MAC Reports in Sync with Estimates - Analyst Blog

February 06 2012 - 3:30AM

Zacks

Macerich Co.

(MAC), a real estate investment trust (REIT), reported fourth

quarter 2011 FFO (fund from operations) of $118.8 million or 83

cents per share compared with $108.9 million or 77 cents per share

in the year-earlier quarter. Fund from operations, a widely used

metric to gauge the performance of REITs, is obtained after adding

depreciation and amortization and other non-cash expenses to net

income.

Adjusted FFO in the reported

quarter was $124.6 million or 87 cents per share versus $108.9

million or 77 cents in the year-ago quarter. FFO growth in the

fourth quarter was driven by strong fundamentals in the portfolio

with solid tenant sales growth and healthy occupancy levels.

Adjusted quarterly FFO per share was in line with the Zacks

Consensus Estimate.

For full year 2011, FFO was $399.6

million or $2.79 per share compared with $351.3 million or $2.66

per share in the previous year. Adjusted FFO in the reported fiscal

was $2.88 per share versus $2.66 in 2010. Adjusted fiscal 2011 FFO

per share was well ahead of the Zacks Consensus Estimate of

$2.58.

Total revenues during the quarter

were $217.8 million versus $203.9 million in the year-ago period.

For full year 2011, total revenues were $803.3 million versus

$758.6 million in 2010.

Overall same-store occupancy at

quarter-end was 92.7% compared to 91.9% in the previous quarter.

Mall tenant sales increased 12.9% in 2011 to $489 per square foot

compared with $433 in 2010.

During the reported quarter,

Simon Property Group Inc. (SPG) exchanged its 50%

ownership interests in six malls and one community center with

Macerich for their 50% ownership interests in five malls and one

community center. The transaction did not involve any cash

exchange, other than the customary net working capital adjustments.

As a result of the transaction, Simon owns 100% of Empire Mall,

Lindale Mall, Mesa Mall, Rushmore Mall, Southern Hills Mall and

Empire East, and Macerich fully owns Eastland Mall, Lake Square

Mall, Northpark Mall, South Ridge Mall, Southpark Mall, Valley Mall

and Eastland Convenience Center.

Macerich closed on a $140 million,

4.00% 10-year fixed rate loan on Pacific View Mall in Ventura,

California, during the quarter. Subsequent to the quarter-end, the

company closed on a $75 million, 10-year fixed rate loan

collateralized by La Encantada Center.

During the reported quarter,

Macerich executed a $125 million seven-year unsecured note at LIBOR

plus 2.20%. The company utilized the proceeds to pay down its line

of credit. For full-year 2012, Macerich expects FFO in the range of

$3.38 to $3.46 per share.

We maintain our long-term ‘Neutral’

recommendation on Macerich, which currently retains a Zacks #3 Rank

that translates into a short-term ‘Hold’ rating.

MACERICH CO (MAC): Free Stock Analysis Report

SIMON PROPERTY (SPG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

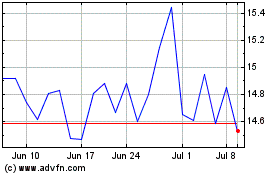

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

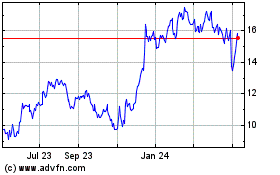

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024