifts that have (or will

have) a major effect on an entity's operations and financial results. The amendments also require expanded disclosures concerning

discontinued operations and disclosures of certain financial results attributable to a disposal of a significant components of

an entity that does not qualify for discontinued operations reporting. The amendments in this ASU are effective prospectively

for reporting periods beginning on or after December 15, 2014, with early adoption permitted. The impact on our Financial Statements

of adopting ASU 2014-08 is being assessed by management.

On

May 28, 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers (Topic 606)”. The standard outlines

a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes

most current revenue recognition guidance. The accounting standard is effective for annual reporting periods (including interim

reporting periods within those periods) beginning after December 15, 2016. Early adoption is not permitted. The impact on the

Company’s Financial Statements of adopting ASU 2014-09 is being assessed by management.

Management

does not believe that any other recently issued, but not yet effective accounting pronouncements, if adopted, would have a material

effect on the accompanying consolidated financial statements.

NOTE

4 – INVENTORIES, NET

Inventories

consist of the following:

| | |

March 31,

2014 | |

December 31,

2013 |

| | |

| |

|

| Raw materials | |

$ | 399,007 | | |

$ | 392,147 | |

| Finished goods | |

| 67,702 | | |

| 81,499 | |

| Obsolescence reserve | |

| (326,526 | ) | |

| (326,526 | ) |

| | |

| | | |

| | |

| Total inventories | |

$ | 140,183 | | |

$ | 147,120 | |

NOTE 5 - PROPERTY,

PLANT AND EQUIPMENT, NET

| March 31, 2014 | |

|

| Cost | | |

| Accumulated

Depreciation | | |

Net Book

Value |

| | |

|

| | | |

| | | |

|

| Leasehold improvements | |

|

$ | 218,053 | | |

| (7,068 | ) | |

210,985 |

| Machinery and office equipment | |

|

| 6,590,755 | | |

| (1,770,217 | ) | |

4,820,538 |

| Furniture and fixtures | |

|

| 16,368 | | |

| (13,696 | ) | |

2,672 |

| Land | |

|

| 273,118 | | |

| — | | |

273,118 |

| Asset retirement obligation | |

|

| 27,745 | | |

| (3,607 | ) | |

24,138 |

| Office and industrial buildings | |

|

| 650,660 | | |

| (89,965 | ) | |

560,695 |

| Fixed assets under capital lease | |

|

| 64,918 | | |

| (23,148 | ) | |

41,770 |

| Construction in process | |

|

| 1,027,323 | | |

| | | |

1,027,323 |

| | |

|

$ | 8,868,941 | | |

| (1,907,701 | ) | |

6,961,240 |

| December 31, 2013 | |

Cost | |

Accumulated Depreciation | |

Net Book Value |

| | |

| | | |

| | | |

| | |

| Leasehold improvements | |

$ | 218,053 | | |

| (5,251 | ) | |

| 212,802 | |

| Machinery and office equipment | |

| 6,590,755 | | |

| (1,558,597 | ) | |

| 5,032,158 | |

| Furniture and fixtures | |

| 16,368 | | |

| (13,148 | ) | |

| 3,220 | |

| Land | |

| 273,118 | | |

| — | | |

| 273,118 | |

| Asset retirement obligation | |

| 27,745 | | |

| (3,329 | ) | |

| 24,416 | |

| Office and industrial buildings | |

| 650,660 | | |

| (83,459 | ) | |

| 567,201 | |

| Fixed assets under capital lease | |

| 64,918 | | |

| (21,149 | ) | |

| 43,769 | |

| Construction in process | |

| 1,027,323 | | |

| — | | |

| 1,027,323 | |

| | |

| | | |

| | | |

| | |

| | |

$ | 8,868,941 | | |

| (1,684,933 | ) | |

| 7,184,008 | |

At March

31, 2014 and 2013, machinery and equipment with a cost of $64,918, and accumulated amortization of $23,148 and $17,094, respectively,

were under capital lease.

