KB Home (KBH) - Bear of the Day

March 01 2012 - 7:00PM

Zacks

KB Home (KBH) faces a fragile housing market. Increased

availability of housing alternatives may keep the company's

earnings under pressure. Furthermore, the company's housing market

is highly concentrated, which poses threats to its earnings

performance.

The company did post a profit of $0.18 per share during the

fourth quarter of fiscal 2011, which was much higher than the Zacks

Consensus Estimate of $0.03. Nevertheless, the negative factors

have led us to downgrade the recommendation on shares of KB Home

from Neutral to Underperform with a target price of $10.00.

Our long-term Underperform recommendation on the stock indicates

that it will perform lower than the overall market. Our $10 target

price, 25.0X our 2013 EPS estimate, reflects this view.

KB HOME (KBH): Free Stock Analysis Report

To read this article on Zacks.com click here.

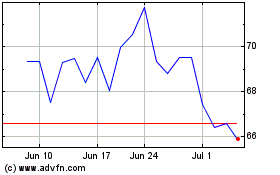

KB Home (NYSE:KBH)

Historical Stock Chart

From May 2024 to Jun 2024

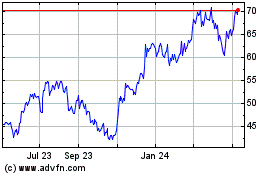

KB Home (NYSE:KBH)

Historical Stock Chart

From Jun 2023 to Jun 2024