BEIJING—China's biggest banks posted their lowest annual profit

growth in a decade, as bad loans mount in an ailing economy that is

pushing lenders toward riskier avenues of expansion.

Three major banks reporting 2015 results on Wednesday said that

they wrote off 142 billion yuan ($21.85 billion) in irrecoverable

debt last year, 1.4 times the volume in 2014, an indication that

their customers—many of them state-owned industrial companies—are

struggling to repay loans.

Bank profits were nearly flat, compared with rates near 40% just

three years ago, with banks building ever-larger capital buffers to

cover bad loans as Chinese companies flounder under a severe

overhang of real estate inventory and excess industrial

capacity.

The prevalence of bad loans means booming business for

asset-restructuring companies—state-owned "bad banks" set up to

soak up and sell off soured debt—prompting conventional banks to

explore ways to keep such deals for themselves.

Net profit among commercial lenders rose 2.4% last year,

compared with 9.6% a year earlier. China's largest bank by assets,

Industrial & Commercial Bank of China Ltd., posted 0.5% profit

growth to 277.1 billion yuan ($42.8 billion).

Profit at Bank of China Ltd., China's fourth-largest lender,

which for the third quarter reported its first profit decline in

six years, rose 0.7% for all of last year.

Industrywide, nonperforming loans rose to 1.67% of total loans

last year from 1.25% in 2014, the China Banking Regulatory

Commission said. Investment bank China International Capital Corp.

estimated the true ratio could be as high as 8.1% this year; other

analysts have projected even higher estimates.

Credit is souring so fast that commercial lenders are having a

hard time expanding capital provisions to keep pace. Two years ago,

China Construction Bank Corp., the second-largest lender, was

setting aside a buffer that was more than twice the size of their

bad loans. Last year, that ratio had fallen to 1.5 times, it said

Wednesday.

Slowing profits have forced many Chinese banks, especially

midsize lenders, to invest aggressively in shadow-banking assets

such as trust and wealth-management products. Such assets, termed

"investment receivables," are opaque cocktails of high-yield risk

that could jeopardize liquidity should banks need to offload them

if markets turn turbulent, analysts say.

"The disclosure for such investment receivables is quite poor,

and it's very difficult to judge the quality of the portfolio,"

said Christine Kuo, senior vice president at Moody's Investors

Service.

Investment receivables at China Citic Bank Corp. rose 70.4% to

1.1 trillion yuan in 2015, the bank said. China's seventh-largest

lender attributed the year-over-year rise to more investments in

directional asset-management plans, which allow banks to repackage

loans as off-balance sheet investments, and wealth-management

products. Similarly, China Merchants Bank Co., the sixth-largest

lender, said its investment receivables rose 75% last year.

As profits at commercial banks flatline, the so-called bad banks

are flourishing. The biggest among them, China Huarong Asset

Management Co., said last week its 2015 profit rose 36% from 2014.

China Cinda Asset Management Co. said Tuesday its profit was up 18%

in the period.

Asset-management companies have been enjoying a buyers' market,

acquiring bad loans at about 30 cents on the dollar, as China's

ailing real estate sector and heavy industries feed a bad-loan

pipeline that is proving lucrative business for those who can

repackage and sell their components. Huarong said the property

sector alone accounted for some 66% of its distressed-debt

acquisitions last year.

At such prices, analysts say, a small number of commercial

lenders are experimenting with complex ways to restructure bad

loans themselves—in one case, by having a bank-related company

broker a deal to subscribe to a debtor's issue of new shares, the

proceeds of which are used to pay off the debtor's bad loans.

A more popular means of disguising bad debt is by parking them

in a category labeled "special mentions," which effectively is "a

vast warehouse for unrecognized nonperforming loans" that isn't

subject to detailed audits, said Ted Osborne, a partner at

PricewaterhouseCoopers in Hong Kong specializing in debt

restructuring.

ICBC reported it had 520.5 billion yuan of special-mention loans

at the end of 2015, an amount nearly three times as large as its

nonperforming loans and 63% larger than in 2014. Bank of

Communications Co. reported 118.1 billion yuan of special-mention

loans in 2015, more than twice the volume of its bad loans.

Banks are facing more problems as Beijing plans to let companies

repay distressed loans via equity transfers to lenders.

Analysts say allowing nonviable companies to take on more

leverage would prolong inefficiencies in the broader economy. "Such

a policy move will likely accelerate bad-loan exposures at banks

and impact their near-term earnings and profitability," said

Bernstein Research analyst Wei Hou.

Such transfers reduce nonperforming loans on paper but could end

up inflicting greater damage on bank balance sheets. These plans

require lenders to set aside four times the value of the equity

investment in capital provisions, far higher than the equivalent

value that needs to be set aside for a regular corporate loan.

Liyan Qi contributed to this article.

Write to Chuin-Wei Yap at chuin-wei.yap@wsj.com

(END) Dow Jones Newswires

March 30, 2016 09:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

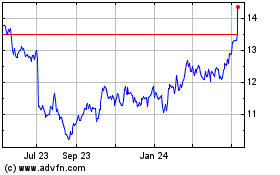

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Apr 2024 to May 2024

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From May 2023 to May 2024