true

S-1/A

0001563298

0001563298

2023-01-01

2023-12-31

0001563298

2023-12-31

0001563298

2022-12-31

0001563298

2022-01-01

2022-12-31

0001563298

us-gaap:PreferredStockMember

2021-12-31

0001563298

us-gaap:CommonStockMember

2021-12-31

0001563298

EAWD:CommonStockSubscriptionsMember

2021-12-31

0001563298

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001563298

us-gaap:RetainedEarningsMember

2021-12-31

0001563298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001563298

2021-12-31

0001563298

us-gaap:PreferredStockMember

2022-12-31

0001563298

us-gaap:CommonStockMember

2022-12-31

0001563298

EAWD:CommonStockSubscriptionsMember

2022-12-31

0001563298

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001563298

us-gaap:RetainedEarningsMember

2022-12-31

0001563298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001563298

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001563298

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001563298

EAWD:CommonStockSubscriptionsMember

2022-01-01

2022-12-31

0001563298

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001563298

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001563298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001563298

us-gaap:PreferredStockMember

2023-01-01

2023-12-31

0001563298

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001563298

EAWD:CommonStockSubscriptionsMember

2023-01-01

2023-12-31

0001563298

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001563298

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001563298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0001563298

us-gaap:PreferredStockMember

2023-12-31

0001563298

us-gaap:CommonStockMember

2023-12-31

0001563298

EAWD:CommonStockSubscriptionsMember

2023-12-31

0001563298

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001563298

us-gaap:RetainedEarningsMember

2023-12-31

0001563298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001563298

us-gaap:FairValueInputsLevel12And3Member

2023-12-31

0001563298

us-gaap:FairValueInputsLevel12And3Member

2022-12-31

0001563298

us-gaap:OfficeEquipmentMember

2023-12-31

0001563298

us-gaap:FurnitureAndFixturesMember

2023-12-31

0001563298

us-gaap:AutomobilesMember

2023-12-31

0001563298

us-gaap:MachineryAndEquipmentMember

2023-12-31

0001563298

EAWD:December2012Member

2023-01-01

2023-12-31

0001563298

us-gaap:OfficeEquipmentMember

2022-12-31

0001563298

us-gaap:FurnitureAndFixturesMember

2022-12-31

0001563298

EAWD:FinancingLeaseEquipmentMember

2023-12-31

0001563298

EAWD:FinancingLeaseEquipmentMember

2022-12-31

0001563298

us-gaap:MachineryAndEquipmentMember

2022-12-31

0001563298

us-gaap:AutomobilesMember

2022-12-31

0001563298

EAWD:VirhtechGmbhMember

2023-12-31

0001563298

EAWD:VirhtechGmbhMember

2022-12-31

0001563298

us-gaap:ConvertibleDebtMember

2023-01-01

2023-12-31

0001563298

us-gaap:ConvertibleDebtMember

2023-12-31

0001563298

us-gaap:ConvertibleDebtMember

2022-01-01

2022-12-31

0001563298

us-gaap:ConvertibleDebtMember

2022-12-31

0001563298

srt:MinimumMember

2023-01-01

2023-12-31

0001563298

srt:MaximumMember

2023-01-01

2023-12-31

0001563298

srt:MinimumMember

2022-01-01

2022-12-31

0001563298

srt:MaximumMember

2022-01-01

2022-12-31

0001563298

us-gaap:FairValueInputsLevel1Member

2023-12-31

0001563298

us-gaap:FairValueInputsLevel2Member

2023-12-31

0001563298

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001563298

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001563298

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001563298

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001563298

EAWD:FinanceLeaseLiabilityMember

2023-12-31

0001563298

2023-10-31

0001563298

2023-10-30

2023-10-31

0001563298

EAWD:VehicleLeaseMember

2023-10-31

0001563298

EAWD:VehicleLeaseMember

2023-10-30

2023-10-31

0001563298

EAWD:OperatingLeaseLiabilitiesMember

2023-12-31

0001563298

EAWD:OperatingLeaseLiabilitiesMember

2023-01-01

2023-12-31

0001563298

EAWD:OperatingLeaseLiabilitiesMember

2022-01-01

2022-12-31

0001563298

EAWD:OfficerRalphHofmeierMember

2023-12-31

0001563298

EAWD:OfficerRalphHofmeierMember

2022-12-31

0001563298

EAWD:OfficerIrmaVelazquezMember

2023-12-31

0001563298

EAWD:OfficerIrmaVelazquezMember

2022-12-31

0001563298

2019-12-13

0001563298

2020-12-31

0001563298

2023-09-01

0001563298

2023-01-17

2023-01-18

0001563298

2023-03-31

0001563298

EAWD:CommonStockSubscriptionsMember

2023-01-01

2023-03-31

0001563298

us-gaap:InvestorMember

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001563298

us-gaap:InvestorMember

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001563298

EAWD:Investor1Member

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001563298

EAWD:Investor1Member

us-gaap:CommonStockMember

2023-10-01

2023-12-31

0001563298

us-gaap:InvestorMember

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001563298

us-gaap:InvestorMember

us-gaap:CommonStockMember

2023-10-01

2023-12-31

0001563298

2023-10-01

2023-10-31

0001563298

2023-11-01

2023-11-30

0001563298

2022-01-26

0001563298

EAWD:ELOCMember

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001563298

us-gaap:ConvertibleDebtMember

2023-04-01

2023-06-30

0001563298

us-gaap:ConvertibleDebtMember

2023-07-01

2023-09-30

0001563298

us-gaap:ConvertibleDebtMember

2023-10-01

2023-12-31

0001563298

EAWD:GaryRodneyMember

2023-01-18

0001563298

EAWD:GaryRodneyMember

2023-01-01

2023-01-18

0001563298

EAWD:RalphHofmeierMember

2023-01-18

0001563298

EAWD:RalphHofmeierMember

2023-01-01

2023-01-18

0001563298

2023-10-05

2023-10-06

0001563298

2023-11-10

2023-11-11

0001563298

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001563298

us-gaap:CommonStockMember

2022-12-31

0001563298

EAWD:TysadcoPartnersLLCMember

2023-01-01

2023-12-31

0001563298

EAWD:VelazquezMember

2023-12-31

0001563298

EAWD:EmploymentAgreements2022Member

2022-01-01

2022-12-31

0001563298

EAWD:EmploymentAgreements2022Member

EAWD:EmployeesMember

2022-08-04

0001563298

us-gaap:USTreasuryAndGovernmentMember

2023-01-01

2023-12-31

0001563298

us-gaap:USTreasuryAndGovernmentMember

2022-01-01

2022-12-31

0001563298

EAWD:ForeignMember

2023-01-01

2023-12-31

0001563298

EAWD:ForeignMember

2022-01-01

2022-12-31

0001563298

us-gaap:USTreasuryAndGovernmentMember

2023-12-31

0001563298

us-gaap:USTreasuryAndGovernmentMember

2022-12-31

0001563298

EAWD:ForeignMember

2023-12-31

0001563298

EAWD:ForeignMember

2022-12-31

0001563298

us-gaap:SubsequentEventMember

EAWD:GSCapitalPartnersLLCMember

2024-01-16

2024-01-17

0001563298

us-gaap:SubsequentEventMember

us-gaap:InvestorMember

2024-02-04

2024-02-05

0001563298

us-gaap:SubsequentEventMember

us-gaap:InvestorMember

