SANTA MONICA, Calif., Nov. 5 /PRNewswire-FirstCall/ -- The Macerich

Company (NYSE:MAC) today announced results of operations for the

quarter ended September 30, 2009 which included total funds from

operations ("FFO") diluted of $88.7 million or $.97 per

share-diluted, compared to $1.12 per share-diluted for the quarter

ended September 30, 2008. For the nine months ended September 30,

2009, FFO-diluted was $251.4 million, or $2.80 per share-diluted

compared to $290.7 million or $3.29 per share-diluted for the nine

months ended September 30, 2008. Net income available to common

stockholders for the quarter ended September 30, 2009 was $142.8

million or $1.75 per share-diluted compared to $2.6 million or $.03

per share-diluted for the quarter ended September 30, 2008.

Included in net income for the quarter was $161.6 million of gain

on sale of assets which primarily resulted from the sale of a joint

venture interest in Queens Center. For the nine months ended

September 30, 2009, net income available to common stockholders was

$135.1 million or $1.71 per share-diluted compared to $110.9

million or $1.50 per share-diluted for the nine months ended

September 30, 2008. The Company's definition of FFO is in

accordance with the definition provided by the National Association

of Real Estate Investment Trusts ("NAREIT"). A reconciliation of

net income to FFO and net income per common share-diluted ("EPS")

to FFO per share-diluted is included in the financial tables

accompanying this press release. Recent Activity: -- During the

quarter, Macerich signed 294,000 square feet of specialty store

leases with average initial rents of $40.98 per square foot.

Starting base rent on new lease signings was 14.2% higher than the

expiring base rent. -- The Company completed three joint venture

transactions generating over $434 million of cash proceeds. --

Portfolio occupancy at September 30, 2009 was 91.0% compared to

90.5% at June 30, 2009 and 92.8% at September 30, 2008. -- On

October 27, 2009, the Company closed a common stock offering of

13.8 million shares that raised net proceeds of $383 million. --

Tenant sales per square foot were $418 for the twelve month period

ended September 30, 2009 compared to sales per square foot of $441

for the year ended December 31, 2008. Commenting on the quarter,

Arthur Coppola chairman and chief executive officer of Macerich

stated, "We had a significant amount of capital activity during the

quarter having completed three joint ventures that netted over $434

million in cash proceeds. We systematically continued our efforts

to de-leverage our balance sheet with the recently completed common

equity offering. Our liquidity and debt reduction plan has also

included selling non core assets and issuing stock dividends. Year

to date we have generated over $1 billion in cash that has been

applied towards our de-leveraging goals." Redevelopment and

Development Activity On October 15, 2009, Macerich opened the first

phase of the Barneys New York-anchored expansion at Scottsdale

Fashion Square. Joining Barneys New York are first-to-market

retailers Aqua Beachwear, Arthur, Christian Audigier, Love Culture,

True Religion and Michael Stars along with Aveda Lifestyle Salon,

Forever 21 and three restaurants - Marcella's Ristorante, Modern

Steak, and Barneys New York's exclusive Fred's dining concept. In

addition, the first Microsoft store in the country opened at

Scottsdale Fashion Square. At Santa Monica Place, Macerich recently

announced that Burberry, Michael Kors, Bernini, Angl, Swarovski and

mini-anchors CB2 and Nike are the latest brands planned to open.

The new Santa Monica Place is currently under construction and

slated to open in August 2010 with anchors Bloomingdale's and

Nordstrom. Macerich also announced nine restaurants for the

third-level dining deck and completed deals with Tiffany & Co.

and Louis Vuitton. To date, Macerich has announced nearly 40

retailers and restaurants, including Kitson LA, BCBGMAXAZRIA,

Coach, Joe's Jeans, True Religion, Ed Hardy, Love Culture, Michael

Brandon and restaurant concepts La Sandia, Zengo, Pizza Antica,

XINO and Ozumo Sushi. Phase I of Northgate Mall, a

722,948-square-foot regional mall under redevelopment in Marin

County, is scheduled to open in November 2009. Kohl's opened

successfully on September 30, 2009 replacing a Mervyn's site. Among

the retailers opening in the first phase are H&M, Children's

Place, Chipotle, Gymboree, Hot Topic, PacSun, Panera Bread, See's

Candies, Sunglass Hut, Tilly's, Tomatina and Vans. Retailers will

continue to open in phases into 2010. Financing Activity During the

quarter $446 million in unsecured term notes, due in 2010, were

paid off. Capital used for the debt reduction was primarily from

proceeds from joint venture sales and operating cash retained by

reducing the dividend and paying 90% of the dividend in stock.

