SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2020

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Juscelino Kubitschek 1830 |03º andar| Conj. 32 Torre 2 - Cond. São Luiz

São Paulo, SP, 04543- 000

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

Gafisa S.A.

Publicly-held Company

CNPJ 01.545.826/0001-07

NIRE 35.300.147.952 – CVM Code 01610-1

MANAGEMENT PROPOSAL FOR THE EXTRAORDINARY SHAREHOLDERS’ MEETING

TO BE HELD ON AUGUST 7, 2020

Gafisa S.A.

Publicly-held Company

CNPJ 01.545.826/0001-07

NIRE 35.300.147.952 – CVM Code No. 01610-1

EXTRAORDINARY SHAREHOLDERS’ MEETING

TO BE HELD ON AUGUST 7, 2020

SUMMARY

Pursuant to Instruction issued by the Brazilian Securities and Exchange Commission (“CVM”) No. 481 of December 17, 2009 (“ICVM 481/09”), the management of Gafisa S.A. (“Company” or “Gafisa”) hereby submits the Management Proposal for the items to be resolved at the Extraordinary Shareholders’ Meeting to be held on second call, on August 7, 2020, at 4:30 p.m., at the Company’s headquarters, in the City and State of São Paulo, at Avenida Presidente Juscelino Kubitschek, n.º 1830, cj. 32, Bloco 2, Condomínio Edifício São Luiz, Vila Nova Conceição, CEP 04543-900.

Gafisa S.A.

Publicly-held Company

CNPJ 01.545.826/0001-07

NIRE 35.300.147.952 – CVM Code No. 01610-1

EXTRAORDINARY SHAREHOLDERS’ MEETING

TO BE HELD ON AUGUST 7, 2020

Dear shareholders,

The Board of Directors of Gafisa S.A., a corporation headquartered in the City and State of São Paulo, at Avenida Presidente Juscelino Kubitschek, n.º 1830, cj. 32, Bloco 2, Condomínio Edifício São Luiz, Vila Nova Conceição, CEP 04543-900, with its articles of incorporation filed at the Board of Trade of the State of São Paulo under NIRE No. 35.300.147.952, enrolled with the Corporate Taxpayer’s ID (CNPJ) No. 01.545.826/0001-07, registered at the Brazilian Securities and Exchange Commission (“CVM”) as category “A” publicly-held company, under the Code No. 01610-1 (“Company”), pursuant to Article 124 of Law No. 6.404 of December 15, 1976, as amended (“Brazilian Corporation Law”) and Articles 3 and 5 of CVM Instruction No. 481 of December 17, 2009, as amended (“ICVM 481/09”), hereby calls the Company’s shareholders to attend the Extraordinary Shareholders’ Meeting to be held on first call on August 7, 2020, at 4:30 p.m., at the Company’s headquarters (“ESM”), in compliance with prevailing corporate laws and provisions of the Company’s bylaws (“Proposal”).

1. PURPOSE

(i) Ratify the capital increase of April 30, 2020;

The Capital Increase of April 30, 2020, was fully paid and subscribed in the total amount of three hundred, ten million and one thousand Reais (R$310,001,000.00), by issuing seventy-five million, six hundred and ten thousand (75,610,000) book-entry common shares.

(ii) Elect a new member of the Board of Directors;

See Exhibit II hereto.

(iii) Approve the acquisition of properties referring to the Company’s turnaround;

The properties under consideration compose Gafisa’s turnaround plan, located in the cities of São Paulo, Rio de Janeiro, Cabo Frio (the latter two according to MOU [Memorandum of Understanding] approved at the ESM of 12/19/2019), Contagem and Nova Lima.

(iv) Approve the new capital increase, in the amount of up to R$389,999,999.10;

See Exhibit I hereto.

(v) Define the term, not less than 30 days, to shareholders exercise their preemptive right in the subscription of capital increase.

See Exhibit I hereto.