For the

three-month period ended March 31, 2014, total depreciation expense consists of $Nil included in Cost of Sales and depreciation

of property, plant and equipment and accretion of long-term liability of $222,996, which is separately disclosed in the operating

expenses.

For the

three-month period ended March 31, 2013, total depreciation expense consists of $7,646 included in Cost of Sales and depreciation

of property, plant and equipment and accretion of long-term liability of $184,755, which is separately disclosed in the operating

expenses.

Depreciation

expense recognized in the condensed consolidated statements of operations was included in the following captions:

| | |

For the three months periods ended |

| | |

March 31, | |

March 31, |

| Depreciation Expense | |

2014 | |

2013 |

| | |

| |

|

| Depreciation expense and accretion of the asset retirement obligation included in operating expenses | |

$ | 222,719 | | |

| 177,109 | |

| Depreciation expense included in cost of sales | |

| — | | |

| 7,646 | |

| Depreciation expense included in net loss from discontinued operations | |

| — | | |

| 4,572 | |

| Total depreciation of property, plant and equipment and accretion of the asset retirement obligation | |

$ | 222,719 | | |

| 189,329 | |

| | |

| | | |

| | |

NOTE

6 – SHORT-TERM NOTE RECEIVABLE

Upon

consummation of the sale of Pak-It, the Company entered into a long-term note receivable (the “Note”) with the buyer

of Pak-It in the amount of $500,000. The Note was recorded as of the date of closing at the fair value determined by

discounting the face value of the Note using 7%, based on factors considered by the Company at the time of recording the Note. Interest

income is amortized into the value of the Note during the life of the Note and is recognized as interest income throughout the

term of the Note, which was due on July 1, 2013. Interest income recognized on the Note for the three-month periods ended

March 31, 2014 and 2013 was $Nil and $6,139, respectively.

Cancellation

of Promissory note

On February

7, 2014, the Company accepted a cash payment of $200,000 in settlement of the $500,000 promissory note dated February 14, 2012

(the “Note”) that was originally issued by Big 3 Packaging LLC (the “Buyer”) in connection with the Company’s

sale to Buyer of substantially all of the assets of Pak-It on February 14, 2012. In connection with the termination of the Note,

the Company and the Buyer executed a mutual general release of claims.

The Note

matured on July 1, 2013 but remained unpaid by the Buyer. The Company fully reserved for the full value of the note and included

the amount of $500,000 as a loss contributable to discontinued operations (Note 15). The final termination payment of $200,000

was recorded as a bad debt recovery and included in income from discontinued operations for the three month period ended March

31, 2014.

NOTE 7 – RESTRICTED

CASH AND LETTER OF CREDIT

| | |

| March 31, 2014 | | |

| December

31, 2013 | |

| | |

| | | |

| | |

| Restricted Cash securing $100,000 Letter of Credit | |

$ | 100,147 | | |

| 100,122 | |

During

2012, the Company entered into a letter of credit with one of its financial institutions to secure a performance bond required

by a governmental agency for the sale of fuel. This letter of credit is fully secured by restricted cash held by this

institution and was not utilized at any point during the period ended March 31, 2014. Restricted cash consists of $100,000

plus interest earned on the balance.

NOTE 8

- INCOME TAXES

The Company

calculates its income tax expense by estimating the annual effective tax rate and applying that rate to the year-to-date ordinary

income (loss) at the end of the period. The Company records a tax valuation allowance when it is more likely than not

that it will not be able to recover the value of its deferred tax assets. As of March 31, 2014 and 2013, the Company

calculated its estimated annualized effective tax rate at 0% and 0%, respectively, for both the United States and Canada. The

Company had no income tax expense on its $1,942,410 pre-tax loss from continuing operations for the three months ended March 31,

2014.

