0001471781

false

0001471781

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

and Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2023

GBT

TECHNOLOGIES INC.

(Exact name of small business issuer as specified

in its charter)

| Nevada |

000-54530 |

27-0603137 |

| (State or other jurisdiction of incorporation

or organization) |

Commission File Number |

(I.R.S. Employer Identification No.) |

2450 Colorado Ave., Suite 100E, Santa

Monica, CA 90404

(Address of principal executive offices) (Zip

code)

Registrant’s telephone number including

area code: 888-685-7336

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act: Not

applicable.

| Title of each class |

Trading Symbol |

Name of each exchange on

which registered |

| Not applicable. |

|

|

Item 1.01 Entry Into a Material Definitive Agreement

On April 17, 2023,

Bannix Acquisition Corp. (“Bannix”), EVIE Autonomous Group Ltd. (“EVIE”) and EVIE’s shareholders

entered into a Business Combination Agreement pursuant to which Bannix agreed to acquire EVIE. In addition, Bannix agreed

to acquire from GBT Technologies Inc. (the “Company” or “GBT”), the Apollo

System which is intellectual property covered by patent application filed with the US Patent and Trademark Office. This patent

application describes a machine learning driven technology that controls radio wave transmissions, analyzes their reflections data,

and constructs 2D/3D images of stationary and moving objects. The Apollo system is based on radio waves and can detect an entity’s

moving and stationary positions, enabling imaging technology to show these movements and positions on a screen in real time. This

includes an AI technology that controls the radio waves transmission and analyzes the reflections. The goal is to integrate the

Apollo System as an efficient driver monitoring system, detecting impaired or distracted drivers, providing audible and visual

alerts (“the “Patents”).

On August 8, 2023, Bannix entered into a Patent Purchase Agreement (“PPA”)

with GBT Tokenize Corp. (“Tokenize”), which is 50% owned by GBT, where GBT provided its consent, to acquire the entire right,

title, and interest of the Patents. The closing date of the PPA will be immediately follow the closing of the acquisition of EVIE by Bannix.

The Purchase Price is set at 5% of the consideration that Bannix is paying to the shareholders of EVIE. The Business Combination Agreement

sets the consideration to be paid by Bannix at $850 million and, in turn, the consideration in the PPA to be paid to Tokenize is $42.5

million. If the final purchase price is less than $30 million, Tokenize has the option to cancel the PPA. In accordance therewith, Bannix

agrees to pay, issue and deliver to Tokenize, $42,500,000 in series A preferred stock to Tokenize, which such terms will be more fully

set forth in the Series A Preferred Stock Certificate of Designation to be filed with the Secretary of State of the State of prior to

the Closing Date. The Series A Preferred Stock will have stated value of face value of $1,000 per share and is convertible, at the option

of Tokenize, into shares of common stock of Bannix at 5% discount to the VWAP during the 20 trading days prior to conversion, and in any

event not less than $1.00. The Series A Preferred Stock will not have voting rights and will be entitled to dividends only in the event

of liquidation. The Series A Preferred Stock will have a 4.99% beneficial ownership limitation.

Series A Preferred Stock and the shares of

common stock issuable upon conversion of the Series A Preferred Stock (the “Conversion Shares”) shall be subject to

a lock-up beginning on the Closing Date and ending on the earliest of (i) the six (6) months after such date, (ii) a Change in

Control, or (iii) written consent of Purchaser (the “Seller Lockup Period”)

The foregoing description of the terms of the

above transactions do not purport to be complete and are qualified in their entirety by reference to the provisions of such agreements,

the forms of which are filed as exhibits to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed with this Form 8-K:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| GBT TECHNOLOGIES INC. |

GBT TECHNOLOGIES

INC. |

| |

|

|

| |

By: |

/s/ Mansour Khatib |

| |

Name: |

Mansour Khatib |

| |

Title: |

Chief Executive Officer |

| |

|

|

| Date: August 11, 2023 |

|

|

EXHIBIT 10.1

PATENT PURCHASE AGREEMENT

This PATENT PURCHASE

AGREEMENT (“Agreement”) effective as of August 8 2023 (the ”Effective Date”) is made

and entered into by and between GBT Tokenize Corp. having its principal place of business at c/o GBT Technologies, Inc, 2450

Colorado Ave. Suite 100E Santa Monica, CA 90404 (“Seller”) and Bannix Acquisition

Corp. having its principal place of business at 8265 West Sunset Blvd., Suite # 107,

West Hollywood, California 90046 (“Purchaser”). Seller and Purchaser may hereinafter be referred to collectively

as the “Parties” and individually as a “Party” when convenient.

