Quanex Building Products Corporation (NYSE:NX)

(“Quanex” or the “Company”) today announced its results for the

three months ended April 30, 2024.

The Company reported the following selected

financial results:

| |

Three Months Ended April 30, |

|

Six Months Ended April 30, |

|

($ in millions, except per share data) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net

Sales |

$266.2 |

|

$273.5 |

|

$505.4 |

|

$535.5 |

| Gross

Margin |

$66.2 |

|

$67.2 |

|

$117.7 |

|

$118.9 |

|

Gross Margin % |

24.9% |

|

24.6% |

|

23.3% |

|

22.2% |

| Net

Income |

$15.4 |

|

$21.5 |

|

$21.6 |

|

$23.4 |

| Diluted

EPS |

$0.46 |

|

$0.65 |

|

$0.65 |

|

$0.71 |

| |

|

|

|

|

|

|

|

| Adjusted Net

Income |

$21.8 |

|

$21.7 |

|

$27.6 |

|

$27.8 |

| Adjusted

Diluted EPS |

$0.66 |

|

$0.66 |

|

$0.83 |

|

$0.84 |

| Adjusted

EBITDA |

$40.0 |

|

$39.9 |

|

$59.3 |

|

$60.4 |

|

Adjusted EBITDA Margin % |

15.0% |

|

14.6% |

|

11.7% |

|

11.3% |

| |

|

|

|

|

|

|

|

| Cash

Provided by Operating Activities |

$33.1 |

|

$35.3 |

|

$36.9 |

|

$38.5 |

| Free Cash

Flow |

$25.5 |

|

$27.8 |

|

$19.8 |

|

$23.4 |

(See Non-GAAP Terminology Definitions and Disclaimers section,

Non-GAAP Financial Measure Disclosure table, Selected Segment Data

table and reconciliation tables for additional information)

George Wilson, Chairman, President and Chief

Executive Officer, commented, “Our second quarter results came in

as expected and we continue to execute. Volumes in North America

increased in the second quarter compared to the first quarter of

the year, which is encouraging and follows normal seasonality in

our business. Volumes in Europe were challenged during the quarter

as low consumer confidence continues to impact demand. However, we

continue to operate efficiently and were able to realize margin

expansion in both of our North American operating segments and on a

consolidated basis for the second quarter of 2024. Our continued

focus on generating cash and managing working capital enabled us to

pay down the remaining $10 million balance on our revolver.”

Second Quarter 2024 Results Summary

Quanex reported net sales of $266.2 million

during the three months ended April 30, 2024, which represents a

decrease of 2.7% compared to $273.5 million for the same period of

2023. The decrease was largely attributable to softer market demand

in the Company’s European Fenestration and North American Cabinet

Components segments. Quanex reported a 1.8% increase in net sales

for the second quarter in its North American Fenestration segment

primarily due to improved volume. In its North American Cabinet

Components segment, the Company reported a decline of 4.6% in net

sales for the second quarter as a result of lower volume and

decreased pricing related to raw material index pricing mechanisms.

Excluding foreign exchange impact, Quanex realized a decrease in

net sales of 10.4% for the second quarter in its European

Fenestration segment mainly due to lower volume and pricing

pressure. (See Sales Analysis table for additional information)

The increase in adjusted earnings for the three

months ended April 30, 2024 was mostly attributable to a decline in

raw material costs, lower income tax expense and lower interest

expense.

Balance Sheet Update

As of April 30, 2024, Quanex had total debt of

$55.2 million (primarily finance leases) and the Company’s leverage

ratio of Net Debt to LTM Adjusted EBITDA continued to improve and

Quanex is Net Debt free. As of April 30, 2024, the Company’s LTM

Net Income was $80.7 million and LTM Adjusted EBITDA was $158.5

million. (See Non-GAAP Terminology Definitions and

Disclaimers section, Net Debt Reconciliation table and Last Twelve

Months Adjusted EBITDA Reconciliation table for additional

information)

Outlook

Mr. Wilson stated, “As expected, we are starting

to see a seasonal uptick in the demand for our products in North

America. Market dynamics in Europe continue to be challenging and

volumes are soft; however, we are performing well, and our business

is resilient. Based on results to date, conversations with our

customers, recent demand trends, and the latest macro data, we are

reaffirming our prior guidance for fiscal 2024. On a consolidated

basis, we continue to estimate net sales of approximately $1.1

billion, which should result in approximately $145 million to $150

million of Adjusted EBITDA* in fiscal 2024.”

*When Quanex provides expectations for Adjusted

EBITDA on a forward-looking basis, a reconciliation of the

differences between the non-GAAP expectations and corresponding

GAAP measures is generally not available without unreasonable

effort. Certain items required for such a reconciliation are

outside of the Company’s control and/or cannot be reasonably

predicted or estimated, such as the provision for income taxes.

Recent Events

As previously disclosed on April 22, 2024,

Quanex announced it had reached agreement with Tyman plc (LSE:TYMN)

(“Tyman”) on the terms of a recommended cash and share offer (the

“Acquisition”), under which Quanex will acquire the entire issued

and to be issued share capital of Tyman for approximately $1.1

billion in enterprise value. The full terms and conditions of the

Acquisition are set out in a joint announcement released on April

22, 2024 under Rule 2.7 of the UK Takeover Code. A copy of this

announcement is available on the Quanex website at

https://www.roadto2b.com, subject to certain access restrictions.

The Acquisition has been unanimously approved by the Boards of

Directors of both Quanex and Tyman and is currently expected to

close in the second half of the calendar year 2024, subject to the

satisfaction of customary closing conditions, including shareholder

approval from both Tyman and Quanex shareholders and regulatory

approvals.

Conference Call and Webcast

Information

The Company has also scheduled a conference call

for Friday, June 7, 2024 at 11:00 a.m. ET (10:00 a.m. CT) to

discuss the release. A link to the live audio webcast will be

available on Quanex’s website at http://www.quanex.com in the

Investors section under Presentations & Events.

Participants can pre-register for the conference call using the

following link:

https://register.vevent.com/register/BI8e90696b55d04353a1f5e63939f8a6f6

Registered participants will receive an email

containing conference call details for dial-in options. To avoid

delays, it is recommended that participants dial into the

conference call ten minutes ahead of the scheduled start time. A

replay will be available for a limited time on the Company’s

website at http://www.quanex.com in the Investors section under

Presentations & Events.

About Quanex

Quanex is a global manufacturer with core

capabilities and broad applications across various end markets. The

Company currently collaborates and partners with leading OEMs to

provide innovative solutions in the window, door, vinyl fencing,

solar, refrigeration, custom mixing and cabinetry markets.

