UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission File Number: 333-39249

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Pioneer Natural Resources Company

777 Hidden Ridge

Irving, Texas 75038

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

Financial Statements and Supplemental Schedule

As of December 31, 2023 and 2022 and for the year ended December 31, 2023

With Report of Independent Registered Public Accounting Firm

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

TABLE OF CONTENTS

| | | | | |

| |

| |

| Page |

| Report of Independent Registered Public Accounting Firm | |

Statements of Net Assets Available for Benefits as of December 31, 2023 and 2022 | |

Statement of Changes in Net Assets Available for Benefits for the Year Ended December 31, 2023 | |

| Notes to Financial Statements | |

Schedule H; Line 4i – Schedule of Assets (Held At End of Year) as of December 31, 2023 | |

| Signatures | |

| Index to Exhibits | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Participants and Plan Administrator of the Pioneer Natural Resources USA, Inc. 401(k) and Matching Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Pioneer Natural Resources USA, Inc. 401(k) and Matching Plan (the "Plan") as of December 31, 2023, and the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023, and the changes in net assets available for benefits for the year ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental schedule of Form 5500, Schedule H, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2023, has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Whitley Penn LLP

We have served as the Plan's auditor since 2014.

Dallas, Texas

June 20, 2024

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Investments at fair value | $ | 782,455,263 | | | $ | 663,077,288 | |

| Notes receivable from participants | 9,283,342 | | | 8,690,575 | |

| | | |

| Total assets | 791,738,605 | | | 671,767,863 | |

| Accrued administrative expenses | (37,694) | | | (33,283) | |

| Net assets available for benefits | $ | 791,700,911 | | | $ | 671,734,580 | |

See accompanying notes to financial statements.

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

| | | | | | |

| Year Ended December 31, 2023 | |

| Additions to net assets available for benefits: | | |

Net increase in fair value of investments | $ | 106,281,617 | | |

| Employer contributions | 28,909,290 | | |

| Participants' contributions | 27,217,261 | | |

| Interest and dividend income | 14,462,178 | | |

| Rollover contributions | 1,949,976 | | |

| | |

| Total additions | 178,820,322 | | |

| | |

| Deductions from net assets available for benefits: | | |

| | |

| Distributions to participants | 58,214,970 | | |

| Administrative expenses | 545,103 | | |

Other deductions, net | 93,918 | | |

| Total deductions | 58,853,991 | | |

Net increase in net assets available for benefits | 119,966,331 | | |

| Net assets available for benefits, beginning of year | 671,734,580 | | |

| Net assets available for benefits, end of year | $ | 791,700,911 | | |

See accompanying notes to financial statements.

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2023 and 2022

NOTE 1. Description of Plan

The following description of the Pioneer Natural Resources USA, Inc. 401(k) and Matching Plan (the "Plan") provides only general information. A more complete description of the Plan is accessible to each participant and beneficiary through the website maintained for the Plan at www.vanguard.com. Access to the website is only available to each participant and beneficiary. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA").

General

The Plan is a defined contribution plan established on January 1, 1990 under Section 401 of the Internal Revenue Code of 1986, as amended (the "Code"). The Plan was established for the benefit of the employees of Pioneer Natural Resources USA, Inc., a wholly-owned subsidiary of Pioneer Natural Resources Company (the "Company"), and any affiliate of Pioneer Natural Resources USA, Inc. that has adopted the Plan pursuant to the terms of the Plan (collectively referred to as the "Employer"). All regular full-time and part-time employees of the Employer are eligible to participate in the Plan on the first payroll date following their date of hire. A temporary employee is eligible to participate in the Plan upon the earlier of (i) the first day of the Plan year after the employee completes one year of eligibility service (which is the period of twelve consecutive months commencing on the employee's employment date or any Plan year commencing after the employee's employment date, during which the employee completes at least 1,000 hours of service) or (ii) the date that is six months after the employee completes one year of eligibility service. The Plan's assets are held in a trust and certain administrative functions are performed by Vanguard Fiduciary Trust Company, the trustee of the Plan (the "Trustee"). The Plan is administered by the Pioneer Natural Resources USA, Inc. 401(k) and Matching Plan Committee (the "Plan Administrator").