RECITALS

WHEREAS,

Seller is the owner of the entire right, title, and interest of certain patents and patent applications providing an intellectual

property basis for a machine learning driven technology that controls radio wave transmissions,

analyzes their reflections data, and constructs 2D/3D images of stationary and in motion objects, which patents are more specifically

described on Exhibit A which is attached hereto (the “Patents”).

WHEREAS, Purchaser is as enhancement

to its exiting IP portfolio, desirous of acquiring the entire right, title, and interest of the Patents from the Seller.

WHEREAS, the Parties now

desire to enter into this Agreement.

NOW, THEREFORE, in consideration

of the terms and provisions contained herein and other good and valuable consideration, the receipt, adequacy, and sufficiency

of which are hereby acknowledged, the Parties agree as follows:

1. DEFINITIONS

For the purpose of this Agreement, the

following terms, whether in singular or in plural form, when used with a capital initial letter shall have the respective meanings

as follows.

1.1 “Action”

means an assertion made or a proceeding filed by a Person or one of its affiliates.

1.2 “Assigned Patent(s)”

means the issued patent and patent applications listed in Exhibit A hereto.

1.3 “Person” means

any natural person, corporation, company, partnership, association, sole proprietorship, trust, joint venture, non-profit entity,

institute, governmental authority, trust association or other form of entity not specifically listed herein including, without

limitation, Seller or any of its affiliates, or Purchaser or any of its affiliates.

2. PURCHASE AND SALE OF PATENTS

2.1 Purchase and Sale of Patents.

Effective as of the Closing Date and subject to the fulfillment of the Parties’ obligations set forth in Sections 3.2 and

3.3 below, Seller hereby sells, assigns and transfers to Purchaser its entire right, title and interest in and to all of the Assigned

Patents, including all past, present and future causes of actions and claims for damages derived by reason of patent infringement

thereof for Purchaser’s own use and for the use of its assigns, successors, and legal representatives, to the full end of

the term of each one of the Assigned Patents. To evidence the assignment of the Assigned Patent, Seller shall execute a patent

assignment document (“Patent Assignment”) for the Assigned Patent. Notwithstanding the foregoing assignment,

in the event that the Closing is not consummated within one hundred twenty (120) calendar days from the Effective Date, Seller

shall have the right, in its sole discretion, to terminate this Agreement including all obligations of Seller and all rights of

Purchaser set forth in this Agreement.

2.2 Purchase

Price. The Purchase Price in this Agreement is set at 5% of the consideration that the Purchaser is paying to the shareholders

of EVIE Group Autonomous Ltd. pursuant to that certain Business Combination Agreement (“BCA”) dated June 26, 2023 with

EVIE Autonomous Group Ltd. and its shareholders. The BCA sets the consideration to be paid by the Purchaser at $850 million and,

in turn, the consideration in this Agreement paid to the Seller is $42.5 million. The Parties agree that the final Purchase Price

at closing will be equal to 5% of the total consideration that the Purchaser is paying under the BCA to the shareholders of EVIE

Autonomous Group Ltd. If the final Purchase Price is less than $30 million, the Seller has the option to cancel this Agreement.

In accordance therewith, Purchaser hereby agrees to pay, issue and deliver to o Seller, pursuant to

the terms set forth in Section 3.2, 42,500 shares of its series a preferred stock to the Seller, which such terms will be

more fully set forth in the Series A Preferred Stock Certificate of Designation to be filed with the Secretary of State of the

State prior to the Closing Date (the “Purchase Price”). The

Series A Preferred Stock will have stated value of face value of $1,000 per share and is convertible,

at the option of the Seller, into shares of common stock of Purchaser at 5% discount to the VWAP during the 20 trading days prior

to conversion, and in any event not less than $1.00. The Series A Preferred Stock will not have voting rights and will be entitled

to dividends only in the event of liquidation. The Series A Preferred Stock will have a 4.99% beneficial ownership limitation.