Looking ahead, Quanex plans to leverage its material science

expertise and process engineering to expand into adjacent

markets.

For more information contact Scott Zuehlke,

Senior Vice President, Chief Financial Officer & Treasurer, at

713-877-5327 or scott.zuehlke@quanex.com.

Non-GAAP Terminology Definitions and

Disclaimers

Adjusted Net Income (defined as net income

further adjusted to exclude purchase price accounting inventory

step-ups, transaction costs, certain severance charges, gain/loss

on the sale of certain fixed assets, restructuring charges, asset

impairment charges, other net adjustments related to foreign

currency transaction gain/loss and effective tax rates reflecting

impacts of adjustments on a with and without basis) and Adjusted

EPS are non-GAAP financial measures that Quanex believes provide a

consistent basis for comparison between periods and more accurately

reflects operational performance, as they are not influenced by

certain income or expense items not affecting ongoing operations.

EBITDA (defined as net income or loss before interest, taxes,

depreciation and amortization and other, net), Adjusted EBITDA and

LTM Adjusted EBITDA (defined as EBITDA further adjusted to exclude

purchase price accounting inventory step-ups, transaction costs,

certain severance charges, gain/loss on the sale of certain fixed

assets, restructuring charges and asset impairment charges) are

non-GAAP financial measures that the Company uses to measure

operational performance and assist with financial

decision-making. Net Debt is defined as total debt

(outstanding balance on the revolving credit facility plus

financial lease obligations) less cash and cash equivalents. The

leverage ratio of Net Debt to LTM Adjusted EBITDA is a financial

measure that the Company believes is useful to investors and

financial analysts in evaluating Quanex’s leverage. In addition,

with certain limited adjustments, this leverage ratio is the basis

for a key covenant in the Company’s credit agreement.

Free Cash Flow is a non-GAAP measure calculated

using cash provided by operating activities less capital

expenditures. Quanex uses the Free Cash Flow metric to measure

operational and cash management performance and assist with

financial decision-making. Free Cash Flow is measured before

application of certain contractual commitments (including capital

lease obligations), and accordingly is not a true measure of the

Company’s residual cash flow available for discretionary

expenditures. Quanex believes Free Cash Flow is useful to investors

in understanding and evaluating the Company’s financial and cash

management performance.

Quanex believes that the presented non-GAAP

measures provide a consistent basis for comparison between periods

and will assist investors in understanding the Company’s financial

performance when comparing results to other investment

opportunities. The presented non-GAAP measures may not be the

same as those used by other companies. Quanex does not intend for

this information to be considered in isolation or as a substitute

for other measures prepared in accordance with U.S. GAAP.

Forward Looking Statements

Statements that use the words “estimated,”

“expect,” “could,” “should,” “believe,” “will,” “might,” or similar

words reflecting future expectations or beliefs are forward-looking

statements. The forward-looking statements include, but are not

limited to, the following: impacts from public health issues

(including pandemics, such as the recent COVID-19 pandemic) on the

economy and the demand for Quanex’s products, timing estimates or

any other expectations related to the Acquisition, the Company’s

future operating results, future financial condition, future uses

of cash and other expenditures, expenses and tax rates,

expectations relating to Quanex’s industry, and the Company’s

future growth, including any guidance discussed in this press

release. The statements and guidance set forth in this release are

based on current expectations. Actual results or events may differ

materially from this release. For a complete discussion of factors

that may affect Quanex’s future performance, please refer to the

Company’s Annual Report on Form 10-K for the fiscal year ended

October 31, 2023, and the Company’s Quarterly Reports on Form 10-Q

under the sections entitled “Cautionary Note Regarding

Forward-Looking Statements” and “Risk Factors”. Any forward-looking

statements in this press release are made as of the date hereof,

and Quanex undertakes no obligation to update or revise any

forward-looking statements to reflect new information or

events.

Important Additional Information will be

Filed with the SEC

In connection with the Acquisition, Quanex filed

with the U.S. Securities and Exchange Commission (the “SEC”) a

definitive proxy statement on June 6, 2024 (the “Proxy Statement”).

Before making any voting decision, Quanex’s stockholders are urged

to read the Proxy Statement and other relevant documents filed or

to be filed with the SEC in connection with the Acquisition or

incorporated by reference in the Proxy Statement carefully and in

their entirety because they contain important information about the

Acquisition and the share issuance proposal. Quanex’s stockholders

and investors will be able to obtain, without charge, a copy of the

Proxy Statement and other relevant documents filed with the SEC

from the SEC’s website at http://www.sec.gov or directing a written

request to Quanex (Attention: Investor Relations), at 945 Bunker

Hill Road, Suite 900, Houston, Texas 77024 or from Quanex’s website

at https://investors.quanex.com.

No Offer or Solicitation

The information contained in this press release

is not intended to and does not constitute an offer to sell or the

solicitation of an offer to subscribe for or buy or an invitation

to purchase or subscribe for any securities or the solicitation of

any vote or approval in any jurisdiction pursuant to the

Acquisition or otherwise, nor shall there be any sale, issuance or

transfer of securities in any jurisdiction in contravention of

applicable law. In particular, this press release is not an offer

of securities for sale into the United States or in any other

jurisdiction. No offer of securities shall be made in the United

States absent registration under the U.S. Securities Act of 1933,

as amended (the “Securities Act”), or pursuant to an exemption

from, or in a transaction not subject to, such registration

requirements. Any securities issued in the Acquisition are

anticipated to be issued in reliance upon available exemptions from

such registration requirements pursuant to Section 3(a)(10) of the

Securities Act. The Acquisition will be made solely by means of the

scheme document to be published by Tyman in due course, or (if

applicable) pursuant to an offer document to be published by

Quanex, which (as applicable) would contain the full terms and

conditions of the Acquisition. Any decision in respect of, or other

response to, the Acquisition, should be made only on the basis of

the information contained in such document(s) and the Proxy

Statement. If, in the future, Quanex ultimately seeks to implement

the Acquisition by way of a takeover offer or otherwise in a manner

that is not exempt from the registration requirements of the

Securities Act, that offer will be made in compliance with

applicable US laws and regulations.

This press release does not constitute a

prospectus or a prospectus exempted document.

Participants in the

Solicitation

Quanex and certain of its directors and

executive officers and employees may be considered participants in

the solicitation of proxies from the stockholders of Quanex in

respect of the Acquisition, including the share issuance proposal.

Information regarding the persons who may, under the rules of the

SEC, be deemed participants in the solicitation of the stockholders

of Quanex in connection with the Acquisition, including a

description of their direct or indirect interests, by security

holdings or otherwise, are set forth in the Proxy Statement.

