WESTCHESTER, Ill., Feb. 14 /PRNewswire-FirstCall/ -- TreeHouse

Foods, Inc. (NYSE:THS) today reported a substantial increase in

adjusted full year earnings compared to last year, after one-time

items. On an adjusted basis, as described below, fully-diluted

earnings per share improved significantly to $1.32 compared to

$1.06 last year. Income from continuing operations before

adjustments was $1.33 per diluted share for the year ended December

31, 2007, compared to $1.42 per diluted share last year. The

reported results for this year include negative effects of purchase

accounting adjustments from the purchase of the E.D. Smith Income

Trust ("E.D. Smith") totaling approximately $0.09 per share. These

costs were offset by a one-time exchange gain of $0.07 per share

related to a forward currency contract used to hedge the Canadian

dollar purchase price of E.D. Smith and a favorable tax adjustment

related to deferred tax liabilities at E.D. Smith of $0.03 per

share. The reported results for last year benefited from the

curtailment of certain post employment benefit obligations of $0.57

per share, partially offset by trademark write-downs of $0.16 per

share, net costs associated with closed facilities and purchase

accounting adjustments related to the Company's acquisition of the

soup and infant feeding business earlier last year of $0.05 per

share. ITEMS AFFECTING DILUTED EPS COMPARABILITY: Three Months

Ended Twelve Months Ended December 31 December 31 2007 2006 2007

2006 (unaudited) (unaudited) EPS as reported $0.46 $0.70 $1.33

$1.42 Gain on curtailment of post retirement benefits plan (0.57)

(0.57) Gain on foreign currency hedge transaction (0.07) (0.07)

Acquisition integration and accounting adjustments 0.09 0.09 0.03

Plant closing costs 0.01 0.02 Tax benefits from revaluation of

deferred tax liabilities (0.03) (0.03) Write-down of trade names -

0.16 - 0.16 Adjusted EPS $0.45 $0.30 $1.32 $1.06 Excluding these

unusual items in 2007 and 2006, operating results would have been

$1.32 per fully-diluted share in 2007 compared to $1.06 in 2006.

The improvement in results was achieved primarily in our core

business before the 2007 acquisitions as we focused on a

combination of pricing programs to offset commodity cost inflation

and internal efficiencies to improve our operating gross margins.

Commenting on the results, Sam K. Reed, Chairman and CEO, said,

"Our 2007 results indicate that despite a slower than expected

start to the year and input cost inflation that escalated beyond

all food industry expectations, we have shown that strategic

pricing decisions and an aggressive program of internal cost

savings can overcome daunting external influences. We are

especially pleased to finish the year at the high end of our

expectations despite the unprecedented headwinds we faced this

year." Adjusted operating earnings before interest, taxes,

depreciation, amortization and unusual items (Adjusted EBITDA,

reconciled to net income, the most directly comparable GAAP

measure, on the attached schedule) increased to $46.2 million in

the fourth quarter compared to $31.5 million in the same period

last year. The increase is due primarily to the addition of the San

Antonio Farms and E.D. Smith acquisitions but also reflects

improved margins in the legacy businesses. Full year Adjusted

EBITDA was $137.6 million compared to $109.3 million last year, an

increase of 25.9%, which exceeds the 23.3% year-over-year growth in

total revenues. Net sales for the fourth quarter totaled $370.9

million, an increase of 31.1% over the fourth quarter of 2006.

