Robex Secures Temporary Financing of $5 Million for the Nampala Mine

May 08 2014 - 10:42AM

Marketwired Canada

Robex Resources inc. ("Robex" or the "Company") (TSX VENTURE:RBX)(FRANKFURT:RB4)

confirms the closing of a CDN$5 million revolving credit facility (the "Credit

Facility") provided by Mr. Georges Cohen, President and CEO of the Company. The

purpose of the Credit Facility is to meet the cash flow needs of the Company as

it prepares to enter into the production phase of its Nampala mine in Mali (the

"Mine"), to support capital expenditures, and to purchase gold production

equipment.

The Credit Facility will provide the Company a temporary source of financing in

order to allow its subsidiary, Nampala S.A., to begin the production phase of

the Mine, which is expected to occur in June 2014. The Company also requires the

temporary financing to enable the Mine to achieve its full capacity, which is

expected to occur during the third quarter of this year.

The Credit Facility has a term of one (1) year, bears an interest rate of 8% per

year, and is renewable on an annual basis. Monthly payments on the Credit

Facility are for interest only, on the portion of the capital used by Company,

and the Company can elect to repay the Credit Facility early without penalty.

The Company granted a first rank hypothec on the present and future movable

property of the Company as security for the Credit Facility.

A material change report has concurrently been filed by the Company which is

less than 21 days prior to the closing of the financing. This is explained by

the immediate cash flow needs of Nampala S.A. which otherwise would have delayed

the achievement of the Company's production objectives.

Robex Resources Inc. on social networks : Twitter, Linkedin et Viadeo

This press release contains statements that may constitute "forward-looking

information" or "forward-looking statements" as set out within the context of

security law. This forward-looking information is subject to many risks and

uncertainties, some of which are beyond Robex Inc.'s ("Robex") control. The

actual results or conclusions may differ considerably from those that have been

set out, or intimated, in this forward-looking information. There are many

factors which may cause such disparity, especially the instability of metal

market prices, the results of fluctuations in foreign currency exchange rates or

in interest rates, poorly estimated reserves, environmental risks (stricter

regulations), unforeseen geological situations, unfavourable extraction

conditions, political risks brought on by mining in developing countries,

regulatory and governmental policy changes (laws and policies), failure to

obtain the requisite permits and approvals from government bodies, or any other

risk relating to mining and development. There is no guarantee that the

circumstances anticipated in this forward-looking information will occur, or if

they do occur, how they will benefit Robex. The forward-looking information is

based on the estimates and opinions of Robex's management at the time of the

publication of the information and Robex does not assume any obligation to make

public updates or modifications to any of the forward-looking statements,

whether as a result of new information, future events, or any other cause,

except if it is required by securities laws.

The TSX Venture Exchange or its Regulation Services Provider (as defined in the

policies of the TSX Venture Exchange) accepts no liability for the authenticity

or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Augustin Rousselet

Chief Financial Officer

info@robexgold.com

+1.581.741-7421

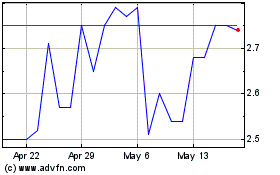

Robex Resources (TSXV:RBX)

Historical Stock Chart

From Apr 2024 to May 2024

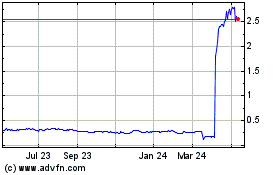

Robex Resources (TSXV:RBX)

Historical Stock Chart

From May 2023 to May 2024