Macerich also announced the closing of an $85 million loan on

Paradise Valley Mall in Phoenix, Arizona. The loan on the

previously unencumbered asset bears interest at a floating rate

with the initial rate of 5.50%. The term of the loan is three

years, extendable to five years at the Company's election. After

considering extensions and other loans committed but not yet

closed, the Company's remaining debt maturities for 2009 are only

$30 million and $268 million for 2010. All of these debt maturities

are on secured property loans. Macerich is a fully integrated

self-managed and self-administered real estate investment trust,

which focuses on the acquisition, leasing, management, development

and redevelopment of regional malls throughout the United States.

The Company is the sole general partner and owns an 89% ownership

interest in The Macerich Partnership, L.P. Macerich now owns

approximately 76 million square feet of gross leaseable area

consisting primarily of interests in 72 regional malls. Additional

information about Macerich can be obtained from the Company's

website at http://www.macerich.com/. Investor Conference Call The

Company will provide an online Web simulcast and rebroadcast of its

quarterly earnings conference call. The call will be available on

The Macerich Company's website at http://www.macerich.com/

(Investing Section) and through CCBN at http://www.earnings.com/.

The call begins today, November 5, 2009 at 10:30 AM Pacific Time.

To listen to the call, please go to any of these websites at least

15 minutes prior to the call in order to register and download

audio software if needed. An online replay at

http://www.macerich.com/ (Investing Section) will be available for

one year after the call. The Company will publish a supplemental

financial information package which will be available at

http://www.macerich.com/ in the Investing Section. It will also be

furnished to the SEC as part of a Current Report on Form 8-K. Note:

This release contains statements that constitute forward-looking

statements. Stockholders are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve risks, uncertainties and other factors that may cause

actual results, performance or achievements of the Company to vary

materially from those anticipated, expected or projected. Such

factors include, among others, general industry, economic and

business conditions, which will, among other things, affect demand

for retail space or retail goods, availability and creditworthiness

of current and prospective tenants, anchor or tenant bankruptcies,

closures, mergers or consolidations, lease rates and terms,

interest rate fluctuations, availability, terms and cost of

financing and operating expenses; adverse changes in the real

estate markets including, among other things, competition from

other companies, retail formats and technology, risks of real

estate development and redevelopment, acquisitions and

dispositions; the liquidity of real estate investments,

governmental actions and initiatives (including legislative and

regulatory changes); environmental and safety requirements; and

terrorist activities which could adversely affect all of the above

factors. The reader is directed to the Company's various filings

with the Securities and Exchange Commission, including the Annual

Report on Form 10-K for the year ended December 31, 2008 and the

Quarterly Reports on Form 10-Q, for a discussion of such risks and

uncertainties, which discussion is incorporated herein by

reference. The Company does not intend, and undertakes no

obligation, to update any forward-looking information to reflect

events or circumstances after the date of this release or to

reflect the occurrence of unanticipated events unless required by

law to do so. (See attached tables) THE MACERICH COMPANY FINANCIAL

HIGHLIGHTS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) Results of

Operations: Results before Impact of SFAS Results after SFAS 144

(a) 144 (a) SFAS 144 (a) -------------- --------------

-------------- For the For the For the Three Months Three Months

Three Months Ended Ended Ended September 30, September 30,

September 30, ------------- ------------- ------------- Unaudited

Unaudited --------- --------- 2009 2008 (b) 2009 2008 2009 2008 (b)

---- -------- ---- ---- ---- -------- Minimum rents $119,903

$133,985 (414) ($2,902) $119,489 $131,083 Percentage rents 3,909

4,114 - - 3,909 4,114 Tenant recoveries 59,754 70,059 55 (642)

59,809 69,417 Management Companies' revenues 10,449 10,261 - -

10,449 10,261 Other income 6,648 7,388 (8) (2) 6,640 7,386 -----

----- --- --- ----- ----- Total revenues 200,663 225,807 (367)

