3rd UPDATE: BlackRock To Buy Remaining BofA Stake For $2.55 Billion

May 19 2011 - 1:59PM

Dow Jones News

BlackRock Inc. (BLK) will buy out the remaining stake that Bank

of America Corp. (BAC) held in the world's largest money manager

for about $2.55 billion, the two companies said Thursday, giving

BlackRock more control of its own company and the bank a capital

boost.

The buyout ends a five-year investment, started when Merrill

Lynch & Co. first took a massive stake in the money manager,

accelerating BlackRock's rapid growth.

For Bank of America, which acquired the stake with its 2009

purchase of Merrill, the deal is the latest in a series of

divestitures that the nation's largest bank by assets said are

helping it to narrow its focus.

The move will also likely provide a lift to Bank of America's

capital position, which came under scrutiny from investors after

the bank disclosed the Federal Reserve had objected to its capital

plan earlier this year. The bank has said the plan was rejected but

didn't explain why. It plans to resubmit the plan later this year,

noting it had always said the goal was for a second-half "modest"

dividend increase.

Bank of America had been carrying the investment on its books at

$2.2 billion, meaning it should record a pre-tax gain of around

$350 million.

The Fed's rejection has been a key reason why the bank's stock

has slumped 20% over the past three months. Shares slipped 0.7% to

$11.71 in recent trading.

For BlackRock, which rose 2.6% to $198.325 in recent trading,

the deal frees it from the bank's investment.

A BlackRock spokesman said the transaction will be "immediately

accretive," with the reduction in dividend payments more than

covering the expected interest-rate costs associated with financing

the buyback.

BlackRock said the share repurchase will be funded with

available cash and a total of $2.0 billion of commercial paper,

medium-term and long-term debt.

Nomura analyst Glenn Schorr estimated BlackRock's earnings in

2012 and 2013 will rise 3%, given the lower share count. He raised

BlackRock's target price to $232 from $225.

There will be no change to the money manager's dividend rate

because of the buyback, the spokesman added. BlackRock in February

raised the quarterly dividend rate 38% to $1.38 a share.

A spokesman for the bank said the decision to exit fully was

mutual, as BlackRock had approached Bank of America about the

purchase and the bank agreed.

Analysts initially said the repurchase was positive for

BlackRock as it removes one major overhang on share price, after

Bank of America and PNC Financial Services Group Inc. (PNC) sold

big portions of their ownership in the New York firm in

November.

One analyst, who declined to be named, said it is unlikely that

PNC, which owns a 25% stake in BlackRock, will further sell down

its holding.

PNC said in a statement that it does "continually monitor"

investments but "considers BlackRock an extremely valuable and

trusted business partner."

Barclays PLC (BCS,BARC.LN) owns a 19.9% economic interest in

BlackRock, including both common and preferred shares. Barclays got

the stake in December 2009, having sold its asset-management unit

Barclays Global Investors to the money manager.

Nomura's Schorr said BlackRock has the financial strength to

"possibly repurchase Barclays stake in the firm if and when

Barclays decides to sell."

A BlackRock spokesman said, "We are aware of the announcement by

BlackRock regarding its proposed buyback of the Bank of America

Merrill Lynch stake in Blackrock and are reviewing the situation.

Our strategic relationship with BlackRock remains unchanged."

Under the deal announced Thursday, BlackRock would buy back Bank

of America's nearly 13.6 million series B convertible preferred

shares for about $187.65 each, a 2.9% discount to Wednesday's

close. Bank of America had already sold some 51.2 million shares of

BlackRock last year in a public offering, which priced at $163 a

share.

The two said their strategic partnership will continue even

without the investment, and Bank of America's investment-bank head,

Thomas Montag, will remain on BlackRock's board. The 2006 deal was

seen as a way for BlackRock to grow in stature, expanding its reach

into stock-market mutual funds, which it acquired from Merrill,

while also getting widespread distribution of its funds by what was

known as the Thundering Herd of Merrill brokers.

-By David Benoit and Amy Or, Dow Jones Newswires;

212-416-2458 david.benoit@dowjones.com;

--Matt Jarzemsky contributed to this article.

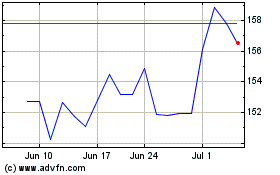

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

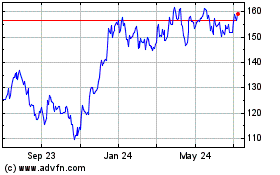

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Nov 2023 to Nov 2024