Ford Motor $2 Billion Convertible Seen Pricing With 4%-4.5% Coupon-Sources

November 03 2009 - 5:11PM

Dow Jones News

Ford Motor Co. (F) is expected to price $2 billion of seven-year

convertible bonds later Tuesday, according to two people familiar

with the matter.

If there is sufficient demand for the issue, the company will

upsize the deal to $2.3 billion, these people said. The bonds are

expected to price with a coupon of 4% to 4.5%, and a conversion

premium of 22.5% to 27.5%, these people said.

Barclays Capital, BofA Merrill Lynch, Citigroup (C), Deutsche

Bank Securities, Goldman Sachs (GS), JPMorgan (JPM), Morgan Stanley

(MS) and RBS (RBS) are acting as managers of the senior convertible

notes offering

In a statement announcing the convertible sale Monday, Ford also

said it is looking to extend the maturity of its $10.7 billion

revolving-credit facility to 2013 from 2011.

Ford has already secured lender agreements to delay about $6

billion. In addition, the company plans to sell off some of its

shares to raise another $1 billion.

Ford is the only one of the Big Three auto makers that has

dodged a Chapter 11 filing.

The capital raising comes after Ford failed to win more

cost-cutting concessions from the United Auto Workers.

Rank-and-file members soundly defeated the concessions demand after

workers objected to the modifications due to Ford's brightening

financial outlook.

-By Kate Haywood, Dow Jones Newswires; 212-416-2218;

kate.haywood@dowjones.com

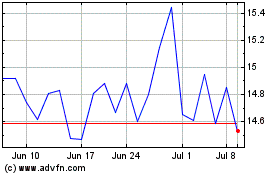

Macerich (NYSE:MAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

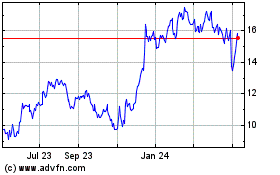

Macerich (NYSE:MAC)

Historical Stock Chart

From Jul 2023 to Jul 2024