UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary

Proxy Statement |

| ¨ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive

Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting

Material under §240.14a-12 |

Ventas, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee

required. |

| ¨ |

Fee paid

previously with preliminary materials. |

| ¨ |

Fee computed

on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

On January 11, 2024, Ventas, Inc. sent the following

communication to employees:

To: All Corporate Employees

Date: 1-11-2024

Dear Colleagues,

This morning we issued a press release confirming that a shareholder

– Land & Buildings – nominated three candidates to stand for election to the Ventas Board of Directors. It’s

fairly common for shareholders to express their views publicly, and Ventas has navigated this situation before.

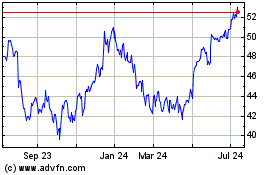

As always, our Board and management team are committed to acting in

the best interest of Ventas and our shareholders. This commitment is demonstrated by the value we have created for shareholders and the

performance of our business, including the 2023 business accomplishments I recently shared with you. Through your efforts, Ventas’s

total shareholder return (TSR) has outperformed key benchmarks in the long- and short-term, including both the Nareit Healthcare REIT

index and the RMS REIT benchmark for the past two years – and over the past 24 years! The attached summary demonstrates Ventas's

outperformance for shareholders.

In terms of next steps, we have a small group focused on this matter

and our Board will follow its normal governance practices with respect to the new nominations.

All of us will remain focused on business as usual at Ventas, building

on our positive accomplishments and momentum. Together, I am confident we will capitalize on the strong demographic tailwinds supporting

our business – and the significant demand advantage we enjoy compared to the broader commercial real estate market – as we

enable exceptional environments that benefit the large and growing aging population.

Please promptly refer any inquiries and communications (a) from

the media to Molly McEvily and Jamie Tully; and (b) from analysts or investors to BJ Grant and Emmett Simmons.

If you have questions, feel free to speak to your executive leader

or others in the Ventas Leadership Team. We are available to support you and answer your questions.

Thank you, and let’s keep up the great work, continue making

meaningful progress and drive performance for all our stakeholders.

Sincerely,

Debra A. Cafaro

Chairman and Chief Executive Officer

Forward-Looking Statements

This communication includes forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements include, among others, statements of expectations, beliefs, future plans and strategies, anticipated

results from operations and developments and other matters that are not historical facts. Forward-looking statements include, among other

things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “assume,”

“may,” “will,” “project,” “expect,” “believe,” “intend,” “anticipate,”

“seek,” “target,” “forecast,” “plan,” “potential,” “opportunity,”

“estimate,” “could,” “would,” “should” and other comparable and derivative terms or the

negatives thereof.

Forward-looking statements are based on management’s beliefs

as well as on a number of assumptions concerning future events. You should not put undue reliance on these forward-looking statements,

which are not a guarantee of performance and are subject to a number of uncertainties and other factors that could cause actual events

or results to differ materially from those expressed or implied by the forward-looking statements. We do not undertake a duty to update

these forward-looking statements, which speak only as of the date on which they are made. We urge you to carefully review the disclosures

we make concerning risks and uncertainties that may affect our business and future financial performance, including those made below

and in our filings with the Securities and Exchange Commission, such as in the sections titled “Cautionary Statements - Summary

Risk Factors,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2022.

Certain factors that could affect our future results and our ability

to achieve our stated goals include, but are not limited to: (a) the impact and extended consequences of the COVID-19 pandemic and

other viruses and infections, such as flu and respiratory syncytial virus, on our revenue, level of profitability, liquidity and overall

risk exposure and the implementation and impact of regulations related to the CARES Act and other stimulus legislation and any future

COVID-19 relief measures, including the risk that some or all of the CARES Act or other COVID-19 relief payments we or our tenants, managers

or borrowers received could be recouped; (b) our ability to achieve the anticipated benefits and synergies from, and effectively

integrate, our completed or anticipated acquisitions and investments, including our ownership of the properties included in our equitized

loan portfolio; (c) our exposure and the exposure of our tenants, managers and borrowers to complex healthcare and other regulation

and the challenges and expense associated with complying with such regulation; (d) the potential for significant general and commercial

claims, legal actions, regulatory proceedings or enforcement actions that could subject us or our tenants, managers or borrowers to increased

operating costs, uninsured liabilities fines or significant operational limitations, including the loss or suspension of or moratoriums

on accreditations, licenses or certificates of need, suspension of new admissions, suspension, decertification or exclusion from federal,

state or foreign healthcare programs or the closure of facilities or communities; (e) the impact of market and general economic

conditions on us and our tenants, managers and borrowers, including economic and financial market events, such as bank failures and other

events affecting financial institutions, market volatility, increases in inflation, changes in interest rates and exchange rates, tightening

of lending standards and reduced availability of credit or capital, geopolitical conditions, supply chain pressures, rising labor costs

and historically low unemployment, events that affect consumer confidence, our occupancy rates and resident fee revenues, and the actual

and perceived state of the real estate markets, labor markets and public and private capital markets; (f) our reliance and the reliance

of our tenants, managers and borrowers on the financial, credit and capital markets and the risk that those markets may be disrupted

or become constrained, including as a result of bank failures or concerns or rumors about such events, tightening of lending standards