2024-02-06

2024-02-07

0001563298

us-gaap:SubsequentEventMember

EAWD:GeebisConsultingLLCMember

2024-02-14

2024-02-15

0001563298

us-gaap:SubsequentEventMember

EAWD:GeebisConsultingLLCMember

2024-02-15

0001563298

us-gaap:SubsequentEventMember

us-gaap:InvestorMember

2024-03-24

2024-03-25

0001563298

us-gaap:SubsequentEventMember

EAWD:Investor1Member

2024-03-24

2024-03-25

0001563298

us-gaap:SubsequentEventMember

EAWD:DiagonalLendingLLC1800Member

2024-03-06

2024-03-07

0001563298

us-gaap:SubsequentEventMember

EAWD:DiagonalLendingLLC1800Member

2024-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

iso4217:EUR

xbrli:pure

As filed with the Securities and Exchange Commission

on May 13, 2024

Registration No. 333-275226

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No. 2 to

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT

OF 1933

ENERGY AND WATER DEVELOPMENT CORP.

(Exact name of registrant as specified in its charter)

| Florida |

|

3585 |

|

30-0781375 |

| (State or other jurisdiction of incorporation or organization) |

|

(Primary Standard Industrial Classification Code Number) |

|

(I.R.S. Employer

Identification No.) |

| 7901 4th Street N STE #4174, St Petersburg, Florida |

|

33702 |

| (Address of principal executive offices) |

|

(Zip Code) |

____________________________

7901 4th Street N, STE #4174

St. Petersburg, FL 33702

727-677-9408

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

____________________________

Irma Velazquez

Chief Executive Officer

Energy and Water Development Corp.

7901 4th Street N, STE #4174

St. Petersburg, FL 33702

727-677-9408

(Names, address, including zip code, and telephone

number, including area code, of agent for service)

____________________________

| Copies to: |

Louis A. Bevilacqua,

Esq.

Bevilacqua PLLC

1050 Connecticut Avenue,

NW

Suite 500

Washington, DC 20036

(202) 869-0888 |

Joseph M. Lucosky,

Esq.

Steven A. Lipstein,

Esq.

Lucosky Brookman

LLP

101 Wood Avenue South

Woodbridge, NJ 08830

(732) 395-4400 |

Approximate date of commencement of proposed

sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant

to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See

the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company

☒ |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of Securities Act.

The registrant

hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall

file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with

Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission,

acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains two

prospectuses, as set forth below.

| • |

|

Public

Offering Prospectus. A prospectus to be used for the public offering of shares

of our common stock through the underwriters named on the cover page of this prospectus, which we refer to as the Public Offering

Prospectus. |

| • |

|

Resale

Prospectus. A prospectus to be used for the resale by selling stockholders of 39,957,667 shares of common stock,

which we refer to as the Resale Prospectus, which we have filed on behalf of the selling stockholders pursuant to a verbal understanding

with the selling stockholders that we would include their shares in the Resale Prospectus. |

The Resale Prospectus is substantively identical

to the Public Offering Prospectus, except for the following principal points:

| • | | they contain different

front and back covers; |

| • | | they contain different

Offering sections in the Prospectus Summary; |

| • | | they contain different

Use of Proceeds sections; |

| • | | the Capitalization

and Dilution sections are deleted from the Resale Prospectus; |

| • | | a Selling Stockholders

section is included in the Resale Prospectus; |

| • | | the Underwriting

section from the Public Offering Prospectus is deleted from the Resale Prospectus and

a Plan of Distribution section is inserted in its place; and |

| • | | the Legal Matters

section in the Resale Prospectus deletes the reference to counsel for the underwriters. |

The registrant has included in this registration

statement a set of alternate pages after the back cover page of the Public Offering Prospectus, which we refer to as the Alternate Pages,

to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus

will exclude the Alternate Pages and will be used for the public offering by the registrant. The Resale Prospectus will be substantively

identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale

offering by the selling stockholders.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED MAY 13,

2024 |

Shares of Common Stock

____________________________

We are offering shares of common stock,

assuming a public offering price of $ per share (which is the midpoint of the estimated range of the public offering price). We currently

estimate that the public offering price will be between $ and $ per share.

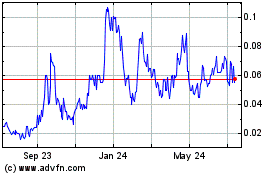

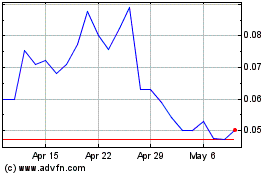

Our common stock is currently quoted on

the OTCQB Market operated by OTC Markets Group Inc. under the symbol “EAWD.” On May 10, 2024, the closing price of our common

stock on OTCQB Market was $0.052. In connection with this offering, we intend to apply for the listing of our common stock on NYSE American

under the symbol “EAWD.” The closing of this offering is contingent upon our uplisting to NYSE American.

We

are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, and

as such, have elected to comply with certain reduced public company reporting

requirements for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging

Growth Company” and “Risk Factors — Risks Related to this Offering and Ownership of Our Common Stock.”

Investing

in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the material

risks of investing in our securities under the heading “Risk Factors” beginning on page 13 of this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

| |

|

Per Share |

|

Total |

| Public offering price |

|

$ |

|

|

$ |

|

| Underwriting discounts and commissions(1) |

|

$ |

|

|

$ |

|

| Proceeds to us, before expenses(2) |

|

$ |

|

|

$ |

|

| (1) | Does

not include additional compensation payable to the representative of the underwriters in

connection with this offering. See “Underwriting” for a complete description

of the compensation arrangements. |

| (2) | We

estimate the total expenses payable by us, excluding the underwriting discount, will be approximately

$ . |

We have granted the underwriters an option

for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of shares to be offered by us pursuant

to this offering (excluding shares subject to this option), solely for the purpose of covering over-allotments, at the public offering

price less the underwriting discounts and commissions.

