PanAmSat Announces Financing Transactions Including Debt Tender Offers

July 14 2004 - 5:33PM

PR Newswire (US)

PanAmSat Announces Financing Transactions Including Debt Tender

Offers WILTON, Conn., July 14 /PRNewswire-FirstCall/ -- PanAmSat

Corporation (NASDAQ:SPOT) (the "Company" or "PanAmSat") announced

today that, in connection with the anticipated sale of PanAmSat to

affiliates of Kohlberg Kravis Roberts & Co., The Carlyle Group

and Providence Equity Partners, Inc. (the "Acquisition"), it will

commence certain related financing transactions consisting of the

borrowing of new senior secured and unsecured indebtedness and the

repayment of certain indebtedness. After completion of the

refinancing transactions, which are scheduled to close at the same

time as the Acquisition, PanAmSat intends to have indebtedness of

approximately $4.2 billion outstanding (including amounts undrawn

under a revolving credit facility), consisting of: * new senior

secured credit facilities with $2,660 million of term loans and a

$250 million revolving credit facility; * up to $1,010 million of

new senior unsecured indebtedness; and * approximately $275 million

of existing senior secured notes. As part of its debt repayment,

PanAmSat has commenced a cash tender offer (and related consent

solicitation described below) to purchase any and all of the $800

million outstanding principal amount of its 8-1/2% Senior Notes due

2012 ("8-1/2% Notes") (the "8-1/2% Notes Tender Offer") and a cash

tender offer to purchase any and all of the $275 million

outstanding principal amount of its 6-1/8% Notes due 2005 ("6-1/8%

Notes") (the "6-1/8% Notes Tender Offer"). The 8-1/2% Notes Tender

Offer and the 6-1/8% Notes Tender Offer are conditioned upon the

satisfaction of all conditions precedent to the Acquisition (other

than, in the case of the 8-1/2% Notes Tender Offer, the condition

relating to the receipt of sufficient consents in the 8-1/2% Notes

Tender Offer). The other financing transactions are conditioned

upon the consummation of the Acquisition, and the Acquisition is

conditioned upon these financing transactions (except the 6-1/8%

Notes Tender Offer). Additional information regarding the

Acquisition and the related transactions can be found in the

Company's Securities and Exchange Commission filings. In

conjunction with the 8-1/2% Notes Tender Offer, PanAmSat is

soliciting consents to effect certain proposed amendments to the

indenture governing the 8-1/2% Notes. The 8-1/2% Notes Tender Offer

and consent solicitation are being made pursuant to an Offer to

Purchase and Consent Solicitation Statement (the "8-1/2% Notes

Offer to Purchase") dated July 14, 2004, which more fully sets

forth the terms and conditions of the 8-1/2% Notes Tender Offer.

The total consideration offered for the 8-1/2% Notes, paid in cash,

is equal to, per $1,000 principal amount of 8-1/2% Notes, the

present value, as of the settlement date, for 8-1/2% Notes

purchased in the offer, of (i) the earliest redemption price for

the 8-1/2% Notes ($1,042.50) and (ii) the interest that would

accrue from the last interest payment date and that would be

payable on each interest payment date occurring on and prior to the

earliest redemption date, February 1, 2007, calculated based on (A)

the yield to maturity on the 2.250% U.S. Treasury Note due February

15, 2007, based on the bid price of such reference security as of

2:00 p.m., New York City time, on the tenth business day

immediately preceding the expiration date, as displayed on

Bloomberg Government Pricing Monitor on "Page PX5," plus (B) 50

basis points, minus accrued and unpaid interest from the last

interest payment date to, but not including, the settlement date

(the "8-1/2% Notes Total Consideration") (rounded to the nearest

cent). The purchase price is the 8- 1/2% Notes Total Consideration

minus a consent payment in an amount in cash equal to $20.00 per

$1,000 principal amount of 8-1/2% Notes in respect of 8- 1/2% Notes

validly tendered and not validly withdrawn as to which consents to

the amendments are delivered on or prior to 5:00 p.m., New York

City time on July 27, 2004 (unless such date is extended). Among

other things, the proposed amendments to the indenture governing

the 8-1/2% Notes would eliminate most of the indenture's

restrictive covenants and would amend certain other provisions

contained in the indenture. Adoption of the proposed amendments

requires the consent of the holders of at least a majority of the

aggregate principal amount of the 8-1/2% Notes outstanding. Holders

who tender their 8-1/2% Notes will be required to consent to the

proposed amendments and holders may not deliver consents to the

proposed amendments without tendering their 8-1/2% Notes in the

tender offer. Tendered 8-1/2% Notes may be withdrawn and consents

may be revoked at any time prior to 5:00 p.m., New York City time,

on July 27, 2004 (unless such date is extended), but not

thereafter. The 8-1/2% Notes Tender Offer is scheduled to expire at

5:00 p.m., New York City time, on August 13, 2004 (unless such date

is extended). The Consent Payment Deadline is at 5:00 p.m., New

York City time, on July 27, 2004 (unless such date is extended).

The 8-1/2% Notes Tender Offer is conditioned upon, among other

things, a minimum tender of at least a majority of the aggregate

principal amount of the 8-1/2% Notes outstanding, a requisite

consent condition and the satisfaction of all conditions precedent

to the Acquisition (other than the condition relating to the

receipt of sufficient consents in the 8-1/2% Notes Tender Offer).