(3,546) 200,296 222,261 -------------- ------- ------- ---- ------

------- ------- Shopping center and operating expenses 65,160

74,100 (208) (899) 64,952 73,201 Management Companies' operating

expenses 16,400 19,014 - - 16,400 19,014 Income tax expense

(benefit) 302 (362) - - 302 (362) Depreciation and amortization

61,856 66,637 (41) (700) 61,815 65,937 REIT general and

administrative expenses 7,084 2,881 - - 7,084 2,881 Interest

expense (b) 65,779 73,889 - - 65,779 73,889 Loss on early

extinguishment of debt (455) - - - (455) - Gain (loss) on sale or

write down of assets 161,580 (5,178) (3,968) 961 157,612 (4,217)

Equity in income of unconsolidated joint ventures (c) 19,165 19,928

- - 19,165 19,928 Income from continuing operations 164,372 4,398

(4,086) (986) 160,286 3,412 Discontinued operations: Gain (loss) on

sale or disposition of assets - - 3,968 (961) 3,968 (961) Income

from discontinued operations - - 118 1,947 118 1,947 Total income

from discontinued operations - - 4,086 986 4,086 986 Net income

164,372 4,398 - - 164,372 4,398 Less net income attributable to

noncontrolling interests 21,534 925 - - 21,534 925 Net income

attributable the Company 142,838 3,473 - - 142,838 3,473 Less

preferred dividends (d) - 835 - - - 835 Net income available to

common stockholders $142,838 $2,638 - - $142,838 $2,638

------------- -------- ------ --- --- -------- ------ Average

number of shares outstanding - basic 79,496 74,931 79,496 74,931

--------------- ------ ------ ------ ------ Average shares

outstanding, assuming full conversion of OP Units (e) 91,347 87,439

91,347 87,439 ------ ------ ------ ------ Average shares

outstanding - Funds From Operations ("FFO") - diluted (d) (e)

91,347 88,333 91,347 88,333 ---------------- ------ ------ ------

------ Per share income- diluted before discontinued operations - -

$1.71 $0.02 ------------- --- --- ----- ----- Net income per

share-basic (b) $1.75 $0.03 $1.75 $0.03 -------------- ----- -----

----- ----- Net income per share- diluted (b) (d) (e) $1.75 $0.03

$1.75 $0.03 ---------------- ----- ----- ----- ----- Dividend

declared per share $0.60 $0.80 $0.60 $0.80 ------------- -----

----- ----- ----- FFO - basic (b) (e) (f) $88,650 $97,711 $88,650

$97,711 ------------- ------- ------- ------- ------- FFO - diluted

(b) (d) (e) (f) $88,650 $98,546 $88,650 $98,546 ----------------

------- ------- ------- ------- FFO per share- basic (b) (e) (f)

$0.97 $1.12 $0.97 $1.12 ---------------- ----- ----- ----- -----

FFO per share- diluted (b) (d) (e) (f) $0.97 $1.12 $0.97 $1.12

--------------- ----- ----- ----- ----- THE MACERICH COMPANY

FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Results of Operations: Results before Impact of SFAS Results after

SFAS 144 (a) 144 (a) SFAS 144 (a) -------------- --------------

-------------- For the For the For the Nine Months Nine Months Nine

Months Ended Ended Ended September 30, September 30, September 30,

------------- ------------- ------------- Unaudited Unaudited

--------- --------- 2009 2008 (b) 2009 2008 2009 2008 (b) ----

-------- ---- ---- ---- -------- Minimum rents $370,879 $396,745

(3,634) ($8,673) $367,245 $388,072 Percentage rents 9,396 9,772 6 -

9,402 9,772 Tenant recoveries 187,194 204,956 (220) (1,916) 186,974

203,040 Management Companies' revenues 28,335 30,334 - - 28,335

30,334 Other income 21,552 20,776 (15) (356) 21,537 20,420 ------

------ --- ---- ------ ------ Total revenues 617,356 662,583

(3,863) (10,945) 613,493 651,638 -------------- ------- -------

------ ------- ------- ------- Shopping center and operating

expenses 203,504 214,407 (1,667) (2,727) 201,837 211,680 Management

Companies' operating expenses 58,702 57,886 - - 58,702 57,886

Income tax benefit (878) (750) - - (878) (750) Depreciation and

amortization 190,507 185,538 (1,214) (2,431) 189,293 183,107 REIT

general and administrative expenses 16,989 11,419 - - 16,989 11,419

Interest expense (b) 207,631 220,299 - - 207,631 220,299 Gain on

early extinguishment of debt 29,145 - - - 29,145 - Gain (loss) on

sale or write down of assets 136,731 95,135 23,045 (98,189) 159,776

(3,054) Equity in income of unconsolidated joint ventures (c)