2.3 Lock-Up

of Purchaser Preferred Stock. Series A Preferred Stock and the shares of common stock issuable upon conversion of the Series

A Preferred Stock (the “Conversion Shares”) shall be subject to a lock-up beginning on the Closing Date and

ending on the earliest of (i) the six (6) months after such date, (ii) a Change in Control, or (iii) written consent of Purchaser

(the “Seller Lockup Period”). On the Closing Date, the Seller shall enter into a lock-up agreement pursuant

to which Seller may not, directly or indirectly, (i) offer, sell, offer to sell, contract to sell, hedge, pledge, sell any option

or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase or sell (or announce

any offer, sale, offer of sale, contract of sale, hedge, pledge, sale of any option or contract to purchase, purchase of any option

or contract of sale, grant of any option, right or warrant to purchase or other sale or disposition), or otherwise transfer or

dispose of (or enter into any transaction or device that is designed to, or could be expected to, result in the disposition by

any person at any time in the future), any Series A Preferred Stock or Conversion Shares acquired pursuant to this Agreement or

(ii) enter into any swap or other agreement or any transaction that transfers, in whole or in part, directly or indirectly, the

economic consequence of ownership of any Series A Preferred Stock or Conversion Shares, whether or not any such swap or transaction

described in clause (i) or (ii) above is to be settled by delivery of Series A Preferred Stock; provided, however,

following the expiration of the Lockup Period and continuing for a period through the twenty four (24) month anniversary of the

Closing Date, the Seller will not sell the Series A Preferred Stock or the Conversion Shares exceeding

15% of the Purchaser’s total daily volume on its trading market. The terms of this provision shall convey to any subsequent

holder of the Series A Preferred Stock.

3. CLOSING AND DELIVERY

3.1 The Closing. The transaction

shall be consummated at the officers of the Purchaser immediately following the closing of the acquisition described in that certain

Business Combination Agreement entered between Purchaser, EVIE Autonomous Group Ltd. and its shareholders (the “Closing Date”).

3.2 Seller Deliverables. At the

closing, Seller shall deliver to Purchaser a duly executed Patent Assignment(s).

3.3 Purchaser Deliverables. At

the closing, Purchaser shall deliver or cause to be delivered to Seller or its affiliate the Purchase Price which will consist

of a stock certificate representing the Series A Preferred Stock.

4. TRANSFER OF PATENT

4.1 Patent Assignment(s). Effective

as of the Closing Date, Seller hereby sells, assigns, transfers and conveys to Purchaser all rights, title and interest it has

in and to the Assigned Patent and all inventions and discoveries described therein and all rights of Seller to collect royalties

under such Patent.

4.2 Assignment of Causes of Action.

Effective as of the Closing Date, Seller hereby sells, assigns, transfers and conveys to Purchaser all right, title and interest

it has in and to all causes of action and enforcement rights, whether currently pending, filed, or otherwise, for the Assigned

Patent and all inventions and discoveries described therein, including without limitation all rights to pursue damages, injunctive

relief and other remedies for past, current and future infringement of the Assigned Patent as of the Effective Date.

5. ADDITIONAL OBLIGATIONS

5.1 Further Assurances. Seller

agrees to cooperate with Purchaser in the obtaining and sustaining of any and all such additional documentation needed and in confirming

Purchaser’s exclusive ownership of the Assigned Patents. At the reasonable request of Purchaser and without demanding further

consideration from Purchaser, Seller agrees to execute and deliver such other instruments and do and perform such other acts and

things as may be reasonably necessary for effecting completely the consummation of the transfer of ownership in and to the Assigned

Patent as contemplated hereby, including without limitation execution, acknowledgment and recordation of other such papers, as

necessary or desirable for fully perfecting and conveying unto Purchaser the benefit of the transfer of ownership in and to the

Assigned Patent as contemplated hereby.

5.2 Further Assistance. Subject

to the terms and conditions hereof, Seller agrees, upon the reasonable request of Purchaser, to do all things necessary, proper,

or advisable, including without limitation the execution, acknowledgment and recordation of specific assignments, oaths, declarations

and other documents on a country-by-country basis, to assist Purchaser in obtaining, perfecting, sustaining, and/or enforcing the

patent rights. Such assistance may also include providing prompt production of pertinent facts and documents, giving of testimony,

execution of petitions, oaths, powers of attorney, specifications, declarations or other papers and other assistance reasonably

necessary for filing patent applications, complying with any duty of disclosure, and conducting prosecution, reexamination, reissue,

interference or other priority proceedings, opposition proceedings, cancellation proceedings, public use proceedings, infringement

or other court actions and the like with respect to the Assigned Patent. Seller’s agreement to render any of the foregoing

assistance is subject to Purchaser’s payment of all reasonable expenses of Seller incurred in connection therewith and the

availability of Seller’s personnel.

