Current Report Filing (8-k)

December 09 2022 - 6:03AM

Edgar (US Regulatory)

0001818502FALSE00018185022022-12-062022-12-060001818502us-gaap:CommonClassAMember2022-12-062022-12-060001818502us-gaap:WarrantMember2022-12-062022-12-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 6, 2022

OppFi Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39550 | 85-1648122 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

130 E. Randolph Street, Suite 3400

Chicago, Illinois 60601

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (312) 212-8079

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange

on which registered |

Class A common stock, $0.0001 par

value per share | OPFI | The New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share | OPFI WS | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The information included in Item 4.02 below is incorporated herein by reference.

Item 4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On December 6, 2022, the Audit Committee (the “Audit Committee”) of the Board of Directors of OppFi Inc., a Delaware corporation (the “Company”), after discussion with the Company's management, concluded that the Company’s (i) previously issued audited consolidated financial statements as of and for the year ended December 31, 2021 included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, (ii) previously issued unaudited consolidated financial statements as of and for the three months ended March 31, 2022 included in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022 and (iii) previously issued unaudited consolidated financial statements as of and for the three and nine months ended September 30, 2021 included in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2021 (collectively, the “Prior Financial Statements”), and any reports, related earnings releases, investor presentations or similar communications describing the Prior Financial Statements should no longer be relied upon due to a misapplication of accounting guidance in connection with the Company's calculations of diluted earnings per share for such periods. The Company previously identified this misapplication and properly applied the accounting guidance when calculating diluted earnings per share in the Company's Quarterly Reports on Form 10-Q for the quarterly periods ended June 30, 2022 and September 30, 2022; accordingly, such reports can continue to be relied upon.

In conjunction with the preparation of the Company's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2022, management of the Company re-evaluated its accounting for equity units of the Company's less-than-wholly owned subsidiary, Opportunity Financial, LLC (the "OppFi-LLC Units"), that may be exchanged for the Company's Class A common stock. As previously disclosed in the Company's Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022, the Company determined that it misapplied the guidance prescribed by Financial Accounting Standards Board Accounting Standards Codification 260-10-55-20(b) when calculating diluted earnings per share. The Company has concluded that diluted earnings per share should be calculated using the lower of the treasury stock method or the if-converted method as prescribed by U.S. Generally Accepted Accounting Principles (“GAAP”).

After giving effect to this change, the Company’s diluted GAAP earnings per share for the fiscal year ended December 31, 2021, the quarterly period ended March 31, 2022, and the three and nine months ended September 30, 2021 would have been $0.48, $0.00, $0.29, and $0.29, respectively. As a result, diluted GAAP earnings per share for the fiscal year ended December 31, 2021, quarterly period ended March 31, 2022, and the three and nine months ended September 30, 2021 should be reduced by $1.45, $0.08, $0.77, and $0.79, respectively.

As a result of the foregoing, as soon as practicable, the Company will amend its Annual Report on Form 10-K for the year ended December 31, 2021 and its Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022 to restate its financial statements for those periods. The Company previously disclosed its revised calculation of diluted GAAP earnings per share for the quarterly period ended September 30, 2021 in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022, and will restate the unaudited consolidated financial statements for the quarterly period ended September 30, 2021 to correct for the accounting of the OppFi-LLC Units and will include the effected portions of those restated financial statements in the Company’s amended Annual Report on Form 10-K for the year ended December 31, 2021.The Company does not expect that the restatements will have any impact on the Company’s operating performance or reported key performance indicators other than diluted earnings per share.

Management has discussed the matters described herein with the Company's independent registered public accounting firm, RSM US LLP.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| Date: December 8, 2022 | OppFi Inc. |

| | |

| By: | /s/ Pamela D. Johnson |

| | Pamela D. Johnson |

| | Chief Financial Officer |

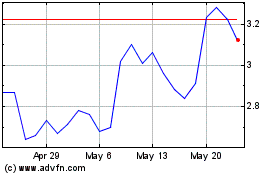

OppFi (NYSE:OPFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

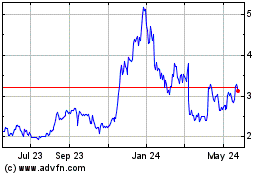

OppFi (NYSE:OPFI)

Historical Stock Chart

From Jul 2023 to Jul 2024