The Company

recognizes the financial statement benefit of a tax position only after determining that the relevant tax authority would more

likely than not sustain the position following an audit. For tax positions meeting the more-likely-than-not threshold, the amount

recognized in the financial statements is the largest benefit that has a greater than 50% likelihood of being realized upon ultimate

settlement with the relevant tax authority. The Company recognizes interest accrued on uncertain tax positions as well as interest

received from favorable tax settlements within interest expense. The Company recognizes penalties accrued on unrecognized tax

benefits within selling, general and administrative expenses. As of March 31, 2014, the Company had no uncertain tax positions.

The Company

does not anticipate any significant changes to the total amounts of unrecognized tax benefits in the next twelve months. The years

ended December 31, 2008 through December 31, 2013 are open tax years.

NOTE 9

– LONG-TERM DEBT, MORTGAGE PAYABLE AND CAPITAL LEASES

| | |

March 31, 2014 | |

December 31, 2013 |

| Mortgage in the amount of $280,000 Canadian dollars, bears simple interest at 7% per annum, secured by the land and building, and matures on June 15, 2015. Principal and interest are due, in their entirety, at maturity. | |

$ | 280,700 | | |

$ | 280,700 | |

| Equipment capital lease bears interest at 5.0% per annum, secured by the equipment and matures in April 2015, repayable in monthly installments of approximately $360. | |

| 4,542 | | |

| 5,556 | |

| Equipment capital lease, bears interest at 5.85% per annum, secured by the equipment and matures in November 2015, repayable in monthly installments of approximately $516. | |

| 9,810 | | |

| 11,201 | |

| Equipment capital lease (provided by a related party) bears interest at 3.9% per annum, secured by the equipment and matures on May 10, 2015, repayable in monthly installments starting January 2015 approximately $3,800. | |

| 19,928 | | |

| 18,140 | |

| Secured Promissory Notes (provided by a related party) bearing interest of 12% per annum compounded annually and payable upon maturity in 2018 and secured by a security interest in substantially all of the assets of the Company and its subsidiaries. (Note 13) | |

| 2,375,630 | | |

| 2,240,100 | |

| | |

| 2,690,610 | | |

| 2,555,697 | |

| | |

| | | |

| | |

| Less: current portion | |

| 22,034 | | |

| 23,618 | |

| | |

$ | 2,668,576 | | |

$ | 2,532,079 | |

| Continuity of Secured Promissory Notes | |

March 31, 2014 | |

December 31, 2013 |

| Face value of August 29, 2013 secured note payable | |

$ | 1,000,000 | | |

$ | 1,000,000 | |

| Face value of September 30, 2013 secured note payable | |

| 2,000,000 | | |

| 2,000,000 | |

| Total face value of promissory notes payable | |

| 3,000,000 | | |

| 3,000,000 | |

| Discount on August 29, 2013 secured note payable | |

| (310,200 | ) | |

| (310,200 | ) |

| Discount on September 30, 2013 secured note payable | |

| (600,400 | ) | |

| (600,400 | ) |

| Accretion of discount on secured notes payable | |

| 96,230 | | |

| 50,700 | |

| Interest on secured notes payable | |

| 190,000 | | |

| 100,000 | |

| Carrying value of Secured Promissory Notes | |

$ | 2,375,630 | | |

$ | 2,240,100 | |

The following

annual payments of principal are required over the next five years in respect of these mortgages and capital leases:

| Twelve Months Ended March 31, | |

Annual Payments |

| | 2015 | | |

$ | 22,034 | |

| | 2016 | | |

| 292,946 | |

| | 2017 | | |

| — | |

| | 2018 | | |

| — | |

| | 2019 | | |

| 2,375,630 | |

| | Total repayments | | |

$ | 2,690,610 | |

NOTE 10

– COMMITMENTS AND CONTINGENCIES

Commitments

Plastic2Oil

Marine, Inc., one of the Company’s subsidiaries, which is currently not operating, is a party to a consulting services contract

entered into in 2010 with a company owned by Mr. Richard Heddle, who was appointed CEO of the Company in August 2013. The contract

provides the related company with a share of the operating income earned from Plastic2Oil technology installed on marine vessels

which are owned by the related company. The contract provides a minimum future payment equal to fifty percent of the operating

income generated from the operations of two of the most profitable marine vessel processors and 10% from all other marine vessel

processors. As of March 31, 2014, there was no currently installed marine vessel processors as per the terms of the contract.