Organic sales improved 4.5% while revenues from acquired companies

contributed the balance. Gross margins for the fourth quarter

improved 13 basis points to 20.5% despite significant input cost

increases over the prior year. The improved margins resulted from a

combination of pricing programs designed to recover escalating

input costs, improved plant efficiencies and internal cost savings

programs. Excluding new acquisitions, margins improved to 21.6% in

the fourth quarter from 20.3% last year, reflecting three straight

quarters of gross margin improvement as all of our reporting

segments registered year-over-year margin improvement in the fourth

quarter. Selling, distribution, general and administrative expenses

were $44.8 million for the quarter, an increase from $36.6 million

in the fourth quarter of 2006. The increase was due to the growth

of the Company from new acquisitions in 2007. Excluding

acquisitions, operating expenses would have been lower by $1.4

million due to lower stock option expense of $1.4 million. Selling,

general and administrative expenses as a percent of sales improved

to 12.1% of sales in the fourth quarter of 2007 compared to 13.0%

last year. Other operating expense for the fourth quarter of 2007

was immaterial, compared to a gain of $21.1 million in 2006. During

the fourth quarter of 2006, the Company recorded a curtailment gain

as a result of transferring the post retirement medical benefits of

certain union employees from a company funded plan to a

multiemployer union sponsored plan. The gain totaled $29.4 million

($18.1 million after tax, or $0.57 per share) and represented the

accumulated benefit obligations to be administered by the union

plan and reimbursed by the Company on a "pay as you go" basis in

the future. Partially offsetting the gain on curtailment was a

charge of $8.2 million ($0.16 per share) to write down the value of

the Mocha Mix trademark. Interest expense in the quarter was $9.2

million compared to $4.6 million last year due to higher bank debt

used to fund the San Antonio Farms and E.D. Smith acquisitions. The

Company's fourth quarter effective income tax rate of 35.8% was

lower than the full year run rate of 37.4% due to a positive mix of

lower corporate tax rates in Canada associated with the Ontario

operations of E.D. Smith and a one-time credit to revalue deferred

tax liabilities using new Canadian statutory rates. Net income from

continuing operations for the fourth quarter totaled $14.3 million

compared to $22.4 million last year. Fully-diluted earnings per

share for the quarter were $0.46 per share compared to $0.70 per

share last year. Excluding one-time adjustments of $0.09 to revalue

inventories acquired in the E.D. Smith acquisition, a one-time

foreign currency hedge gain of $0.07 and a favorable tax adjustment

relating to deferred tax liabilities at E.D. Smith of $0.03,

adjusted operating earnings per share would have been $0.45. Last

year's results included a gain on curtailment of $0.57, trademark

write-downs of $0.16 and plant closure costs of $0.01. Excluding

these unusual items in 2007 and 2006, the adjusted earnings per

share of $0.45 compares to $0.30 per share last year, an increase

of 50%. "Our fourth quarter results are the culmination of a year

long campaign to counter the effects of commodity inflation. They

demonstrate our determination to progress under even the most

volatile of market conditions. We showed revenue growth and margin

improvement both sequentially and compared to last year and

maintained our focus on operating cost efficiencies, all while

integrating new businesses into our Bay Valley Foods operating

company," commented Mr. Reed. SEGMENT RESULTS Pickle segment net

sales for the fourth quarter increased by 8.3% or approximately

$6.2 million from the prior year as higher foodservice revenues

from the addition of the DeGraffenreid acquisition and higher

retail pricing drove the increase. Adjusted gross margins improved

as well, finishing at 13.1% in the quarter compared to 12.6% last

year. The combination of pricing and productivity gains contributed

to the improvement. Adjusted gross margin ("AGM") is gross profit

less delivery and commission costs and is TreeHouse's measure of

segment performance. Powder segment sales increased by 20.8%

compared to the same quarter last year as organic growth and

pricing contributed to the gain. Adjusted gross margins also

improved despite the significant increases in non-diary creamer

input costs (casein, palm and coconut oils). AGM in the quarter was

20.2% compared to 19.2% last year. Soup and infant feeding sales

declined from $102.8 million last year to $95.2 million this year

as a result of lower branded baby food sales. In addition, soup

sales were down slightly from a year ago as the entire soup

category experienced lower than expected sales, which we believe

were negatively affected by an unseasonably warm autumn. Adjusted

gross margins for the quarter improved to 14.2% compared to 12.4%

last year as a result of both pricing and internal efficiency

measures. GUIDANCE FOR 2008 We expect that 2008 will not see an

abatement in commodity cost increases, requiring continuing

pressure to drive internal efficiencies while passing along input

costs that we do not control. Our primary focus will be to continue

to grow our businesses organically, push for margin enhancement,

integrate E.D. Smith's Canadian operations and maintain our

strategy of growth through acquisitions. Net sales are expected to

increase by 28% to 29% in 2008 due to having a full 12 months of

the San Antonio Farms and E.D. Smith businesses in our 2008

results. Input costs are expected to continue to increase, possibly

faster than the Company's ability to raise prices. However, by

maintaining focus on productivity programs, we expect to hold our

overall gross margins steady and to increase them where

opportunities exist. We expect net income before one-time items to

be in the range of $1.50 to $1.55 per diluted share. The full year

guidance assumes first quarter earnings per share to be $0.24 to

$0.26 compared to $0.24 last year. The relatively small improvement

over last year's first quarter earnings per share of $0.24 reflects

the lag effect of recent pricing and productivity actions at E.D.

Smith, which are not expected to be fully realized until late in

the second quarter. Yesterday we announced our intention to close

our Portland, Oregon pickle plant in early June 2008. The plant has

88 employees. An adjacent distribution center is not a part of the

pickle plant closure. The Company will record a non-recurring,

pre-tax charge to operating income of approximately $22 million, or

$0.44 per share, in its first fiscal quarter ending March 31, 2008.