(vi) Authorize the issue of convertible debentures;

Within the scope of the Company’s long-term Strategic Plan approved at the Extraordinary Shareholders’ Meeting of April 15, 2020, authorize the Board of Directors to issue debentures in the future, convertible or not, subscribed with domestic currency or credits held against the Company, in the maximum amount of eight hundred million Reais (R$800,000,000.00), to provide funds to the Company and make feasible the acquisition of assets.

2. CALL FOR THE ESM

Pursuant to the Brazilian Corporation Law, the first publication of the announcement of the call for publicly-held companies’ general meeting shall be made, at least, fifteen (15) days in advance of the general meeting. Also, Article 8 of CVM Instruction No. 559 of March 27, 2015, determines that the issuer company of shares to back the Depositary Receipts Program shall call for the general meeting, at least, thirty (30) in advance.

The publication of call announcement shall be made on the webpage of CVM and the market management entity where the Company’s securities are accepted for trading (Article 289, caput of the Brazilian Corporation Law), without prejudice of its availability on the Company’s webpage (Article 289, Paragraph 2 of the Brazilian Corporation Law), as well in the Official Gazette of the State of São Paulo and in the newspaper Valor Econômico, which shall be made on this date, as well as on July 3 and 7, 2020.

In the specific case of the Company, considering the issue of American Depositary Receipts sponsored by the Company, the call for the ESM was made, at least, thirty

(30) days in advance through the call notice published on the webpage of CVM, B3 S.A. – Brasil, Bolsa, Balcão (“B3”) and the Company.

3. PLACE OF ESM

In attention of provisions of the Brazilian corporation law, the ESM shall be held at the Company’s headquarters, in the City and State of São Paulo, at Avenida Presidente Juscelino Kubitschek, 1830, Condomínio Edifício São Luiz, Vila Nova Conceição, CEP 04543-900.

4. INFORMATION ON ATTENDANCE AT THE ESM

Pursuant to Article 126 of the Brazilian Corporation Law to attend the ESM, shareholders shall submit to the Company the following documents:

(i) original or certified copy of identity document (General Registry Identity Document - RG, driver’s license (CNH), passport, identity documents issued by professional associations or professional identity cards issued by bodies of Public Administration, as long as they include holder’s photo);

(ii) receipt issued by the financial institution providing bookkeeping services for the Company’s shares, within five (5) days in advance of the ESM;

(iii) in the assumption of shareholder’s representation, original or certified copy of the notarized proxy instrument, duly regularized as provided for by laws; and

(iv) concerning shareholders participating in the fungible custody of registered shares, a statement containing respective equity interest, issued by the appropriate body, within forty-eight (48) hours in advance of the ESM.

The corporate shareholder’s representative shall submit a certified copy (unless in case of digital authentication) of the following documents, duly registered at the appropriate body: (a) charter or bylaws; and (b) corporate act electing manager who will (b.i) attend the ESM as the legal entity’s representative, or (b.ii) sign the proxy so that a third party represents the corporate shareholder.

As far as investment funds are concerned, quotaholders’ representation at the ESM shall be incumbent upon asset management company, observing the provisions of the fund’s regulations. In this case, the asset management company’s representative, besides the corporate documents mentioned above relating to the management company, shall submit a simple copy of the fund’s regulations, duly registered at the appropriate body.

For attendance by means of an attorney-in-fact, the proxy should have been granted less than one (1) year, pursuant to Article 126, Paragraph 1 of the Brazilian Corporation Law. In compliance with provisions of Article 654, Paragraphs 1 and 2 of Law No. 10.406/2002 (“Civil Code”), the proxy instrument shall indicate the place where it was granted, the full qualification of grantor and grantee, date and objective of the grant, designation and extension of powers granted, containing grantor’s notarized signature.

The Company’s individual shareholders only may be represented at the ESM by an attorney-in-fact who is the Company’s shareholder, manager, attorney, or financial institution, as provided for in Article 126, Paragraph 1 of the Brazilian Corporation Law. Corporate shareholders of the Company may be represented by attorney-in-fact empowered pursuant to its charter or bylaws and according to the Brazilian Civil Code rules.

