MetLife Study Reveals Employers of All Sizes Closely Following Health Care Reform While Consumers’ Attention is Split along...

December 28 2009 - 10:58AM

Business Wire

Health care legislation continues to be a very hot topic among

Americans today. According to new research from MetLife, 75% of

individuals and 83% of employers report paying close attention to

health care legislation developments. Regardless of company size or

whether or not they currently offer medical benefits, eight-in-ten

employers say they are on top of the legislation. However, interest

is very different among generations as 83% of Baby Boomers and 74%

of Generation Y individuals say they are closely following reform

developments, compared to 63% of Generation X.

As for where they obtain information about health care reform

legislation, consumers and businesses alike turn to traditional

media outlets. More than eight-in-ten (85%) individuals and 56% of

employers cite traditional media outlets (TV, radio, newspapers and

magazines) as preferred sources. However, more than half (57%) of

larger employers (500 or more employees) are also turning to their

benefits brokers or consultants for information, more so than to

business media (42%), general audience media (37%) or industry

publications (32%).

“We have seen a great appetite for information on health care

reform,” said Ronald Leopold, MD and vice president, U.S. Business,

MetLife. “Our study also reveals a tremendous opportunity for

insurance brokers and benefits consultants to help better educate

their clients. In turn, well-informed employers will be better

positioned to share with their employees the implications of health

care reform on their personal situations.”

Current Satisfaction Impacts Attitudes Toward Health Care

Reform

Not surprisingly, levels of satisfaction with current medical

benefits impact Americans’ attitudes toward health care reform.

More than six-in-ten (62%) Americans without any medical insurance

feel that health care reform will be “good for America,” contrasted

with 42% of those with medical insurance. 65% of Generation Y

individuals believe that health care reform will impact them

favorably, but only 44% are satisfied with their current medical

insurance. On the other hand, while only 34% of Boomers believe

that health care reform will have a positive impact on them

personally, 63% also say they are satisfied with their current

medical coverage.

Attitudes toward health care reform also correspond to health

status. According to the MetLife study, 65% of consumers who assess

their health as fair or poor say that health care reform will have

a positive impact on them and their families, contrasted to 28% for

those who say their health is very good or excellent.

Employers’ Next Steps

Three-quarters of employers strongly agree that employees

consider health insurance a critical component of a compensation

package. Virtually all (96%) also say promoting a culture of health

and wellness for employees is important. However, many of today’s

employers (41%) aren’t sure what they will do regarding medical

benefits should legislation pass. Thirty percent of those that do

offer medical coverage expect their health benefits to remain

unchanged, while 39% of those employers who do not currently offer

medical coverage are not anticipating offering that benefit.

While 36% of employers are unsure about what they will do

regarding non-medical benefits like life insurance, disability

income protection, and dental benefits should legislation pass, 44%

of those that offer these benefits anticipate that they will make

no changes to them. Only 5% of employers who offer these benefits

say they would consider reducing them.

“Effective communications for diverse audiences is a critical

component for the success of health care reform. While there is

understandably a reason for a ‘wait and see’ approach by employers

as the legislation is debated, communicating to employees that

their current benefits are not changing in the short-term can be

surprisingly reassuring,” continued Dr. Leopold.

Methodology

The MetLife Study of Employer/Consumer Attitudes on Health Care

Reform surveyed employers and working age consumers to assess their

attitudes toward potential health care reform legislation. The

telephone survey was fielded by GfK Custom Research North America

between November 2, 2009 and November 22, 2009. 501 interviews were

conducted with benefits decision-makers at companies with ten or

more employees, representing a mix of industries and geographic

regions, and 701 interviews were conducted with consumers between

the ages of 21 and 65.

About MetLife

MetLife is a subsidiary of MetLife, Inc. (NYSE: MET), a leading

provider of insurance, employee benefits and financial services

with operations throughout the United States and the Latin America,

Europe and Asia Pacific regions. Through its subsidiaries and

affiliates, MetLife, Inc. reaches more than 70 million customers

around the world and MetLife is the largest life insurer in the

United States (based on life insurance in-force). The MetLife

companies offer life insurance, annuities, auto and home insurance,

retail banking and other financial services to individuals, as well

as group insurance and retirement & savings products and

services to corporations and other institutions. For more

information, visit www.metlife.com.

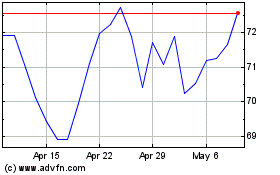

MetLife (NYSE:MET)

Historical Stock Chart

From Oct 2024 to Nov 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Nov 2023 to Nov 2024