Current Report Filing (8-k)

November 14 2016 - 5:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 14, 2016

NORTHWEST BIOTHERAPEUTICS, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

001-35737

|

94-3306718

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

4800 Montgomery Lane, Suite 800

Bethesda, MD 20814

|

|

(Address of principal executive offices)

|

|

(204) 497-9024

|

|

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 3.01

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

This report on Form 8-K is being filed in addition to the disclosure

of the same subject matter in the Company’s most recent Quarterly Report on Form 10-Q in order to fulfill Nasdaq requirements.

As the Company previously reported, in

late October and thereafter, the Company engaged in discussions with institutional investors interested in providing financing.

Under Nasdaq Listing Rule, the number of shares which the Company may issue is limited in certain types of transactions (and not

similarly limited in other types of transactions). The number of shares which the investors were interested to purchase may

exceed the maximum number of shares issuable by the Company in the type of transaction contemplated.

While this issue is being addressed, the

Company has entered into a debt financing. On November 4, 2016, the Company entered into Promissory Note Agreements (the

“Notes”) for $2.5 million principal amount. The Notes are not convertible; they have one-year maturity and 10%

annual interest, with the interest payable at maturity. No equity or derivative equity securities were issued in connection with

this transaction.

In connection with the discussions with

the investors, the Company contacted Nasdaq to make the necessary filings for Listing of Additional Shares and to pursue a determination

of the maximum number of shares the Company may issue to the investors. On November 1, 2016, the Company submitted to Nasdaq information

about the Company’s financing transactions during the preceding six-month period.

As reported in the Company’s quarterly

report on form 10-Q, on November 7, 2016 the Company received a letter from Nasdaq indicating that certain of the Company’s

financing transactions did not comply with Nasdaq’s Listing Rule 5635(d). The Nasdaq Staff had determined to aggregate a

series of transactions that were completed between May 15, 2016 and October 13, 2016 for purposes of assessing whether the

20% threshold for shareholder approval had been triggered for issuances priced below the applicable market price. These transactions

included repricing of existing common stock purchase warrants and issuances of new common shares and common stock purchase warrants.

As also reported in the Company’s

10-Q, the Company and its representatives are in discussions with the Nasdaq Staff regarding available avenues for remediation,

and the Company intends to submit its plan of remediation to Nasdaq on or before the November 18, 2016 deadline established by

Nasdaq (The Nasdaq Staff shortened the 45 day period for submitting a plan, pursuant to their discretionary authority under Listing

Rule 5101. The Staff based this determination on the Company’s recent shareholder approval violation, pending bid price grace

period and concerns about the Company’s internal processes for review of transactions such as these). If Nasdaq does not

accept the plan of remediation, Nasdaq may issue a notice of delisting. The Company would then have the right to request a hearing

before an independent Nasdaq Listing Qualifications Panel (the “Panel”). A request for a hearing would stay any suspension

or delisting action pending the hearing and the expiration of any additional extension period granted by the Panel. The Panel would

have the discretion to grant the Company an extension period of up to 180 calendar days from the date of the delisting letter within

which the Company would be required to demonstrate compliance with all applicable listing requirements. Notwithstanding the foregoing,

there can be no assurance that the Company will be able to satisfy the applicable listing requirements and maintain its listing

on The Nasdaq Stock Market.

As previously reported, on June 24, 2016

the Company was advised by the Nasdaq Staff that it no longer meets the $1.00 per share requirement for continued listing pursuant

to Nasdaq Listing Rule 5550(a)(2) and was granted a grace period through December 21, 2016 in which to regain compliance. Compliance

can be achieved by maintaining a closing bid price of at least $1.00 per share for a minimum of 10 consecutive business days. If

the Company does not regain compliance by December 21, 2016, the Company may be eligible for a second 180-day grace period if it

meets the initial listing standards (with the exception of the bid price and market value of publicly held shares requirements)

for The Nasdaq Capital Market, which the Company does not currently meet, and provides written notice to Nasdaq of its intention

to cure the deficiency during the second 180-day grace period, by effecting a reverse stock split, if necessary, and satisfying

any other applicable requirements. If the Company does not regain compliance by December 21, the Staff would issue a notice

of delisting and the Company would at that time have the opportunity to request a hearing in accordance with the above-described

procedures.

SIGNATURES

PURSUANT TO THE REQUIREMENTS OF THE

SECURITIES EXCHANGE ACT OF 1934, THE REGISTRANT HAS DULY CAUSED THIS REPORT TO BE SIGNED ON ITS BEHALF BY THE UNDERSIGNED THEREUNTO

DULY AUTHORIZED.

|

|

NORTHWEST BIOTHERAPEUTICS, INC.

|

|

|

|

|

|

|

|

|

|

Date: November 14, 2016

|

By:

|

/s/

Linda F. Powers

|

|

|

|

Name: Linda F. Powers

|

|

|

|

Title: Chief Executive Officer

|

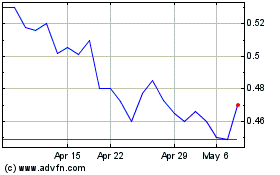

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Nov 2023 to Nov 2024