Shareholders’ documents issued abroad shall contain the signatories’ notarization by a notary public, or apostille attached or, if country issuing the document is not a signatory of Hague Convention, they shall be legalized at the Brazilian Consulate, translated by a sworn translator enrolled with the Board of Trade, and registered at the Registry of Deeds and Documents.

The Company requests its shareholders to deposit the documents necessary to attend the ESM, at least, forty-eight (48) hours in advance, in the attention of the Investor Relations Department at the Company’s headquarters, also via e-mail, at the address (ri@gafisa.com.br).

However, the Company points out that the previous forward of documentation only aims at speeding up the process, and it is not a prerequisite to attend the General Meeting called herein. Subsequently, shareholders may attend the General Meeting even though they did not send the documentation mentioned above previously, but only submitting them upon the opening of the General Meeting, as provided for in Paragraph 2 of Article 5 of ICVM 481/09.

5. DOCUMENTS FOR CONSULTATION

All documents relating to the matters proposed are available for your consultation on the webpages of the Company (http://ri.gafisa.com.br/), B3 (www.b3.com.br), and CVM (www.cvm.gov.br).

6. CONCLUSIONS

Due to the reasons mentioned above, the Company’s Management submits this present Proposal for your analysis and recommends its approval.

São Paulo, July 2, 2020.

Leo Julian Simpson

Chairman of the Board of Directors

Gafisa S.A.

Publicly-held Company

CNPJ 01.545.826/0001-07

NIRE 35.300.147.952 – CVM Code No. 01610-1

MANAGEMENT PROPOSAL FOR THE EXTRAORDINARY SHAREHOLDERS’ MEETING TO

BE HELD ON AUGUST 7, 2020

EXHIBIT I

Information of Exhibit 14 of ICVM 481/09

__________________________________________________________

1. Inform the total amount of increase and new capital stock

The total amount of the Company’s capital increase shall be up to three hundred, eighty-nine million, nine hundred, ninety-nine thousand, nine hundred, ninety-nine Reais and ten centavos (R$389,999,999.10) to be subscribed from the private issue of up to ninety-five million, one hundred, twenty-one thousand, nine hundred and fifty-one (95,121,951) common shares, at the unit price of four Reais and ten centavos (R$4.10), of which (i) one hundred, ninety-nine million, nine hundred, ninety-nine thousand, nine hundred, ninety-six Reais and seventy centavos (R$199,999,996.70), corresponding to the minimum increase amount, shall be subscribed from the private issue of forty-eight million, seven hundred, eighty thousand, four hundred and eighty-seven (48,780,487) common shares; and (ii) the remaining amount, one hundred, ninety million, two Reais and forty centavos (R$190,000,002.40), shall correspond to the private issue, now, of forty-six million, three hundred, forty-one thousand, four hundred and sixty-four (46,341,464) common shares;

Thus, if the total amount of increase is fully subscribed, without subsequent capital decrease, the new capital stock of the Company shall increase from six hundred, fifty-one million, two hundred, forty-eight thousand, three hundred, ninety-six Reais and twenty-three centavos (R$651,248,396.23), divided into one hundred, ninety-five million, six hundred and ten thousand (195,610,000) common shares to one billion, forty-one million, two hundred, forty-eight thousand, three hundred, ninety-five Reais and thirty-three centavos (R$1,041,248,395.33), divided into two hundred, ninety million, seven hundred, thirty-one thousand, nine hundred and fifty-one (290,731,951) common shares.

2. Inform if increase shall be made by (a) conversion of debentures or other bonds into shares; (b) exercise of subscription right or subscription warrant; (c) capitalization of profits or reserves; or (d) subscription of new shares.

An increase shall be fully made by subscribing to new shares.

3. Explain, in detail, the reasons for the increase and its legal and economic consequences

The main reason for the capital increase approved on April 30, 2020 (“April 30 Increase”) was to provide the Company with funds to pay for the acquisition of all shares composing the capital stock of Upcon Incorporadora S.A. (“Upcon”).