As of

March 31, 2014, the Company has committed to purchase certain pieces of key machinery from vendors related to the future expansion

of our operations. In addition to the payments made to these vendors classified as deposits on assets, the Company

will be required to pay approximately $495,000 upon the delivery of these assets.

The Company

leases its premises in Thorold, Ontario, which was previously used in the operation JBI (Canada), Inc. doing business as Regional

Recycling of Niagara ("RRON"). As of March 31, 2014, the remaining lease term was almost 17 years. During the third

quarter of 2013, the Company determined that it would shut down the operations of RRON (see Note 15). The employees of RRON were

given notice of the shut down in the first week of September, after which point the Company approached the landlord about terminating

the lease; however, there was no formal termination as an agreement to terminate the lease was not reached. During September of

2013, the Company assessed its options with the facility, including potential sublease, but determined that a sublease of the

facility was not permitted by the lease and officially decided to cease use of the premises as of September 30, 2013. Accordingly,

the Company applied September 30, 2013 as the cease-use-date in recognizing the liability for the contract termination costs.

In measuring the liability, the Company calculated all remaining contracted lease payments, being $1,872,650 ($1,926,000 CAD),

and performed a present value calculation using a discount rate of 20%. The present value calculation resulted in an accrued lease

liability of $505,747, of which $79,428 is due within the next 12 months and has been presented as a current liability. The

total accrued lease liability expense was reduced by $68,818 of the deferred rent liability which was being amortized over the

period of the lease. The total expense included in loss from discontinued operations in the consolidated statements

of operations is $11,165 for the three-month period ended March 31, 2014 (Note 17).

All future

payments required under various agreements are summarized below:

| Fiscal year ending December

31, 2014 |

|

$ |

95,900 |

|

| 2015 |

|

|

95,900 |

|

| 2016 |

|

|

95,900 |

|

| 2017 |

|

|

95,900 |

|

| 2018 |

|

|

101,542 |

|

| Thereafter |

|

|

1,303,117 |

|

| Total |

|

$ |

1,788,259 |

|

Contingencies

In August

2010, a former employee filed a complaint against the Company’s subsidiary alleging wrongful dismissal and seeking compensatory

damages. The Company denied the validity of the contract which was signed by the former employee as employee and president

of the subsidiary. The Company entered into negotiations with the former employee to trade-off some of the benefits of the alleged

employment agreement in return for repayment of debts to the Company incurred by the former employee while in the employment of

the Company’s subsidiary. The debt in the amount of $346,386 was written off. Prior to December 31,

2011, the former employee settled the dispute with the Company and agreed to repay $250,813 to the Company. The employee

owns shares of the Company and will sell and use the proceeds to make the repayments. The Company recognizes these

receipts as recoveries when realized. As of March 31, 2014, the Company has received $118,250 of repayments. This is

a cumulative amount from 2012 and 2013. These recoveries of bad debt are included in selling, general and administrative

expenses.

As previously

reported, on July 28, 2011, certain of the Company’s stockholders filed a class action lawsuit against the Company and Messrs.

