Eaton's Turkish Deal to Ramp Portfolio - Analyst Blog

February 27 2012 - 11:35AM

Zacks

Industrial manufacturing giant Eaton

Corporation (ETN) announced its decision to acquire

Istanbul-based Polimer Kauçuk Sanayi ve Pazarlama A.S. The company

expects the deal to be closed during the second quarter of

2012.

This Turkish company, Polimer Kauçuk Sanayi ve Pazarlama A.S,

primarily engages in the manufacture of industrial and hydraulic

hoses. Apart from that, its other line of businesses includes

mining, manufacturing, construction, agriculture, food and

beverage, oil and gas, and chemicals. Several Polimer Kauçuk's

products are sold around the globe under the SEL Hose brand

name.

Eaton expects that this acquisition will be immediately

accretive to its 2012 earnings, and hence increased its 2012

guidance by 3 cents to a range of $4.13–$4.53 per share. The

company also increased its 2012 operating earnings guidance by 5

cents, in a range of $4.20–$4.60 per share, excluding acquisition

integration charges. The acquisition is likely to bolster Eaton’s

presence in the emerging markets and also expand its global

coverage, with respect to its hose product segment.

In view of Eaton’s last few deals, it is quite evident that the

company is intent on diversifying its portfolio and expand its line

of business by taking the inorganic route. In December last year,

Eaton completed the acquisition of E.A. Pedersen Company, a

manufacturer of medium voltage switchgear catering primarily to

electrical utilities. This transaction will strengthen Eaton’s

footprint in medium voltage assembly businesses, with the addition

of utility-based power products.

The company has made some significant deals in 2011. These

include the acquisition of high power inverter provider, IE Power,

Inc; Germany-based advanced liquid filtration solutions provider E.

Begerow GmbH & Co KG, and, ACTOM Low Voltage, a motor control

components, engineered electrical distribution systems and

uninterruptible power supply systems manufacturer and supplier

based in South Africa.

As of December 31, 2011 the company had a cash balance of $385

million. We believe that the company can comfortably utilize its

surplus cash balance for meeting the acquisition costs.

Cleveland, Ohio-based diversified power management company Eaton

Corporation itself provides an array of products to its customers.

These include powertrain, truck and automotive systems, electrical

components and systems, hydraulics and pneumatic systems for

commercial and military use. Eaton has approximately 73,000

employees and a strong customer base in more than 150

countries.

Eaton Corporation currently retains a Zacks #3 Rank, which

translates into a short-term Hold rating. The company competes with

ITT Corporation (ITT) and Parker Hannifin

Corporation (PH).

EATON CORP (ETN): Free Stock Analysis Report

ITT CORP (ITT): Free Stock Analysis Report

PARKER HANNIFIN (PH): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

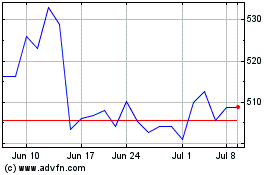

Parker Hannifin (NYSE:PH)

Historical Stock Chart

From Apr 2024 to May 2024

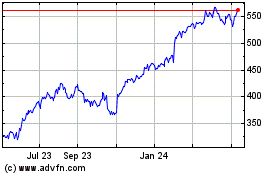

Parker Hannifin (NYSE:PH)

Historical Stock Chart

From May 2023 to May 2024