Form 8-K - Current report

May 02 2024 - 5:20PM

Edgar (US Regulatory)

0001643301false00016433012024-05-022024-05-02iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 2, 2024

AVENIR WELLNESS SOLUTIONS, INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 000-55908 | | 90-1504639 |

(State or other jurisdiction | | (Commission | | (IRS Employer |

of incorporation) | | File Number) | | Identification No.) |

5805 Sepulveda Blvd., Suite 801 Sherman Oaks, California | | 91411 |

(Address of principal executive offices) | | (Zip Code) |

(424) 273-8675

(Registrant’s telephone number, including area code)

________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.02(a) Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On May 2, 2024, the Audit Committee of the Board of Directors of Avenir Wellness Solutions, Inc. (the “Company”), based on the recommendation of management and after consultation with the Company’s independent registered public accounting firm, determined that the Company will restate certain of its previously issued financial statements. The Company believes, based on information available to date, that it will restate its financial statements for the year ended December 31, 2021 and the quarterly periods within that year commencing with the second quarter of 2021 and also the second quarter of 2022. Accordingly, investors should not rely on the Company’s financial statements for the year ended December 31, 2021 and the quarterly periods within that year commencing with the second quarter of 2021 and the second quarter of 2022.

During the preparation of its Form 10-K filing for the year ended December 31, 2022, the Company identified errors made by prior management of the Company related to the calculation of its earnings per share (EPS) that affected the financial statements included in the previously filed Forms 10-Q and Form 10-K for the periods noted above. The errors were attributed to a spreadsheet formula error which caused the incorrect calculation of the weighted average shares outstanding used to compute EPS thereby incorrectly increasing the reported loss per share for those periods. Upon discovery of the error, the Company’s current management promptly initiated a comprehensive review of its EPS calculations and corrected its previously reported EPS figures accordingly for the year ended December 31, 2021 including the related disclosure of the occurrence and impact of the error. Based on its analysis considering ASC 250 “Accounting Changes and Error Corrections” and Staff Accounting Bulletin 99 “Materiality,” the Company initially determined that these errors were immaterial to the previously issued consolidated financial statements and that the correction and disclosure of the error in its Form 10-K for the year ended December 31, 2022 which included the 2021 financial statements was adequate. The Company has since determined that the errors in its previously reported EPS are material and is thus restating the impacted financial statements included in the filings noted above.

A copy of this disclosure was provided to the independent accountant on the same day as filing this Current Report on Form 8-K (“Report”). The Company has requested that the independent accountant furnish a letter to the Securities and Exchange Commission (“SEC”) stating whether they agree with the Company’s statements made in response to this Item 4.02. The Company will file the independent accountant’s response letter as an exhibit to the amended Report within two business days of receipt.

The Company will amend the applicable filings to present restated financial statements reflecting the corrections in accordance with ASC 250.

Safe Harbor Statement

This Report contains forward-looking statements, including the Company’s statements regarding the anticipated periods and consequences of the restatement of the Company’s financial statements described above. All forward-looking statements contained in this Report involve risks and uncertainties. Our actual results and outcomes could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the possibility that the restatement could have unanticipated consequences. The words “strive,” “objective,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We have based these forward-looking statements on our current expectations and projections about future events. Although we believe that the expectations underlying any of our forward-looking statements are reasonable, these expectations may prove to be incorrect and all of these statements are subject to risks and uncertainties. Should one or more of these risks and uncertainties materialize, or should underlying assumptions, projections, or expectations prove incorrect, actual results, performance, financial condition, or events may vary materially and adversely from those anticipated, estimated, or expected.

All forward-looking statements included in this Report are expressly qualified in their entirety by these cautionary statements. We wish to caution readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the uncertainties and factors described above, as well as others that we may consider immaterial or do not anticipate at this time. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations may prove correct. Our expectations reflected in our forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown uncertainties and factors, including those described above. The risks and uncertainties described above are not exclusive, and further information concerning us and our business, including factors that potentially could materially affect our financial results or condition or relationships with customers and potential customers, may emerge from time to time. We assume no, and we specifically disclaim any, obligation to update, amend, or clarify forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. We advise you, however, to consult any further disclosures we make on related subjects in our periodic reports that we file with or furnish to the SEC.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AVENIR WELLNESS SOLUTIONS, INC. | |

| | |

Date: May 2, 2024 | By: | /s/ Joel Bennett | |

| Name: | Joel Bennett | |

| Title: | Chief Financial Officer | |

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

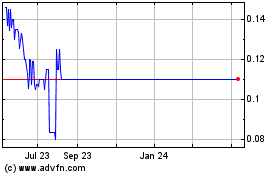

Cure Pharmaceutical (PK) (USOTC:CURR)

Historical Stock Chart

From Apr 2024 to May 2024

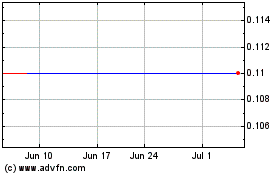

Cure Pharmaceutical (PK) (USOTC:CURR)

Historical Stock Chart

From May 2023 to May 2024