Pursuant to a separate resale prospectus

included in the registration statement of which this prospectus forms a part, we are also registering 39,957,667 shares of common stock

for resale by certain selling stockholders. This public offering and the resale offering will be concurrent in that the selling stockholders

may commence selling efforts at any time after the registration statement is declared effective. However, the closing of this public

offering will not occur until one (1) or two (2) trading days after trading on NYSE American commences, which is expected to occur on

the trading day following the date that the registration statement is declared effective. The

selling stockholders may sell their shares from time to time at the market price prevailing at the time of offer and sale, or at prices

related to such prevailing market prices or in negotiated transactions or a combination of such methods. Please see “Risk

Factors—Risks Related to this Offering and Ownership of Our Common Stock” for certain risks related to the concurrent

registration of shares in the resale offering.

The underwriters expect to deliver the

shares against payment as set forth under “Underwriting” on or about ,

2024.

EF Hutton

division of Benchmark Investments, LLC

The date of this prospectus is ,

2024

Page

i

ABOUT THIS PROSPECTUS

You should rely only on the information

contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We

and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained

in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer

to sell only the shares of common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

We are not making an offer to sell these shares of common stock in any jurisdiction where the offer or sale is not permitted or where

the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale.

The information contained in this prospectus is current only as of the date on the front cover of the prospectus. Our business, financial

condition, results of operations and prospects may have changed since that date.

Persons who come into possession of this

prospectus and any applicable free writing prospectus in jurisdictions outside the United States are required to inform themselves about

and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable

to that jurisdiction. See “Underwriting” for additional information on these restrictions.

INDUSTRY AND MARKET DATA

We are responsible for the disclosure in

this prospectus. However, this prospectus includes industry data that we obtained from market research, publicly available information

and industry publications. We did not fund, and are not otherwise affiliated with, any of the sources cited in this prospectus. The market

research, publicly available information and industry publications that we use generally state that the information contained therein

has been obtained from sources believed to be reliable. The information therein represents the most recently available data from the

relevant sources and publications and we believe remains reliable. However, this data involves

a number of assumptions and limitations regarding our industry which are necessarily subject to a high degree of uncertainty and risk

due to a variety of factors, including those described in the section titled “Risk Factors.” Forward-looking

information obtained from these sources is also subject to the same qualifications and additional uncertainties regarding the other forward-looking

statements in this prospectus.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We own or have rights to various trademarks,

service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks,

service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’

trademarks, service marks and trade names or products in this prospectus is not intended to, and does not imply a relationship with,

or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus

may appear without the ®, TM or SM symbols, but the omission of such references is not intended to indicate, in any way, that we

will not assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service

marks and trade names.

ii

PROSPECTUS SUMMARY

This summary highlights selected information

contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider

before deciding whether to invest in our securities. You should carefully read the entire prospectus, including the risks associated with

an investment in our company discussed in the “Risk Factors” section of this prospectus, before making an investment decision.

Some of the statements in this prospectus are forward-looking statements. See the section titled “Cautionary Statement Regarding

Forward-Looking Statements.”

Unless otherwise indicated by the context,

reference in this prospectus to “we,” “us,” “our,” “our company” and similar references

are to Energy and Water Development Corp. and its consolidated subsidiaries.

Our

Company

Overview

We are an engineering services company

formed as an outsourcing green tech platform focused on sustainable water and energy solutions. We are a United Nations, or UN, “accredited

vendor” and offer design, construction, maintenance and specialty consulting services to private companies, government entities,

non-government organizations, or NGOs, and intergovernmental organizations, or IGOs, for the sustainable supply of energy and water.

We build sustainable water and energy systems

out of existing, proven technologies, utilizing our intellectual property and our technical know-how to customize solutions to meet our

clients’ needs. Using our patent-pending design, we are working to design, build, and operate off-the-grid atmospheric water generation,

or AWG, systems in Mexico and the United States, as well as off-the-grid electric vehicle, or EV, charging stations in Germany.

Globally, 2 billion people do not have

safe drinking water and 3.6 billion lack access to safely managed sanitation, according to a report published by the United Nations Educational,

Scientific and Cultural Organization, or UNESCO, in March 2023. This organization has identified an urgent need to establish strong international

mechanisms to prevent the global water crisis from spiraling out of control. In view of this increased world-wide demand for water and

energy, our business goals are focused on self-sufficient energy supplied water generation and green energy production. To accomplish

this, we set out to establish an outsourcing green tech platform to commercialize our state-of-the-art technologies while providing engineering

and technical consultation services to design the most sustainable technological solutions that can provide water and energy. We also

intend to secure all required technical, maintenance, education, and training related to the identified technology solutions. To this

end, we have sought potential collaborations with green tech research and development centers in Europe and have established operating

subsidiaries in Germany, where we have started to assemble our patent-pending innovative off-the-grid, self-sufficient energy supply

AWG systems.

Our Corporate History and Structure

Our company was originally incorporated

as a Delaware corporation named Wealthhound.com, Inc. in 2000 and was converted to a Florida corporation under the name Eagle International

Holdings Group, Inc. in 2007. Our company was originally formed as a shell entity that was in the market to merge with an operating company.

On March 10, 2008, our name was changed to Eurosport Active World Corp.

On March 17, 2008,

we entered into an agreement and plan of acquisition with Inko Sport America, LLC, or ISA, a privately-held Florida limited liability

company, wherein all of the owners of ISA exchanged their ownership interests in ISA for shares of our company. In connection with the

closing of this acquisition, we adopted ISA’s business plan. ISA was administratively dissolved in September 2010.

In 2012, our business

plan changed to engage in the promotion and design of technological solutions for the generation of water and energy. On August 21, 2019,

our name was changed to Energy and Water Development Corp. to more accurately reflect our business plan.

In order to effectively cater to our expanding

operations in Germany, we have strategically established a branch for business operations in Germany, along with two wholly owned German

subsidiaries: Energy and Water Development Deutschland GmbH, or EAWD Deutschland, and EAWD Logistik GmbH, or EAWD Logistik. Moreover,

recognizing the importance of regional market demands, we have also extended our presence to Mexico through a wholly owned subsidiary

called EAWD Mexico SAPI de CV, or EAWD Mexico, enhancing our capacity to address the needs of this area efficiently. This strategic positioning

not only reflects our commitment to environmental progress but also ensures an optimized response to evolving market requirements.

Our Market Opportunity

Amidst the backdrop of climate change and

the rise of extreme weather events, the green tech industry is witnessing transformative shifts. These phenomena have exacerbated water

scarcity and intensified the global demand for energy. Recognizing the pressing nature of these challenges, we are committed to crafting

sustainable and renewable solutions. As such, we believe that we are poised to become a pivotal player in an industry that is not only

rapidly expanding, but also unlocking numerous new markets in response to these urgent environmental issues.

