Simon Property Beats Estimates - Analyst Blog

July 26 2011 - 10:30AM

Zacks

Simon Property Group

Inc. (SPG), a leading real estate investment trust (REIT),

reported second quarter 2011 FFO (funds from operations) of $583.0

million or $1.65 per share, compared to $487.7 million or $1.38 in

the year-earlier quarter. Fund from operations, a widely used

metric to gauge the performance of REITs, is obtained after adding

depreciation and amortization and other non-cash expenses to net

income.

The reported quarterly FFO exceeded

the Zacks Consensus Estimate by 7 cents. Total revenues during the

reported quarter increased to $1.0 billion from $933.6 million in

the year-ago period. Total revenues during the reported quarter

were well ahead of the Zacks Consensus Estimate of $976

million.

Occupancy in the regional malls and

premium outlet centers combined portfolio was 93.5% at quarter-end,

compared to 93.1% in the year-ago period – an increase of 40 bps

year-over-year. Comparable sales in the combined portfolio

increased to $513 per square foot, compared to $469 in the

prior-year quarter. Average rent per square foot in the combined

portfolio increased during second quarter 2011 to $39.70 from

$38.62 in the year-ago period.

The strong performance by the

company in terms of total sales and average rent per square foot is

attributable to the positive impact from the previous acquisitions.

Comparable property net operating income during the quarter for the

regional malls and premium outlet centers combined portfolio surged

3.5%, further reflecting the high quality of its assets.

The company continued its active

development and redevelopment programs during the quarter. Simon

Property opened the expansion center of Tosu Premium Outlets in

Fukuoka, Japan, spanning 52,000 square feet of space adding 28 new

stores. At the same time, Simon Property continued construction

works in Johor Premium Outlets – a new 173,000 square foot upscale

outlet center in Johor, Malaysia, and a 93,000 square foot

expansion of Ami Premium Outlets in Ibaraki Prefecture, Japan.

In the U.S., the company started

construction work on Merrimack Premium Outlets – a new development

project in Merrimack, New Hampshire, spanning 409,000 square feet

of upscale outlet space. Simon Property is also continuing its

redevelopment works in 18 centers across the country.

During the reported quarter, the

company acquired full ownership interest in ABQ Uptown – a

lifestyle center in Albuquerque, New Mexico, for $86 million. The

222,000 square foot center, presently 95% leased, generates sales

of approximately $650 per square foot. Simon Property also sold

Prime Outlets – Jeffersonville, a 410,000 square foot outlet center

in Jeffersonville, Ohio, for $134 million during the reported

quarter.

At quarter-end, the company had

approximately $789.7 million of cash on hand. The company

maintained its quarterly dividend at 80 cents per share. With

strong quarterly results, Simon Property increased its previous

2011 FFO guidance from the range of $6.55 – $6.65 per share to

$6.65 – $6.73.

We currently maintain our ‘Neutral’

recommendation on the stock, which presently has a Zacks #3 Rank

translating into a short-term ‘Hold’ rating. We also have a

‘Neutral’ recommendation and a Zacks #3 Rank for Macerich

Co. (MAC), one of the competitors of Simon Property.

MACERICH CO (MAC): Free Stock Analysis Report

SIMON PROPERTY (SPG): Free Stock Analysis Report

Zacks Investment Research

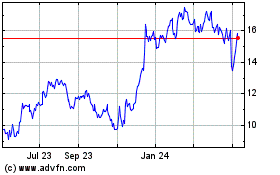

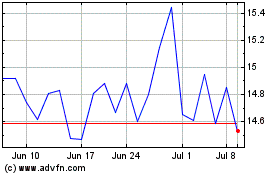

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024