Ongoing annual cost savings from the closing are expected to be

$5.7 million. Due to the timing of the closing, cost savings in

2008 are not expected to be significant. The charge will be a

non-recurring item and has not been included in the guidance

information for 2008. Commenting on the outlook for 2008, Sam K.

Reed said, "We performed very well in 2007 despite extraordinary

input cost increases that were approximately four times the level

the food industry expected. Although we can hope for improvement in

commodity prices in 2008, the hard reality is that we fully expect

another year of increases. Despite the continued need to pass these

costs along to customers, our teams have shown their ability to

manage in a very difficult environment and to drive internal

efficiencies. Both the San Antonio Farms and E.D. Smith

acquisitions will open new markets for our portfolio of private

label and foodservice products. We believe that our guided growth

in earnings of 13% to 16% before considering any new acquisitions

in 2008 represents an aggressive target in these market conditions

but one we are confident of achieving." COMPARISON OF ADJUSTED

INFORMATION TO GAAP INFORMATION The adjusted financial results

contained in this press release are from continuing operations and

are adjusted to eliminate the net expense or net gain related to

items identified below. This information is provided in order to

allow investors to make meaningful comparisons of the Company's

operating performance between periods and to view the Company's

business from the same perspective as Company management. Because

the Company cannot predict the timing and amount of charges

associated with non-recurring items or facility closings and

reorganizations, management does not consider these costs when

evaluating the Company's performance, when making decisions

regarding the allocation of resources, in determining incentive

compensation for management, or in determining earnings estimates.

These costs are not recorded in any of the Company's operating

segments. Adjusted EBITDA represents net income before interest

expense, income tax expense, depreciation and amortization expense,

and non-recurring items. Adjusted EBITDA is a performance measure

and liquidity measure used by our management, and we believe is

commonly reported and widely used by investors and other interested

parties, as a measure of a company's operating performance and

ability to incur and service debt. This non-GAAP financial

information is provided as additional information for investors and

is not in accordance with or an alternative to GAAP. These non-GAAP

measures may be different from similar measures used by other

companies. A full reconciliation table between earnings for the

three and twelve month periods ended December 31, 2007 and December

31, 2006 calculated according to GAAP and Adjusted EBITDA is

attached. Conference Call Webcast A webcast to discuss the

Company's financial results will be held at 8:00 a.m. (Eastern

Standard Time) today and may be accessed by visiting the "Investor

Overview" page through the "Investor Relations" menu of the

Company's website at http://www.treehousefoods.com/. About

TreeHouse Foods TreeHouse is a food manufacturer servicing

primarily the retail grocery and foodservice channels. Its products

include non-dairy powdered coffee creamer; canned soup, salad

dressings and sauces; salsa and Mexican sauces; jams, jellies and

pie fillings under the E.D. Smith brand name; pickles and related

products; infant feeding products; and other food products

including aseptic sauces, refrigerated salad dressings, and liquid

non-dairy creamer. TreeHouse believes it is the largest

manufacturer of pickles and non-dairy powdered creamer in the

United States based on sales volume. FORWARD LOOKING STATEMENTS

This press release contains "forward-looking statements."

Forward-looking statements include all statements that do not

relate solely to historical or current facts, and can generally be

identified by the use of words such as "may," "should," "could,"

"expects," "seek to," "anticipates," "plans," "believes,"

"estimates," "intends," "predicts," "projects," "potential" or

"continue" or the negative of such terms and other comparable

terminology. These statements are only predictions. The outcome of

the events described in these forward-looking statements is subject

to known and unknown risks, uncertainties and other factors that

may cause the Company or its industry's actual results, levels of

activity, performance or achievements to be materially different

from any future results, levels of activity, performance or

achievement expressed or implied by these forward-looking

statements. TreeHouse's Form 10-K for the year ended December 31,

2006 and its subsequent quarterly reports discuss some of the

factors that could contribute to these differences. You are

cautioned not to unduly rely on such forward-looking statements,

which speak only as of the date made, when evaluating the

information presented in this presentation. The Company expressly

disclaims any obligation or undertaking to disseminate any updates

or revisions to any forward-looking statement contained herein, to

reflect any change in its expectations with regard thereto, or any

other change in events, conditions or circumstances on which any

statement is based. FINANCIAL INFORMATION TREEHOUSE FOODS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In thousands, except