Contributions

Participants may elect to contribute pre-tax basic compensation, as defined in the Plan ("Basic Compensation"), to the Plan ("Pre-Tax Contributions"). Participants may also make contributions to the Plan, which allow a participant to pay federal income taxes on a portion of their contributions to the Plan and take related distributions from the Plan free of federal income tax ("Roth Contributions"). Finally, participants may elect to make after-tax contributions to the Plan. A participant's combined pre-tax, Roth and after-tax contributions to the Plan cannot exceed 80 percent of the participant's Basic Compensation per pay period or the applicable legal limit. Certain participants may make catch-up contributions to the Plan in accordance with Section 414(v) of the Code. Pre-tax, Roth, after-tax and catch-up contributions are hereinafter referred to as "Participant Contributions."

Contributions made in cash by the Employer on behalf of a participant ("Matching Contributions") are, for each pay period beginning on or after August 15, 2022, an amount equal to 200 percent of the Pre-Tax Contributions and Roth Contributions made by the participant, not exceeding five percent of the participant's annual Basic Compensation. The Company elected to fund 2023 Matching Contributions totaling $1,281,571 via cash on hand subsequent to December 31, 2023.

Employees who are eligible for participation in the Plan are automatically enrolled in the Plan with a contribution rate of five percent of the employee's pre-tax Basic Compensation. Employees may opt out of participation or make an alternate election within 30 days of becoming eligible for participation. All contributions are subject to certain limitations of the Code.

Participant Accounts and Investment Options

Participant accounts are credited with their Participant Contributions and Matching Contributions. In accordance with Section 404(c) of ERISA and the Plan's Investment Policy Statement, participants exercise individual control over their accounts and are provided a broad range of investment funds in which they may choose to invest their Participant Contributions and Matching Contributions. Earnings and losses attributable to each participant's chosen investments are allocated to the participant's account and a flat quarterly fee of $13.00 ($52.00 annually) is deducted from each participant's account to cover expenses associated with administering the Plan. The benefit to which a participant is entitled is the amount that can be realized from the participant's vested account. See Note 3 for additional information regarding investment risks and uncertainties.

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2023 and 2022

Vesting

Participants are immediately vested in their Participant Contributions and any earnings thereon. Participants vest in 25 percent of their Matching Contributions and earnings thereon for each full year of completed service to the Company over a four-year period that begins with the participant's date of hire. Participants' account balances that were merged into the Plan from predecessor plans are fully vested.

Payments of Benefits

A participant may receive a distribution of the vested amount credited to the participant's accounts under the Plan upon one of the following events:

•retirement (which means separation from employment on or after the participant's 65th birthday),

•permanent disability,

•death, or

•other separation from employment.

Vested balances greater than $5,000. If the total value of the vested portion of a participant's accounts (other than rollover amounts) exceeds $5,000, subject to participant consent, payments will begin no later than 60 days after the end of the Plan year in which the participant becomes entitled to a distribution. Distributions of the participant's vested portion of the account can be in the form of a single distribution. Further, the vested portion of a retired, disabled or deceased participant also can be in the form of monthly, quarterly or annual installment distributions over a period of two or more years, but no longer than one of the following periods (as selected by the participant or the designated beneficiary): for a retired or disabled participant, (i) the participant's life, (ii) the lives of the participant and his or her designated beneficiary, (iii) a period not extending beyond the participant's life expectancy, or (iv) a period not extending beyond the joint life and last survivor expectancy of the participant and his or her designated beneficiary, and for a deceased participant, (a) the life of the participant's designated beneficiary or (b) a period not extending beyond the life expectancy of the designated beneficiary. Upon the termination of employment, retirement or disability of a participant, such participant's vested account balances attributable to predecessor plans shall be distributed in the form of a joint and survivor annuity unless the participant directs the Plan Administrator to distribute the benefits in the form of a single distribution or installment distributions.