Additional information regarding Quanex’s directors and executive

officers is contained in Quanex’s Annual Report on Form 10-K for

the fiscal year ended October 31, 2023 and its annual meeting proxy

statement on Schedule 14A, dated January 25, 2024, which are filed

with the SEC.

UK Takeover Code: Profit

Forecast

UK Takeover Code

The Acquisition referred to in the paragraph

entitled “Recent Events” above is governed by the UK's City Code on

Takeovers and Mergers (the “UK Takeover Code”). In accordance with

the rules of the UK Takeover Code, Quanex is required to publish

certain confirmations in connection with the information set out in

this release. These confirmations are set out below.

Quanex Profit Forecast

The following statement in this press release

(the “Quanex Profit Forecast”) constitutes an ordinary course

profit forecast for the purposes of Rule 28.1(a) and Note 2(b) on

Rule 28.1 of the UK Takeover Code:

“As expected, we are

starting to see a seasonal uptick in the demand for our products in

North America. Market dynamics in Europe continue to be challenging

and volumes are soft; however, we are performing well, and our

business is resilient. Based on results to date, conversations with

our customers, recent demand trends, and the latest macro data, we

are reaffirming our prior guidance for fiscal 2024. On a

consolidated basis, we continue to estimate net sales of

approximately $1.1 billion, which should result in approximately

$145 million to $150 million of Adjusted EBITDA* in fiscal

2024.

*When Quanex provides

expectations for Adjusted EBITDA on a forward-looking basis, a

reconciliation of the differences between the non-GAAP expectations

and corresponding GAAP measures is generally not available without

unreasonable effort. Certain items required for such a

reconciliation are outside of the Company’s control and/or cannot

be reasonably predicted or estimated, such as the provision for

income taxes.”

References to “GAAP” in the Quanex Profit

Forecast are to U.S. GAAP, being the accounting policies applied in

the preparation of the Quanex group’s annual results for the fiscal

year ended October 31, 2023.

Basis of preparation

The Quanex Profit Forecast has been prepared on

a basis consistent with Quanex’s accounting policies, as set out in

the paragraph entitled “Non-GAAP Terminology Definitions and

Disclaimers”.

The Quanex Profit Forecast excludes any

transaction costs applicable to the Acquisition or any other

associated accounting impacts as a direct result of the

Acquisition.

Assumptions

The Quanex Profit Forecast is based on the

assumptions listed below, any of which could turn out to be

incorrect and therefore affect the validity of the Quanex Profit

Forecast.

- There are no

material changes to the prevailing macroeconomic or political

conditions in the markets and regions in which the Quanex group

operates.

- There will be

no material changes to the conditions of the markets and regions in

which the Quanex group operates or in relation to customer sales

volume or product mix or the behaviour of competitors in those

markets and regions.

- There are no

material changes to the Quanex group’s cost base throughout the

fiscal year.

- There will be

no material changes in foreign exchange rates that will have a

significant impact on the Quanex group’s revenue or cost base.

- The interest,

inflation and tax rates in the markets and regions in which the

Quanex group operates will remain materially unchanged from the

prevailing rates.

- There will be

no business disruptions that materially affect the Quanex group or

its key customers, including natural disasters, acts of terrorism,

cyber-attack and/or technological issues or supply chain

disruptions.

- There will be

no material changes in legislation or regulatory requirements

impacting on the Quanex group’s operations or on its accounting

policies.

- There will be

no material litigation in relation to any of the Quanex group’s

operations.

- The Acquisition

will not result in any material changes to the Quanex group’s

obligations to customers.

- The Acquisition

will not have any material impact on the Quanex group’s ability to

negotiate new business.

- There will be

no material change to the present executive management of the

Quanex group.

- There will be

no material change in the operational strategy of the Quanex

group.

- There will be

no material acquisitions or disposals in the relevant period.

- There will be

no material strategic investments in the relevant period.

- There will be

no material change in the dividend or capital policies of the

Quanex group.

- The Quanex

Profit Forecast does not include any impact on the Quanex group of

the Acquisition.

Other important factors and information are

contained in Quanex’s most recent Annual Report on Form 10-K,

including the risks summarised in the section entitled “Risk

Factors”, Quanex’s most recent Quarterly Report on Form 10-Q, and

Quanex’s other periodic filings with the SEC and available at

https://investors.quanex.com/.

Quanex Directors’ confirmation

With the consent of Tyman, the UK's Panel on

Takeovers and Mergers has granted a dispensation from the UK

Takeover Code requirement for Quanex’s reporting accountants and

financial advisers to prepare reports in respect of the Quanex

Profit Forecast.

The Quanex Directors have considered the Quanex

Profit Forecast and confirm that it has been properly compiled on

the basis of the assumptions set out in this release and that the

basis of the accounting used is consistent with Quanex’s accounting

policies.

No Profit Forecasts or

Estimates

The Quanex Profit Forecast is a profit forecast

for the purposes of Rule 28 of the UK Takeover Code.

Other than in respect of the Quanex Profit

Forecast, no statement in this release is intended as, or is to be

construed as, a profit forecast or profit estimate for any period

and no statement in this release should be interpreted to mean that

earnings or earnings per unit of common stock for the current or

future financial years would necessarily match or exceed the

historical published earnings or earnings per unit of common

stock.

For the purposes of Rule 28 of the UK Takeover

Code, the Quanex Profit Forecast contained in this release is the

responsibility of Quanex and the Quanex Directors.

Publication on Website

A copy of this release will be made available on

Quanex’s website at https://www.roadto2b.com/ by no later than 12

noon (London time) on the business day following the date of this

release. Neither the contents of that website nor the content of

any other website accessible from hyperlinks on such website is

incorporated into, or forms part of, this release.

| |

| CONDENSED

CONSOLIDATED STATEMENTS OF NET INCOME |

| (In thousands,

except per share data) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended April 30, |