According to an atmospheric water generator

market size report published by Grand View Research in 2020, the global AWG market size was $2.9 billion in 2022 and it is expected to

reach approximately $5.5 billion by 2032. This industry growth is expected to be driven by freshwater scarcity and increasing technological

investments, followed by favorable government regulations. As for energy, according to the International Agency of Energy, global electricity

demand is projected to grow between 62% and 185% by 2050 compared with 2021 levels.

According to an electric vehicle fluids

global market report published by Research and Markets in 2023, the global electric vehicle fluids market has grown from $1.33 billion

in 2022 to $1.7 billion in 2023 at a compound annual growth rate, or CAGR, of 27.4%. The electric vehicle fluids market is expected to

grow to $4.57 billion in 2027 at a CAGR of 28.0%. There is also an increasing consensus among European truck manufacturers and industry

stakeholders that battery electric trucks, or BETs, will play a dominant role in the decarbonization of the road freight sector. Most

truck makers including Daimler, DAF, MAN, Scania and Volvo are now focusing on bringing BETs to the mass market for all vehicle segments,

including long-haul, starting from 2024. For this, a network of public high-power and overnight charging points needs to be rolled out

across Europe no later than 2024.

According to a global market report published

by Research and Markets in 2023, EV-charging demand could reach 23 TWh per year in Germany by 2030, or up to 43 TWh in an accelerated-adoption

scenario, an 8% increase over current energy demand. This accelerated scenario corresponds to 16 million EVs in Germany by 2030, an increase

in line with studies commissioned by the European Union and spurred by its proposed internal combustion engine vehicle ban as well as

improving engine-efficiency rates. Solar charging has a very small footprint in the industry, and we consider our company to be a pioneer

of off-the-grid charging stations.

The green tech industry is complex because

it still requires increased promotion and public education about its potential. Furthermore, regulations in each country are different

and, in many cases, several segments are regulated by both national and local (state, provincial, municipal) governments. Our approach

seeks to assist businesses with the growth and development of their general operations by ensuring the efficient, profitable, and sustainable

supply/generation of water and energy allowing our potential customers to focus on their business while adopting strategies of sustainability.

The main market dynamics to consider are

the growing numbers of AWGs across various end-use verticals and the high energy consumption, production cost, and high carbon footprint

of such technology. We believe that our innovative off-the-grid systems offer distinct advantages over both centralized and traditional

off-the-grid solutions. Designed for optimal efficiency, these systems prioritize environmental sustainability by utilizing renewable

energy sources, primarily solar. Not just alternatives, they seamlessly complement existing centralized infrastructures, ensuring a consistent

supply of water and power. Their modular design promotes easy scalability, catering to growing demands without massive overhauls. Furthermore,

the decentralized nature of our systems offers enhanced reliability, reducing the risks of large-scale outages that plague centralized

setups. This fusion of resilience, sustainability, and efficiency positions our solutions as a comprehensive response to modern energy

and water needs.

Our Business Strategy

Our mission is to provide sustainable water

generation systems based on high efficiency, renewable sources and to provide off-the-grid self-sufficient energy supply solutions. Through

a combination of the best design and configuration of state-of-the-art technology-assisted solutions, we have created a completely self-sufficient

off-the-grid energy generation and water production system, which can be simultaneously used to meet potable water requirements and the

electrical energy needs of the industrial sector.

Using our own off-the-grid AWG systems,

off-the-grid EV charging stations, off-the-grid power systems, off-the-grid water purification systems, and other identified technology,

products, and services licensed or purchased from third party sources, we are delivering and installing a product set that suits the

green technology water and/or energy needs of our customers. By using the state-of-the art technological solutions and technologies identified,

designed, and provided by us and our collaborators, we believe that our potential clients will be free to focus on the performance of

their operations as well as with the water and energy consumption or generation regulations within their industry.

Our aim is to collaborate with a diverse

range of clients across various sectors, including private enterprises, governmental bodies, municipalities, NGOs and IGOs. We recognize

the unique needs of each sector and tailor our solutions accordingly.

In the private sector, we work closely

with companies spanning industries such as manufacturing, hospitality, and agriculture. These organizations often require reliable water

and energy sources to maintain their operations. By providing them with our advanced technology and technical services, we empower them

to establish sustainable supplies and generation capabilities. This contributes significantly to their climate adaptation strategies,

enhancing resilience and reducing environmental impact.

Within the public sector, our engagement

extends to government entities and municipalities. These entities play a crucial role in safeguarding their communities’ well-being

and continuity. By equipping them with innovative solutions, we help them secure water and energy resources to support critical services,

disaster response, and long-term urban planning. This, in turn, aids in climate adaptation and fosters sustainable development.

NGOs and IGOs also form a key part of our

potential clientele. These entities often work in challenging environments or regions with limited infrastructure. By partnering with

us, they will gain access to cutting-edge technology that empowers them to provide essential services, such as clean water and energy,

to underserved populations. This not only aligns with their humanitarian missions but also promotes climate adaptation and community

resilience.

In every sector with which we engage, our

contributions are aligned with the broader goals of climate adaptation. By offering technology and technical services that enable the

efficient generation and management of water and energy, we help our clients thrive in a changing environment while contributing positively

to the global effort of mitigating climate challenges. With our outsourced technical arm and our commission-based global network of distributors,

we expect to create sustainable added value to each project we undertake while generating revenue from the sale of own products, royalties

from the commercialization of energy and water in certain cases, and the licensing of our innovated technologies, as well as from our

engineering, technical consulting, and project management services.

We plan to provide customized technology

solutions and technical services, based upon client need and preference, which may include any or all of the following:

| · | Sustainable

water and energy generation systems |

| · | Aqua

Mission Systems (individual solutions for individual needs) |

| · | Off-the-grid

EV charging stations |

| · | Strategic

and financial partnering |

We also plan to focus on addressing areas

of the industry which concentrate on new technological and engineering concepts relating to water and energy generation and those related

components that assist in advancing the green tech industry. These include:

| · | Advancement

of off-the-grid AWG systems |

| · | Development

of techniques to attain a self-sufficient supply of energy |

| · | Advancement

of new ideas on energy generation, storage and management implementation |

| · | Designing,

prototyping, and arranging the manufacture of new water and energy generation systems |

| · | Designing

and prototyping off-the-grid self-sufficient power systems |

| · | Designing

and prototyping solar powered charging stations for electric vehicles |

Our Products

The technological solutions that we plan

to offer include the following.

Off-the-Grid AWG Systems

AWG systems are standard equipment in many

places; however, operating AWG systems requires high amounts of energy that are often not available in the places where they are needed

most, making the price for the generated water very high. Our innovative off-the-grid AWG systems are designed to have an internal power

supply and the ability to generate power. Our off-the-grid AWG systems produce sufficient quantities of potable water even in very dry

and hot climate conditions and can be scaled to almost any size, community, and/or population. Presently, AWG systems are largely used

in Asian and African countries. The majority of manufacturers of AWG systems, which rely on dehumidifying, are located in China.

