Citigroup & PNC Financial - Alternative Dividend Strategies

March 15 2011 - 7:35AM

Marketwired

Investors are once again looking to major US banks as safe

companies that will post steady profits and hopefully begin

providing steady dividends. While certain major banks have said

dividend increases are a top priority, others argue that now is not

the right time to return cash to shareholders. The Bedford Report

examines the outlook for companies in the Financial Sector and

provides research reports on Citigroup, Inc. (NYSE: C) and PNC

Financial Services, Inc. (NYSE: PNC). Access to the full company

reports can be found at:

www.bedfordreport.com/2011-03-C

www.bedfordreport.com/2011-03-PNC

In the coming weeks, the Federal Reserve is expected to disclose

the results of its latest round of stress tests. The crucial points

of the tests are banks' ability to survive another recession as

well as meeting regulatory capital requirements. Due to the

recession, the Federal Reserve had barred major banks from

increasing their dividends. As many of these banks repaid the

bailout money, they began pressuring the regulators to let them

restore their dividends.

Most of the largest banks are targeting a dividend increase in

2011 or 2012 to roughly 30 percent of earnings.

The Bedford Report releases regular market updates on the

Financial Sector so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.bedfordreport.com and get

exclusive access to our numerous analyst reports and industry

newsletters.

Citigroup's CEO Vikram Pandit said that "2012 is the right year

for us to return capital." Pandit added that Citi wants "to make

sure that we are in exactly the right place on Basel III." Under

Basel III, only if a bank operating in a steady economic

environment maintains a Tier 1 capital ratio of 12% would it be

allowed to pay or increase common dividends.

PNC CEO James Rohr believes his company is "in a solid position

to deliver greater shareholder value this year." The company's CFO

Richard Johnson added that the bank is well capitalized "and should

be when the (Basel 3) rules go into effect in 2013."

The Bedford Report provides Analyst Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above-mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

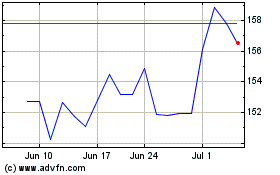

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

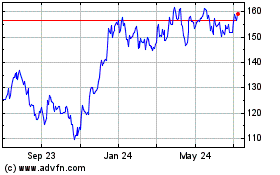

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Nov 2023 to Nov 2024