China Construction Bank to Provide Debt Financing for Anbang's Starwood Deal

March 21 2016 - 6:43AM

Dow Jones News

By Julie Steinberg and Kane Wu

HONG KONG--Chinese state lender China Construction Bank Corp. is

stepping up to write a big check for a Chinese insurer's $13.2

billion bid for Starwood Hotels & Resorts Worldwide Inc.

China's Anbang Insurance Group Co. won backing from Starwood's

board Friday over an earlier agreed deal with Marriott

International Group Inc. Starwood on Friday said its board

"believes that the binding and fully financed proposal" from Anbang

and its consortium members "provides a high degree of closing

certainty."

Anbang, which has been relatively unknown on the global stage

until recently, put together a consortium of investors for the deal

that includes J.C. Flowers & Co. and China-based private-equity

firm Primavera Capital Group. Those investors are providing the

equity financing, while China Construction Bank is providing debt

financing. Securing financing from the state-owned bank gives the

bid an added degree of credibility.

Chinese banks have been eager to fund recent megadeals. China

Citic Bank International, for example, is one of the banks leading

the syndicated loans for China National Chemical Corp.'s proposed

$43 billion acquisition of Swiss pesticide and seed company

Syngenta AG, The Wall Street Journal reported last month.

The consortium led by Anbang last week raised its unsolicited

bid for Starwood to about $13.2 billion. The group had earlier

offered about $13 billion to buy the Stamford, Conn., hotel

chain.

The takeover battle reflects China's increasing appetite to do

big deals as its economy slows and companies seek higher-yielding

assets. Chinese investors have sought to buy U.S. and European

properties that stand to benefit from a boom in Chinese travelers

abroad.

Starwood said Friday that the new Anbang bid of $78 a share in

cash, up from an earlier offer of $76 a share, was superior to a

deal it has in place with Marriott. Starwood said it plans to set

that deal aside and tie up with Anbang. Marriott has until March 28

to make changes to its own offer.

Anbang Insurance has spent billions purchasing part or all of

insurers in South Korea, Europe and the U.S., as well as taking

stakes in listed Chinese developers, a bank, a traditional Chinese

medicine maker and a wind turbine manufacturer. While it ranks

outside the top 10 of Chinese insurers by premiums, the

Beijing-based company has done nearly $28 billion worth of deals,

according to Dealogic, with most of those acquisitions of foreign

companies coming in the past two years.

Write to Julie Steinberg at julie.steinberg@wsj.com and Kane Wu

at Kane.Wu@wsj.com

(END) Dow Jones Newswires

March 21, 2016 06:28 ET (10:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Apr 2024 to May 2024

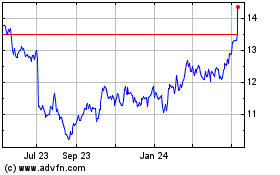

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From May 2023 to May 2024