Vested balances less than or equal to $5,000. If the total value of the vested portion of the participant's accounts is $1,000 or less, payment will be made in a single distribution as soon as administratively possible. If the total value of the vested portion of the participant's accounts is greater than $1,000 but less than or equal to $5,000 (not including amounts in the participant's rollover account, if any), and a distribution is required to be made to a participant prior to attainment of age 65, the Plan will automatically pay the distribution in a direct rollover to an individual retirement account designated by the Plan Administrator unless the participant elects to have it paid directly to the participant in a single distribution or rolled over to another eligible retirement plan.

In either case, vested amounts that are invested in the Pioneer Natural Resources Stock Fund may, at the election of the participant, be distributed in the form of the Company's common stock with cash distributed in lieu of fractional shares of stock. Under the Plan, a participant's beneficiary will receive the participant's account balances in the event of the participant's death.

In-Service Withdrawals

A current employee of the Employer may withdraw (i) all or a portion of the participant's account balances derived from after-tax Participant Contributions or rollover contributions, (ii) pre-tax Participant Contributions (excluding earnings and qualified non-elective contributions allocated to the participant's pre-tax Participant Contributions accounts) under certain hardship conditions specified in the Plan document, or (iii) if the participant has attained the age of 59½, all or a portion of the participant's vested account balances (excluding balances in certain predecessor plan accounts that contain employer Matching Contributions). In addition, certain withdrawals may be made by (i) a participant who is a reservist or national guardsman called to active duty or (ii) a participant who is performing qualified military service and who is receiving differential wage payments from the Employer.

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2023 and 2022

Participant Loans

Participants may borrow from their accounts a maximum of the lesser of (i) $50,000 (reduced by the highest total outstanding balance of all other Plan loans to the participant during the one-year period ending on the day before the date a new loan is made) or (ii) 50 percent of their account's vested balances. The loans are secured by the balance in the participants' accounts. Participants' loans bear interest at an annual rate equal to the prime borrowing rate at the inception of the loan plus one percent. Interest rates range from 4.25 percent to 9.50 percent and 4.25 percent to 7.25 percent on outstanding participant loans as of December 31, 2023 and 2022, respectively. When the loan is repaid, both principal and interest are deposited into the participant's account. Loan principal and interest are paid ratably through payroll deductions over a period not to exceed five years unless the loan is for the purpose of acquiring the principal residence of the participant, which is not to exceed a period of 15 years. A participant may not have more than two participant loans outstanding at any time. Loans to participants are valued at their unpaid principal balance plus any accrued but unpaid interest.

Forfeitures

The unvested portion of a participant's account is forfeited to the Plan upon termination of employment. Forfeitures may be used to defray Plan administrative expenses, reduce Matching Contributions made to the Plan by the Employer or restore previously forfeited amounts to participants upon rehire by the Company. In 2023, forfeitures of $179,415 were used to pay Plan administrative expenses. Plan assets in the Plan's forfeiture account totaled $464,857 and $711,666 as of December 31, 2023 and 2022, respectively.

Plan Termination

Although it has not expressed any intent to do so, the Employer has the right under the Plan, subject to the provisions of ERISA, to discontinue its Matching Contributions at any time or to terminate the Plan. In the event of the Plan's termination or the complete discontinuance of any Matching Contributions to the Plan, participants will immediately become fully vested in their accounts.

NOTE 2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying financial statements have been prepared under the accrual basis of accounting in accordance with generally accepted accounting principles in the United States of America ("GAAP").

Distributions of Benefits

Distributions of benefits to participants are recorded when paid.

