UPDATE: Simon Property 4Q Net Up 66% On Higher Rents; Dividend Up 5.6%

February 03 2012 - 9:43AM

Dow Jones News

Simon Property Group Inc.'s (SPG) fourth-quarter earnings rose

66% as the nation's largest mall owner booked higher average rents

and increased occupancy.

Simon is the first of the major mall real estate investment

trust to report its quarterly earnings ahead of Macerich Co. later

this session and General Growth Properties next week. The company's

earnings handily beat analysts expectations and continue to

underscore the advantage large operators of high-end malls and

outlet centers have in a slow economy.

In addition, strengthening retail sales over the past 12 months

have given mall landlords more leverage to raise rates as they sign

leases more retailers.

Funds from operations, a key profit metric for REITs, rose to

$1.91 a share from $1.80 a year ago, topping the $1.90 expected by

analysts. Meanwhile, occupancy at the company's U.S. regional malls

and premium outlets increased to 94.8% from 94.5% a year earlier

and 93.9% at the end of the third quarter. After the results, the

company's share price ticked up 0.44% to $138.05 in pre-market

trading.

Citing strong recent performance and its expectations for the

year ahead, the real estate investment trust also raised its

quarterly dividend to 95 cents a share from 90 cents.

Looking to 2012, the company called for earnings of $3.28 to

$3.38 a share, well ahead of the $3.15 currently expected by

analysts polled by Thomson Reuters. Funds from operations was

estimated at $7.20 to $7.30 a share. Analysts currently expect

funds from operations of $7.28.

With its interest in nearly 400 properties and rents on the

rise, Simon Property is considered by many analysts to be among the

strongest companies in the REIT industry.

The company reported a profit of $363.8 million, up from a

year-earlier profit of $218.8 million. Per-share earnings,

reflecting the payment of preferred dividends, rose to $1.24 from

74 cents a year earlier.

Revenue improved 4.6% to $1.17 billion. Analysts expected

earnings of 90 cents a share on $1.16 billion in revenue.

Average rents were up 4.4% from a year earlier.

-By A.D. Pruitt, Dow Jones Newswires; 212-416-2197;

angela.pruitt@dowjones.com;

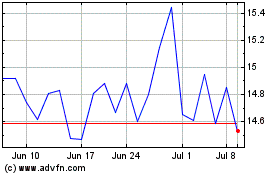

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

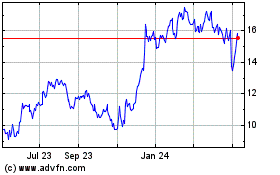

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024