Form 8-K - Current report

September 17 2024 - 4:08PM

Edgar (US Regulatory)

0001601712false00016017122024-09-122024-09-120001601712us-gaap:CommonStockMember2024-09-122024-09-120001601712us-gaap:SeriesAPreferredStockMember2024-09-122024-09-120001601712us-gaap:SeriesBPreferredStockMember2024-09-122024-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

September 12, 2024

Date of Report

(Date of earliest event reported)

SYNCHRONY FINANCIAL

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36560 | | 51-0483352 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 777 Long Ridge Road | | |

| Stamford, | Connecticut | | 06902 |

| (Address of principal executive offices) | | (Zip Code) |

(203) 585-2400

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | SYF | New York Stock Exchange |

| Depositary Shares Each Representing a 1/40th Interest in a Share of 5.625% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A | SYFPrA | New York Stock Exchange |

| Depositary Shares Each Representing a 1/40th Interest in a Share of 8.250% Fixed Rate Reset Non-Cumulative Perpetual Preferred Stock, Series B | SYFPrB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(d)On September 12, 2024, the Board of Directors (the “Board”) of Synchrony Financial (the “Company”), elected Mr. Daniel Colao as a director of the Company and appointed him to serve on the Risk and Technology Committees of the Board, effective October 1, 2024.

Mr. Colao will participate in the same compensation program as each of the Company’s other independent, non-management directors. Under the program, Mr. Colao will receive annual compensation of $265,000, of which $100,000 will be paid in cash and $165,000 will be paid in Company restricted stock units. He will also receive additional annual cash compensation of $20,000 for service on the Risk Committee and $15,000 for service on the Technology Committee.

In connection with joining the Board, Mr. Colao entered into the Company’s standard form of indemnification agreement. The indemnification agreement provides Mr. Colao with contractual rights to indemnification and expense advancement rights under the Company’s bylaws, as well as contractual rights to additional indemnification as provided in the indemnification agreement. The form of indemnification agreement was previously filed with the Securities and Exchange Commission on August 1, 2014 as Exhibit 10.89 of Amendment No. 1 to the Company’s Registration Statement on Form S-1 (333-197244).

There are no arrangements or understandings between Mr. Colao and any other person pursuant to which he was selected as a director. There are no relationships or transactions to which Mr. Colao is a party that would require disclosure under Item 404(a) of Regulation S-K.

A copy of the press release announcing the election of Mr. Colao is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are being furnished as part of this report:

| | | | | | | | |

| | |

| Number | | Description |

| |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | SYNCHRONY FINANCIAL |

| | | |

Date: September 17, 2024 | | | | By: | | /s/ Brian D. Doubles |

| | | | Name: | | Brian D. Doubles |

| | | | Title: | | President and Chief Executive Officer |

NEWS RELEASE

Synchrony Names Dan Colao to Board of Directors

Seasoned executive deepens financial, risk and strategic expertise

STAMFORD, Conn. – September 17, 2024 – Synchrony Financial (NYSE: SYF), a premier consumer financial services company, today announced Daniel Colao, a retired financial services executive with over 30 years of industry experience, has been appointed to Synchrony’s Board of Directors, effective October 1, 2024.

“We’re thrilled to welcome Dan back to the Synchrony Board of Directors,” said Brian Doubles, President and Chief Executive Officer. Mr. Colao previously served on the Company’s Board from February 2014 to November 2015. “Dan has extensive expertise in financial services and consumer lending, and will provide valuable insights to the Board as the company navigates the economic environment and regulatory landscape.”

Mr. Colao most recently served as the Chief Financial Officer and Executive Advisor of GE Capital from 2017 until his retirement in June 2021. In this role, he was integral in the strategic repositioning of GE Capital, including the execution of multiple transactions to improve overall capital allocation, as well as actions to strengthen reserves, governance, and controls within the business division. Mr. Colao currently serves on the Advisory Board of AX Partners, a privately-held capital markets solutions provider.

“I am excited to re-join the Synchrony Board. I really respect their values-based culture and strong management team, as well as the dedication of the Board and management to the Company’s employees, customers, partners, and shareholders,” said Mr. Colao.

With the appointment of Mr. Colao, Synchrony’s Board of Directors will now consist of eleven members.

About Synchrony

| | |

| Synchrony (NYSE: SYF) is a premier consumer financial services company delivering one of the industry’s most complete digitally-enabled product suites. Our experience, expertise and scale encompass a broad spectrum of industries including digital, health and wellness, retail, telecommunications, home, auto, outdoor, pet and more. We have an established and diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which we refer to as our “partners.” We connect our partners and consumers through our dynamic financial ecosystem and provide them with a diverse set of financing solutions and innovative digital capabilities to address their specific needs and deliver seamless, omnichannel experiences. We offer the right financing products to the right customers in their channel of choice. For more information, visit www.synchrony.com and Twitter: @Synchrony. |

Contacts

Investor Relations:

Kathryn Miller

Synchrony

kathryn.miller@syf.com

(203) 585-6291

Media Relations:

Lisa Lanspery

Synchrony

lisa.lanspery@syf.com

(203) 585-6143

v3.24.3

Cover

|

Sep. 12, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 12, 2024

|

| Entity Registrant Name |

SYNCHRONY FINANCIAL

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36560

|

| Entity Tax Identification Number |

51-0483352

|

| Entity Address, Address Line One |

777 Long Ridge Road

|

| Entity Address, Postal Zip Code |

06902

|

| Entity Address, State or Province |

CT

|

| Entity Address, City or Town |

Stamford,

|

| City Area Code |

203

|

| Local Phone Number |

585-2400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001601712

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

SYF

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares Each Representing a 1/40th Interest in a Share of 5.625% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A

|

| Trading Symbol |

SYFPrA

|

| Security Exchange Name |

NYSE

|

| Series B Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares Each Representing a 1/40th Interest in a Share of 8.250% Fixed Rate Reset Non-Cumulative Perpetual Preferred Stock, Series B

|

| Trading Symbol |

SYFPrB

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

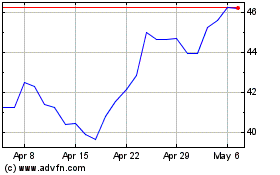

Synchrony Financiall (NYSE:SYF)

Historical Stock Chart

From Aug 2024 to Sep 2024

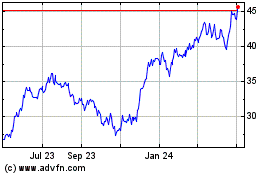

Synchrony Financiall (NYSE:SYF)

Historical Stock Chart

From Sep 2023 to Sep 2024