- Revenue down $332 million, or 10.7% from prior year largely due

to COVID-19 impacts

- EPS of $0.22; adjusted EPS of $0.35, excluding first quarter

special charges

- Strong liquidity position, Q1 2020 ending cash balance of $2.4

billion

Textron Inc. (NYSE: TXT) today reported first quarter 2020 net

income of $0.22 per share, compared to $0.76 per share in the first

quarter of 2019. Adjusted net income, a non-GAAP measure, was $0.35

per share for the first quarter of 2020, which excludes $39 million

of pre-tax special charges ($0.13 per share, after-tax) recorded in

the first quarter, related to the impairment of intangible assets

at Textron Aviation and Industrial due to economic disruptions

caused by the COVID-19 pandemic.

“Our team is meeting the unprecedented challenges presented by

this pandemic with a commitment to the health and safety of our

employees and communities while meeting customer commitments,” said

Textron Chairman and CEO Scott C. Donnelly. “We have taken measures

to reduce cost and conserve cash, including temporary plant

shutdowns and employee furloughs at many of our commercial

businesses. While the effects of COVID-19 on many of our end

markets has been unfavorable, Bell and Textron Systems delivered

higher revenue and strong margin performance for the quarter in

their military businesses.”

Cash Flow

Net cash used by operating activities of continuing operations

of the manufacturing group for the first quarter was $393 million,

compared to $196 million of net cash used last year. Manufacturing

cash flow before pension contributions, a non-GAAP measure that is

defined and reconciled to GAAP in an attachment to this release,

reflected a use of cash of $430 million compared to a use of cash

of $291 million last year.

First Quarter Segment Results

Textron Aviation

Revenues at Textron Aviation of $872 million were down $262

million in the first quarter of 2019, primarily due to lower volume

and mix of $260 million, largely the result of lower Citation jet

volume of $154 million and lower commercial turboprop volume of $99

million. The decrease in Citation jet and turboprop volume

reflected a decline in demand related to the pandemic, disruption

in our composite manufacturing production due to a plant accident

that occurred in December 2019, and delays in the acceptance of

aircraft related to COVID-19 travel restrictions.

Textron Aviation delivered 23 jets, down from 44 last year, and

16 commercial turboprops, down from 44 last year.

Segment profit was $3 million in the first quarter, down $103

million from a year ago, primarily due to the lower volume and the

unfavorable impact of $23 million from performance, which includes

$12 million of idle facility costs recognized in the first quarter

of 2020 due to temporary manufacturing facility closures and

employee furloughs resulting from the COVID-19 pandemic.

Textron Aviation backlog at the end of the first quarter was

$1.4 billion.

Bell

Bell revenues were $823 million, up $84 million or 11% from last

year, primarily on higher military volume, partially offset by

lower commercial volume.

Bell delivered 15 commercial helicopters in the quarter, down

from 30 last year.

Segment profit of $115 million was up $11 million, largely on

higher military volume partially offset by the unfavorable impact

of $8 million from performance and other. Performance and other

included $25 million in lower net favorable program adjustments,

partially offset by lower research and development costs.

Bell backlog at the end of the first quarter was $6.4

billion.

Textron Systems

Revenues at Textron Systems were $328 million, up $21 million or

7% from last year, primarily due to higher volume in most product

lines.

Segment profit of $26 million was down $2 million from last

year, as unfavorable performance was largely offset by the impact

of higher volume.

Textron Systems’ backlog at the end of the first quarter was

$1.4 billion.

Industrial

Industrial revenues were $740 million, a decrease of $172

million from last year, primarily related to lower volume and mix

in the Fuel Systems and Functional Components product line from

manufacturing facility closures related to the COVID-19 pandemic

that began in China in January and expanded to European and North

American locations by the end of the quarter.

Segment profit of $9 million was down $41 million from the first

quarter of 2019, primarily related to the lower volume and mix.

Industrial also realized approximately $13 million of unfavorable

performance in the first quarter due to manufacturing facility

closures and employee furloughs resulting from the COVID-19

pandemic, that was mostly offset by other favorable

performance.

Finance

Finance segment revenues were down $3 million, and profit was

down $3 million from last year’s first quarter.

Outlook

“Textron is well-prepared to handle this period of uncertainty.

Our financial profile consists of ample liquidity and diversified

revenue streams. We are confident in the actions we are taking

during this downturn and we expect them to position us for success

as we begin to exit this global shutdown,” said Textron Chairman

and CEO Scott C. Donnelly.

Conference Call Information

Textron will host its conference call today, April 30, 2020 at

8:00 a.m. (Eastern) to discuss its results and outlook. The call

will be available via webcast at www.textron.com or by direct dial

at (844) 721-7241 in the U.S. or (409) 207-6955 outside of the

U.S.; Access Code: 4252363.