Citigroup Global Markets Inc. is acting as dealer manager and

solicitation agent for the 8-1/2% Notes Tender Offer. The

information agent for the 8-1/2% Notes Tender Offer is Global

Bondholder Services Corporation. The tender agent for the 8-1/2%

Notes Tender Offer is The Bank of New York. Questions regarding the

8-1/2% Notes Tender Offer may be directed to Citigroup Global

Markets Inc., telephone number (800) 558-3745 (toll free) and (212)

723-6106 (call collect). Requests for copies of the 8-1/2% Notes

Offer to Purchase and related documents may be directed to Global

Bondholder Services Corporation, telephone number (866) 952-2200

(toll free) and (212) 430-3774. The 6-1/8% Notes Tender Offer is

being made pursuant to an Offer to Purchase (the "6-1/8% Notes

Offer to Purchase") dated July 14, 2004, which more fully sets

forth the terms and conditions of the 6-1/8% Notes Tender Offer.

The total consideration offered for the 6-1/8% Notes is an amount,

paid in cash, equal to, per $1,000 principal amount of 6-1/8%

Notes, the present value, as of the settlement date, for 6-1/8%

Notes purchased in the offer, of (i) $1,000 (the amount payable on

January 15, 2005, which is the maturity date of the 6-1/8% Notes)

and (ii) the interest that would accrue from the last interest

payment date and that would be payable on the interest payment date

occurring on the maturity date calculated based on (A) the yield to

maturity on the 1.750% U.S. Treasury Note due December 31, 2004,

based on the bid price of such reference security as of 2:00 p.m.,

New York City time, on the tenth business day immediately preceding

the expiration date, as displayed on Bloomberg Government Pricing

Monitor on "Page PX3," plus (B) 50 basis points, minus accrued and

unpaid interest from the last interest payment date to, but not

including, settlement date (the "6-1/8% Notes Total Consideration")

(rounded to the nearest cent). The purchase price is the 6-1/8%

Notes Total Consideration (as defined in the 6-1/8% Notes Offer to

Purchase) minus an early tender premium in an amount in cash equal

to $20.00 per $1,000 principal amount of 6-1/8% Notes in respect of

6-1/8% Notes validly tendered and not validly withdrawn on or prior

to July 27, 2004 (unless such date is extended). The 6-1/8% Notes

Tender Offer is scheduled to expire at 5:00 p.m., New York City

time, on August 13, 2004 (unless such date is extended). The Early

Tender Deadline is at 5:00 p.m., New York City time, on July 27,

2004 (unless such date is extended). The 6-1/8% Notes Tender Offer

is conditioned upon, among other things, the satisfaction of all

conditions precedent to the Acquisition. Citigroup Global Markets

Inc. is acting as dealer manager for the 6-1/8% Notes Tender Offer.

The information agent for the 6-1/8% Notes Tender Offer is Global

Bondholder Services Corporation. The tender agent for the 6-1/8%

Notes Tender Offer is JPMorgan Chase Bank. Questions regarding the

6-1/8% Notes Tender Offer may be directed to Citigroup Global

Markets Inc., telephone number (800) 558-3745 (toll free) and (212)

723-6106 (call collect). Requests for copies of the 6-1/8% Notes

Offer to Purchase and related documents may be directed to Global

Bondholder Services Corporation, telephone number (866) 952-2200

(toll free) and (212) 430-3774. This announcement is not an offer

to purchase, a solicitation of an offer to purchase, or a

solicitation of consents with respect to the 8-1/2% Notes or the

6-1/8% Notes nor is this announcement an offer or solicitation of

an offer to sell any securities. The 8-1/2% Notes Tender Offer and

6-1/8% Notes Tender Offer are made solely by means of the 8-1/2%

Notes Offer to Purchase and 6- 1/8% Notes Offer to Purchase,

respectively. Through its owned and operated fleet of 24

satellites, PanAmSat is a leading global provider of video,

broadcasting and network distribution and delivery services. In

total, the Company's in-orbit fleet is capable of reaching over 98

percent of the world's population through cable television systems,

broadcast affiliates, direct-to-home operators, Internet service

providers and telecommunications companies. In addition, PanAmSat

supports the largest concentration of satellite-based business

networks in the U.S., as well as specialized communications

services in remote areas throughout the world. This document

contains forward-looking statements within the meaning of the safe

harbor provisions of the Securities Litigation Reform Act of 1995.

Terms such as "expect," "believe," "continue," and "grow," as well

as similar comments, are forward-looking in nature. Although the

Company believes its growth plans are based upon reasonable

assumptions, it can give no assurances that such expectations can

be attained. Factors that could cause actual results to differ

materially from the Company's expectations include general business

and economic conditions, competitive factors, raw materials

purchasing, and fluctuations in demand. The Company undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events or otherwise.

Please refer to the Company's Securities and Exchange Commission

filings for further information. DATASOURCE: PanAmSat Corporation

CONTACT: Kathryn Lancioni of PanAmSat, +1-646-293-7415 Web site:

http://www.panamsat.com/

Copyright

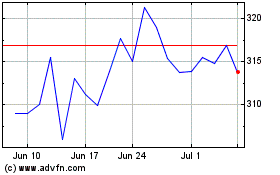

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jun 2024 to Jul 2024

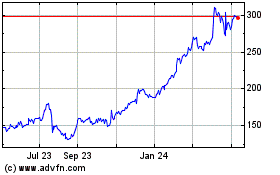

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jul 2023 to Jul 2024