Investment Valuation

The Plan's investments presented in the accompanying Statements of Net Assets Available for Benefits as of December 31, 2023 and 2022 are stated at fair value as reported by the Trustee.

Investments in the common/collective trusts are valued at net asset value based upon the fair values of the underlying net assets of the trusts, as determined by the issuer. Vanguard Retirement Savings Trust III ("VRSTIII") invests in fully benefit-responsive investment contracts, including traditional contracts, wrapper contracts re-bid to determine the replacement cost and underlying bond instruments valued by the Trustee. The net asset value is used as a practical expedient to estimate fair value. The practical expedient would not be used if it is determined to be probable that the fund will sell the investment for an amount different from the reported net asset value. Participant transactions (purchases and sales) may occur daily. If the Plan initiates a full redemption of the common/collective trust, the issuer reserves the right to require 12 months notification in order to ensure that securities liquidations will be carried out in an orderly business manner. The value of the investment in VRSTIII as of December 31, 2023 and 2022 was $32,051,073 and $40,737,441, respectively. See Note 4 for additional information about fair value. Security Transactions and Investment Income

Security transactions are accounted for on a trade-date basis. Expenses incurred with transactions, if any, are added to the purchase price or deducted from the selling price at the time of the transactions. Dividend income is

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2023 and 2022

recorded on the ex-dividend date. Interest income is recorded as earned on an accrual basis. Net increases or decreases in the fair value of investments include the Plan's gains and losses on investments bought and sold as well as investments held during the year.

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2023 or 2022. If a participant ceases to make loan repayments and the Plan Administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

Use of Estimates

The preparation of the accompanying financial statements in conformity with GAAP requires the Plan's management to make estimates that affect the amounts reported in the financial statements, accompanying notes and supplemental schedule. Actual results could differ from those estimates.

NOTE 3. Investments

The Trustee holds the Plan's investments and executes all investment transactions. The investment funds in which participants are allowed to invest their accounts under the Plan are subject to a number of risks and uncertainties. These risks and uncertainties include, among other things, interest rate risk, credit risk, political risk, general business risks and overall market volatility risk. The investment funds have individual risk profiles that cause them to respond differently to changes in the risks and uncertainties described above. Due to the level of risk associated with the investment funds, it is reasonably possible that changes in the fair values of the investment funds may have occurred since December 31, 2023, or may occur during the near term, and that such changes could cause participants' account balances, and thus the benefits to which participants are entitled under the Plan, to differ materially from those reported as of December 31, 2023 and 2022. See Schedule H; Line 4i - Schedules of Assets (Held At End of Year) for additional information about individual investment values as of December 31, 2023.

NOTE 4. Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or the price paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair value measurements are based upon inputs that market participants use in pricing an asset or liability, which are characterized according to a hierarchy that prioritizes those inputs based on the degree to which they are observable. Observable inputs represent market data obtained from independent sources, whereas unobservable inputs reflect a company's own market assumptions, which are used if observable inputs are not reasonably available without undue cost and effort. The fair value input hierarchy level into which an asset or liability measurement in its entirety falls is determined based on the lowest level input that is significant to the measurement in its entirety. The three input levels of the fair value hierarchy are as follows:

• Level 1 – quoted prices for identical assets or liabilities in active markets.

• Level 2 – quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability (e.g. interest rates) and inputs derived principally from or corroborated by observable market data by correlation or other means.

• Level 3 – unobservable inputs for the asset or liability.

