Toll Brothers Make Losses - Analyst Blog

February 22 2012 - 8:38AM

Zacks

Toll Brothers Inc. (TOL) recorded a loss of

$2.8 million or 2 cents per share in the first quarter of fiscal

2012 ended January 31, 2012 compared with a profit of $3.4 million

or 2 cents per share in the same quarter of fiscal 2011 and the

Zacks Consensus Estimate of a profit of 3 cents per share.

Revenues dipped 4% to $322.0 million during the quarter on a 1%

fall in home building deliveries to 564 units. It was lower than

the Zacks Consensus Estimate of $358 million.

Net signed contracts rose 45% to $444.7 million and 19% to 652

units during the quarter. The average price of net signed contracts

was $682,000 compared with $561,000 in the same quarter of

2011.

Toll Brothers ended the quarter with a backlog of $1.12 billion

and 1,784 units, an increase of 35% in dollars and 21% in units,

compared with $825.2 million and 1,472 units in the prior year.

The company's contract cancellation rate (current-quarter

cancellations divided by current-quarter gross signed contracts)

was 6.2% compared with 5.7% in the first quarter of fiscal 2011.

These rates are consistent with the company’s pre-downturn

historical averages.

Toll Brothers had 228 selling communities at the end of the

quarter compared with 200 at the end of the prior-year quarter. The

company ended the quarter with approximately 39,700 owned and

optioned lots, compared with 37,500 lots at the end of the previous

year quarter.

Toll Brothers had cash, cash equivalents and marketable

securities of $719.4 million as of January 31, 2012 compared with

$1.1 billion as of January 31, 2011. The company’s

net-debt-to-capital ratio was 25.0% as of January 31, 2012 compared

with 17.6% as of January 31, 2011.

Toll Brothers anticipates home building deliveries between 2,600

and 3,200 homes in the fiscal 2012 at an average price between

$550,000 and $575,000 based on its first-quarter-end backlog and

current community count.

Based in Horsham, Pennsylvania, Toll Brothers, a Zacks #3 Rank

(Hold rating) stock, is engaged in the development, construction,

financing, and sale of residential homes in the United States. It

builds luxury, single-family detached and attached home

communities; master planned luxury residential resort-style golf

communities; and urban low, mid, and high-rise communities

principally on the land it develops and improves.

The company operates its own architectural, engineering,

mortgage, title, land development and land sale, golf course

development and management, home security, landscape, cable TV and

broadband Internet delivery subsidiaries. Its competitors include

DR Horton Inc. (DHI), PulteGroup

Inc. (PHM), Lennar Corp. (LEN),

KB Home (KBH) and Hovnanian Enterprises

Inc. (HOV).

D R HORTON INC (DHI): Free Stock Analysis Report

HOVNANIAN ENTRP (HOV): Free Stock Analysis Report

KB HOME (KBH): Free Stock Analysis Report

LENNAR CORP -A (LEN): Free Stock Analysis Report

PULTE GROUP ONC (PHM): Free Stock Analysis Report

TOLL BROTHERS (TOL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

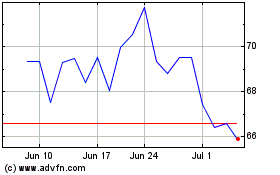

KB Home (NYSE:KBH)

Historical Stock Chart

From May 2024 to Jun 2024

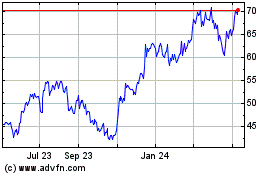

KB Home (NYSE:KBH)

Historical Stock Chart

From Jun 2023 to Jun 2024