|

Six Months Ended April 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

266,201 |

|

|

$ |

273,535 |

|

|

$ |

505,356 |

|

|

$ |

535,451 |

|

| Cost of

sales |

|

|

199,963 |

|

|

|

206,372 |

|

|

|

387,686 |

|

|

|

416,521 |

|

| Selling,

general and administrative |

|

|

34,707 |

|

|

|

27,371 |

|

|

|

67,070 |

|

|

|

64,115 |

|

| Depreciation

and amortization |

|

|

10,894 |

|

|

|

10,456 |

|

|

|

22,046 |

|

|

|

21,076 |

|

| Operating

income |

|

|

20,637 |

|

|

|

29,336 |

|

|

|

28,554 |

|

|

|

33,739 |

|

| Interest

expense |

|

|

(950 |

) |

|

|

(2,244 |

) |

|

|

(2,018 |

) |

|

|

(4,503 |

) |

| Other,

net |

|

|

4 |

|

|

|

(29 |

) |

|

|

1,046 |

|

|

|

189 |

|

| Income

before income taxes |

|

|

19,691 |

|

|

|

27,063 |

|

|

|

27,582 |

|

|

|

29,425 |

|

| Income tax

expense |

|

|

(4,314 |

) |

|

|

(5,551 |

) |

|

|

(5,956 |

) |

|

|

(6,004 |

) |

| Net

income |

|

$ |

15,377 |

|

|

$ |

21,512 |

|

|

$ |

21,626 |

|

|

$ |

23,421 |

|

| |

|

|

|

|

|

|

|

|

| Earnings per

common share, basic |

|

$ |

0.47 |

|

|

$ |

0.65 |

|

|

$ |

0.66 |

|

|

$ |

0.71 |

|

| Earnings per

common share, diluted |

|

$ |

0.46 |

|

|

$ |

0.65 |

|

|

$ |

0.65 |

|

|

$ |

0.71 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

| Basic |

|

|

32,870 |

|

|

|

32,858 |

|

|

|

32,847 |

|

|

|

32,905 |

|

| Diluted |

|

|

33,103 |

|

|

|

33,017 |

|

|

|

33,076 |

|

|

|

33,070 |

|

| |

|

|

|

|

|

|

|

|

| Cash

dividends per share |

|

$ |

0.08 |

|

|

$ |

0.08 |

|

|

$ |

0.16 |

|

|

$ |

0.16 |

|

| |

|

|

|

|

|

|

|

|

|

|

| QUANEX

BUILDING PRODUCTS CORPORATION |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| (In thousands) |

| (Unaudited) |

| |

|

|

|

|

| |

|

April 30, 2024 |

|

October 31, 2023 |

|

ASSETS |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

56,149 |

|

|

$ |

58,474 |

|

|

Accounts receivable, net |

|

|

87,078 |

|

|

|

97,311 |

|

|

Inventories |

|

|

101,446 |

|

|

|

97,959 |

|

|

Income taxes receivable |

|

|

6,054 |

|

|

|

8,298 |

|

|

Prepaid and other current assets |

|

|

12,776 |

|

|

|

11,558 |

|

|

Total current assets |

|

|

263,503 |

|

|

|

273,600 |

|

| Property,

plant and equipment, net |

|

|

252,857 |

|

|

|

250,664 |

|

| Operating

lease right-of-use assets |

|

|

65,019 |

|

|

|

46,620 |

|

|

Goodwill |

|

|

184,481 |

|

|

|

182,956 |

|

| Intangible

assets, net |

|

|

68,667 |

|

|

|

74,115 |

|

| Other

assets |

|

|

2,686 |

|

|

|

3,188 |

|

|

Total assets |

|

$ |

837,213 |

|

|

$ |

831,143 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

60,615 |

|

|

$ |

74,371 |

|

|

Accrued liabilities |

|

|

48,851 |

|

|

|

50,319 |

|

|

Income taxes payable |

|

|

- |

|

|

|

384 |

|

|

Current maturities of long-term debt |

|

|

2,632 |

|

|

|

2,365 |

|

|

Current operating lease liabilities |

|

|

6,433 |

|

|

|

7,224 |

|

|

Total current liabilities |

|

|

118,531 |

|

|

|

134,663 |

|

| Long-term

debt |

|

|

51,549 |

|

|

|

66,435 |

|

| Noncurrent

operating lease liabilities |

|

|

59,965 |

|

|

|

40,361 |

|

| Deferred

income taxes |

|

|

29,280 |

|

|

|

29,133 |

|

| Other

liabilities |

|

|

11,766 |

|

|

|

14,997 |

|

|

Total liabilities |

|

|

271,091 |

|

|

|

285,589 |

|

|

Stockholders’ equity: |

|

|

|

|

|

Common stock |

|

|

371 |

|

|

|

372 |

|

|

Additional paid-in-capital |

|

|

249,502 |

|

|

|

251,576 |

|

|

Retained earnings |

|

|

425,650 |

|

|

|

409,318 |

|

|

Accumulated other comprehensive loss |

|

|

(34,631 |

) |

|

|

(38,141 |

) |

|

Treasury stock at cost |

|

|

(74,770 |

) |

|

|

(77,571 |

) |

|

Total stockholders’ equity |

|

|

566,122 |

|

|

|

545,554 |

|

|

Total liabilities and stockholders' equity |

|

$ |

837,213 |

|

|

$ |

831,143 |

|

| |

|

|

|

|

|

|

| QUANEX

BUILDING PRODUCTS CORPORATION |

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW |

| (In thousands) |

| (Unaudited) |

|

|

|

|

|

| |

Six Months Ended April 30, |

| |

2024 |

|

2023 |

|

Operating activities: |

|

|

|

|

Net income |

$ |

21,626 |

|

|

$ |

23,421 |

|

|

Adjustments to reconcile net income to cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization |

|

22,046 |

|

|

|

21,076 |

|

|

Stock-based compensation |

|

1,365 |

|

|

|

1,398 |

|

|

Deferred income tax |

|

(155 |

) |

|

|

97 |

|

|

Other, net |

|

162 |

|

|

|

982 |

|

|

Changes in assets and liabilities: |

|

|

|

|

Decrease in accounts receivable |

|

10,832 |

|

|

|

11,564 |

|

|

(Increase) decrease in inventory |

|

(3,008 |

) |

|

|

14,799 |

|

|

Increase in other current assets |

|

(1,124 |

) |

|

|

(1,746 |

) |

|

Decrease in accounts payable |

|

(12,619 |

) |

|

|

(19,825 |

) |

|

Decrease in accrued liabilities |

|

(4,602 |

) |

|

|

(14,407 |

) |

|

Increase (decrease) in income taxes payable |

|

1,856 |

|

|

|

(1,754 |

) |

|

Increase in deferred pension benefits |

|

- |

|

|

|

17 |

|

|

Increase in other long-term liabilities |

|

9 |

|

|

|

1,808 |

|

|

Other, net |

|

557 |

|

|

|

1,030 |

|

| Cash

provided by operating activities |

|

36,945 |

|

|

|

38,460 |

|

|

Investing activities: |

|

|

|

|

Business acquisition |

|

- |

|

|

|

(91,302 |

) |

|

Capital expenditures |

|

(17,183 |

) |

|

|

(15,074 |

) |

|

Proceeds from disposition of capital assets |

|

93 |

|

|

|

101 |

|

| Cash used

for investing activities |

|

(17,090 |

) |

|

|

(106,275 |

) |

|

Financing activities: |

|

|

|

|

Borrowings under credit facilities |

|

- |

|

|

|

102,000 |

|

|

Repayments of credit facility borrowings |

|

(15,000 |

) |

|

|

(35,000 |

) |

|

Repayments of other long-term debt |

|

(954 |

) |

|

|

(1,306 |

) |

|

Common stock dividends paid |

|

(5,294 |

) |

|

|

(5,320 |

) |

|

Issuance of common stock |

|

554 |

|

|

|

99 |

|

|

Payroll tax paid to settle shares forfeited upon vesting of

stock |

|

(1,193 |

) |

|

|

(567 |

) |

|

Purchase of treasury stock |

|

- |

|

|

|

(5,593 |

) |

| Cash (used

for) provided by financing activities |

|

(21,887 |

) |

|

|

54,313 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

(293 |

) |

|

|

1,905 |

|

| Decrease in

cash and cash equivalents |

|

(2,325 |

) |

|

|

(11,597 |

) |

| Cash and

cash equivalents at beginning of period |

|

58,474 |

|

|

|

55,093 |

|

| Cash and

cash equivalents at end of period |

$ |

56,149 |

|

|

$ |

43,496 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| QUANEX

BUILDING PRODUCTS CORPORATIONFREE CASH FLOW AND

NET DEBT RECONCILIATION(In thousands)(Unaudited) |

|

|

|

The following table reconciles the Company's calculation of Free

Cash Flow, a non-GAAP measure, to its most directly comparable GAAP

measure. The Company defines Free Cash Flow as cash provided by

operating activities less capital expenditures. |

| |

|

|

|

|

|

|

|

| |

Three Months Ended April 30, |

|

Six Months Ended April 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Cash

provided by operating activities |

$33,091 |

|

$35,325 |

|

$36,945 |

|

$38,460 |

| Capital

expenditures |

(7,603) |

|

(7,492) |

|

(17,183) |

|

(15,074) |

| Free

Cash Flow |

$25,488 |

|

$27,833 |

|

$19,762 |

|

$23,386 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

The following table reconciles the Company's Net Debt which is

defined as total debt principal of the Company plus finance lease

obligations minus cash. |

| |

|

|

|

|

|

|

|

| |

As of April 30, |

|

|

| |

2024 |

|

2023 |

|

|

|

|

| Revolving

credit facility |

$0 |

|

$80,000 |

|

|

|

|

| Finance

lease obligations(1) |

55,217 |

|

55,626 |

|

|

|

|

| Total

debt(2) |

55,217 |

|

135,626 |

|

|

|

|

| Less: Cash

and cash equivalents |

56,149 |

|

43,496 |

|

|

|

|

| Net

Debt |

($932) |

|

$92,130 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

(1) Includes $51.0 million and $53.1 million in real estate lease

liabilities considered finance leases under U.S. GAAP as of April

30, 2024 and April 30, 2023, respectively. |

|

(2) Excludes outstanding letters of credit. |

| |

|

|

|

|

|

|

|

| |

| QUANEX

BUILDING PRODUCTS CORPORATION |

| NON-GAAP

FINANCIAL MEASURE DISCLOSURE |

| LAST TWELVE

MONTHS ADJUSTED EBITDA RECONCILIATION |

| (In thousands,

except per share data) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Last Twelve Months Adjusted

EBITDA |

|

Three Months Ended April 30, 2024 |

|

Three Months Ended January 31, 2024 |

|

Three Months Ended October 31, 2023 |

|

Three Months Ended July 31, 2023 |

|

Total |

| |

|

Reconciliation |

|

Reconciliation |

|

Reconciliation |

|

Reconciliation |

|

Reconciliation |

|

Net income as reported |

|

$ |

15,377 |

|

|

$ |

6,249 |

|

|

$ |

27,382 |

|

|

$ |

31,698 |

|

|

$ |

80,706 |

|

| Income tax

expense |

|

|

4,314 |

|

|

|

1,642 |

|

|

|

4,442 |

|

|

|

4,099 |

|

|

|

14,497 |

|

| Other,

net |

|

|

(4 |

) |

|

|

(1,042 |

) |

|

|

6,110 |

|

|

|

(402 |

) |

|

|

4,662 |

|

| Interest

expense |

|

|

950 |

|

|

|

1,068 |

|

|

|

1,565 |

|

|

|

2,068 |

|

|

|

5,651 |

|

| Depreciation

and amortization |

|

|

10,894 |

|

|

|

11,152 |

|

|

|

11,194 |

|

|

|

10,596 |

|

|

|

43,836 |

|

| EBITDA |

|

|

31,531 |

|

|

|

19,069 |

|

|

|

50,693 |

|

|

|

48,059 |

|

|

|

149,352 |

|

| Cost of

sales(1),(2) |

|

|

631 |

|

|

|

- |

|

|

|

(35 |

) |

|

|

- |

|

|

|

596 |

|

| Selling,

general and administrative(1),(2),(3) |

|

|

7,862 |

|

|

|

205 |

|

|

|

109 |

|

|

|

395 |

|

|

|

8,571 |

|

| Adjusted

EBITDA |

|

$ |

40,024 |

|

|

$ |

19,274 |

|

|

$ |

50,767 |

|

|

$ |

48,454 |

|

|

$ |

158,519 |

|

| |

|

|

|

|

|

|

|

|

|

|

| (1) Expense related to

plant closure. |

| (2) Loss on damage to

manufacturing facilities caused by weather. |

| (3) Transaction and

advisory fees. |

| |

|

|

|

|

|

|

|

|

|

|

| |

| QUANEX

BUILDING PRODUCTS CORPORATION |

| NON-GAAP

FINANCIAL MEASURE DISCLOSURE |

| (In thousands,

except per share data) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Adjusted Net Income and Adjusted

