Bank Failures Zoom to 51 - Analyst Blog

July 11 2011 - 6:25AM

Zacks

Following a week’s lull, U.S. regulators were back in action

last week, shuttering three more banks.

Out of these three banks, two were based in Colorado and one in

Illinois. These closures have pushed the number of failed U.S.

banks to 51 so far in 2011.

Looking back, there were 157 bank failures in 2010, 140 in 2009

and 25 in 2008.

While the financials of bigger banks have been stabilizing on

the back of an economic recovery, many smaller banks are still

struggling to survive. Nagging issues like rock-bottom home prices

along with still-high loan defaults and unemployment levels

continue to trouble such institutions.

Lingering effects of the financial crisis continue to weigh on

many banks. It becomes a prerequisite for such banks to absorb bad

loans offered during the credit explosion, making them susceptible

to severe problems. The uncertain environment is aggravating the

risk of bank failures even further.

The failed banks are:

- Chicago, Illinois-based First Chicago Bank & Trust, with

total assets of about $959.3 million and total deposits of about

$887.5 million as of March 31, 2011.

- Castle Rock, Colorado-based Colorado Capital Bank, with about

$717.5 million in total assets and $672.8 million in total deposits

as of March 31, 2011.

- Windsor, Colorado-based Signature Bank, with about $66.7

million in total assets and $64.5 million in total deposits as of

March 31, 2011.

These bank failures represent another jolt to the deposit

insurance fund (DIF), meant for protecting customer accounts, as it

has been appointed receiver for the banks.

The Federal Deposit Insurance Corporation (FDIC) insures

deposits in 7,575 banks and savings associations in the country as

well as promotes the safety and soundness of these institutions.

When a bank fails, the agency reimburses customer deposits of up to

$250,000 per account.

Though the FDIC has managed to shore up its deposit insurance

fund during the last few quarters, the ongoing bank failures have

kept it under pressure. As of March 31, 2011, the fund remained in

the red with a deficit of $1.0 billion, though substantially better

than the deficit of $7.4 billion in the prior quarter.

As the deficit significantly narrowed during the quarter and the

fund is almost close to break-even, the agency expects to swing

back to profits in the next quarter itself.

The failure of First Chicago Bank & Trust is expected to

deal a blow of about $284.3 million to the FDIC, while Colorado

Capital Bank and Signature Bank will cost about $283.8 million and

$22.3 million, respectively.

Northbrook, Illinois-based Northbrook Bank & Trust Company

has agreed to assume the entire deposits and assets of First

Chicago Bank & Trust. The FDIC and Northbrook Bank & Trust

Company have agreed to share losses on $699.8 million of First

Chicago Bank & Trust's assets.

Raleigh, North Carolina-based First-Citizens Bank & Trust

Company has agreed to assume the entire deposits and assets of

Colorado Capital Bank. The FDIC and First-Citizens Bank & Trust

Company have agreed to share losses on $580.0 million of Colorado

Capital Bank's assets.

Julesburg, Colorado-based Points West Community Bank has agreed

to assume all of the deposits and assets of Signature Bank.

The number of banks on FDIC’s list of problem institutions saw a

marginal increase to 888 in the first quarter from 884 in the

previous. This is the highest number since 928 problem institutions

way back in March 31, 1993, due to the then savings and loan

crisis.

Increasing loan losses on commercial real estate could trigger

hundreds of bank failures in the coming years. Going by the current

rate of bank insolvencies, the DIF is likely to feel a $52 billion

dent by 2014. However, considering the failure track record so far

this year, the FDIC does not expect the number of bank failures in

2011 to surpass that of 2010.

With so many bank failures, consolidation has become the

industry fashion. For almost all of the failed banks, the FDIC

enters into a purchase agreement with healthy institutions.

When Washington Mutual collapsed in 2008 (branded as the largest

bank failure in the U.S. history), it was acquired by

JPMorgan Chase & Co. (JPM) The other major

acquirers of failed institutions since 2008 include U.S.

Bancorp (USB) and BB&T Corporation

(BBT).

BB&T CORP (BBT): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

US BANCORP (USB): Free Stock Analysis Report

Zacks Investment Research

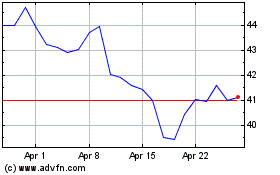

US Bancorp (NYSE:USB)

Historical Stock Chart

From Jun 2024 to Jul 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

From Jul 2023 to Jul 2024