Bordynuik and Baldwin on behalf of purchasers of its securities. In an amended complaint filed on July 10, 2012, these

stockholders sought to represent such purchasers during the period from August 28, 2009 through January 4, 2012. The original

and amended complaints in that case, filed in federal court in Nevada, allege that the defendants made false or misleading statements,

or both, and failed to disclose material adverse facts about the Company’s business, operations and prospects in press releases

and filings made with the SEC. Specifically, the lawsuit alleges that the Company made false or misleading statements or failed

to disclose material information, or a combination thereof regarding: (1) that certain media credits (“Media Credits”)

were substantially overvalued; (2) that the Company improperly accounted for acquisitions; (3) that, as such, the Company's financial

results were not prepared in accordance with Generally Accepted Accounting Principles; and (4) that the Company lacked adequate internal

and financial controls. During the quarter ended June 30, 2012, a lead plaintiff was appointed in the case and an amended

complaint was filed. The Company’s’ answer to the amended complaint was filed during the fourth quarter of 2012.

On

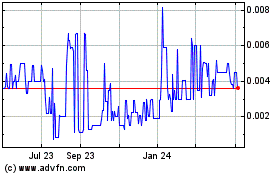

August 8, 2013, JBI, Inc., entered a stipulation agreement (the “Stipulation Agreement”) in potential settlement of

the previously reported class action lawsuit filed by certain stockholders of the Company against the Company and Messrs. Bordynuik

and Baldwin (both former officers of the Company) on behalf of a settlement class consisting of purchasers of the Company’s

common stock during the period from August 28, 2009 through January 4, 2012 (the “Proposed Class Period”). Under

the Stipulation Agreement, the Company would agree to issue shares of its common stock that will comprise a settlement fund. The

number of shares to be issued will be dependent on the price per share of the Company’s common stock during a period preceding

the date of the Court’s entry of final judgment in the case (the “Judgment Date”). If the price of

the Company’s common stock is less than $0.50 per share based upon the average closing price for the 90 trading days preceding

the Judgment Date, the Company would issue 3 million shares of its common stock. If the price of the Company’s common stock

is between $0.50 and $0.70 per share, based upon the same 90-day average closing price, the Company would issue 2.5 million shares

of its common stock. If the price of the Company’s common stock is more than $0.70 per share based upon the same

90-day average closing price the Company will issue 1.75 million shares of its common stock. The shares will not be

distributed to class members in kind. At any time after final approval by the Court, class counsel would have the option

to sell all or any portion of such shares for the benefit of class members, subject to certain volume limitations. Plaintiff’s

counsel’s attorneys’ fees, subject to Court approval, would be paid out of the settlement fund. The Company

would also pay settlement-related costs up to a maximum of $200,000. The plaintiffs and each of the class members who

purchased the Company’s common stock during the Proposed Class Period and alleged they were damaged would be deemed to have

fully released all claims against the Company and other defendants upon entry of judgment. On September 10, 2013, that

agreement was submitted to the Court, and class counsel moved for entry of an order granting preliminary approval of the settlement,

including the mailing of a settlement notice that will include, among other things, the general terms of the settlement, proposed

plan of allocation, and terms of plaintiff’s counsel’s fee application. On April 1, 2014, the Court issued

an Order denying that motion. It is anticipated that additional briefing will be submitted to the Court in support

of the motion, and that the Court will then reconsider its Order. The Company cannot predict the outcome of the class action

litigation at this time.

On April

25, 2013, plaintiffs ASPTO LLC, Plastic2Oil of Clearwater 1 LLC, and ES Resources LLC filed suit against the Company in the Circuit

Court of Pinellas County, Florida, alleging breaches of certain contracts and seeking unspecified damages. The Company

thereafter removed the case to the United States District Court for the Middle District of Florida, and filed a motion to dismiss

certain counts of the Complaint. On November 12, 2013, the Court issued an Order transferring the case to the United

States District Court for the District of Massachusetts. On June 12, 2014, the parties stipulated to a dismissal of

the case without prejudice, and the case has been dismissed.