EPS |

|

Three Months EndedApril 30, 2024 |

|

Three Months EndedApril 30, 2023 |

|

Six Months EndedApril 30, 2024 |

|

Six Months EndedApril 30, 2023 |

|

| |

|

Net Income |

|

Diluted EPS |

|

Net Income |

|

Diluted EPS |

|

Net Income |

|

Diluted EPS |

|

Net Income |

|

Diluted EPS |

|

|

Net income as reported |

|

$ |

15,377 |

|

|

$ |

0.46 |

|

|

$ |

21,512 |

|

|

$ |

0.65 |

|

|

$ |

21,626 |

|

|

$ |

0.65 |

|

|

$ |

23,421 |

|

|

$ |

0.71 |

|

|

| Net income

reconciling items from below |

|

|

6,409 |

|

|

$ |

0.20 |

|

|

|

195 |

|

|

$ |

0.01 |

|

|

|

5,974 |

|

|

$ |

0.18 |

|

|

|

4,349 |

|

|

$ |

0.13 |

|

|

| Adjusted net

income and adjusted EPS |

|

$ |

21,786 |

|

|

$ |

0.66 |

|

|

$ |

21,707 |

|

|

$ |

0.66 |

|

|

$ |

27,600 |

|

|

$ |

0.83 |

|

|

$ |

27,770 |

|

|

$ |

0.84 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Adjusted EBITDA |

|

Three Months EndedApril 30, 2024 |

|

Three Months EndedApril 30, 2023 |

|

Six Months EndedApril 30, 2024 |

|

Six Months EndedApril 30, 2023 |

|

| |

|

Reconciliation |

|

|

|

Reconciliation |

|

|

|

Reconciliation |

|

|

|

Reconciliation |

|

|

|

| Net income

as reported |

|

$ |

15,377 |

|

|

|

|

$ |

21,512 |

|

|

|

|

$ |

21,626 |

|

|

|

|

$ |

23,421 |

|

|

|

|

| Income tax

expense |

|

|

4,314 |

|

|

|

|

|

5,551 |

|

|

|

|

|

5,956 |

|

|

|

|

|

6,004 |

|

|

|

|

| Other,

net |

|

|

(4 |

) |

|

|

|

|

29 |

|

|

|

|

|

(1,046 |

) |

|

|

|

|

(189 |

) |

|

|

|

| Interest

expense |

|

|

950 |

|

|

|

|

|

2,244 |

|

|

|

|

|

2,018 |

|

|

|

|

|

4,503 |

|

|

|

|

| Depreciation

and amortization |

|

|

10,894 |

|

|

|

|

|

10,456 |

|

|

|

|

|

22,046 |

|

|

|

|

|

21,076 |

|

|

|

|

| EBITDA |

|

|

31,531 |

|

|

|

|

|

39,792 |

|

|

|

|

|

50,600 |

|

|

|

|

|

54,815 |

|

|

|

|

| EBITDA

reconciling items from below |

|

|

8,493 |

|

|

|

|

|

111 |

|

|

|

|

|

8,698 |

|

|

|

|

|

5,559 |

|

|

|

|

| Adjusted

EBITDA |

|

$ |

40,024 |

|

|

|

|

$ |

39,903 |

|

|

|

|

$ |

59,298 |

|

|

|

|

$ |

60,374 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciling Items |

|

Three Months EndedApril 30, 2024 |

|

Three Months EndedApril 30, 2023 |

|

Six Months EndedApril 30, 2024 |

|

Six Months EndedApril 30, 2023 |

|

| |

|

Income Statement |

|

Reconciling Items |

|

Income Statement |

|

Reconciling Items |

|

Income Statement |

|

Reconciling Items |

|

Income Statement |

|

Reconciling Items |

|

| Net

sales |

|

$ |

266,201 |

|

|

$ |

- |

|

|

$ |

273,535 |

|

|

$ |

- |

|

|

$ |

505,356 |

|

|

$ |

- |

|

|

$ |

535,451 |

|

|

$ |

- |

|

|

| Cost of

sales |

|

|

199,963 |

|

|

|

(631 |

) |

(1) |

|

206,372 |

|

|

|

(48 |

) |

(2) |

|

387,686 |

|

|

|

(631 |

) |

(1) |

|

416,521 |

|

|

|

(48 |

) |

(2) |

| Selling,

general and administrative |

|

|

34,707 |

|

|

|

(7,862 |

) |

(1), (3) |

|

27,371 |

|

|

|

(63 |

) |

(2), (3) |

|

67,070 |

|

|

|

(8,067 |

) |

(1), (3) |

|

64,115 |

|

|

|

(5,511 |

) |

(2), (3) |

| EBITDA |

|

|

31,531 |

|

|

|

8,493 |

|

|

|

39,792 |

|

|

|

111 |

|

|

|

50,600 |

|

|

|

8,698 |

|

|

|

54,815 |

|

|

|

5,559 |

|

|

| Depreciation

and amortization |

|

|

10,894 |

|

|

|

- |

|

|

|

10,456 |

|

|

|

- |

|

|

|

22,046 |

|

|

|

- |

|

|

|

21,076 |

|

|

|

- |

|

|

| Operating

income |

|

|

20,637 |

|

|

|

8,493 |

|

|

|

29,336 |

|

|

|

111 |

|

|

|

28,554 |

|

|

|

8,698 |

|

|

|

33,739 |

|

|

|

5,559 |

|

|

| Interest

expense |

|

|

(950 |

) |

|

|

- |

|

|

|

(2,244 |

) |

|

|

- |

|

|

|

(2,018 |

) |

|

|

- |

|

|

|

(4,503 |

) |

|

|

- |

|

|

| Other,

net |

|

|

4 |

|

|

|

(92 |

) |

(4) |

|

(29 |

) |

|

|

132 |

|

(4) |

|

1,046 |

|

|

|

(847 |

) |

(4) |

|

189 |

|

|

|

90 |

|

(4) |

| Income

before income taxes |

|

|

19,691 |

|

|

|

8,401 |

|

|

|

27,063 |

|

|

|

243 |

|

|

|

27,582 |

|

|

|

7,851 |

|

|

|

29,425 |

|

|

|

5,649 |

|

|

| Income tax

expense |

|

|

(4,314 |

) |

|

|

(1,992 |

) |

(5) |

|

(5,551 |

) |

|

|

(48 |

) |

(5) |

|

(5,956 |

) |

|

|

(1,877 |

) |

(5) |

|

(6,004 |

) |

|

|

(1,300 |

) |

(4) |

| Net

income |

|

$ |

15,377 |

|

|

$ |

6,409 |

|

|

$ |

21,512 |

|

|

$ |

195 |

|

|

$ |

21,626 |

|

|

$ |

5,974 |

|

|

$ |

23,421 |

|

|

$ |

4,349 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted

earnings per share |

|

$ |

0.46 |

|

|

|

|

$ |

0.65 |

|

|

|

|

$ |

0.65 |

|

|

|

|

$ |

0.71 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Expense related to

plant closure. |

| (2) Loss on damage to

manufacturing facilities caused by weather. |

| (3) Transaction and

advisory fees. |

| (4) Pension settlement

(refund) expense and foreign currency transaction losses

(gains). |

| (5)Tax impact of net

income reconciling items. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| QUANEX