In this regard, considering the conditions agreed with Upcon’s shareholders, and high demand for shares within the scope of the April 30 Increase, this complementary increase shall be necessary, seeking to maintain at the Company the amounts necessary for its operations, working capital and growth upturn.

Once concluded referred capital increase, which shall confer the preemptive right to the Company’s shareholders, all shares issued by Upcon shall be acquired, which will become a wholly-owned subsidiary of the Company, as well as the Company’s cash will receive complementary funds, for the purposes mentioned above.

4. Provide a copy of the Fiscal Council report, where applicable

Not applicable

5. In the event of capital increase by means of share subscription

a. Describe the allocation of funds

Out of the total amount of capital increase under consideration, whether the minimum amount, (i) one hundred, ninety-nine million, nine hundred, ninety-nine thousand, nine hundred, ninety-sixty Reais and seventy centavos (R$199,999,996.70); whether the total amount shall be used to acquire all shares composing the capital stock of UPCON Incorporadora S.A., while, (ii) remaining one hundred, ninety million, two Reais and forty centavos (R$190,000,002.40) shall be used as working capital to reinforce the Company’s cash, so that it may safely and satisfactorily, execute new projects and honor its obligations amid this challenging scenario we have been facing with COVID-19 pandemic.

b. Inform the number of shares issued of each type and class

All in all, at most, (i) ninety-five million, one hundred, twenty-one thousand, nine hundred and fifty-one (95,121,951) non-par, registered, book-entry, common shares shall be issued at the price of four Reais and ten centavos (R$4.10), or (ii) at least, forty-eight million, seven hundred, eighty thousand, four hundred and eighty-seven (48,780,487) non-par, registered, book-entry, common shares, issued at the price of four Reais and ten centavos (R$4.10).

c. Describe the rights, advantages, and restrictions assigned to shares to be issued

Shares to be issued shall be non-par, registered, book-entry, common shares, and each share shall confer to its holder the right to one vote in the general meeting’s resolutions, as well as other rights assured by Law No. 6.404/76.

d. Inform if subscription shall be public or private

The subscription of capital increase under consideration shall be private.

e. Referring to a private subscription, inform if related parties, as those defined by accounting standards dealing with this issue, will subscribe shares in the capital increase, specifying respective amounts, when these amounts are already known.

Taking into account that subscription shall be private, shareholders shall be the recipients, but they do not characterize related party according to the accounting standards.

f. Inform the issue price of new shares or reasons by which pricing shall be delegated to the board of directors, in cases of public distribution.

Not applicable.

g. Inform the face value of shares issued or, when referring to non-par shares, the issue price amount to be allocated to the capital reserve

Shares to be issued shall not have a face value and no amount shall be allocated to the capital reserve.

h. Provide Management opinion on the capital increase effects, especially referring to dilution caused by the increase

As mentioned above, the capital increase is a way of concluding the payment for the acquisition of all shares issued by Upcon Incorporadora S.A. Also, working capital and growth upturn with new projects are proposed as a way of the Company obtaining resources to deal with its operations, and at the same time, preserving its cash funds raised in the previous capital increase.

It is worth noting that, in addition to the Company’s projects, Upcon Incorporadora S.A. has projects in progress, and estimates a PSV (Potential Sales Value) surpassing R$1.4 billion, as indicated by Banco Fator S.A. report previously sent as complementary documentation to the Management Proposal for April 30 Increase.

The preemptive right shall be ensured to the Company’s shareholders to subscribe to securities, the purpose of a private issue. If even assuring the preemptive right, any dilution is verified, this is counterbalanced by the addition of real and potential assets contributed by Upcon Incorporadora S.A., as well as cash funds corresponding to the subscription and payment for the shares. Therefore, eventual dilution is relative.

i. Inform the criterion to calculate the issue price and justify, in detail, the economic aspects determining its election

Share pricing took into the account the same issue price of April 30 Increase, time proximity of current capital increase, which maintained the fundamentals contained in studies and analysis of Eleven Serviços de Consultoria e Análise S.A. which took into account the three parameters mentioned in Article 170, Paragraph 1 of Law No. 6.404/76, and a twenty percent (20%) discount was considered out of amount weighted from these legal three parameters, in line with the practice already adopted by the Company but, also due to the time proximity with April 30 Increase.

