COLLECTIVE BRND (PSS) - Profit Tracks

July 07 2011 - 8:00PM

Zacks

Since inception in 1988, the S&P 500 has outperformed the Zacks

#5 Rank List - Stocks to Sell Now by 80% annually (+2% versus

+10%). While the rest of Wall Street continued to tout stocks

during the market declines of the last few years, Zacks told

investors which stocks to sell or avoid.

Here is a synopsis of why HTHT and PSS have a Zacks Rank of #5

(Strong Sell) and should most likely be sold or avoided for the

next one to three months. Note that a #5 Strong Sell rating is

applied to 5% of all the stocks in the Zacks Rank universe:

China Lodging Group, Ltd (HTHT) announced its first

-quarter loss of 4 cents per share on May 10 that lagged analysts?

expectations by 300%. Moreover the diluted earnings per share fell

by 200% on a year-over-year basis. The Zacks Consensus Estimate for

the current year slipped 5 cents per share to 0.44 cents in the

last 60 days. Next year?s estimate dipped 8 cents per share to 0.83

cents per share in that time span.

Collective Brands Inc. (PSS) posted a first-quarter

profit of 42 cents per share on May 24, which came in 40 cents

wider than the average forecast. The diluted earnings per share

fell 49% as compared to results of 2011. Net sales dipped by a

percent on a year-over-year basis. The Zacks Consensus Estimate for

2012 fell to a profit of $1.13 per share from $1.28 over the past

month as 2 out of the 6 covering analysts slashed forecasts. Next

year?s forecasts slipped 11 cents to $1.54 cents per share in the

same time span.

Here is a synopsis of why THS and SAM have a Zacks Rank of 4

(Sell) and should also most likely be sold or avoided for the next

one to three months. Note that a #4 Sell rating is applied to 15%

of all the stocks ranked by Zacks;

TreeHouse Foods Inc. (THS) first-quarter profit of 0.59

cents per share, posted on May 5, lagged analysts? projections by

nearly 11 %. For 2011, the Zacks Consensus Estimate moved down 16

cents in the last 30 days as 13 out of the 14 covering analysts cut

back on forecasts. Forecast for next year slid 10 cents to $3.37

per share in the same time span.

The Boston Bear Company, Inc. (SAM) reported a

first-quarter profit of 28 cents per share on May 4, that fell 38%

short of the Zacks Consensus Estimate. The full-year average

forecast is currently pegged at $3.54 cents per share, compared

with last 60 days projection of $3.59. Next year?s forecast dropped

9 cents per share in the same period.

CHINA LODGING (HTHT): Free Stock Analysis Report

COLLECTIVE BRND (PSS): Free Stock Analysis Report

BOSTON BEER INC (SAM): Free Stock Analysis Report

TREEHOUSE FOODS (THS): Free Stock Analysis Report

Zacks Investment Research

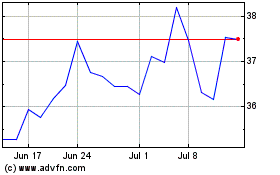

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jun 2024 to Jul 2024

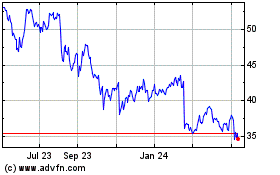

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jul 2023 to Jul 2024