In addition, the call will be recorded and available for

playback beginning at 11:00 a.m. (Eastern) on Thursday, April 30,

2020 by dialing (402) 970-0847; Access Code: 1767619.

A package containing key data that will be covered on today’s

call can be found in the Investor Relations section of the

company’s website at www.textron.com.

About Textron Inc.

Textron Inc. is a multi-industry company that leverages its

global network of aircraft, defense, industrial and finance

businesses to provide customers with innovative solutions and

services. Textron is known around the world for its powerful brands

such as Bell, Cessna, Beechcraft, Hawker, Jacobsen, Kautex,

Lycoming, E-Z-GO, Arctic Cat, Textron Systems, and TRU Simulation +

Training. For more information visit: www.textron.com.

Forward-looking Information

Certain statements in this release and other oral and written

statements made by us from time to time are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements, which may

describe strategies, goals, outlook or other non-historical

matters, or project revenues, income, returns or other financial

measures, often include words such as “believe,” “expect,”

“anticipate,” “intend,” “plan,” “estimate,” “guidance,” “project,”

“target,” “potential,” “will,” “should,” “could,” “likely” or “may”

and similar expressions intended to identify forward-looking

statements. These statements are only predictions and involve known

and unknown risks, uncertainties, and other factors that may cause

our actual results to differ materially from those expressed or

implied by such forward-looking statements. Given these

uncertainties, you should not place undue reliance on these

forward-looking statements. Forward-looking statements speak only

as of the date on which they are made, and we undertake no

obligation to update or revise any forward-looking statements. In

addition to those factors described in our Annual Report on Form

10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”,

among the factors that could cause actual results to differ

materially from past and projected future results are the

following: Interruptions in the U.S. Government’s ability to fund

its activities and/or pay its obligations; changing priorities or

reductions in the U.S. Government defense budget, including those

related to military operations in foreign countries; our ability to

perform as anticipated and to control costs under contracts with

the U.S. Government; the U.S. Government’s ability to unilaterally

modify or terminate its contracts with us for the U.S. Government’s

convenience or for our failure to perform, to change applicable

procurement and accounting policies, or, under certain

circumstances, to withhold payment or suspend or debar us as a

contractor eligible to receive future contract awards; changes in

foreign military funding priorities or budget constraints and

determinations, or changes in government regulations or policies on

the export and import of military and commercial products;

volatility in the global economy or changes in worldwide political

conditions that adversely impact demand for our products;

volatility in interest rates or foreign exchange rates; risks

related to our international business, including establishing and

maintaining facilities in locations around the world and relying on

joint venture partners, subcontractors, suppliers, representatives,

consultants and other business partners in connection with

international business, including in emerging market countries; our

Finance segment’s ability to maintain portfolio credit quality or

to realize full value of receivables; performance issues with key

suppliers or subcontractors; legislative or regulatory actions,

both domestic and foreign, impacting our operations or demand for

our products; our ability to control costs and successfully

implement various cost-reduction activities; the efficacy of

research and development investments to develop new products or

unanticipated expenses in connection with the launching of

significant new products or programs; the timing of our new product

launches or certifications of our new aircraft products; our

ability to keep pace with our competitors in the introduction of

new products and upgrades with features and technologies desired by

our customers; pension plan assumptions and future contributions;

demand softness or volatility in the markets in which we do

business; cybersecurity threats, including the potential

misappropriation of assets or sensitive information, corruption of

data or, operational disruption; difficulty or unanticipated

expenses in connection with integrating acquired businesses; the

risk that acquisitions do not perform as planned, including, for

example, the risk that acquired businesses will not achieve revenue

and profit projections; the impact of changes in tax legislation;

and risks and uncertainties related to the impact of the COVID-19

pandemic on our business and operations.

TEXTRON INC.

Revenues by Segment and

Reconciliation of Segment Profit to Net Income

(Dollars in millions, except per

share amounts)

(Unaudited)

Three Months Ended

April 4,

2020

March 30,

2019

REVENUES MANUFACTURING: Textron

Aviation

$

872

$

1,134

Bell

823

739

Textron Systems

328

307

Industrial

740

912

2,763

3,092

FINANCE

14

17

Total revenues

$

2,777

$

3,109

SEGMENT PROFIT

MANUFACTURING: Textron Aviation

$

3

$

106

Bell

115

104

Textron Systems

26

28

Industrial

9

50

153

288

FINANCE

3

6

Segment Profit

156

294

Corporate expenses and other, net

(14

)

(47

)

Interest expense, net for Manufacturing group

(34

)

(35

)