j. If the issue price is defined with premium or discount in relation to the market cap, identify the reason for premium or discount and explain how it was calculated

As explained above, share issue price observed the fundamentals adopted in April 30 Increase, which also envisages a twenty percent (20%) discount, since the Company seeks stimulating its shareholders to exercise the preemptive right.

k. Provide a copy of all reports and studies subsidizing the issue pricing

An analysis and evaluation report is attached hereto, issued by Eleven Serviços de Consultoria e Análise S.A., which served as the basis of issue pricing referring to April 30 Increase, whose fundamentals were maintained.

l. Inform the price of each type and class of the Company’s shares in the markets where shares are traded, identifying:

i. Minimum, average and maximum price each year, over the last three (3) years

|

Last 3 years

|

|

|

Minimum

|

Average

|

Maximum

|

|

2020 YTD

|

2,80

|

,89

|

10,15

|

|

2019

|

4,77

|

7,63

|

16,95

|

|

2018

|

9,47

|

13,07

|

20,60

|

|

2017

|

1,88

|

12,52

|

28,79

|

ii. Minimum, average and maximum price each quarter, over the last two (2) years

|

Quarters of the last 2 years

|

|

|

Minimum

|

Average

|

Maximum

|

|

1Q20*

|

3,27

|

4,27

|

6,22

|

|

4Q19

|

2,80

|

7,40

|

10,15

|

|

3Q19

|

5,45

|

6,41

|

8,67

|

|

2Q19

|

5,06

|

6,16

|

7,15

|

|

1Q19

|

4,77

|

6,00

|

8,39

|

|

4Q18

|

8,54

|

12,20

|

16,95

|

|

3Q18

|

11,13

|

13,83

|

16,90

|

|

2Q18

|

9,90

|

11,44

|

12,40

|

|

1Q18

|

3,27

|

4,27

|

6,22

|

*until 03/30/2020

iii. Minimum, average and maximum price each month, over the last six (6) months

|

Last 6 months

|

|

|

Minimum

|

Average

|

Maximum

|

|

jun/20

|

2.80

|

4.60

|

7.40

|

|

may/20

|

6.88

|

8.36

|

9.19

|

|

apr/20

|

8.14

|

9.33

|

10.15

|

|

mar/20

|

5.92

|

7.33

|

8.67

|

|

feb/20

|

5.54

|

6.23

|

6.78

|

|

jan/20

|

5.45

|

5.73

|

6.13

|

iv. Average price of the last 90 days

|

|

Minimum

|

Average

|

Maximum

|

|

Last 90 days*

|

3,27

|

4,30

|

6,22

|

|

Last 90 Trading Sessions

|

2,80

|

4,62

|

8,52

|

*Since April 1st, 2020

m. Inform the share issue prices in capital increases made over the last three (3) years

|

Date of Increase

|

Issue Price

|

|

04/30/2020

|

R$4.10

|

|

08/15/2019

|

R$ 5.57

|

|

04/15/2019

|

R$ 5.03

|

|

12/20/2017

|

R$ 15.00

|

n. State percentage of potential dilution resulting from the issue

As already informed in item 1 above, the capital increase envisages a minimum increase amount of one hundred, ninety-nine million, nine hundred, ninety-nine thousand, nine hundred, ninety-six Reais and seventy centavos (R$199,999,996.70) and a maximum increase amount of three hundred, eighty-nine million, nine hundred, ninety-nine thousand, nine hundred, ninety-nine Reais and ten centavos (R$389,999,999.10).

In the minimum increase amount, forty-eight million, seven hundred, eighty thousand, four hundred and eighty-seven (48,780,487) shares shall be issued and in the maximum increase amount, ninety-five million, one hundred and twenty-one thousand, nine hundred and fifty-one (95,121,951) shares shall be issued.

In the minimum increase amount, dilution can be 16.78%.

