2nd UPDATE: Macy's Posts 3Q Profit As Sales Rise Nearly 7%

November 10 2010 - 12:55PM

Dow Jones News

Celebrities and service are going to be keynotes for Macy's Inc.

(M) during the holiday selling season.

Riding a resurgence of sales this year, the retailer is now

turning to its employees and the famous names whose products it

carries to continue the strength through the holiday season.

"We have momentum as we enter the fourth quarter," Chief

Financial Officer Karen Hoguet told analysts during a conference

call after the retailer on Wednesday posted strong third-quarter

results.

Hoguet said she didn't expect the holiday season "to be any more

promotional than last year" in terms of pricing and that Macy's

will be "very thoughtful about pricing decisions" in the face of

higher material and labor costs all retailers are starting to deal

with.

"We want to maintain a very high level of value for our

customers, but at the same time, obviously, we also want to

maximize sales and margin," Hoguet said. "So I think it's just too

early to say."

Macy's will be quite promotional when it comes to trying to

build sales during Christmastime. The retailer is upping the

profile of the celebrities whose merchandise it already carries,

such as Jessica Simpson, Martha Stewart and Rachel Roy, by offering

"designer gifts" under their names. Seasonal staff is being trained

through Macy's "Magic Steps" program to engage customers, provide

advice and encourage them to buy. Some 400 stores will have new

gift shops that carry limited edition gifts for under $50. The

products are being promoted in a variety of ways, including online,

Hoguet said.

"Our organization is ready and prepared to execute the fourth

quarter to a whole new level," she said.

The comments followed Macy's reporting strong third-quarter

results, reflecting the continuation of a turnaround strategy that

emphasizes local tastes and is allowing the retailer to outpace

competition.

Macy's posted a profit for the period ended Oct. 30, coming back

from a loss the same time a year ago, as sales rose.

"Throughout 2010, we have gained confidence and momentum as

customers have responded favorably to our execution of key

strategies developed and activated over the past few years," Chief

Executive Terry Lundgren said.

But the results may have come at some cost. Gross margin, which

gauges how much profit is derived from sales, fell in the third

quarter, suggesting that already highly promotional Macy's may be

becoming even more so. The average price for merchandise in the

third quarter was "flattish...down a little bit," Hoguet said.

Macy's also expects its gross margin in the fourth quarter to be

below the prior year's, she said.

Macy's game plan of late has been to more closely tailor

merchandise to local tastes and needs, with efforts ranging from

having more warm weather gear in the South for longer in the season

to stocking Kentucky Derby merchandise in the Louisville, Ky., area

as the big race draws near. The company has continued to benefit

from prior consolidation of its divisions and introduction of new

brands, including the recent launch of the Material Girl Line by

Madonna and her daughter.

The approach appears to be paying off, with Macy's outdistancing

major competitors Kohl's Corp. (KSS) and J.C. Penney Co. (JCP) in

monthly comparable-store sales. Kohl's and J.C. Penney are

scheduled to report their third-quarter results on Thursday and

Friday, respectively.

Macy's is also enjoying the resurgence of upper-end spending,

with its Bloomingdale's chain seeing strength in the latest period.

The retailer also saw a surge in online sales.

The third-quarter showing, taken in its entirety, makes Macy's

"well positioned to take market share this holiday season," said

Citigroup analyst Deborah Weinswig.

Macy's in the third quarter reported a profit of $10 million, or

2 cents a share, compared with a prior-year loss of $35 million, or

8 cents a share. Excluding debt-repurchase and other impacts,

earnings were 8 cents compared with a loss of 3 cents.

Analysts polled by Thomson Reuters most recently forecast a

5-cent profit.

The retailer for the full-year expects earnings of $1.94 to

$1.99 a share, based on second-half guidance it raised last week

and what Macy's reported in the first two quarters.

Gross margin edged down to 40% from 40.5%, while overhead costs

were flat.

Macy's last week reported total sales increased 6.6% to $5.62

billion as same-store sales grew 3.9%. A year earlier, total sales

fell 3.9% and same-store sales fell 3.6%.

Sales grew 24% at its online business, which includes macys.com

and bloomingdales.com.

Shares were recently 0.8% lower at $25.02.

-By Karen Talley, Dow Jones Newswires; 212-416-2196;

karen.talley@dowjones.com

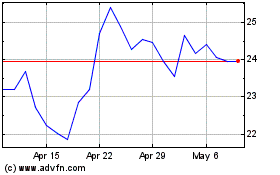

Kohls (NYSE:KSS)

Historical Stock Chart

From Jun 2024 to Jul 2024

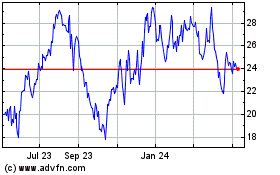

Kohls (NYSE:KSS)

Historical Stock Chart

From Jul 2023 to Jul 2024