Earnings Scorecard: Simon Property - Analyst Blog

May 12 2011 - 10:00AM

Zacks

Simon Property Group

Inc. (SPG), a leading real estate investment trust (REIT),

reported fiscal 2011 first quarter funds from operations (FFO) of

$1.61 per share, which beat the Zacks Consensus Estimate by 7

cents. Fund from operations, a widely used metric to gauge the

performance of REIT, is obtained after adding depreciation and

amortization and other non-cash expenses to net income.

We cover below the results of the

recent earnings announcement, as well as the subsequent analyst

estimate revisions and the Zacks ratings for the short-term and

long-term outlook for the stock.

Earnings Report

Review

Total revenues during the reported

quarter increased to $1.0 billion from $925.1 million in the

year-ago period. Total revenues during the reported quarter were

well ahead of the Zacks Consensus Estimate of $964 million.

Occupancy in the regional malls and

premium outlet centers combined portfolio was 92.9% at quarter-end,

compared to 92.2% in the year-ago period. Comparable sales in the

combined portfolio increased to $500 per square foot, compared to

$462 in the prior-year quarter. Average rent per square foot in the

combined portfolio increased during first quarter 2011 to $39.26

from $38.72 in the year-ago period.

(Read our full coverage on this

earnings report: Simon Property Beats Estimates)

Earnings Estimate Revisions-

Overview

Fiscal earnings estimates have moved

up for Simon Property since the earnings release, meaning that

analysts are bullish about the long-term performance of the

company. Let’s dig into the earnings estimate details.

Agreement of Estimate

Revisions

In the last 30 days, fiscal 2011

earnings estimates were raised by 13 analysts out of 21 covering

the stock, while none had lowered the same. For fiscal 2012, 12 out

of 21 analysts covering the stock have revised their estimates

upward, while only 1 has lowered it during the same time period.

This indicates a clear positive directional movement for the fiscal

year earnings.

Magnitude of Estimate

Revisions

Earnings estimates for fiscal 2011

have increased by 7 cents in the last 30 days to $6.69. With strong

first quarter 2011 results, Simon Property has increased its 2011

FFO guidance from the range of $6.45 – $6.60 per share to $6.55 –

$6.65. For fiscal 2012, earnings estimates have increased by 7

cents during the last 30 days to $7.09. Management expects fiscal

2011 to be an all-time high for the company in terms of its

earnings. Furthermore, management reiterated to continue its

aggressive yet disciplined approach to profitably grow its

business, driven by its unrivalled financial strength.

Moving Forward

The long-term earnings estimate

picture for Simon Property is optimistic. Simon Property is the

largest publicly traded retail real estate company in North America

with assets in almost all retail distribution channels.

Furthermore, the company’s international presence gives it a more

sustainable long-term growth story than its domestically focused

peers. The geographic and product diversity of the company

insulates it from market volatility to a great extent and provides

a steady source of income.

However, Simon Property’s properties

consist primarily of community shopping centers making its

performance dependent upon general economic conditions of the

market affecting retail space. Excess retail space in a number of

markets and the increase in consumer purchases through catalogs and

the Internet could hurt demand for Simon Property properties.

We maintain our ‘Neutral’ rating on

Simon Property, which currently has a Zacks #3 Rank that translates

into a short-term ‘Hold’ rating, indicating that the stock is

expected to perform in line with the overall U.S. equity market for

the next 1–3 months. We also have a ‘Neutral’ recommendation and a

Zacks #3 Rank for Macerich Co. (MAC), one of the

competitors of Simon Property.

About Earnings Estimate

Scorecard

Len Zacks, PhD in mathematics

from MIT, proved over 30 years ago that earnings estimate revisions

are the most powerful force impacting stock prices. He turned this

ground breaking discovery into two of the most celebrating stock

rating systems in use today. The Zacks Rank for stock trading in a

1 to 3 month time horizon and the Zacks Recommendation for

long-term investing (6+ months). These “Earnings Estimate

Scorecard” articles help analyze the important aspects of estimate

revisions for each stock after their quarterly earnings

announcements. Learn more about earnings estimates and our proven

stock ratings at http://www.zacks.com/education/

MACERICH CO (MAC): Free Stock Analysis Report

SIMON PROPERTY (SPG): Free Stock Analysis Report

Zacks Investment Research

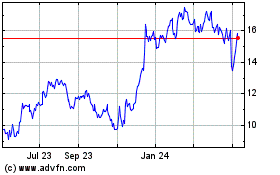

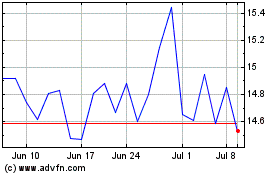

Macerich (NYSE:MAC)

Historical Stock Chart

From May 2024 to Jun 2024

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2023 to Jun 2024