6. REPRESENTATIONS AND WARRANTIES

Seller hereby warrants to Purchaser

as follows:

6.1 No Assignment. Seller warrants

that (i) no assignment of the Assigned Patents, application or patent therefor has been made to a party other than Purchaser and

(ii) there is no obligation to make any assignment of the invention(s), application, or any patent therefor to any party other

than Purchaser.

6.2 Title and Contest. Seller

has good and marketable title to the Assigned Patent, including without limitation all rights, title, and interest in the Assigned

Patent to sue for infringement thereof. The Assigned Patent is free and clear of all liens, mortgages, security interests or other

encumbrances, and restrictions on transfer. There are no actions, suits, claims or proceedings threatened, pending or in progress

on the part of any named inventor of the Patent relating in any way to the Assigned Patent and Seller has not received notice of

(and Seller is not aware of any facts or circumstances which could reasonably be expected to give rise to) any other actions, suits,

investigations, claims or proceedings threatened, pending or in progress relating in any way to the Patent. There are no existing

contracts, agreements, options, commitments, proposals, bids, offers, or rights with, to, or in any Person to acquire the Assigned

Patent.

6.3 Restrictions on Rights. Purchaser

will not be subject to any covenant not to sue or similar restrictions on its enforcement or enjoyment of the Assigned Patent as

a result of the transaction contemplated in this Agreement, or any prior transaction related to the Assigned Patent.

6.4 Payment of Fees Due. Seller

has paid all fees due on the Assigned Patent to the United States Patent and Trademark Office as of the Effective Date of this

Agreement.

7. MISCELLANEOUS

7.1 No Representation or Warranty. SELLER

MAKES NO REPRESENTATIONS OR WARRANTIES WHATSOEVER THAT THE PATENT COVERED BY THIS AGREEMENT ARE EITHER VALID OR ARE INFRINGED BY

ANY OTHER PARTIES.

7.2 Limitation on Consequential Damages.

EXCEPT IN THE CASE OF FRAUD BY SELLER, NEITHER PARTY SHALL BE LIABLE TO THE OTHER FOR LOSS OF PROFITS, OR ANY OTHER INDIRECT OR

SPECIAL, CONSEQUENTIAL, PUNITIVE OR INCIDENTAL DAMAGES, HOWEVER CAUSED, EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGE. THE

PARTIES ACKNOWLEDGE THAT THESE LIMITATIONS ON POTENTIAL LIABILITIES WERE AN ESSENTIAL ELEMENT IN SETTING CONSIDERATION UNDER THIS

AGREEMENT

7.3 Limitation of Liability.

EXCEPT IN THE CASE OF FRAUD BY SELLER, IN NO EVENT SHALL EITHER PARTY’ S TOTAL LIABILITY UNDER THIS AGREEMENT EXCEED THE

PURCHASE PRICE. THE PARTIES ACKNOWLEDGE THAT THESE LIMITATIONS ON POTENTIAL LIABILITIES WERE AN ESSENTIAL ELEMENT IN SETTING CONSIDERATION

UNDER THIS AGREEMENT.

7.4 Confidentiality of Terms.

The parties hereto shall keep the terms and existence of this Agreement and the identities of the parties hereto confidential and

shall not now or hereafter divulge any of this information to any third party except: (a) with the prior written consent of the

other party, such consent shall not be unreasonably withheld; (b) as otherwise may be required by law or legal process, including

in confidence to financial advisors in their capacity of advising a party in such matters and as required by the Securities Exchange

Act of 1934, as amended; (c) during the course of litigation, so long as the disclosure of such terms and conditions are restricted

in the same manner as is the confidential information of other litigating parties; or (d) in confidence to its legal counsel, accountants,

banks and financing sources.

7.5 Governing Law. This Agreement

shall be governed and construed in accordance with the laws of the State of Nevada.

7.6 Severability. If any provision

of this Agreement shall be held invalid or unenforceable, such invalidity or unenforceability shall attach only to such provision

and shall not in any manner affect or render invalid or unenforceable any other severable provision of this Agreement, and this

Agreement shall be carried out as if any such invalid or unenforceable provisions were not contained herein.