By contrast, we use a proven German technology

for condensate water from the air based on A/C technology. We believe that this method allows higher, more efficient, sustainable performance

and a larger quantity of water generation because of its internal power supply and because it does not require high humidity to function.

We have licensed the rights to use this German AWG technology for ninety-nine years; however, thanks to our continued research and development

efforts, we have designed a new, innovative and more efficient configuration that allows the substantial amount of energy required to

operate the equipment to be supplied by the equipment itself. Our off-the-grid AWG systems line is different in size from the standard

AWG line. Our off-the-grid AWG systems are energy self-sufficient and can condense large amounts of water out of the atmosphere and we

believe they could be a solution in countries around the world that deal with issues of water scarcity.

Our off-the-grid AWG system with an internal

power supply works by first “inhaling” large volumes of air, then cooling the air down to the dew point, and finally collecting,

filtering, and mineralizing the resulting condensed water. Through this process, pure drinking water is created that meets the quality

standards of the World Health Organization, or the WHO. In regions with high temperatures and high humidity levels, a single system can

generate more than 300,000 liters of water per day. Our off-the-grid AWG systems start at 2,640 gallons/day and can expand the water

supply to one acre-feet/day, which we believe, in effect, is essentially the ability to produce an unlimited supply of water. As a certified

vendor of the UN Global Marketplace, we are introducing our off-the-grid AWG systems to the UN with the hopes of initially supplying

the equipment to a large cluster of agencies established in key locations for humanitarian response as well as refugee camps around the

world in need of fresh water.

Off-the-Grid Water Purification Systems

We are seeking to respond to the growing

need for drinking water by proposing a water purification solution utilizing solar, photovoltaic energy and, when applicable, a mini-windmill

or other alternate source of renewable energy. The design of the system is ready to be built and delivered on demand.

Generally, drinking water is produced by

passing sea water, lake water, river water, or stagnant water through several stages of purification and treatment until it is rendered

drinkable in accordance with WHO standards. In the case of sea or stagnant water, we recommend a treatment via reverse osmosis membranes,

which permits the retention of dissolved solids and results in obtaining water of drinking quality. If the water being treated emanates

from lakes or rivers, we recommend treatment via an ultrafiltration membrane which functions by retaining suspended materials such as

colloids, viruses and bacteria. The systems proposed by us are containerized and contain all the equipment necessary to function autonomously,

in part due to an automatic cleansing system that can be accessed remotely via satellite or the internet. Moreover, the machines use

available renewable energy sources such as solar or wind to function.

Off-the-Grid EV Charging Stations

Based on our patent-pending off-the-grid

power system, we have developed an innovative design and configuration of off-the-grid charging stations for BETs and electric vehicles

in Germany. In 2021, we built our first off-the-grid charging station in Relligen, Germany to charge our fleet vehicles and to gather

usage and operational data. We believe that our product is the first off-the-grid solution available in Europe for charging the BETs

and electric passenger vehicles that are currently on the roads of Europe. We plan to establish up to 1,700 charging stations throughout

Germany starting with 40 locations scheduled to be installed by the end of the fourth quarter of 2024.

Off-the-Grid Power Systems

Batteries for stationary storage have become

a commodity, but in order to reduce the duration, complexity and cost of the installation, and to increase the capacity or relocate a

system over time as well as to reduce the carbon footprint and environmental impact, we offer a complete electrical energy storage system

and energy management system for a wide range of customers and applications, including microgrids and EV fast charging stations. A highly

capable energy management system secures an efficient energy supply and storage of energy.

This product portfolio includes systems

and complete services for solar power generation, including a high-quality frameless glass solar panel with a super-matte surface, which

secures a high-performance energy source. In contrast to classic solar systems on the roof, we combine the highest standards of aesthetics

with high efficiency energy generation. With these solutions, we support our customers on their way to CO2 neutrality and the search

for alternative renewable energies.

Our Current Projects

We envision a dual-utility future for our

systems, simultaneously offering both water and energy where needed. We plan to establish off-the-grid charging stations throughout Germany

and, given the increasing drought issues there and in France, Spain, Italy, the United States, Mexico, and other parts of Latin America,

we foresee our systems providing vital water supplies to these regions.

Germany

We have secured a 7,200 sqm plot in Kassel,

adjacent to the A7 Autobahn, which is Germany’s primary north-south route located at the heart of the country. On June 1, 2023,

we commenced construction of Europe’s premier large-scale, off-the-grid charging station for electric trucks and passenger vehicles

in Germany.

Harnessing solar and wind power, each off-the-grid

charging system will be capable of consistently powering up to 120 direct current, or DC, charging stalls, depending on the size of the

charging park. Specifically, the Kassel off-the-grid system is designed to simultaneously charge 50 electric trucks and up to 60 electric

vehicles. This patented system is designed for future integration and expansion. Our technology creates a “micro-grid” that

operates independently from the public power grid, ensuring continuous EV charging regardless of public grid availability. Often referred

to as a “mini-grid” or “island grid,” it offers consistent power for both alternating current, or AC, and DC

chargers. In Kassel, the stalls will range in power from 300 KW to 480 KW, with some having dual charging capabilities, allowing two

trucks to charge simultaneously. This system is equipped to cater to both the emerging 800 Volt vehicles and the more common 400 Volt

charging systems, accommodating the diverse charging needs of today’s electric vehicles and trucks.

In 2021, we also completed the development

and installation of the first of forty planned solar powered off-the-grid EV charging stations for electric long-haul trucks in Relligen,

Germany. Our charging stations are the first off-the-grid charging station available for these e-trucks in Europe and we plan to contract

with companies that own these electric long-haul trucks to provide fleet charging as well as to install them in public places for per-use

fees with the following business model:

| · | E-Truck

Overnight Parking: A per-truck parking fee of €6 for 12 hours €12 for 24

hours. Additionally, customers will be required to pay a €4 per truck reservation fee

and applicable tax. |

| · | E-Truck

Monthly Parking: A monthly flat rate of €1,000 for up to ten trucks per day.

We will negotiate these monthly contracts with local companies to provide their drivers with

prearranged local parking. |

| · | Long-term

Logistics: In the event a freight forwarder needs a long-term parking solution, the

fee will be €140 per month per truck. |

| · | Hourly

Public Charging: The general public will receive one hour of free parking with the

purchase of at least €20 worth of charging. Regular rates apply after one hour. |

| · | Overnight

Public Parking: Overnight public parking will be charged at the above-listed hourly

public parking rates, plus charging fees. |

In 2021, we installed an off-the-grid AWG

system powered by solar energy at our office location in Relligen, Germany. This installation served as a demonstration of the system’s

capacity to produce significant amounts of water, with projections reaching up to two million gallons daily. In addition, the surplus

energy harnessed from the sun has been effectively utilized to charge our five EVs. In October 2023, we moved to a larger office and

warehouse space in Bargteheide, Germany, where we plan to re-install our demonstration system.