and reduced availability of credit or capital; (g) our ability, and the ability of our tenants, managers and borrowers, to navigate

the trends impacting our or their businesses and the industries in which we or they operate; (h) the risk of bankruptcy, inability

to obtain benefits from governmental programs, insolvency or financial deterioration of our tenants, managers, borrowers and other obligors

which may, among other things, have an adverse impact on the ability of such parties to pay obligations due to us or our financial results

and financial condition; (i) the risk that the borrowers under our loans or other investments default or that, to the extent we

are able to foreclose or otherwise acquire the collateral securing our loans or other investments, we will be required to incur additional

expense or indebtedness in connection therewith, that the assets will underperform expectations or that we may not be able to subsequently

dispose of all or part of such assets on favorable terms; (j) the recognition of reserves, allowances, credit losses or impairment

charges are inherently uncertain, may increase or decrease in the future and may not represent or reflect the ultimate value of, or loss

that we ultimately realize with respect to, the relevant assets, which could have an adverse impact on our results of operations and

financial condition; (k) the non-renewal of any leases or management agreement or defaults by tenants or managers thereunder and

the risk of our inability to replace those tenants or managers on favorable terms, if at all; (l) our ability to identify and consummate

future investments in or dispositions of healthcare assets and effectively manage our portfolio opportunities and our investments in

co-investment vehicles, joint ventures and minority interests, including our ability to dispose of such assets on favorable terms as

a result of rights of first offer or rights of first refusal in favor of third parties; (m) risks related to development, redevelopment

and construction projects, including costs associated with inflation, rising interest rates, labor conditions and supply chain pressures;

(n) our ability to attract and retain talented employees; (o) the limitations and significant requirements imposed upon our

business as a result of our status as a REIT and the adverse consequences (including the possible loss of our status as a REIT) that

would result if we are not able to comply with such requirements; (p) the risk of changes in healthcare law or regulation or in

tax laws, guidance and interpretations, particularly as applied to REITs, that could adversely affect us or our tenants, managers or

borrowers; (q) increases in our borrowing costs as a result of becoming more leveraged, including in connection with acquisitions

or other investment activity and rising interest rates; (r) our reliance on third parties to operate a majority of our assets and

our limited control and influence over such operations and results; (s) our dependency on a limited number of tenants and managers

for a significant portion of our revenues and operating income; (t) the availability, adequacy and pricing of insurance coverage

provided by our policies and policies maintained by our tenants, managers or other counterparties; (u) the occurrence of cyber incidents

that could disrupt our operations, result in the loss of confidential information or damage our business relationships and reputation;

(v) the impact of merger, acquisition and investment activity in the healthcare industry or otherwise affecting our tenants, managers

or borrowers; (w) disruptions to the management and operations of our business and the uncertainties caused by activist investors;

(x) the risk of catastrophic or extreme weather and other natural events and the physical effects of climate change; (y) the

risk of potential dilution resulting from future sales or issuances of our equity securities; and (z) the other factors set forth

in our periodic filings with the Securities and Exchange Commission.

Important Additional Information Regarding Proxy Solicitation

The

Company intends to file a proxy statement and proxy card with the SEC in connection with the solicitation of proxies for the Company’s

2024 Annual Meeting of stockholders (the “Proxy Statement” and such meeting the “2024 Annual Meeting”). The Company,

its directors and certain of its executive officers will be participants in the solicitation of proxies from stockholders in respect

of the 2024 Annual Meeting. Information regarding the names of the Company’s directors and executive officers and their respective

interests in the Company by security holdings or otherwise is set forth in the Company’s proxy statement for the 2023 Annual Meeting

of stockholders, filed with the SEC on April 5, 2023 (the “2023 Proxy Statement”) and available at https://www.sec.gov/ix?doc=/Archives/edgar/data/740260/000130817923000537/vtr4121871-def14a.htm.

Please refer to the sections captioned “Stock Ownership of Directors, Management and Certain Beneficial Owners,” “Non-Employee

Director Compensation” and “Executive Compensation” in the 2023 Proxy Statement. To the extent holdings of such participants

in the Company’s securities have changed since the amounts described in the 2023 Proxy Statement, such changes have been reflected

on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC.

Additional information can also be found in the Company’s Annual Report on Form 10-K for the year ended December 31,

2022, filed with the SEC on February 10, 2023 and available at https://www.sec.gov/ix?doc=/Archives/edgar/data/740260/000074026023000070/vtr-20221231.htm.

Details concerning the nominees of the Company’s Board of Directors for election at the 2024 Annual Meeting will be included in

the Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT

DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY AMENDMENTS AND SUPPLEMENTS

THERETO BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. These documents, including the definitive Proxy Statement (and any amendments

or supplements thereto) and other documents filed by the Company with the SEC, are available for no charge at the SEC’s website

at http://www.sec.gov and at the Company’s investor relations website at https://ir.ventasreit.com.

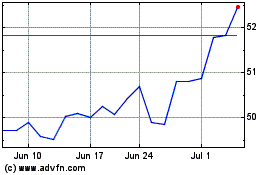

The communication to employees attached the following slide:

Ventas (NYSE:VTR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ventas (NYSE:VTR)

Historical Stock Chart

From Nov 2023 to Nov 2024