BUILDING PRODUCTS CORPORATION |

| SELECTED

SEGMENT DATA |

| (In thousands) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| This table provides

gross margin, operating income (loss), EBITDA, and Adjusted EBITDA

by reportable segment. Non-operating expense and income tax expense

are not allocated to the reportable segments. |

| |

|

NA Fenestration |

|

EU Fenestration |

|

NA Cabinet Components |

|

UnallocatedCorp & Other |

|

Total |

|

Three months ended April 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

159,774 |

|

|

$ |

56,583 |

|

|

$ |

51,078 |

|

|

$ |

(1,234 |

) |

|

$ |

266,201 |

|

|

Cost of sales |

|

|

122,261 |

|

|

|

35,694 |

|

|

|

42,624 |

|

|

|

(616 |

) |

|

|

199,963 |

|

|

Gross Margin |

|

|

37,513 |

|

|

|

20,889 |

|

|

|

8,454 |

|

|

|

(618 |

) |

|

|

66,238 |

|

|

Gross Margin % |

|

|

23.5 |

% |

|

|

36.9 |

% |

|

|

16.6 |

% |

|

|

|

|

24.9 |

% |

|

Selling, general and administrative(1) |

|

|

13,730 |

|

|

|

7,873 |

|

|

|

5,066 |

|

|

|

8,038 |

|

|

|

34,707 |

|

|

Depreciation and amortization |

|

|

5,218 |

|

|

|

2,538 |

|

|

|

3,082 |

|

|

|

56 |

|

|

|

10,894 |

|

|

Operating income (loss) |

|

|

18,565 |

|

|

|

10,478 |

|

|

|

306 |

|

|

|

(8,712 |

) |

|

|

20,637 |

|

|

Depreciation and amortization |

|

|

5,218 |

|

|

|

2,538 |

|

|

|

3,082 |

|

|

|

56 |

|

|

|

10,894 |

|

|

EBITDA |

|

|

23,783 |

|

|

|

13,016 |

|

|

|

3,388 |

|

|

|

(8,656 |

) |

|

|

31,531 |

|

|

Expense related to plant closure (Cost of sales) |

|

|

|

|

- |

|

|

|

631 |

|

|

|

- |

|

|

|

631 |

|

|

Expense related to plant closure (SG&A) |

|

|

- |

|

|

|

- |

|

|

|

978 |

|

|

|

- |

|

|

|

978 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6,884 |

|

|

|

6,884 |

|

|

Adjusted EBITDA |

|

$ |

23,783 |

|

|

$ |

13,016 |

|

|

$ |

4,997 |

|

|

$ |

(1,772 |

) |

|

$ |

40,024 |

|

|

Adjusted EBITDA Margin % |

|

|

14.9 |

% |

|

|

23.0 |

% |

|

|

9.8 |

% |

|

|

|

|

15.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended April 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