Mexico

In November 2020, our distributor in Mexico

made a significant move by placing an initial order valued at $550,000 for a solar-powered off-the-grid AWG system. This system was manufactured

in Germany and delivered in 2021. Following the success of this transaction and evident satisfaction of the client, we are in active

discussions with the same client for the acquisition of three additional units.

This successful implementation of our product

and the trust demonstrated by our Mexican client has spurred interest by others in the region. Consequently, we are witnessing an uptick

in proposal submissions for potential clients across Mexico in Mexico City, Monterrey, San Luis Potosi, Quintana Roo, and Merida.

On November 30, 2023, we and several significant

landowners of the Magdalena Contreras Municipality in Mexico City signed a joint memorandum of understanding to formalize their commitment

to join forces to initiate a groundbreaking project: the first off-the-grid AWG plant on the American continent. This memorandum of understanding

lays out the groundwork for the development of this facility. In its initial phase, the plant is expected to produce approximately 3.2

million liters of water annually by extracting moisture directly from the air.

South Africa

In 2019, we signed a sales contract for

the sale of a solar powered off-the-grid AWG system to a South African customer for a purchase price of $2,800,000. Building of the equipment

began in the fourth quarter of 2019; however, because of delays due to COVID-19 and the global supply chain, the expected delivery date

is late 2024. We have not yet received any payments from this customer.

Our Competitive Strengths

We believe that we have several competitive

advantages that differentiate us from other companies in our industry. Our competitive strengths include:

| · | United

Nations Accreditation: We are a UN accredited vendor, which not only boosts our credibility

but also opens up numerous opportunities for participation in global projects that require

high standards of operational and ethical compliance. We believe that this status can be

a significant differentiator in attracting partnerships and projects with international agencies. |

| · | Focus

on Sustainability and Innovation: Unlike many companies that might prioritize one

over the other, we equally emphasize both technological innovation and environmental sustainability.

We leverage proven technologies to deliver eco-friendly solutions, ensuring that our projects,

such as generating clean energy and addressing water scarcity, meet current needs without

compromising the ability of future generations to meet theirs. |

| · | Customized

Solutions: We offer customized solutions based on the unique requirements of our

clients. This approach not only caters to a broad spectrum of needs but also enhances client

satisfaction and loyalty, as we provide tailored solutions rather than a one-size-fits-all

product. |

| · | Proprietary

Technology and Patents: We are actively engaged in research and development, leading

to proprietary technologies and patents, such as our systems for self-sufficient energy supply

and atmospheric water generation. We believe that these innovations provide us with unique

products that are hard to replicate, giving us an edge over our competitors. |

| · | Experienced

Leadership: Our management team has decades of experience and established relationships

across various sectors, which we believe contributes significantly to our strategic vision

and operational execution. This depth of experience enables us to navigate complex project

demands and market dynamics effectively. |

We believe that these factors create a

robust framework that will enable us to compete effectively in the global market for sustainable energy and water solutions.

Our Growth Strategies

The key elements of our strategy to grow

our business include:

| · | Expansion

of Technology Portfolio: We focus on continuously expanding our portfolio of proprietary

technologies and solutions. This includes developing new patents and enhancing existing technologies

to stay at the forefront of innovation in water and energy solutions. |

| · | Strategic

Partnerships and Alliances: We leverage strategic partnerships and alliances to expand

our reach and enhance our capabilities. Collaborating with other industry leaders, government

bodies, and international organizations allows us to access new markets and resources, and

share risks associated with new projects. |

| · | Market

Diversification: We aim to diversify our market presence by targeting various sectors

including private companies, government entities, and NGOs across different regions. This

diversification will help in spreading business risks and tapping into new opportunities

in emerging markets. |

| · | Sustainability

Initiatives: Commitment to sustainability is at the core of our growth strategy.

By focusing on eco-friendly and sustainable solutions, we believe that we not only meet the

increasing global demand for green technologies but also position ourselves as a leader in

sustainable practices. |

| · | Enhancing

Operational Efficiency: We continuously strive to improve our operational efficiencies

through the adoption of advanced technologies and optimization of processes. This helps in

reducing costs, improving service delivery, and increasing customer satisfaction. |

| · | Client-Centric

Solutions: By maintaining a strong focus on delivering customized solutions that

meet the specific needs of our clients, we ensure long-term relationships and a strong client

base, which is crucial for sustained growth. |

These strategic elements are designed to

reinforce our competitive position while addressing the pressing needs of energy and water management in an environmentally sustainable

manner.

Our Risks and Challenges

An investment in our securities involves

a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the “Risk

Factors” section immediately following this Prospectus Summary. These risks include, but are not limited to, the following:

| · | We

have incurred losses since our inception, and we may not be able to manage our business on

a profitable basis. |

| · | We

will require additional financing to accomplish our business strategy. |

| · | We

cannot accurately predict future revenues or profitability in the emerging market for our

products. |

| · | We

may face significant challenges in obtaining market acceptance of our products, which could

adversely affect our potential sales and revenues. |

| · | If

we do not build brand awareness and brand loyalty, our business may suffer. |

| · | If

we are unable to maintain, train and build an effective international sales and marketing

infrastructure, we will not be able to commercialize and grow our brand successfully. |

| · | We

operate in new and rapidly changing markets, which makes it difficult to evaluate our future

prospects and may increase the risk that we will not be successful. |

| · | We

expect significant competition for our products and services. |

| · | If

we fail to properly manage our anticipated growth, our business could suffer. |

| · | Product

liability associated with the production, marketing and sale of our products, and/or the

expense of defending against claims of product liability, could materially deplete our assets

and generate negative publicity which could impair our reputation. |

| · | Product

defects could result in costly fixes, litigation and damage. |

| · | We

have historically depended on a limited number of third parties to supply key raw materials

to us and the failure to obtain a sufficient supply of these raw materials in a timely fashion

and at reasonable costs could significantly delay our delivery of products. |

| · | Business

interruptions may affect the distribution of our products and/or the stability of our computer

systems, which may affect our business. |

| · | Security

threats, such as ransomware attacks, to our IT infrastructure could expose us to liability,

and damage our reputation and business. |

| · | In

the conduct of our business, we will rely upon the use of patents and intellectual property

owned by other entities, which are non-exclusive. |

| · | We

may not be able to obtain patents or other intellectual property rights necessary to protect

