Pulte Group Tops Estimates - Analyst Blog

February 02 2012 - 7:20AM

Zacks

Pulte Group, Inc. (PHM) reported a profit of

$14 million or 4 cents per share in the fourth quarter of 2011

compared with a loss of $165 million or 44 cents per share in the

same quarter of 2010. Before special items, the company’s profit

stood at $41 million or 11 cents per share during the quarter,

exceeding the Zacks Consensus Estimate of 8 cents per share and the

year ago profit of $6 million or 1 cent per share.

Pulte’s revenues rose marginally by 1% to $1.2 billion from the

fourth quarter of 2010. The increase in revenues was attributable

to a 3% increase in average selling prices to $271,000, which was

partially offset by a 2% decrease in closings to 4,303

homes.

Cost of sales related to home sales was $1.0 billion during the

quarter (including $11 million of impairments) compared with $1.1

billion in the prior-year quarter (including $82 million of

impairments).

Excluding impairments, interest expense and merger-related

costs, home sale gross margin was 18.6% in the quarter, reflecting

an improvement of 200 basis points over the fourth quarter of

2010.

Selling, general & administrative expenses were $117

million, or 10% of home sale revenues, compared with $151 million,

or 13% of home sale revenues, in the fourth quarter of

2010.

Pulte had net new orders of 3,084 homes during the quarter

compared with 3,044 homes a year ago. The company’s contract

backlog was 3,924 homes with a constructed value of $1.1 billion as

of December 31, 2011 compared with a contract backlog of 3,984

homes, valued at $1.1 billion, as of December 31, 2010.

Revenues in the company’s Financial Services scaled up 6.5% to

$1.3 billion. The segment had a pretax loss of $27.4 million in the

quarter compared with a profit of $5.3 million in the fourth

quarter of 2010.

Annual Results

For full year 2011, PulteGroup reported a narrower loss of $210

million or 55 cents per share compared with a loss of $1.1 billion

or $2.90 per share in 2010. Excluding special items, the company

had a loss of $2 million or zero cents per share compared with the

Zacks Consensus Estimate of a loss of 52 cents per share and the

year-ago level of $307 million or 80 cents per share.

Revenues from home sales dipped 9% to $4.0 billion from $4.4

billion in the prior year, driven primarily by an 11% fall in

closings to 15,275 homes. The decrease in unit closings

reflects the pulling ahead of demand created by the tax credit in

2010 and the company’s lower community count. Meanwhile, revenues

from Financial Services declined 9.5% to $4.1 billion during the

year.

Financial Position

Pulte had cash and cash equivalents of $1.1 billion as of

December 31, 2011 compared with $1.5 billion as of December 31,

2010. The company had senior notes of $3.1 billion as of December

31, 2011 versus $3.4 billion as of December 31, 2010.

Pulte’s cash flow from operations declined to $17.2 million in

2011 from $590.9 million in the previous year. Meanwhile, capital

expenditures increased to $21.2 million from $15.2 million in

2010.

Outlook

Based in Bloomfield Hills, Michigan, PulteGroup engages in the

homebuilding and financial services businesses primarily in the

U.S. and Puerto Rico. It competes with Lennar

Corp. (LEN), KB Home (KBH) and DR

Horton Inc. (DHI).

The company expects challenging macroeconomic conditions will

persist in 2012. Nevertheless, it expects to be profitable for the

year. Currently, it retains a Zacks #3 Rank on its shares, which

translates to a short-term (1 to 3 months) rating of Hold”.

D R HORTON INC (DHI): Free Stock Analysis Report

KB HOME (KBH): Free Stock Analysis Report

LENNAR CORP -A (LEN): Free Stock Analysis Report

PULTE GROUP ONC (PHM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

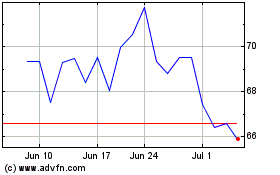

KB Home (NYSE:KBH)

Historical Stock Chart

From May 2024 to Jun 2024

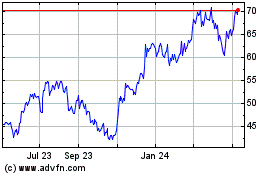

KB Home (NYSE:KBH)

Historical Stock Chart

From Jun 2023 to Jun 2024