49,647 67,172 - - 49,647 67,172 Income from continuing operations

156,424 136,091 22,063 (103,976) 178,487 32,115 Discontinued

operations: (Loss) gain on sale or disposition of assets - -

(23,045) 98,189 (23,045) 98,189 Income from discontinued operations

- - 982 5,787 982 5,787 Total (loss) income from discontinued

operations - - (22,063) 103,976 (22,063) 103,976 Net income 156,424

136,091 - - 156,424 136,091 Less net income attributable to

noncontrolling interests 21,306 20,994 - - 21,306 20,994 Net income

attributable to the Company 135,118 115,097 - - 135,118 115,097

Less preferred dividends (d) - 4,124 - - - 4,124 Net income

available to common stockholders $135,118 $110,973 - - $135,118

$110,973 ------------- -------- -------- --- --- -------- --------

Average number of shares outstanding - basic 77,898 73,688 77,898

73,688 --------------- ------ ------ ------ ------ Average shares

outstanding, assuming full conversion of OP Units (e) 89,635 86,483

89,635 86,483 ------ ------ ------ ------ Average shares

outstanding - Funds From Operations ("FFO") - diluted (d) (e)

89,635 88,418 89,635 88,418 ---------------- ------ ------ ------

------ Per share income- diluted before discontinued operations - -

$1.96 $0.29 ----------------- --- --- ----- ----- Net income per

share-basic (b) $1.71 $1.50 $1.71 $1.50 ----------------- -----

----- ----- ----- Net income per share- diluted (b) (d) (e) $1.71

$1.50 $1.71 $1.50 ---------------- ----- ----- ----- ----- Dividend

declared per share $2.00 $2.40 $2.00 $2.40 ------------- -----

----- ----- ----- FFO - basic (b) (e) (f) $251,410 $286,534

$251,410 $286,534 --------------- -------- -------- --------

-------- FFO - diluted (b) (d) (e) (f) $251,410 $290,658 $251,410

$290,658 --------------- -------- -------- -------- -------- FFO

per share- basic (b) (e) (f) $2.80 $3.32 $2.80 $3.32

---------------- ----- ----- ----- ----- FFO per share- diluted (b)

(d) (e) (f) $2.80 $3.29 $2.80 $3.29 ----------------- ----- -----

----- ----- THE MACERICH COMPANY FINANCIAL HIGHLIGHTS (IN

THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS) (a) SFAS No. 144,

"Accounting for the Impairment or Disposal of Long- Lived Assets"