156,975 |

|

|

$ |

63,763 |

|

|

$ |

53,518 |

|

|

$ |

(721 |

) |

|

$ |

273,535 |

|

|

Cost of sales |

|

|

122,472 |

|

|

|

40,452 |

|

|

|

43,731 |

|

|

|

(283 |

) |

|

|

206,372 |

|

|

Gross Margin |

|

|

34,503 |

|

|

|

23,311 |

|

|

|

9,787 |

|

|

|

(438 |

) |

|

|

67,163 |

|

|

Gross Margin % |

|

|

22.0 |

% |

|

|

36.6 |

% |

|

|

18.3 |

% |

|

|

|

|

24.6 |

% |

|

Selling, general and administrative(1) |

|

|

14,158 |

|

|

|

8,452 |

|

|

|

5,971 |

|

|

|

(1,210 |

) |

|

|

27,371 |

|

|

Depreciation and amortization |

|

|

5,050 |

|

|

|

2,353 |

|

|

|

2,970 |

|

|

|

83 |

|

|

|

10,456 |

|

|

Operating income |

|

|

15,295 |

|

|

|

12,506 |

|

|

|

846 |

|

|

|

689 |

|

|

|

29,336 |

|

|

Depreciation and amortization |

|

|

5,050 |

|

|

|

2,353 |

|

|

|

2,970 |

|

|

|

83 |

|

|

|

10,456 |

|

|

EBITDA |

|

|

20,345 |

|

|

|

14,859 |

|

|

|

3,816 |

|

|

|

772 |

|

|

|

39,792 |

|

|

Loss on damage to manufacturing facilities (Cost of sales) |

|

|

35 |

|

|

|

- |

|

|

|

13 |

|

|

|

- |

|

|

|

48 |

|

|

Loss on damage to manufacturing facilities (SG&A) |

|

|

- |

|

|

|

- |

|

|

|

200 |

|

|

|

- |

|

|

|

200 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(137 |

) |

|

|

(137 |

) |

|

Adjusted EBITDA |

|

$ |

20,380 |

|

|

$ |

14,859 |

|

|

$ |

4,029 |

|

|

$ |

635 |

|

|

$ |

39,903 |

|

|

Adjusted EBITDA Margin % |

|

|

13.0 |

% |

|

|

23.3 |

% |

|

|

7.5 |

% |

|

|

|

|

14.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Six

months ended April 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

307,769 |

|

|

$ |

106,020 |

|

|

$ |

94,215 |

|

|

$ |

(2,648 |

) |

|

$ |

505,356 |

|

|

Cost of sales |

|

|

240,629 |

|

|

|

67,397 |

|

|

|

81,367 |

|

|

|

(1,707 |

) |

|

|

387,686 |

|

|

Gross Margin |

|

|

67,140 |

|

|

|

38,623 |

|

|

|

12,848 |

|

|

|

(941 |

) |

|

|

117,670 |

|

|

Gross Margin % |

|

|

21.8 |

% |

|

|

36.4 |

% |

|

|

13.6 |

% |

|

|

|

|

23.3 |

% |

|

Selling, general and administrative(1) |

|

|

29,640 |

|

|

|

15,618 |

|

|

|

10,192 |

|

|

|

11,620 |

|

|

|

67,070 |

|

|

Depreciation and amortization |

|

|

10,693 |

|

|

|

5,096 |

|

|

|

6,147 |

|

|

|

110 |

|

|

|

22,046 |

|

|

Operating income (loss) |

|

|

26,807 |

|

|

|

17,909 |

|

|

|

(3,491 |

) |

|

|

(12,671 |

) |

|

|

28,554 |

|

|

Depreciation and amortization |

|

|

10,693 |

|

|

|

5,096 |

|

|

|

6,147 |

|

|

|

110 |

|

|

|

22,046 |

|

|

EBITDA |

|

|

37,500 |

|

|

|

23,005 |

|

|

|

2,656 |

|

|

|

(12,561 |

) |

|

|

50,600 |

|

|

Expense related to plant closure (Cost of sales) |

|

|

- |

|

|

|

- |

|

|

|

631 |

|

|

|

- |

|

|

|

631 |

|

|

Expense related to plant closure (SG&A) |

|

|

- |

|

|

|

- |

|

|

|

978 |

|

|

|

- |

|

|

|

978 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7,089 |

|

|

|

7,089 |

|

|

Adjusted EBITDA |

|

$ |

37,500 |

|

|

$ |

23,005 |

|

|

$ |

4,265 |

|

|

$ |

(5,472 |

) |

|

$ |

59,298 |

|

|

Adjusted EBITDA Margin % |

|

|

12.2 |

% |

|

|

21.7 |

% |

|

|

4.5 |

% |

|

|

|

|

11.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Six

months ended April 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

309,955 |

|

|

$ |

118,715 |

|

|

$ |

108,192 |

|

|

$ |

(1,411 |

) |

|

$ |

535,451 |

|

|

Cost of sales |

|

|

247,189 |

|

|

|

78,155 |

|

|

|

91,787 |

|

|

|

(610 |

) |

|

|

416,521 |

|

|

Gross Margin |

|

|

62,766 |

|

|

|

40,560 |

|

|

|

16,405 |

|

|

|

(801 |

) |

|

|

118,930 |

|

|

Gross Margin % |

|

|

20.3 |

% |

|

|

34.2 |

% |

|

|

15.2 |

% |

|

|

|

|

22.2 |

% |

|

Selling, general and administrative(1) |

|

|

27,453 |

|

|

|

15,957 |

|

|

|

10,844 |

|

|

|

9,861 |

|

|

|

64,115 |

|

|

Depreciation and amortization |

|

|

10,295 |

|

|

|

4,701 |

|

|

|

5,904 |

|

|

|

176 |

|

|

|

21,076 |

|

|

Operating income (loss) |

|

|

25,018 |

|

|

|

19,902 |

|

|

|

(343 |

) |

|

|

(10,838 |

) |

|

|

33,739 |

|

|

Depreciation and amortization |

|

|

10,295 |

|

|

|

4,701 |

|

|

|

5,904 |

|

|

|

176 |

|

|

|

21,076 |

|

|

EBITDA |

|

|

35,313 |

|

|

|

24,603 |

|

|

|

5,561 |

|

|

|

(10,662 |

) |

|

|

54,815 |

|

|

Loss on damage to manufacturing facilities (Cost of sales) |

|

|

35 |

|

|

|

- |

|

|

|

13 |

|

|

|

- |

|

|

|

48 |

|

|

Loss on damage to manufacturing facilities (SG&A) |

|

|

- |

|

|

|

- |

|

|

|

200 |

|

|

|

- |

|

|

|

200 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,311 |

|

|

|

5,311 |

|

|

Adjusted EBITDA |

|

$ |

35,348 |

|

|

$ |

24,603 |

|

|

$ |

5,774 |

|

|

$ |

(5,351 |

) |

|

$ |

60,374 |

|

|

Adjusted EBITDA Margin % |

|

|

11.4 |

% |

|

|

20.7 |

% |

|

|

5.3 |

% |

|

|

|

|

11.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes stock-based compensation expense for the three and six

months ended April 30, 2024, respectively of $1.5 million and $4.1

million and $0.4 million and $5.2 million for the comparable prior

year periods. |

| |

|

|

|

|

|

|

|

|

|

|

| |

| QUANEX

BUILDING PRODUCTS CORPORATION |

| SALES

ANALYSIS |

| (In thousands) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended April 30, |

|

Six Months Ended April 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

NA Fenestration: |

|

|

|

|

|

|

|

|

|

United States - fenestration |

$ |

119,646 |

|

|

$ |

120,756 |

|

|

$ |

231,280 |

|

|

$ |

241,523 |

|

| |

International - fenestration |

|

7,465 |

|

|

|

8,350 |

|

|

|

13,609 |

|

|

|

13,477 |

|

| |

United

States - non-fenestration |

|

27,532 |

|

|

|

24,334 |

|

|

|

53,323 |

|

|

|

47,400 |

|

| |

International - non-fenestration |

|

5,131 |

|

|

|

3,535 |

|

|

|

9,557 |

|

|

|

7,555 |

|

| |

|

$ |

159,774 |

|

|

$ |

156,975 |

|

|

$ |

307,769 |

|

|

$ |

309,955 |

|

|

EU Fenestration:(1) |

|

|

|

|

|

|

|

| |

International - fenestration |

$ |

46,968 |

|

|

$ |

47,903 |

|

|

$ |

88,719 |

|

|

$ |

90,257 |

|

| |

International - non-fenestration |

|

9,615 |

|

|

|

15,860 |

|

|

|

17,301 |

|

|

|

28,458 |

|

| |

|

$ |

56,583 |

|

|

$ |

63,763 |

|

|

$ |

106,020 |

|

|

$ |

118,715 |

|

|

NA Cabinet Components: |

|

|

|

|

|

|

|

| |

United

States - fenestration |

$ |

3,737 |

|

|

$ |

4,219 |

|

|

$ |

7,412 |

|

|

$ |

8,127 |

|

| |

United

States - non-fenestration |

|

46,990 |

|

|

|

48,526 |

|

|

|

86,169 |

|

|

|

98,575 |

|

| |

International - non-fenestration |

|

351 |

|

|

|

773 |

|

|

|

634 |

|

|

|

1,490 |

|

| |

|

$ |

51,078 |

|

|

$ |

53,518 |

|

|

$ |

94,215 |

|

|

$ |

108,192 |

|

|

Unallocated Corporate & Other: |

|

|

|

|

|

|

|

| |

Eliminations |

$ |

(1,234 |

) |

|

$ |

(721 |

) |

|

$ |

(2,648 |

) |

|

$ |

(1,411 |

) |

| |

|

$ |

(1,234 |

) |

|

$ |

(721 |

) |

|

$ |

(2,648 |

) |

|

$ |

(1,411 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Sales |

$ |

266,201 |

|

|

$ |

273,535 |

|

|

$ |

505,356 |

|

|

$ |

535,451 |

|

| |

|

|

|

|

|

|

|

|

| (1) Reflects an

increase of $0.6 million and $1.6 million in revenue associated

with foreign currency exchange rate impacts for the three and six

months ended April 30, 2024, respectively. |

| |

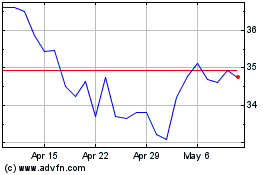

Quanex (NYSE:NX)

Historical Stock Chart

From Oct 2024 to Nov 2024

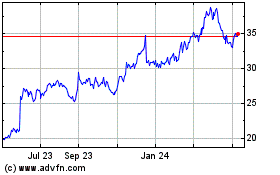

Quanex (NYSE:NX)

Historical Stock Chart

From Nov 2023 to Nov 2024