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2023 and 2022

The following table presents the Plan's financial assets that are measured at fair value on a recurring basis as of December 31, 2023 and 2022, for each of the fair value hierarchy levels:

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of December 31, 2023 | | |

| Quoted Prices in Active Markets for Identical Assets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Fair Value as of December 31, 2023 |

| Assets: | | | | | | | |

| Registered investment company funds | $ | 413,905,731 | | | $ | — | | | $ | — | | | $ | 413,905,731 | |

| Common/collective trusts | — | | | 309,094,280 | | | — | | | 309,094,280 | |

| Pioneer Natural Resources Stock Fund | 27,404,179 | | | — | | | — | | | 27,404,179 | |

| Total recurring fair value measurements | $ | 441,309,910 | | | $ | 309,094,280 | | | $ | — | | | 750,404,190 | |

VRSTIII measured at net asset value (a) | | | | | | | 32,051,073 | |

| Investments at fair value | | | | | | | $ | 782,455,263 | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of December 31, 2022 | | |

| Quoted Prices in Active Markets for Identical Assets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Fair Value as of December 31, 2022 |

| Assets: | | | | | | | |

| Registered investment company funds | $ | 348,954,022 | | | $ | — | | | $ | — | | | $ | 348,954,022 | |

| Common/collective trusts | — | | | 246,815,492 | | | — | | | 246,815,492 | |

| Pioneer Natural Resources Stock Fund | 26,570,333 | | | — | | | — | | | 26,570,333 | |

| Total recurring fair value measurements | $ | 375,524,355 | | | $ | 246,815,492 | | | $ | — | | | 622,339,847 | |

VRSTIII measured at net asset value (a) | | | | | | | 40,737,441 | |

| Investments at fair value | | | | | | | $ | 663,077,288 | |

| | | | | | | |

| | | | | | | |

_______________

(a)Investments in VRSTIII have not been classified in the fair value hierarchy. Investments in VRSTIII are valued at net asset value based upon the fair values of the underlying net assets of the trusts. The net asset value of the VRSTIII is presented in this table to permit reconciliation of the fair value hierarchy to the line items presented in the Statement of Net Assets Available for Benefits.

Registered Investment Company Funds

The Plan's investments in registered investment company funds are valued using published market prices that represent the net asset value of shares or units held by the Plan as of December 31, 2023 and 2022. All significant inputs to these asset exchange values represented Level 1 independent active exchange market price inputs.

Common/Collective Trusts

Common/collective trusts are valued based on the calculated net asset value of the respective investment entity. Although the trusts themselves are not publicly traded, the underlying assets are traded on exchanges and on other markets, and price quotes for the assets held by these trusts are readily available. Additionally, the net asset value per share is determined and published daily and is the basis for current transactions. These investments are classified as Level 2 in the hierarchy.

Pioneer Natural Resources Stock Fund

Investments in the Company's common stock are valued at the last reported sales price on December 31, 2023 and 2022 on the exchange on which it is traded. As of December 31, 2023 and 2022, all significant inputs to these asset exchange values represented Level 1 independent active exchange market price inputs.

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

NOTES TO FINANCIAL STATEMENTS

December 31, 2023 and 2022

NOTE 5. Administrative Expenses

The Employer may pay certain expenses incurred in the administration of the Plan, including expenses and fees of the Trustee, but is not obligated to do so. Any Plan expenses not paid by the Employer are paid from the Plan's forfeiture account or from Plan assets. See Note 1 for additional information about forfeitures. Administrative expenses incurred by the Plan were $545,103 for activity related to the year ended December 31, 2023. NOTE 6. Tax Status of the Plan

The Plan received a determination letter from the Internal Revenue Service ("IRS") dated December 19, 2014, stating that the Plan is qualified under Section 401(a) of the Code and, therefore, the related trust is exempt from taxation. Subsequent to this determination by the IRS, the Plan was amended. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. The Company believes the Plan is being operated in compliance with the applicable requirements of the Code as any areas of noncompliance have been corrected in a timely manner; therefore, the Plan Administrator believes the Plan is qualified and the related trust is tax-exempt.