7.7 Indemnification. Each party

to this Agreement, shall indemnify and hold harmless each other party at all times after the date of this Agreement against and

in respect of any liability, damage or deficiency, all actions, suits, proceedings, demands, assessments, judgments, costs and

expenses including attorney’s fees incident to any of the foregoing, resulting from any misrepresentations, breach of covenant

or warranty or non-fulfillment of any agreement on the part of such party under this Agreement or from any misrepresentation in

or omission from any certificate furnished or to be furnished to a party hereunder. Subject to the terms of this Agreement, the

defaulting party shall reimburse the other party or parties on demand, for any reasonable payment made by said parties at any time

after the Closing, in respect of any liability or claim to which the foregoing indemnity relates, if such payment is made after

reasonable notice to the other party to defend or satisfy the same and such party failed to defend or satisfy the same.

7.8 Entire Agreement; Waiver of Breach.

This Agreement constitutes the entire agreement between the parties and supersedes any prior agreement or understanding among them

in respect of the subject matter hereof, and there are no other agreements, written or oral, nor may the Agreement be modified

except in writing and executed by all of the parties hereto; and no waiver of any breach or condition of this Agreement shall be

deemed to have occurred unless such waiver is in writing, signed by the party against whom enforcement is sought, and no waiver

shall be claimed to be a waiver of any subsequent breach or condition of a like or different nature.

IN WITNESS WHEREOF, the parties have

executed this Agreement the day and year first above written.

| GBT TOKENIZE CORP. |

|

| |

|

| By: |

|

|

| Name: |

Michael D. Murray |

|

| Title: |

Chief Executive Officer |

|

| BANNIX ACQUISITION CORP. |

|

| |

|

| By: |

|

|

| Name: |

Douglas Davis |

|

| Title: |

Chief Executive Officer |

|

We give our consent:

GBT

Technologies, Inc.

|

|

| |

|

| By: |

|

|

| Name: |

Mansour Khatib |

|

| Title: |

Chief Executive Officer |

|

Exhibit A

List of “Assigned Patents”

| Title |

App.

No. |

Country |

Filing

Date |

Status/Deadline |

Patent

No. |

Issue

Date |

| SYSTEMS

AND METHODS OF FACIAL AND BODY RECOGNITION, IDENTIFICATION AND ANALYSIS |

17/212,235 |

USA |

Mar.

25, 2021 |

GRANTED |

US

11,527,104 B2 |

Dec.

13, 2022 |

| SYSTEMS

AND METHODS OF MOBILE DATABASE MANAGEMENT AND SHARING |

16/155,093 |

USA |

Oct.

9, 2018 |

GRANTED |

US

10,853,327 B2 |

Dec.

1, 2020 |

| SYSTEMS

AND METHODS OF MOBILE DATABASE MANAGEMENT AND SHARING |

17/104,001 |

USA |

Nov.

25, 2020 |

GRANTED

(CONTINUATION) |

US

11,663,167 B2 |

May

30, 2023 |

| SYSTEMS

AND METHODS OF REAL-TIME MOVEMENT, POSITION DETECTION, AND IMAGING (APOLLO) |

17/471,213 |

USA |

Sep.

10, 2021 |

GRANTED |

US

11,302,032 Bl |

Apr.

12, 2022 |

ELECTRONIC

CIRCUITS FOR SECURE COMMUNICATIONS AND ASSOCIATED SYSTEMS AND METHODS

(SECURE COMM.) |

15/015,441 |

USA |

Feb.

4, 2016 |

GRANTED |

US

10,521,614 B2 |

Dec.

31, 2019 |

| SYSTEMS

AND METHODS OF REAL-TIME MOVEMENT, POSITION DETECTION, AND IMAGING (APOLLO CONTINUATION) |

17/694,384 |

USA |

Mar.

14, 2022 |

PENDING

(CONTINUATION) |

Publication.

No.: US 2022/0405966 Al |

Dec.

22, 2022 (Publication Date) |

7

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

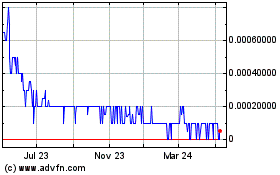

GBT Technologies (PK) (USOTC:GTCH)

Historical Stock Chart

From Oct 2024 to Nov 2024

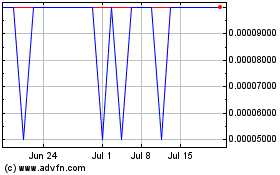

GBT Technologies (PK) (USOTC:GTCH)

Historical Stock Chart

From Nov 2023 to Nov 2024