Simon Property Beats Marginally - Analyst Blog

February 03 2012 - 8:45AM

Zacks

Simon Property Group

Inc. (SPG), a leading real estate investment trust (REIT),

reported fourth quarter 2011 FFO (funds from operations) of $678.9

million or $1.91 per share, compared to $638.7 million or $1.80 in

the year-earlier quarter. Fund from operations, a widely used

metric to gauge the performance of REITs, is obtained after adding

depreciation and amortization and other non-cash expenses to net

income.

The reported quarterly FFO

marginally exceeded the Zacks Consensus Estimate by a penny. Total

revenue during the reported quarter was $1,171.3 million compared

to $1,119.7 million in the year-ago period. The revenue figure

surpassed the Zacks Consensus Estimate of $1,128 million.

For full year 2011, Simon Property

reported FFO of $2,438.8 million or $6.89 per share, compared to

$1,770.5 million or $5.03 in 2010. The reported fiscal FFO exceeded

the Zacks Consensus Estimate by 2 cents. Total revenue during

fiscal 2011 increased to $4,306.4 million from $3,957.6 billion in

2010. The full year revenue exceeded the Zacks Consensus Estimate

of $4,183 million.

Occupancy in the regional malls and

premium outlet centers combined portfolio was 94.8% at quarter-end,

compared to 94.5% in the year-ago period. Comparable sales in the

combined portfolio increased to $536 per square foot, compared to

$484 in the prior-year quarter. Average rent per square foot in the

combined portfolio increased to $39.42 during fourth quarter 2011

from $37.77 in the year-ago period.

The company continued its active

development and redevelopment programs. Simon Property presently

has two new development projects under construction – Merrimack

Premium Outlets in Merrimack, New Hampshire – a 409,000 square foot

upscale outlet center scheduled to open on June 14, 2012; and

Tanger Outlets - Texas City – a 350,000 square foot upscale outlet

center in Texas City, Texas, scheduled to open in October 2012.

At the same time, Simon Property

continued renovation and expansion projects at 23 centers in

addition to the restoration of Opry Mills in Nashville, Tennessee,

which is scheduled to reopen on March 29, 2012. During the reported

quarter, Simon Property completed the 90,000 square foot expansion

of Ami Premium Outlets in Ibaraki Prefecture, Japan. The company

had a 40% stake in the project, which was 100% leased at the

opening.

During the quarter, Simon Property

also opened Johor Premium Outlets – the first Premium Outlet Center

of the company in Southeast Asia. Spanning 190,000 square feet of

gross leasable area featuring 80 stores, the property is

strategically located in Johor, Malaysia, in close proximity to

Senai Airport and the city center of Singapore. The project was

100% leased at opening.

Subsequent to the quarter-end,

Simon Property had the groundbreaking for Busan Premium Outlets – a

240,000 square foot upscale outlet center serving Southeastern

Korea. The company has a 50% ownership interest in the project,

which will be its third Premium Outlet Center in Korea.

During the quarter, Simon Property

exchanged its 50% ownership interests in six malls and one

community center with Macerich Co. (MAC) for its

50% ownership interests in five malls and one community center. The

transaction did not involve any cash exchange, other than the

customary net working capital adjustments. As a result of the

transaction, Simon owns 100% of Empire Mall, Lindale Mall, Mesa

Mall, Rushmore Mall, Southern Hills Mall and Empire East, while

Macerich fully owns Eastland Mall, Lake Square Mall, Northpark

Mall, South Ridge Mall, Southpark Mall, Valley Mall and Eastland

Convenience Center.

Simon Property also sold three

properties during the quarter, including Gwinnett Place, Factory

Merchants Branson, and Crystal River Mall. Simultaneously, the

company acquired an additional 25% ownership interest in Del Amo

Fashion Center, increasing its ownership stake to 50%.

During the reported quarter, Simon

Property entered into a new unsecured revolving credit facility

that increased its borrowing capacity to $4.0 billion. The new

credit facility is scheduled to mature on October 30, 2015, and has

a one-year extension option. The company also sold $1.2 billion

worth of senior unsecured notes during the quarter. Net proceeds

from the offering were used to partially repay the outstanding

debt.

At year-end 2011, the company had

approximately $798.7 million of cash on hand, compared to $796.7

billion in the year-earlier period. The company increased its

quarterly dividend by 5.6% to 95 cents per share. With strong

quarterly and fiscal results, Simon Property expects 2012 FFO in

the range of $7.20–$7.30 per share.

We maintain our ‘Neutral’

recommendation on the stock, which presently has a Zacks #3 Rank

translating into a short-term ‘Hold’ rating.

MACERICH CO (MAC): Free Stock Analysis Report

SIMON PROPERTY (SPG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

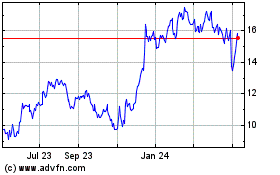

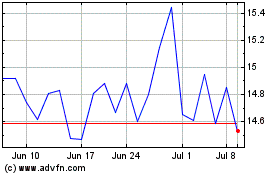

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024