Current Report Filing (8-k)

October 28 2020 - 4:23PM

Edgar (US Regulatory)

False000155227500015522752020-10-282020-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Act of 1934

October 28, 2020

Date of Report (Date of earliest event reported)

SUNOCO LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-35653

|

30-0740483

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8111 Westchester Drive, Suite 400

|

|

Dallas

|

,

|

Texas

|

75225

|

|

(Address of principal executive offices, including zip code)

|

(214) 981-0700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Units Representing Limited Partner Interests

|

SUN

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On October 27, 2020, Dylan Bramhall was appointed Chief Financial Officer of Sunoco GP LLC (the “Company”), the general partner of Sunoco LP (the “Partnership”). Mr. Bramhall, 43, also serves as Senior Vice President Finance and Treasurer of Energy Transfer LP. Mr. Bramhall has served in this capacity for the prior 4 years and in various roles of increasing responsibility at Energy Transfer LP and affiliates, including Regency Energy Partners, for more than 14 years. Mr. Bramhall holds a bachelor of business administration in finance and master of business administration in finance and operations management, both from the University of Iowa.

Pursuant to the terms of Mr. Bramhall’s employment, he will receive an annual base salary of $345,000. He will also be eligible for a cash bonus target of 100% of his base salary, subject to continued employment and less applicable withholdings, which will be paid on the same date that incentive cash bonuses are paid to the Company’s other senior executives. In addition, Mr. Bramhall will be eligible to participate in the Partnership’s Long Term Incentive Plan (“LTIP”), with a target award of 200% of his base salary and with an initial award of 20,000 restricted phantom units of the Partnership to be granted upon the commencement of his employment. These restricted phantom units will be subject to vesting over an approximate five-year period with 60% vesting on December 5, 2023 and 40% vesting on December 5, 2025, based on continued employment with the Company on each such vesting date. Mr. Bramhall will also be eligible to participate in other benefit plans on terms consistent with those applicable to other executives generally. A portion of Mr. Bramhall’s compensation will be allocated to the Partnership by Energy Transfer LP based on a percentage of his overall working time devoted to Partnership business.

There are no arrangements or understandings between Mr. Bramhall and any other person(s) pursuant to which Mr. Bramhall was appointed as Chief Financial Officer. There are no existing relationships between Mr. Bramhall, the Company, the Partnership, Energy Transfer or any of their respective subsidiaries that would require disclosure pursuant to Item 404(a) of Regulation S-K or any familial relationship that would require disclosure under Item 401(d) of Regulation S-K.

Item 7.01. Regulation FD

On October 28, 2020, the Partnership issued a press release announcing the appointment of Mr. Bramhall as Chief Financial Officer. A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and incorporation herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information set forth in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. In accordance with General Instruction B.2 of Form 8-K, the information set forth in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Exhibit Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUNOCO LP

|

|

|

|

By:

|

Sunoco GP LLC, its general partner

|

|

Date:

|

October 28, 2020

|

By:

|

/s/ Arnold Dodderer

|

|

|

|

|

Arnold Dodderer

|

|

|

|

|

General Counsel and Assistant Secretary

|

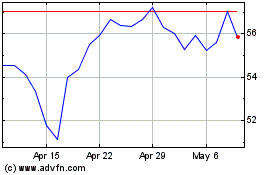

Sunoco (NYSE:SUN)

Historical Stock Chart

From Aug 2024 to Sep 2024

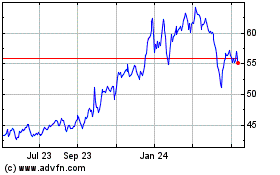

Sunoco (NYSE:SUN)

Historical Stock Chart

From Sep 2023 to Sep 2024