Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

August 28 2013 - 2:48PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433(d)

Registration Statement No. 333-178202

AB SVENSK EXPORTKREDIT (publ)

(Swedish Export Credit Corporation or SEK)

Pricing Term Sheet

|

Issuer:

|

|

Swedish Export Credit Corporation

|

|

Principal Amount:

|

|

US$1,250,000,000

|

|

Maturity:

|

|

September 4, 2015

|

|

Issue Price:

|

|

99.987% of principal amount

|

|

Spread to Benchmark:

|

|

T + 24.05 basis points

|

|

Benchmark:

|

|

UST 0.250% due July 31, 2015

|

|

Coupon:

|

|

0.625%

|

|

Coupon Payment Dates:

|

|

Every March 4 and September 4, commencing March 4, 2014

|

|

Re-Offer Yield:

|

|

0.6315%

|

|

Net Proceeds to Issuer:

|

|

US$1,249,368,750

|

|

Optional Redemption:

|

|

Only after the occurrence of certain tax events, at 100.00% of the principal amount thereof plus accrued and unpaid interest to the redemption date

|

|

Redemption Price:

|

|

100.000% of notional amount

|

|

Business Days:

|

|

New York and London

|

|

Business Days Convention:

|

|

30/360 (following, unadjusted)

|

|

Legal Format:

|

|

SEC Registered US Medium Term Note Program

|

|

Governing Law:

|

|

New York

|

|

Pricing Date:

|

|

August 28, 2013

|

|

Settlement Date:

|

|

September 4, 2013

|

|

CUSIP:

|

|

00254ELY6

|

|

ISIN:

|

|

US00254ELY67

|

|

Joint Lead Managers:

|

|

Credit Suisse Securities (Europe) Limited, Goldman Sachs International and Morgan Stanley & Co. International plc

|

|

Denominations:

|

|

US$200,000 with integral multiples of US$1,000 in excess thereof

|

|

Settlement:

|

|

DTC, Euroclear and Clearstream

|

|

Listing:

|

|

Application will be made to the Irish Stock Exchange for the notes to be admitted to the Official List and trading on its regulated market. No assurance is offered as to whether listing and admission to trading will occur by the settlement date. They may not occur until a date that is later than the settlement date.

|

SELLING RESTRICTIONS

European Economic Area

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”), each of the Joint Lead Managers has or will have represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date”) it has not made and will not make an offer of notes to the public in that Relevant Member State prior to the publication of a prospectus in relation to the notes which has been approved by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member State and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Directive, except that it may, with effect from and including the Relevant Implementation Date, make an offer of notes to the public in that Relevant Member State at any time:

(a)

to legal entities which are qualified investors as defined in the Prospectus Directive;

(b)

to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the relevant Dealer or Dealers nominated by the Issuer for any such offer

; or

(c)

in any other circumstances

falling within Article 3(2)

of the Prospectus Directive.

For the purposes of this provision, the expression an “offer of notes to the public” in relation to any notes in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe the notes, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State and the expression “Prospectus Directive” means Directive 2003/71/EC

(and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in the Relevant Member State and the expression “2010 PD Amending Directive” means Directive 2010/73/EU

.

This EEA selling restriction is in addition to any other selling restrictions set out below.

United Kingdom

This document is only being distributed to and is only directed at (i) persons who are outside the United Kingdom or (ii) to investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). The notes are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such notes will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

Each of the Joint Lead Managers has or will have represented and agreed that:

(a) it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000 (the “FSMA”)) received by it in connection with the issue or sale of the notes in circumstances in which Section 21(1) of the FSMA does not apply to us; and

(b) it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the notes in, from or otherwise involving the United Kingdom.

This communication is intended for the sole use of the person to whom it is provided by us.

Any sales by Credit Suisse Securities (Europe) Limited in the United States will be made through its US affiliated broker-dealer Credit Suisse Securities (USA) LLC. Any sales by Goldman Sachs International in the United States will be made through its US affiliated broker-dealer Goldman, Sachs & Co. Any sales by Morgan Stanley & Co. International plc will be made through its US affiliated broker-dealer Morgan Stanley & Co. LLC.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Credit Suisse Securities (USA) LLC toll-free at 1-800-221-1037, Goldman, Sachs

& Co.

toll-free at 1-866 471 2526 or Morgan Stanley & Co. LLC toll-free at 1-800-584-6837.

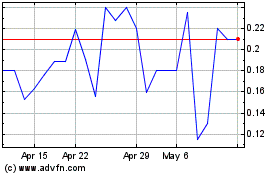

BlueFire Equipment (PK) (USOTC:BLFR)

Historical Stock Chart

From Oct 2024 to Nov 2024

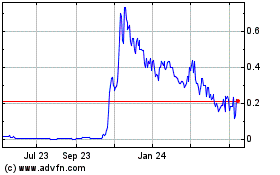

BlueFire Equipment (PK) (USOTC:BLFR)

Historical Stock Chart

From Nov 2023 to Nov 2024