per share data) Three Months Ended Twelve Months Ended December 31

December 31 2007 2006 2007 2006 (unaudited) (unaudited) Net sales

$370,936 $282,870 $1,157,902 $939,396 Cost of sales 295,073 225,395

917,611 738,818 Gross profit 75,863 57,475 240,291 200,578

Operating expenses: Selling and distribution 30,228 21,804 94,636

74,884 General and administrative 14,593 14,836 53,931 57,914 Other

operating income, net (106) (21,087) (415) (19,842) Amortization

expense 3,269 993 7,195 3,268 Total operating expenses 47,984

16,546 155,347 116,224 Operating income 27,879 40,929 84,944 84,354

Other (income) expense: Foreign currency hedge income (3,270) -

(3,270) - Interest expense 9,186 4,592 22,036 12,985 Interest

income (54) (147) (112) (665) Other (income), net (235) - (235) -

Total other expense 5,627 4,445 18,419 12,320 Income from

continuing operations before income taxes 22,252 36,484 66,525

72,034 Income taxes 7,974 14,057 24,873 27,333 Income from

continuing operations 14,278 22,427 41,652 44,701 Income (loss)

from discontinued operations, net of tax - 178 (30) 155 Net income

$14,278 $22,605 $41,622 $44,856 Weighted average common shares:

Basic 31,203 31,202 31,203 31,158 Diluted 31,340 31,886 31,351

31,396 Basic earnings per common share: Income from continuing

operations $0.46 $0.72 $1.33 $1.43 Income from discontinued

operations, net of tax - - - 0.01 Net income $0.46 $0.72 $1.33

$1.44 Diluted earnings per common share: Income from continuing

operations $0.46 $0.70 $1.33 $1.42 Income from discontinued

operations, net of tax - 0.01 - 0.01 Net income $0.46 $0.71 $1.33

$1.43 Supplemental Information: Depreciation and Amortization

10,744 6,633 34,983 24,651 Expense under FAS123R, before tax 3,358

4,799 13,580 18,794 Segment Information: Pickle Segment Net Sales

81,575 75,353 329,686 326,313 Adjusted Gross Margin 10,682 9,480

40,463 42,874 Adjusted Gross Margin Percent 13.1% 12.6% 12.3% 13.1%

Powder Segment Net Sales 91,716 75,912 299,191 267,385 Adjusted

Gross Margin 18,492 14,575 57,654 50,822 Adjusted Gross Margin

Percent 20.2% 19.2% 19.3% 19.0% Soup & Infant Feeding Segment

Net Sales 95,200 102,795 322,223 224,189 Adjusted Gross Margin

13,521 12,719 48,107 30,375 Adjusted Gross Margin Percent 14.2%

12.4% 14.9% 13.5% The following table reconciles our net income to

adjusted EBITDA for the three and twelve months ended December 31,

2007 and 2006: TREEHOUSE FOODS, INC. RECONCILIATION OF REPORTED

EARNINGS TO ADJUSTED EBITDA (In thousands, except per share data)

Three Months Ended Twelve Months Ended December 31 December 31 2007

2006 2007 2006 (unaudited) (unaudited) Net income as reported

$14,278 $22,605 $41,622 $44,856 Interest expense 9,186 4,592 22,036

12,985 Interest income (54) (147) (112) (665) Income taxes 7,974

14,057 24,873 27,333 Discontinued operations - (178) 30 (155)

Depreciation and amortization 10,744 6,633 34,983 24,651 Stock

option expense 3,358 4,799 13,580 18,794 Gain on curtailment of

post retirement benefits plan - (29,409) - (29,409) Gain on foreign

currency hedge transaction (3,270) - (3,270) - Acquisition

integration and accounting adjustments 4,012 230 4,170 1,355

Write-down of trade names - 8,200 - 8,200 Plant shut-down costs and

asset sales of closed facilities - 124 (274) 1,370 Adjusted EBITDA

$46,228 $31,506 $137,638 $109,315

http://www.newscom.com/cgi-bin/prnh/20050726/CGTREELOGO

http://photoarchive.ap.org/ DATASOURCE: TreeHouse Foods, Inc.

CONTACT: Investor Relations of TreeHouse Foods, Inc.,

+1-708-483-1300, ext. 1331 Web site: http://www.treehousefoods.com/

Copyright

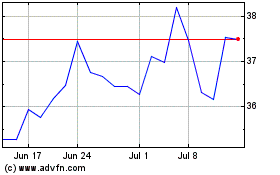

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jun 2024 to Jul 2024

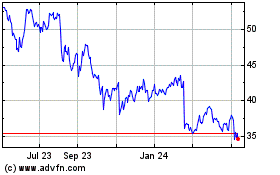

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jul 2023 to Jul 2024