On

August 9, 2013, a purported shareholder derivative suit was filed in the United States District Court for the District of Massachusetts

against John Bordynuik, former Chief Executive Officer of the Company and a former member of the Company’s Board of Directors,

and Ronald C. Baldwin, former Chief Financial Officer of the Company. The Complaint was filed by Erwin Grampp, allegedly

acting on behalf of the Company, and it names the Company as a nominal defendant. This is the second purported shareholder

derivative suit that Mr. Grampp has filed in which the Company has been named as a nominal defendant. As previously

reported, the first such suit by Mr. Grampp was dismissed by the court. This recent Complaint (“Grampp II”)

alleges, inter alia, that defendants Bordynuik and Baldwin breached fiduciary duties owed to the Company by causing the Company

to erroneously book certain media credits in 2009. Grampp II alleges that this conduct resulted in two lawsuits against

the Company, one an action brought by the Securities and Exchange Commission (“SEC Action”) and the other a purported

class action by Ellisa Pancoe and Howard Howell (“Class Action”). Grampp II alleges that the Company has

settled the SEC Action, and that the Company is in the process of settling the Class Action, but that the Company has been damaged

as a result of these two lawsuits. Grampp II seeks to recover damages on behalf of the Company from defendants Bordynuik

and Baldwin in an unspecified amount. It also seeks unspecified equitable relief, and costs and attorneys’ fees

incurred in the action. On October 11, 2013, defendants Bordynuik and Baldwin filed a motion to dismiss this action. Thereafter,

the Court granted plaintiff leave to amend his Complaint, and defendants Bordynuik and Baldwin have renewed their motion to dismiss.

The motion thus renewed is pending and the Court has not ruled upon it. Pursuant to the Company’s By-Laws, the

Company has an obligation to indemnify defendants Bordynuik and Baldwin to the fullest extent permitted by Nevada law.

On August

20, 2013, plaintiff Stephen Seneca filed suit against the Company and John Bordynuik, former Chief Executive Officer of the Company

and a former member of its Board of Directors, alleging claims against the Company for fraud, negligence, civil conspiracy, and

breach of contract, as well as a breach of Section 678.4011, Florida Statutes. The claims allege wrongdoing by the

Company in connection with a Unit Purchase and Exchange Agreement dated September 30, 2009, and certain shares of the Company’s

stock issued pursuant thereto. On September 17, 2013, plaintiff caused a Summons to be issued on the Complaint, and

on September 26, 2013, plaintiff caused the Complaint to be served on the Company. Plaintiff seeks damages “in

excess of one million dollars.” On October 31, 2013, the Company and Mr. Bordynuik filed a motion to dismiss

this Complaint. On May 14, 2014, the Court issued an Order granting the motion in part. The Court dismissed

one of the claims made against the Company, and struck another from the Complaint. Mr. Bordynuik and the Company thereafter

filed their Answer to the complaint. The Company cannot predict the outcome of this matter at this time.

On August

14, 2013, John Bordynuik, Inc. aka 310 Holdings, Inc. brought suit against the Company in the United States District Court for

the District of Nevada, alleging damages for breach of contract, conversion, fraud and fraud in the inducement in connection with

an alleged 2009 Asset Purchase Agreement. In September of 2013 and October of 2013, the Company brought motions to

dismiss the complaint and for summary judgment. Those motions are pending before the Court. The Company

cannot predict the outcome of this matter at this time.

As

of March 31, 2014, the Company is involved in litigation and claims in addition to the above mentioned legal claims, which arise

from time to time in the normal course of business. In the opinion of management, based upon the information and facts

known to them, any liability that may arise from such contingencies would not have a material adverse effect on the consolidated

financial statements of the Company.

NOTE 11 – STOCKHOLDERS’

EQUITY

Common Stock and Additional

Paid in Capital

The

Company issued 3,900,000 additional shares of Common Stock during the three-month period ended March 31, 2014.

