Fed Eases Wells Fargo's Asset Cap to Lend to Small Businesses Harmed by Coronavirus -- 2nd Update

April 08 2020 - 3:33PM

Dow Jones News

By Ben Eisen and Andrew Ackerman

The Federal Reserve temporarily lifted restrictions on Wells

Fargo & Co.'s growth, allowing the troubled bank to make more

loans during the coronavirus crisis and giving it a chance to

improve its tarnished reputation.

The bank's lending capacity has been limited by a $1.95 trillion

cap on assets imposed by the Fed in 2018. The bank will now be able

to exceed that overall limit via loans it makes through two of the

government's small-business lending programs, the central bank said

Wednesday. The cap will remain in place for all other types of

lending.

The central bank said it would "temporarily and narrowly modify

the growth restriction on Wells Fargo so that it can provide

additional support to small businesses."

Exemptions to the limit apply to loans made through the $350

billion Paycheck Protection Program and the Federal Reserve's Main

Street Lending Program, which has yet to be rolled out. Any profits

must go to the Treasury or a nonprofit focused on small

businesses.

The change will amount to a real-time test of whether the

nation's No. 4 bank has fixed the compliance failures that led to

the cap, which was imposed after the bank was found to have created

perhaps millions of fake accounts. In October, the bank brought in

Charles Scharf as its chief executive officer, an outsider tasked

with helping the bank resolve outstanding regulatory issues.

"The Federal Reserve's action does not -- and should not -- in

any way relieve us of our obligations" under the Fed's asset cap,

Mr. Scharf said in a statement.

However, the temporary reprieve may help Mr. Scharf to rebuild

the bank's reputation among regulators and politicians who have

long taken a critical view of the bank, according to Jaret Seiberg,

a policy analyst at Cowen.

House Financial Services Committee Chairwoman Maxine Waters (D.,

Calif.) told Mr. Scharf last month: "The bank you inherited is

essentially a lawless organization that has caused widespread harm

to millions of consumers throughout the nation."

In recent days, Wells Fargo has been more vocal about the

burdens of the asset cap in the current crisis. It said on Sunday

that the balance-sheet restrictions forced it to limit lending

through the Paycheck Protection Program to $10 billion. It has been

prioritizing loans to business customers and nonprofits with fewer

than 50 employees.

Kim Gorton, CEO of Slade Gorton & Co., a Boston-based

seafood processor and distributor, said she hasn't been able to get

a Payment Protection Program loan through Wells Fargo despite

repeated attempts that began on Friday. The bank is her primary

lender.

A Wells Fargo representative told her Monday morning that her

company wouldn't be eligible because the asset cap had limited the

bank's ability to handle loans, she said. Slade Gorton employs

roughly 85 people, including about 25 who are on furlough. Wells

Fargo is a large commercial lender in the $100 billion seafood

industry, which is struggling right now as restaurants shut

down.

"It's not just my little company getting put in this situation,"

she said on Monday. "It's thousands of other companies."

Wells Fargo said on Wednesday afternoon that it would widen its

criteria to accept applications from those who meet the program

requirements and had a business account with the bank on Feb. 15.

In the first two days of the program, more than 170,000 potential

applicants expressed interest, the bank said.

The bank's shares rose about 4.4% in afternoon trading, topping

the S&P 500's 2.9% climb.

Write to Ben Eisen at ben.eisen@wsj.com and Andrew Ackerman at

andrew.ackerman@wsj.com

(END) Dow Jones Newswires

April 08, 2020 15:18 ET (19:18 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

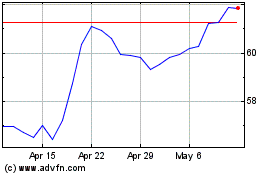

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Aug 2024 to Sep 2024

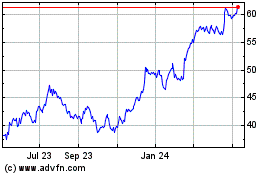

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Sep 2023 to Sep 2024