In the maximum increase amount, dilution can be 32.72%.

o. Inform the terms, conditions, and forms of subscription and payment for shares issued

Once approved the capital increase at the Extraordinary Shareholders’ Meeting (“ESM”) to be held on August 7, 2020, at 4:30 p.m., subsequently, credit holders, especially those deriving from the purchase and sale of shares issued by Upcon Incorporadora S.A., will capitalize it, subscribing the shares issued corresponding to their credit. On the days following the ESM, the corresponding Notice to Shareholders shall be published, to include the initial term to be defined at the ESM, not less than 30 days to the Company’s shareholders exercise their preemptive right. The Notice to Shareholders shall contain details on the share subscription, and the payment for shares shall be made upon subscription, in domestic currency or credits held against the Company.

Each common share issued by the Company shall be entitled to subscribe 0.486283682 new share issued within the scope of capital increase. To exercise the preemptive right discussed herein, the shareholding position shall be

considered, at least, three (3) business days after the publication of the appropriate Notice to Shareholders, under the terms of provisions of Item 5.3.2 of B3’s Issuer Manual.

p. Inform if shareholders will have preemptive right to subscribe to new shares issued and detail the terms and conditions to which this right is subject.

The Company’s shareholders shall have preemptive right to subscribe to new shares issued, within not less than thirty (30) days, as of the date indicated in the appropriate Notice to Shareholders, pursuant to Article 171, Paragraph 2 of the Brazilian Corporation Law.

q. Inform the Management proposal dealing with eventual unsold shares.

Once subscribed to the minimum amount of capital increase, corresponding to R$199,999,996.70, the capital increase may be considered concluded. The Board of Directors may decide whether or not will conduct additional rounds, keeping the market informed of conditions for eventual unsold shares.

r. Describe in detail the procedures to be adopted, in the event of partial ratification of the capital increase

Once subscribed to the minimum amount of capital increase, corresponding to one hundred, ninety-nine million, nine hundred, ninety-nine thousand, nine hundred, ninety-six Reais and seventy centavos (R$199,999,996.70), the capital increase may be considered concluded. The Board of Directors may decide whether or not will conduct additional rounds, keeping the market informed of conditions for eventual unsold shares.

Without prejudice of decision for eventual additional rounds of unsold shares, in the assumption of partial ratification of the capital increase, once reached the minimum amount of one hundred, ninety-nine million, nine hundred, ninety-nine thousand, nine hundred, ninety-six Reais and seventy centavos (R$199,999,996.70), no additional term shall be granted to reconsider subscription decision, however, the underwriter shall be ensured the subscription right, subject to the total capital increase. Thus, the underwriter shall, upon subscription, indicate if, once implemented the foreseen condition, if intends to receive (i) 100% of shares subscribed by him or (ii) the amount corresponding to the percentage between the total number of shares effectively subscribed and the maximum number of shares originally approved to be issued in the total capital increase, assuming, in the lack of manifestation, the underwriter’s interest to receive all the shares subscribed.

Underwriter whose condition to subscribe foreseen in respective subscription list is not implemented, shall receive the amount fully paid by him, without monetary restatement, fully or partially, according to the option indicated in the respective subscription list.

s. If share issue price is, partially or fully, realized in assets

i. Full description of assets

Not applicable.

ii. Clarify the relationship between the assets merged into the Company’s assets and its corporate purpose

Not applicable.

iii. Provide a copy of the assets appraisal report, if available

Not applicable.

Gafisa S.A.