our proprietary technology and business. |

| · | Our

business may suffer if it is alleged or determined that our technology or another aspect

of our business infringes the intellectual property of others. |

| · | Loss

of key personnel critical for management decisions would have an adverse impact on our business. |

| · | We

will face growing regulatory and compliance requirements in a variety of areas, which can

be costly and time consuming. |

| · | Legislation

or government regulations may be adopted which may affect our products and liability. |

| · | We

are subject to, and must remain in compliance with, numerous laws and governmental regulations

concerning the assembling, manufacturing, use, distribution and sale of our products. Some

of our customers also require that it complies with their own unique requirements relating

to these matters. |

| · | Economic,

political and other risks associated with our international operations could adversely affect

our revenues and international growth prospects. |

| · | Our

international operations require us to comply with anti-corruption laws and regulations of

the U.S. government and various international jurisdictions in which we do business. |

| · | Certain

laws and regulations governing international business operations could adversely impact our

operations. |

| · | Certain

of our executive officers and directors are located outside of the U.S., so it will be difficult

to effect service of process and enforcement of legal judgments upon them. |

| · | We

may not be able to satisfy NYSE American’s listing requirements or maintain a listing

of our common stock on NYSE American. |

| · | The

market price of our common stock may be highly volatile, and you could lose all or part of

your investment. |

| · | An

active, liquid trading market for our common stock may not be sustained, which may cause

our common stock to trade at a discount from the public offering price and make it difficult

for you to sell the shares you purchase. |

| · | Our

management has broad discretion as to the use of the net proceeds from this offering. |

| · | We

have no current plans to pay cash dividends on our common stock for the foreseeable future,

and you may not receive any return on investment unless you sell your common stock for a

price greater than that which you paid for it. |

| · | You

will experience immediate and substantial dilution as a result of this offering. |

| · | The

number of shares being registered for resale concurrently with this offering is

significant in relation to our outstanding shares. |

| · | Future

issuances of our common stock or securities convertible into, or exercisable or exchangeable

for, our common stock, or the expiration of lock-up agreements that restrict the issuance

of new shares of common stock or the trading of outstanding common stock, could cause the

market price of our common stock to decline and would result in the dilution of your holdings. |

| · | Future

issuances of debt securities, which would rank senior to our common stock upon our bankruptcy

or liquidation, and future issuances of preferred stock, which could rank senior to our common

stock for the purposes of dividends and liquidating distributions, may adversely affect the

level of return you may be able to achieve from an investment in our common stock. |

Implications of Being an Emerging Growth

Company

We

qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act.

As a result, we are permitted to, and intend to, rely on exemptions from

certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| · | have

an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of

the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

| · | comply

with any requirement that may be adopted by the Public Company Accounting Oversight Board

regarding mandatory audit firm rotation or a supplement to the auditor’s report providing

additional information about the audit and the financial statements (i.e., an auditor discussion

and analysis); |

| · | submit

certain executive compensation matters to stockholder advisory votes, such as “say-on-pay”

and “say-on-frequency;” and |

| · | disclose

certain executive compensation related items such as the correlation between executive compensation

and performance and comparisons of the chief executive officer’s compensation to median

employee compensation. |

In

addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying

with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards

until those standards would otherwise apply to private companies. We have elected

to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those

of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company

until the earliest of (i) December 31, 2024, (ii) the last day of the first fiscal year in which our total annual gross

revenues are $1.235 billion or more, (iii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under

the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our

common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed

second fiscal quarter or (iv) the date on which we have issued more than $1 billion in non-convertible debt during the

preceding three year period.

Corporate Information

Our principal executive office is located

at 7901 4th Street N, STE #4174, St Petersburg, Florida. Our telephone number is 727-677-9408. We maintain a website at www.energy-water.com.

The reference to our website is intended to be an inactive textual reference only. The information contained on, or that can be accessed

through, our website is not part of this prospectus and investors should not rely on such information in deciding whether to purchase

shares of our common stock.

Reverse Stock Split

Our board of directors has approved a 1-for

reverse stock split of our authorized and outstanding common stock. We anticipate that this reverse stock split will become effective

on the effective date of the registration statement of which this prospectus forms a part. As a result of this reverse split, our authorized

common stock will decrease from shares to shares and our issued and outstanding common stock will decrease from shares to

approximately shares. References to “post-split” below are references to the number of shares of our common stock and/or

the exercise or conversion prices of our securities after giving effect to this reverse stock split.

The

Offering

| Shares offered: |

|

shares

of common stock (or shares if the underwriters exercise

the over-allotment in full), based on the assumed public offering price of $ , the

midpoint of the anticipated price range. |

| Offering price: |

|

We currently estimate that the public offering price will be between

$ and $ per share. For purposes of this prospectus, the assumed

public offering price per share is $ , the midpoint of the anticipated price range. The actual

offering price per share will be as determined between the underwriters and us based on market conditions at the time of pricing.

Therefore, the assumed offering price used throughout this prospectus may not be indicative of the final offering price. |

| Shares to be outstanding after this offering(1): |

|

shares

of common stock (or shares if the underwriters exercise

the over-allotment option in full), based on an assumed public offering price

of $ per share, which is the midpoint of the estimated range of the public offering

price shown on the cover page of this prospectus. |

| Over-allotment option: |

|

We have granted to the underwriters a 45-day option to purchase

from us up to an additional 15% of the shares sold in the offering ( additional

shares) at the public offering price, less the underwriting discounts and commissions. |

| Use of proceeds: |

|

We

expect to receive net proceeds of approximately $ million from this offering (or $ million if the underwriters exercise the

over-allotment option in full), based on an assumed public offering price

of $ per share, which is the midpoint of the estimated range of the public offering price shown on the cover page of this

prospectus, after deducting estimated underwriting discounts and commissions

and estimated offering expenses payable by us.

We intend to use the net proceeds from

this offering for the repayment of certain debt and for working capital and general corporate purposes, which may include, at the

discretion of our board of directors, the expansion of our premises, the acquisition of equipment, the hiring of technical and

administrative personnel, and enhancing our sales and marketing capabilities. In addition, while we have not entered into any

agreements, commitments or understandings relating to any significant transaction as of the date of this prospectus, we may use a

portion of the net proceeds to pursue acquisitions, joint ventures and other strategic transactions.