("SFAS 144") addresses financial accounting and reporting for the

impairment or disposal of long-lived assets. The following

dispositions impacted the results for the three and nine months

ended September 30, 2009 and 2008: On April 25, 2005, in connection

with the acquisition of Wilmorite Holdings, L.P. and its

affiliates, the Company issued as part of the consideration

participating and non-participating convertible preferred units in

MACWH, LP. On January 1, 2008, a subsidiary of the Company, at the

election of the holders, redeemed approximately 3.4 million

participating convertible preferred units in exchange for the

distribution of the interests in the entity which held that portion

of the Wilmorite portfolio that consisted of Eastview Commons,

Eastview Mall, Greece Ridge Center, Marketplace Mall and Pittsford

Plaza ("Rochester Properties"). This exchange is referred to as the

"Rochester Redemption." As a result of the Rochester Redemption ,

the Company recorded a gain of $99.3 million and classified the

gain to discontinued operations. On December 19, 2008, the Company

sold the fee simple and/or ground leasehold interests in three

freestanding Mervyn's buildings to the Pacific Premier Retail Trust

joint venture for $43.4 million. As a result of the sale, the

Company has classified the results of operations to discontinued

operations for all periods presented. On July 14, 2009, the Company

sold Village Center, a 170,801 square foot urban village property,

for $11.8 million. During the period of July 15, 2009 through July

30, 2009, the Company sold five Kohl's stores for approximately

$52.7 million. As a result of these sales, the Company has

classified the results of operations to discontinued operations for

all periods presented. (b) On January 1, 2009, the Company adopted

FASB Staff Position APB 14-1, "Accounting for Convertible Debt

Instruments That May Be Settled Upon Conversion (Including Partial

Cash Settlement)" (FSP APB 14-1"). As a result, the Company

retrospectively applied FSP APB 14-1 to the three and nine months

ended September 30, 2008 resulting in an increase to interest

expense of $3.6 million and $10.7 million, respectively, and a

decrease to net income available to common stockholders of $3.0

million and $9.1 million, respectively, or $0.04 and $0.12 per

share, respectively. FSP APB 14-1 decreased FFO for the three and

nine months ended September 30, 2008 by $3.6 million and $7.1

million, respectively, or by $0.04 per share and $0.12 per share,

respectively. (c) This includes, using the equity method of

accounting, the Company's prorata share of the equity in income or

loss of its unconsolidated joint ventures for all periods

presented. (d) On February 25, 1998, the Company sold $100 million

of convertible preferred stock representing 3.627 million shares.

The convertible preferred shares were convertible on a 1 for 1

basis for common stock. On October 18, 2007, 560,000 shares of

convertible preferred stock were converted to common shares.

Additionally, on May 6, 2008, May 8, 2008 and September 18, 2008,

684,000, 1,338,860 and 1,044,271 shares of convertible preferred

stock were converted to common shares, respectively. As of December

31, 2008, there was no convertible preferred stock outstanding. The

preferred shares were assumed converted for purposes of net income

per share - diluted for the three and nine months ended September

30, 2008. The weighted average preferred shares are assumed

converted for purposes of FFO per share - diluted for 2008. (e) The

Macerich Partnership, L.P. (the "Operating Partnership" or the

"OP") has operating partnership units ("OP units"). OP units can be

converted into shares of Company common stock. Conversion of the OP

units not owned by the Company has been assumed for purposes of

calculating the FFO per share and the weighted average number of

shares outstanding. The computation of average shares for FFO -

diluted includes the effect of share and unit-based compensation

plans and convertible senior notes using the treasury stock method.

It also assumes conversion of MACWH, LP preferred and common units

to the extent they are dilutive to the calculation. (f) The Company

uses FFO in addition to net income to report its operating and

financial results and considers FFO and FFO-diluted as supplemental

measures for the real estate industry and a supplement to Generally

Accepted Accounting Principles (GAAP) measures. NAREIT defines FFO

as net income (loss) (computed in accordance with GAAP), excluding

gains (or losses) from extraordinary items and sales of depreciated

operating properties, plus real estate related depreciation and

amortization and after adjustments for unconsolidated partnerships

and joint ventures. Adjustments for unconsolidated partnerships and

joint ventures are calculated to reflect FFO on the same basis. FFO

and FFO on a fully diluted basis are useful to investors in

comparing operating and financial results between periods. This is

especially true since FFO excludes real estate depreciation and

amortization, as the Company believes real estate values fluctuate

based on market conditions rather than depreciating in value

ratably on a straight-line basis over time. FFO on a fully diluted

basis is one of the measures investors find most useful in

measuring the dilutive impact of outstanding convertible

securities. FFO does not represent cash flow from operations as

defined by GAAP, should not be considered as an alternative to net

income as defined by GAAP and is not indicative of cash available

to fund all cash flow needs. The Company also cautions that FFO as

presented, may not be comparable to similarly titled measures

reported by other real estate investment trusts. Gains or losses on

sales of undepreciated assets and the impact of SFAS 141 have been

included in FFO. The inclusion of gains on sales of undepreciated

assets increased FFO for the three and nine months ended September

30, 2009 and 2008 by $0.8 million, $3.3 million, $0.6 million and

$3.6 million, respectively, or by $0.01 per share, $0.04 per share,

$0.01 per share and $0.04 per share, respectively. Additionally,

SFAS 141 increased FFO for the three and nine months ended

September 30, 2009 and 2008 by $3.2 million, $10.4 million, $4.7

million and $13.2 million, respectively, or by $0.04 per share,

$0.12 per share, $0.05 per share and $0.15 per share, respectively.