The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2023, there are no uncertain tax positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

NOTE 7. Related Party and Party-in-Interest Transactions

Plan investments are in shares or units of registered investment company funds and common/collective trusts that are managed by the Trustee or for which the Trustee provides services. The Plan also invests in the common stock of the Company which qualify as related party transactions. Transactions in funds (i) managed by the Trustee or for which the Trustee provides services, (ii) the Pioneer Natural Resources Stock Fund and (iii) loans made to participants qualify as party-in-interest transactions. These transactions are exempt from the prohibited transaction rules under ERISA.

NOTE 8. Subsequent Events

The Plan has evaluated subsequent events through June 20, 2024, the date the financial statements were available to be issued, and noted the following changes to the Plan.

Beginning April 17, 2024, the Pioneer Natural Resources Stock Fund was closed to new Participant Contributions. Any portion of Participant Contributions directed to the Pioneer Natural Resources Stock Fund subsequent to April 16, 2024 were automatically redirected to the Vanguard Target Retirement Trust II with the target date closest to the year the Plan participant will reach age 65.

On October 10, 2023, the Company entered into an Agreement and Plan of Merger (the "Merger Agreement") with Exxon Mobil Corporation, a New Jersey corporation ("ExxonMobil"), and a subsidiary of ExxonMobil. On May 3, 2024, pursuant to the terms of the Merger Agreement, (i) the Company merged with and into a subsidiary of ExxonMobil, with the Company surviving the Merger as a wholly-owned subsidiary of ExxonMobil, (ii) each eligible share of the Company's common stock, including shares in the Pioneer Natural Resources Stock Fund, were cancelled and converted into the right to receive 2.3234 shares of ExxonMobil common stock and (iii) the Pioneer Natural Resources Stock Fund became the ExxonMobil Stock Fund. The ExxonMobil Stock Fund remains closed to new contributions.

PIONEER NATURAL RESOURCES USA, INC. 401(k) AND MATCHING PLAN

Schedule H; Line 4i - Schedule of Assets (Held At End of Year)

EIN: 75-2516853

Plan Number: 001

As of December 31, 2023

| | | | | | | | | | | | | | | | | | | | |

| | | | (c) | | |

| | (b) | | Description of investment including | | (e) |

| | Identity of issuer, borrower, | | maturity date, rate of interest, collateral, | | Current |

| (a) | | lessor, or similar party | | par or maturity value | | value |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Total Stock Market Index Fund: Inst'l Shr - 755,580 shares | | $ | 87,277,061 | |

| | AllianceBernstein | | AB Large Cap Growth Fund; Class Z - 673,904 shares | | 62,464,188 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2050 Trust II - 1,045,795 shares | | 56,201,014 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Institutional Index Fund Inst'l Shares - 135,461 shares | | 53,301,228 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2045 Trust II - 915,429 shares | | 48,581,830 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Total International Stock Index Fund: Inst'l Shr - 381,447 shares | | 47,490,094 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2055 Trust II - 581,419 shares | | 41,850,512 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Total Bond Market Index Fund: Inst'l Shr - 3,950,331 shares | | 38,357,718 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2040 Trust II - 701,004 shares | | 35,954,482 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2035 Trust II - 707,045 shares | | 34,164,398 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Retirement Savings Trust III - 32,051,073 shares | | 32,051,073 | |

| * | | Pioneer Natural Resources Company | | Pioneer Natural Resources Stock Fund - 328,154 shares | | 27,404,179 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2030 Trust II - 591,638 shares | | 27,315,926 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Windsor II Fund Admiral Shares - 323,747 shares | | 24,624,215 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2025 Trust II - 473,394 shares | | 21,373,756 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2020 Trust II - 385,231 shares | | 16,761,383 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Wellington Fund Admiral Shares - 219,753 shares | | 15,690,338 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2060 Trust II - 268,244 shares | | 15,238,963 | |

| | T. Rowe Price | | T. Rowe Price Mid-Cap Growth Fund; Retail Class - 107,601 shares | | 10,764,432 | |