See “Use of Proceeds.” |

| Risk factors: |

|

Investing in our common

stock involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully

consider the information set forth in the “Risk Factors” section beginning on page 13. |

| Lock-up: |

|

We and our directors, officers, and stockholders holding more than

5% of our common stock as of the effective date of the registration statement of which this prospectus forms a part have agreed not to

sell, transfer or dispose of any common stock for a period of ninety (90) days from the effective date of the registration statement

of which this prospectus forms a part, subject to certain exceptions. See “Underwriting” for more information.

|

| Trading market and symbol: |

|

Our common stock is currently quoted on the OTCQB Market under the

symbol “EAWD.” In connection with this offering, we intend to apply for the listing of our common stock on NYSE American

under the symbol “EADW.” The closing of this offering is contingent upon our uplisting to NYSE American. |

| (1) | The

number of shares of common stock outstanding immediately following this offering is based

on 280,445,682 shares outstanding

as of May 10, 2024 and excludes:

|

| · | 48,904,880

shares of common stock issuable upon the conversion of our series A preferred stock; |

| · | 15,561,024

shares of common stock that are reserved for issuance under our 2022 Long Term Incentive

Plan; |

| · | shares

of common stock that could be issued upon the conversion of a promissory note in the remaining

principal amount of $78,000 due on June 30, 2024, which is convertible at any time at a fix

conversion price of $0.03, provided that if the closing price of our common stock is below

$0.03 for the five consecutive trading days prior to conversion, then the conversion price

shall be equal to the lower of $0.01 or 70% of the lowest closing price for the twenty prior

trading days; |

| · | shares

of common stock that could be issued upon the conversion of a promissory note in the principal

amount of $150,000 due on August 15, 2024, which is only convertible after such maturity

date at a fix conversion price of $0.04 (subject to adjustments); provided that if the closing

price of our common stock is below $0.03 for the five consecutive trading days prior to conversion,

then the conversion price shall be equal to the lower of $0.01 or 70% of the lowest closing

price for the twenty prior trading days; and |

| · | shares

of common stock that could be issued upon the conversion of a promissory note in the principal

amount of $147,775 due on December 15, 2024, which is only convertible upon an event of default

(as defined in such note) at a conversion price equal to 75% of the lowest trading price

of our common stock during the ten trading days prior to conversion. |

Please see “Description of Capital

Stock” for additional details regarding our outstanding convertible securities.

Pursuant to a separate resale prospectus

included in the registration statement of which this prospectus forms a part, we are also registering 39,957,667 shares of common stock

for resale by certain selling stockholders. This public offering and the resale offering will be concurrent in that the selling stockholders

may commence selling efforts at any time after the registration statement is declared effective. However, the closing of this public

offering will not occur until one (1) or two (2) trading days after trading on NYSE American commences, which is expected to occur on

the trading day following the date that the registration statement is declared effective. The

selling stockholders may sell their shares from time to time at the market price prevailing at the time of offer and sale, or at prices

related to such prevailing market prices or in negotiated transactions or a combination of such methods. Please see “Risk

Factors—Risks Related to this Offering and Ownership of Our Common Stock” for certain risks related to the concurrent

registration of shares in the resale offering.

Summary

Financial Information

The following tables summarize certain

financial data regarding our business and should be read in conjunction with our financial statements and related notes contained elsewhere

in this prospectus and the information under “Management’s Discussion and Analysis of Financial Condition and Results

of Operations.” As noted elsewhere in this prospectus, as of December 31, 2023, we have not yet generated any revenue.

Our summary consolidated financial data

as of December 31, 2023 and 2022 and for the years then ended are derived from our audited consolidated financial statements included

elsewhere in this prospectus.

All financial statements included in this

prospectus are prepared and presented in accordance with generally accepted accounting principles in the United States, or GAAP. The

summary financial information is only a summary and should be read in conjunction with the historical financial statements and related

notes contained elsewhere herein. The financial statements contained elsewhere fully represent our financial condition and operations;

however, they are not indicative of our future performance.

| Statements of Operations Data | |

Years Ended December 31, | |

| | |

2023 | | |

2022 | |

| Total operating expenses | |

$ | 2,641,724 | | |

$ | 1,910,888 | |

| Loss from operations | |

| (2,641,724 | ) | |

| (1,910,888 | ) |

| Total other expense, net | |

| (791,594 | ) | |

| (31,692 | ) |

| Net loss | |

$ | (3,433,318 | ) | |

$ | (1,942,580 | ) |

| Foreign currency translation adjustments | |

| 8,847 | | |

| 27,442 | |

| Comprehensive loss | |

$ | (3,424,471 | ) | |

$ | (1,915,138 | ) |

| Loss per common share - basic and diluted | |

$ | (0.02 | ) | |

$ | (0.01 | ) |

| Balance Sheet Data | |

As of December 31, | |

| | |

2023 | | |

2022 | |

| Cash | |

$ | 76,627 | | |

$ | 40,886 | |

| Total current assets | |

| 908,103 | | |

| 866,515 | |

| Total assets | |

| 1,424,800 | | |

| 1,174,295 | |

| Total current liabilities | |

| 1,979,883 | | |

| 1,607,213 | |

| Total liabilities | |

| 2,147,984 | | |

| 1,656,159 | |

| Total stockholders’ deficit | |

| (723,184 | ) | |

| (481,864 | ) |

| Total liabilities and stockholders’ deficit | |

$ | 1,424,800 | | |

$ | 1,174,295 | |

RISK FACTORS

An investment in our securities involves

a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this

prospectus, before purchasing our securities. We have listed below (not necessarily in order of importance or probability of occurrence)

what we believe to be the most significant risk factors applicable to us, but they do not constitute all of the risks that may be applicable

to us. Any of the following factors could harm our business, financial condition, results of operations or prospects, and could result

in a partial or complete loss of your investment. Some statements in this prospectus, including statements in the following risk factors,

constitute forward-looking statements. Please refer to the section titled “Cautionary Statement Regarding Forward-Looking Statements”.

Risks Related to Our Business and Industry

We have incurred losses since our

inception, and we may not be able to manage our business on a profitable basis.

We have generated losses since we began

operations in December 2012 and have relied on cash on hand, sales of securities, and the issuance of third-party and related party

debt to support our operations. During the year ended December 31, 2023, we incurred net losses of $3,433,318 and we had a working capital

deficit of $1,071,780 at December 31, 2023. These factors raised a substantial doubt about our ability to continue as a going concern,

and the report of our independent registered public accounting firm that accompanies our financial statements for the year ended December

31, 2023 contains an explanatory paragraph relating to our ability to continue as a going concern. The revenue and income potential of

our business and market are unproven. This makes an evaluation of our company and its prospects difficult and highly speculative. There

can be no assurances that we will be able to develop products or services on a timely and cost effective basis, that will be able to

generate any revenue, that we will have adequate financing or resources to continue operating our business and to provide products to

customers, that we will earn a profit, that we can raise sufficient capital to support operations by attaining profitability, or that

we can satisfy future liabilities.

We will require additional financing

to accomplish our business strategy.

We require substantial working capital

to fund our business development plans, and we expect to experience significant negative cash flow from operations. Depending upon the