On February

19, 2014, the Company entered into Subscription Agreements with three investors in connection with a private placement of shares

of the Company’s common stock and warrants to purchase shares of common stock. The Company agreed to sell and issue to the

Purchasers an aggregate of 2.4 million shares of its common stock and warrants to purchase up to an additional 2.4 million shares

of its common stock. The closings occurred between February 19 and 24, 2014. The purchase price per share was $0.05 and the gross

proceeds to the Company were $120,000. The warrants have a three year term, and an exercise price of $0.10 per share of common

stock. Concurrent with these subscriptions the Company entered into a consulting agreement with the investors and a fourth arm’s

length party under which the Company would issue 1,500,000 shares upon commencement of the contract, and 1,000,000 shares on each

of May 15, 2014, August 15, 2014 and January 15, 2015, respectively, for a total of 4,000,000 shares. Along with each of the forgoing

share issuances, the Company is required to issue a commensurate number of warrants with a three year term and an exercise price

of $0.10.. Additionally, under the terms of the consulting agreement the Company is committed to issue 1,000,000 additional shares

if the Company becomes listed on the AMEX division of the New York Stock Exchange or NASDAQ. The consulting agreement also specifies

contingent fees of 5% of the gross transaction amount for introducing a merger or acquisition candidate and 3% of fees earned

from the introduction of a strategic or business partner.

On March

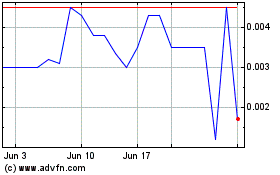

26, 2014, the Company entered into Subscription Agreements with eleven investors in connection with a private placement of shares

of the Company’s common stock and warrants to purchase shares of common stock. The Company agreed to sell and issue to the

Purchasers an aggregate of 3.2 million shares of its common stock and warrants to purchase up to an additional 3.2 million shares

of its common stock. The closings occurred between March 17 and April 8, 2014. The purchase price per share was $0.10 and the

gross proceeds to the Company were $384,960, of which $289,980 was received as of March 31, 2014. The warrants have a three year

term, and an exercise price of $0.10 per share of common stock.

Warrants

| | |

| |

| |

Weighted |

| | |

Warrants | |

Warrants | |

Average |

| Details | |

Number | |

Amount | |

Exercise Price |

| OUTSTANDING, DECEMBER 31, 2013 (i) | |

| 3,143,500 | | |

$ | 1,056,970 | | |

$ | 0.61 | |

| Issued (ii) | |

| 8,150,000 | | |

| 646,420 | | |

| 0.10 | |

| Expired (i) | |

| (143,500 | ) | |

| — | | |

| (2.00 | ) |

| OUTSTANDING, MARCH 31, 2014 | |

| 11,150,000 | | |

$ | 1,703,390 | | |

$ | 0.22 | |

Pursuant

to a private placement that took place between December 30, 2011 and January 6, 2012, the Company issued 1,997,500 warrants to

purchase shares of common stock for $2.00 to the subscribers of the December 2011/ January 2012 private placements. The

warrants have an eighteen month term from the date of issuance, such issuance dates ranged from January 6, 2012 through August

29, 2012. As of December 31,2013, 1,854,000 warrants had expired. The remaining 143,500 outstanding warrants

expired on February, 26, 2014.

Pursuant

to two separate secured debt issuances on August 29, 2013 and September 30, 2013, the Company issued 1,000,000 and 2,000,000 warrants,

respectively, to purchase shares of common stock for $0.54 per share to the holder of the secured debt (see Note 13). The

warrants have a five year term from the date of issuance, as such the corresponding expiry dates are August 29, 2018 and September

30, 2018.

As of

August 29, 2013, the 1,000,000 warrants issued were determined to each have a fair value of $0.3102, totaling a fair value of

$310,200. The Company determined this valuation through use of a binomial pricing model. The assumptions in valuing

these Warrants consisted of:

| ● |

Volatility

– 141.929%, based on the Company’s Historical Stock Price |

| |

|

| ● |

Risk Free Rate –

1.36%, based on the long-term US Treasury rate |

As of

September 30, 2013, the 2,000,000 warrants issued were determined to each have a fair value of $0.3002, totaling a fair value