Special charges (a)

(39

)

-

Income before income taxes

69

212

Income tax expense

(19

)

(33

)

Net Income

$

50

$

179

Earnings Per Share

$

0.22

$

0.76

Diluted average shares outstanding

228,927,000

236,437,000

Net Income and Diluted Earnings Per Share (EPS)

GAAP to Non-GAAP Reconciliation: Three Months

EndedApril 4, 2020 Diluted EPS Net income - GAAP

$

50

$

0.22

Add: Special charges, net of taxes (a)

30

0.13

Adjusted net income - Non-GAAP (b)

$

80

$

0.35

(a)

Special charges included the impairment of indefinite-lived trade

name intangible assets totaling $32 million in the Textron Aviation

segment and $7 million in the Industrial segment resulting from

changes in valuation assumptions related to the economic and

business disruptions caused by the COVID-19 pandemic. (b) Adjusted

net income and adjusted diluted earnings per share are non-GAAP

financial measures as defined in "Non-GAAP Financial Measures"

attached to this release.

Textron Inc.

Condensed Consolidated Balance Sheets (In millions)

(Unaudited)

April 4,2020 January 4,2020

Assets Cash and equivalents

$

2,263

$

1,181

Accounts receivable, net

870

921

Inventories

4,385

4,069

Other current assets

984

894

Net property, plant and equipment

2,483

2,527

Goodwill

2,150

2,150

Other assets

1,854

2,312

Finance group assets

957

964

Total Assets

$

15,946

$

15,018

Liabilities and Shareholders' Equity

Short-term debt and current portion of long-term debt

$

1,396

$

561

Accounts payable

1,322

1,378

Other current liabilities

1,797

1,907

Other liabilities

2,143

2,288

Long-term debt

2,956

2,563

Finance group liabilities

798

803

Total Liabilities

10,412

9,500

Total Shareholders' Equity

5,534

5,518

Total Liabilities and Shareholders' Equity

$

15,946

$

15,018

TEXTRON INC. MANUFACTURING GROUP Condensed

Schedule of Cash Flows (In millions) (Unaudited)

Three Months Ended April 4, March 30,

2020

2019

Cash flows from operating activities: Net income

$

48

$

175

Depreciation and amortization

89

100

Deferred income taxes and income taxes receivable/payable

9

6

Pension, net

(5

)

(14

)

Changes in assets and liabilities: Accounts receivable, net

47

(33

)

Inventories

(368

)

(241

)

Accounts payable

(49

)

47

Dividends received from Finance group

-

50

Other, net

(164

)

(286

)

Net cash from operating activities

(393

)

(196

)

Cash flows from investing activities: Capital expenditures

(50

)

(59

)

Other investing activities, net

(6

)

3

Net cash from investing activities

(56

)

(56

)

Cash flows from financing activities: Increase in short-term

debt

603

100

Proceeds from long-term debt

643

-

Proceeds from borrowings against corporate-owned insurance policies

377

-

Principal payments on long-term debt and nonrecourse debt

(7

)

-

Purchases of Textron common stock

(54

)

(202

)

Dividends paid

(5

)

(5

)

Other financing activities, net

(9

)

9

Net cash from financing activities

1,548

(98

)

Total cash flows from continuing operations

1,099

(350

)

Total cash flows from discontinued operations

(1

)

-

Effect of exchange rate changes on cash and equivalents

(16

)

9

Net change in cash and equivalents

1,082

(341

)

Cash and equivalents at beginning of period

1,181

987

Cash and equivalents at end of period

$

2,263

$

646

Manufacturing Cash Flow GAAP to Non-GAAP

Reconciliation: Three Months Ended

April 4,

March 30,

2020

2019

Net cash from operating activities - GAAP

$

(393

)

$

(196

)

Less: Capital expenditures

(50

)

(59

)

Dividends received from TFC

-

(50

)

Plus: Total pension contributions

12

13

Proceeds from the sale of property, plant and equipment

1

1

Manufacturing cash flow before pension contributions - Non-GAAP

(a)

$

(430

)

$

(291

)

(a) Manufacturing cash flow before pension contributions is a

non-GAAP financial measure as defined in "Non-GAAP Financial

Measures" attached to this release.

TEXTRON INC.

