US Bancorp Issuing 10-Year Notes In US Market Tuesday -Source

February 28 2012 - 10:28AM

Dow Jones News

U.S. Bancorp. (USB) plans to sell 10-year, senior holding

company medium-term notes in the U.S. credit markets Tuesday,

according to a person familiar with the matter.

The notes, which are raising funds for general corporate

purposes, are expected to be rated Aa3 by Moody's Investors

Service, A by Standard & Poor's, AA-minus by Fitch Ratings, and

AA by DBRS.

The deal is registered with the Securities and Exchange

Commission.

U.S. Bancorp is underwriting the notes along with Barclays

Capital and Credit Suisse Group (CS, CSGN.VX).

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

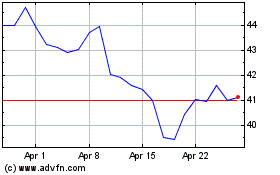

US Bancorp (NYSE:USB)

Historical Stock Chart

From May 2024 to Jun 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

From Jun 2023 to Jun 2024