Publicly-held Company

CNPJ 01.545.826/0001-07

NIRE 35.300.147.952 – CVM Code No. 01610-1

MANAGEMENT PROPOSAL FOR THE EXTRAORDINARY SHAREHOLDERS’ MEETING TO BE HELD ON AUGUST 7, 2020

EXHIBIT II

Information of items 12.5 to 12.10 of the Reference Form relating to Mr. Nelson de Queiroz Sequeiros Tanure

12.5 In relation to each member of the issuer’s Management and members of the fiscal council indicate, as a table / 12.6 Percentage of attendance at meetings held by the respective body during the same period, after office investiture

|

Name

|

Nelson de Queiroz Sequeiros Tanure

|

|

Date of Birth

|

05/28/1985

|

|

Profession

|

Businessman

|

|

CPF/MF or Passport

|

112.254.877-06

|

|

Position to be held

|

Member of the Board of Directors

|

|

Date of election

|

08/07/2020

|

|

Date of investiture

|

Until 09/07/2020

|

|

Term of Office

|

Until the Annual Shareholders’ Meeting of 2021

|

|

Other duties performed

|

Not applicable

|

|

Appointed/Elected by controlling shareholder

|

No

|

|

Independent Member

|

No

|

|

Number of consecutive tenures

|

0

|

|

Percentage of attendance at meetings held

|

0%

|

Mr. Tanure has broad experience in various cases of companies’ turnaround in sectors, such as oil & gas, and infrastructure. Mr. Tanure holds a degree in Economics from IBMEC, with a specialization at the Boston College. Mr. Nelson Queiroz was CEO of Petro Rio S.A., also serving as Chairman of the Board of Directors of this company. Mr. Nelson Queiroz declares, for all legal purposes that over the past five years, he was not criminally convicted, he was not convicted in any administrative proceeding of the Brazilian Securities and Exchange Commission (CVM) or any conviction by an unappealable court decision, in the legal or administrative proceeding, to have suspended him or disqualified him from the practice of any professional or business activity.

12.7 Provide the information mentioned in item 12.5 in relation to members of statutory committees, as well as members of the audit, risk, financial, and compensation committees, even if these committees or structures are not statutory

The member appointed herein does not act as a member of statutory committees, and audit, risk, financial, and compensation committees, even if these committees or structures are not statutory.

12.8 In relation to each person acting as a member of statutory committees, as well as audit, risk, financial and compensation committees, even if these committees or structures are not statutory, inform, as a table, the percentage of attendance at meetings held by the respective body during the same period, after office investiture

Members appointed herein neither acted as members of statutory committees nor audit, risk, financial, and compensation committees, even if these committees or structures are not statutory.

12.9 Inform the existence of a marital relationship, common-law marriage or kinship up to second degree between:

a. issuer’s management

b. (i) issuer’s management and (ii) management of issuer’s direct or indirect subsidiaries

c. (i) management of the issuer or its direct or indirect subsidiaries and (ii) issuer’s direct or indirect controlling shareholders

d. (i) issuer’s management and (ii) management of issuer’s direct and indirect controlling companies

Mr. Nelson de Queiroz Sequeiros Tanure is son of Mr. Nelson Sequeiros Rodriguez Tanure, a member of Gafisa S.A.’s Board of Directors.

12.10 Inform relations of subordination, service rendering or control held, over the last three fiscal years, between issuer’s management and:

a. direct or indirect subsidiary by the issuer, except for those where issuer directly or indirectly holds total capital stock

b. issuer’s direct or indirect controlling shareholder

c. if relevant, supplier, client, debtor or creditor of the issuer, its subsidiary or controlling companies or subsidiaries of any of these parties

Not Applicable

Gafisa S.A.

Publicly-held Company

CNPJ 01.545.826/0001-07

NIRE 35.300.147.952 – CVM Code No. 01610-1

MANAGEMENT PROPOSAL FOR THE EXTRAORDINARY SHAREHOLDERS’ MEETING TO BE HELD ON AUGUST 7, 2020

EXHIBIT III

Reports of Eleven Serviços de Consultoria e Análise S.A.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 2, 2020

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Ian Andrade

Title: Chief Financial Officer

|

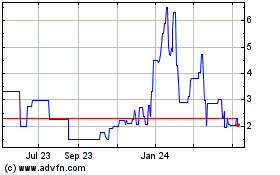

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2024 to May 2024

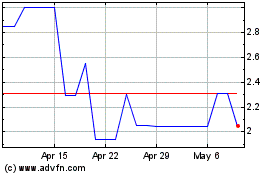

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From May 2023 to May 2024