Condensed Consolidated

Schedule of Cash Flows

(In millions)

(Unaudited)

Three Months Ended

April 4,

March 30,

2020

2019

Cash flows from operating activities: Net income

$

50

$

179

Depreciation and amortization

90

102

Deferred income taxes and income taxes receivable/payable

10

8

Pension, net

(5

)

(14

)

Changes in assets and liabilities: Accounts receivable, net

47

(33

)

Inventories

(368

)

(215

)

Accounts payable

(49

)

47

Captive finance receivables, net

-

(1

)

Other, net

(169

)

(289

)

Net cash from operating activities

(394

)

(216

)

Cash flows from investing activities: Capital

expenditures

(50

)

(59

)

Finance receivables repaid

13

12

Other investing activities, net

(6

)

5

Net cash from investing activities

(43

)

(42

)

Cash flows from financing activities: Increase in

short-term debt

603

100

Proceeds from long-term debt

643

-

Proceeds from borrowings against corporate-owned insurance policies

377

-

Principal payments on long-term debt and nonrecourse debt

(24

)

(19

)

Purchases of Textron common stock

(54

)

(202

)

Dividends paid

(5

)

(5

)

Other financing activities, net

3

10

Net cash from financing activities

1,543

(116

)

Total cash flows from continuing operations

1,106

(374

)

Total cash flows from discontinued operations

(16

)

-

Effect of exchange rate changes on cash and equivalents

(1

)

9

Net change in cash and equivalents

1,089

(365

)

Cash and equivalents at beginning of period

1,357

1,107

Cash and equivalents at end of period

$

2,446

$

742

TEXTRON INC. Non-GAAP Financial Measures

(Dollars in millions, except per share amounts)

We supplement the reporting of our financial information

determined under U.S. generally accepted accounting principles

(GAAP) with certain non-GAAP financial measures. These non-GAAP

financial measures exclude certain significant items that may not

be indicative of, or are unrelated to, results from our ongoing

business operations. We believe that these non-GAAP measures may be

useful for period-over-period comparisons of underlying business

trends and our ongoing business performance, however, they should

be used in conjunction with GAAP measures. Our non-GAAP measures

should not be considered in isolation or as a substitute for the

related GAAP measures, and other companies may define similarly

named measures differently. We encourage investors to review our

financial statements and publicly-filed reports in the entirety and

not to rely on any single financial measure. We utilize the

following definition for the non-GAAP financial measure included in

this release:

Adjusted net income and adjusted

diluted earnings per share

Adjusted net income and adjusted diluted earnings per share both

exclude Special charges, net of taxes. We consider items recorded

in Special charges such as enterprise-wide restructuring, certain

asset impairment charges and acquisition-related restructuring,

integration and transaction costs, to be of a non-recurring nature

that is not indicative of ongoing operations.

Manufacturing cash flow before pension

contributions

Manufacturing cash flow before pension contributions adjusts net

cash from operating activities (GAAP) for the following:

- Deducts capital expenditures and includes proceeds from the

sale of property, plant and equipment to arrive at the net capital

investment required to support ongoing manufacturing

operations;

- Excludes dividends received from Textron Financial Corporation

(TFC) and capital contributions to TFC provided under the Support

Agreement and debt agreements as these cash flows are not

representative of manufacturing operations;

- Adds back pension contributions as we consider our pension

obligations to be debt-like liabilities. Additionally, these

contributions can fluctuate significantly from period to period and

we believe that they are not representative of cash used by our

manufacturing operations during the period.

While we believe this measure provides a focus on cash generated

from manufacturing operations, before pension contributions, and

may be used as an additional relevant measure of liquidity, it does

not necessarily provide the amount available for discretionary

expenditures since we have certain non-discretionary obligations

that are not deducted from the measure.

Net Income and Diluted Earnings Per Share (EPS) GAAP to Non-GAAP

Reconciliation: Three Months EndedApril 4, 2020

Diluted EPS Net income - GAAP

$

50

$

0.22

Special charges, net of income taxes of $9M

30

0.13

Adjusted net income - Non-GAAP

$

80

$

0.35

Manufacturing Cash Flow Before Pension

Contributions GAAP to Non-GAAP Reconciliation: Three

Months Ended April 4,2020 March 30,2019 Net

cash from operating activities of continuing operations - GAAP

$

(393

)

$

(196

)

Less: Capital expenditures

(50

)

(59

)

Dividends received from TFC

-

(50

)

Plus: Total pension contributions

12

13

Proceeds from the sale of property, plant and equipment

1

1

Manufacturing cash flow before pension contributions -

Non-GAAP

$

(430

)

$

(291

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200430005116/en/

Investor Contacts: Eric Salander – 401-457-2288 Cameron

Vollmuth – 401-457-2288 Media Contact: David Sylvestre –

401-457-2362

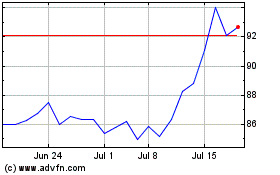

Textron (NYSE:TXT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Textron (NYSE:TXT)

Historical Stock Chart

From Jul 2023 to Jul 2024