THE MACERICH COMPANY FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT PER

SHARE AMOUNTS) Pro rata share of joint ventures: For the For the

Three Months Nine Months Ended Ended September 30, September 30,

-------------- -------------- Unaudited Unaudited -----------

----------- 2009 2008 2009 2008 ---- ---- ---- ---- Revenues:

Minimum rents $72,756 $68,828 $204,733 $202,262 Percentage rents

2,857 2,856 5,712 7,261 Tenant recoveries 35,310 33,024 99,187

97,072 Other 4,361 3,362 11,009 17,371 ----- ----- ------ ------

Total revenues 115,284 108,070 320,641 323,966 ------- -------

------- ------- Expenses: Shopping center and operating expenses

39,982 36,487 111,156 108,400 Interest expense 27,448 25,923 78,747

77,850 Depreciation and amortization 28,552 26,292 80,961 74,326

------ ------ ------ ------ Total operating expenses 95,982 88,702

270,864 260,576 ------ ------ ------- ------- (Loss) gain on sale

or write down of assets (309) 349 (298) 3,272 Equity in income of

joint ventures 172 211 168 510 --- --- --- --- Net income $19,165

$19,928 $49,647 $67,172 ------- ------- ------- -------

Reconciliation of Net income to FFO (f): For the For the Three

Months Nine Months Ended Ended September 30, September 30,

-------------- -------------- Unaudited Unaudited -----------

----------- 2009 2008 2009 2008 ---- ---- ---- ---- Net income -

available to common stockholders $142,838 $2,638 $135,118 $110,973

Adjustments to reconcile net income to FFO - basic Noncontrolling

interests in OP 21,520 386 20,351 19,051 (Gain) loss on sale or

write down of consolidated assets (161,580) 5,178 (136,731)

(95,135) plus gain on undepreciated asset sales- consolidated

assets 792 224 3,289 798 plus noncontrolling interests share of

gain on sale or write-down of consolidated joint ventures - - 310

589 less write down of consolidated assets (589) - (28,228) - Loss

(gain) on sale or write-down of assets from unconsolidated entities

(pro rata) 309 (349) 298 (3,272) plus (loss) gain on undepreciated

asset sales- unconsolidated entities (pro rata share) (26) 328 (24)

2,764 plus noncontrolling interests in gain on sale of

unconsolidated entities - - - 487 less write down of assets -

unconsolidated entities (pro rata share) (282) - (282) -

Depreciation and amortization on consolidated assets 61,856 66,637

190,507 185,538 Less depreciation and amortization allocable to

noncontrolling interests on consolidated joint ventures (1,117)

(1,065) (3,247) (2,426) Depreciation and amortization on joint

ventures (pro rata) 28,552 26,292 80,961 74,326 Less: depreciation

on personal property (3,623) (2,558) (10,912) (7,159) ------ ------

------- ------ Total FFO - basic 88,650 97,711 251,410 286,534

Additional adjustment to arrive at FFO - diluted Preferred stock

dividends earned - 835 - 4,124 --- --- --- ----- Total FFO -

diluted $88,650 $98,546 $251,410 $290,658 ------- ------- --------

-------- Reconciliation of EPS to FFO per diluted share: For the

For the Three Months Nine Months Ended Ended September 30,

September 30, -------------- -------------- Unaudited Unaudited

----------- ----------- 2009 2008 2009 2008 ---- ---- ---- ----

Earnings per share - diluted $1.75 $0.03 $1.71 $1.50 Per share

impact of depreciation and amortization of real estate 0.94 1.03

2.89 2.91 Per share impact of (gain) loss on sale or write-down of

depreciated assets (1.72) 0.06 (1.80) (1.10) Per share impact of

preferred stock not dilutive to EPS - 0.00 - (0.02) --- ---- ---

----- FFO per share - diluted $0.97 $1.12 $2.80 $3.29 ----- -----

----- ----- THE MACERICH COMPANY FINANCIAL HIGHLIGHTS (IN

THOUSANDS, EXCEPT PER SHARE AMOUNTS) For the For the Three Months

Nine Months Reconciliation of Net Ended Ended income to EBITDA:

September 30, September 30, -------------- -------------- Unaudited

Unaudited ----------- ----------- 2009 2008 2009 2008 ---- ----

---- ---- Net income - available to common stockholders $142,838

$2,638 $135,118 $110,973 Interest expense - consolidated assets

65,779 73,889 207,631 220,299 Interest expense - unconsolidated

entities (pro rata) 27,448 25,923 78,747 77,850 Depreciation and

amortization - consolidated assets 61,856 66,637 190,507 185,538

Depreciation and amortization - unconsolidated entities (pro rata)

28,552 26,292 80,961 74,326 Noncontrolling interests in OP 21,520

386 20,351 19,051 Less: Interest expense and depreciation and

amortization allocable to noncontrolling interests on consolidated

joint ventures (1,552) (1,673) (4,511) (3,623) Loss (gain) on early

extinguishment of debt 455 - (29,145) - (Gain) loss on sale or

write down of assets - consolidated assets (161,580) 5,178

(136,731) (95,135) Loss (gain) on sale or write down of assets -

unconsolidated entities (pro rata) 309 (349) 298 (3,272) Add:

Noncontrolling interests share of gain on sale of consolidated

joint ventures - - 310 589 Add: Noncontrolling interests share of

gain on sale of unconsolidated entities - - - 487 Income tax

expense (benefit) 302 (362) (878) (750) Distributions on preferred

units 208 242 623 782 Preferred dividends - 835 - 4,124 --------

-------- -------- -------- EBITDA (g) $186,135 $199,636 $543,281

$591,239 -------- -------- -------- -------- Reconciliation of

EBITDA to Same Centers - Net Operating Income ("NOI"): For the For

the Three Months Nine Months Ended Ended September 30, September

30, -------------- -------------- Unaudited Unaudited -----------

----------- 2009 2008 2009 2008 ---- ---- ---- ---- EBITDA (g)

$186,135 $199,636 $543,281 $591,239 Add: REIT general and

administrative expenses 7,084 2,881 16,989 11,419 Management

Companies' revenues (10,449) (10,261) (28,335) (30,334) Management

Companies' operating expenses 16,400 19,014 58,702 57,886 Lease

termination income of comparable centers (6,901) (3,476) (9,206)

(8,263) EBITDA of non- comparable centers (27,899) (40,824)

(69,791) (105,657) -------- -------- -------- -------- Same Centers

- NOI (h) $164,370 $166,970 $511,640 $516,290 -------- --------

-------- -------- (g) EBITDA represents earnings before interest,

income taxes, depreciation, amortization, noncontrolling interests,

extraordinary items, gain (loss) on sale of assets and preferred

dividends and includes joint ventures at their pro rata share.

Management considers EBITDA to be an appropriate supplemental

measure to net income because it helps investors understand the

ability of the Company to incur and service debt and make capital

expenditures. EBITDA should not be construed as an alternative to

operating income as an indicator of the Company's operating

performance, or to cash flows from operating activities (as

determined in accordance with GAAP) or as a measure of liquidity.

EBITDA, as presented, may not be comparable to similarly titled

measurements reported by other companies. (h) The Company presents

same-center NOI because the Company believes it is useful for

investors to evaluate the operating performance of comparable

centers. Same-center NOI is calculated using total EBITDA and

subtracting out EBITDA from non-comparable centers and eliminating

the management companies and the Company's general and

administrative expenses. Same center NOI excludes the impact of

straight-line and SFAS 141 adjustments to minimum rents.

DATASOURCE: The Macerich Company CONTACT: Arthur Coppola, Chairman

and Chief Executive Officer, or, Thomas E. O'Hern, Senior Executive

Vice President and Chief Financial Officer, both of The Macerich

Company, +1-310-394-6000 Web Site: http://www.macerich.com/

Copyright

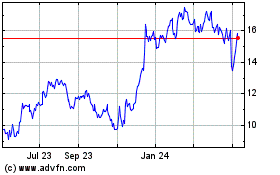

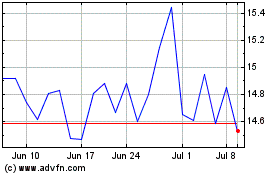

Macerich (NYSE:MAC)

Historical Stock Chart

From May 2024 to Jun 2024

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2023 to Jun 2024