| | JPMorgan | | JPMorgan U.S. Research Enhanced Eq Fd; R6 - 289,193 shares | | 10,671,237 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement Income Trust II - 240,378 shares | | 10,146,335 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Extended Market Index Fund: Inst'l Shares - 80,240 shares | | 10,004,320 | |

| * | | Participant Loans | | Interest rates range from 4.25% to 9.5% with various maturities | | 9,283,342 | |

| | JPMorgan | | JPMorgan Small Cap Growth Fund; Class R6 Shares - 414,966 shares | | 8,266,121 | |

| | American Funds | | American Funds EuroPacific Growth Fund; Class R-6 - 147,305 shares | | 8,057,601 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Mid-Cap Value Index Fund Admiral - 76,102 shares | | 5,713,726 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Small-Cap Value Index Fund Admiral - 60,770 shares | | 4,699,976 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Inflation-Protected Securities Fund: Inst'l Shares - 448,257 shares | | 4,204,652 | |

| | JPMorgan | | JPMorgan Small Cap Equity Fund; Class R6 - 73,289 shares | | 3,973,749 | |

| | PIMCO | | PIMCO Income Fund; Institutional Class - 364,216 shares | | 3,867,972 | |

| | Oppenheimer Funds Inc. | | Invesco Oppenheimer International Small Mid Company Fund; Class R6 - 76,933 shares | | 3,291,205 | |

| | Oppenheimer Funds Inc. | | Invesco Oppenheimer Developing Markets Fund; Class R6 - 65,933 shares | | 2,543,051 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Real Estate Index Fund Admiral Shares - 19,770 shares | | 2,474,216 | |

| | Amundi Asset Management | | Pioneer Bond Fund; Class K - 282,328 shares | | 2,360,261 | |

| | BNY Mellon | | BNY Mellon Natural Resources Fund; Class Y - 49,467 shares | | 2,297,734 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2065 Trust II - 42,363 shares | | 1,482,267 | |

| | Prudential Investment Management | | PGIM Global Total Return; Class R6 - 198,045 shares | | 1,045,677 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Federal Money Market Fund - 464,959 shares | | 464,959 | |

| * | | Vanguard Fiduciary Trust Company | | Vanguard Target Retirement 2070 Trust II - 1,097 shares | | 23,414 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | $ | 791,738,605 | |

_______________

*Party-in-interest

Note: Column (d) is not applicable since all investments are participant directed.

Pursuant to the requirements of the Securities Exchange Act of 1934, the Plan Administrator has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

PIONEER NATURAL RESOURCES USA, INC.

401(k) AND MATCHING PLAN

| | | | | | | | |

| Date: June 20, 2024 | By: | /s/ Martin F. Miller |

| | Martin F. Miller |

| | Executive Vice President and Chief Financial Officer |

INDEX TO EXHIBITS

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 23.1 (a) | | |

| | |

_____________

(a)Filed herewith.

EXHIBIT 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement No. 333-39249 and 333-178671 on Form S-8 of Pioneer Natural Resources Company of our report dated June 20, 2024, with respect to the statements of net assets available for benefits of the Pioneer Natural Resources USA 401(k) and Matching Plan as of December 31, 2023, the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related supplemental schedule of Form 5500, Schedule H, Line 4i- Schedule of Assets (Held at End of Year) as of December 31, 2023, which report appears in the December 31, 2023, annual report on Form 11-K of the Pioneer Natural Resources USA 401(k) and Matching Plan for the year ended December 31, 2023.

/s/ Whitley Penn LLP

Dallas, Texas

June 20, 2024

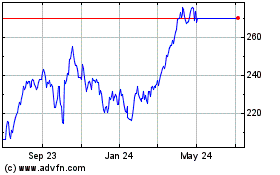

Pioneer Natural Resources (NYSE:PXD)

Historical Stock Chart

From May 2024 to Jun 2024

Pioneer Natural Resources (NYSE:PXD)

Historical Stock Chart

From Jun 2023 to Jun 2024