ICE Midland WTI (HOU) Futures Reach All-Time Daily Volume Record

May 17 2024 - 8:30AM

Business Wire

Intercontinental Exchange, Inc. (NYSE: ICE), a leading global

provider of technology and data, today announced that its ICE

Midland WTI (ICE:HOU) crude futures contract hit its highest volume

day on May 13, 2024, with over 100,000 contracts traded.

The volume activity follows records set in the HOU futures

contract in 2024, including record average daily volume of 16,700

contracts during April, rising to over 29,000 contracts during May

2024, based on month-to-date trading activity. Alongside this, HOU

open interest (OI) is up over 190% year-over-year (y/y).

“It’s great to see the market utilize HOU as the only

exchange-guaranteed source of ratably delivered Midland WTI

barrels,” said Jeff Barbuto, Global Head of Oil Markets at ICE.

“HOU is where U.S. production meets global demand, and the quality

spec of ICE HOU matches the globally accepted Midland-WTI quality.

Physical cargoes load at the U.S. Gulf Coast for export to Asia and

Europe, where HOU-quality barrels are accepted in the Platts Dated

Brent assessment.”

“Right now, the U.S. Gulf Coast market is focused on the

scheduled maintenance of the Wink to Webster pipeline due in June

2024, with Argus announcing that all trades originating from this

pipeline will be excluded from their MEH assessment,” continued

Barbuto. “The ICE HOU contract rules state that HOU must be on-spec

and be delivered ratably. These are the times when

exchange-guaranteed quality and deliveries show their value.”

ICE’s rules state, “It is the Seller’s obligation to ensure that

the Product receipts are available to begin flowing ratably at the

Specified Terminal by the first day of the delivery month." Full

contract rules can be found here:

https://www.ice.com/publicdocs/contractregs/179_SECTION_7A1.pdf

ICE offers HOU time spreads, as well as inter-commodity spreads

with Brent and WTI Cushing (Domestic Light Sweet) to help customers

mitigate price risk between locations and grades. Meanwhile,

customers can benefit from margin offsets as high as 98% when

clearing HOU alongside other oil positions cleared at ICE. Offsets

are available across a range of over 800 oil contracts, including

ICE Brent, ICE Gasoil, ICE WTI, ICE Dubai (Platts), ICE Murban, as

well as RBOB Gasoline. OI across ICE’s total oil complex is up over

20% y/y at 14 million contracts.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune

500 company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges

– including the New York Stock Exchange – and clearing

houses help people invest, raise capital and manage risk. We

offer some of the world’s largest markets to trade and clear energy

and environmental products. Our fixed income, data services

and execution capabilities provide information, analytics and

platforms that help our customers streamline processes and

capitalize on opportunities. At ICE Mortgage Technology , we

are transforming U.S. housing finance, from initial consumer

engagement through loan production, closing, registration and the

long-term servicing relationship. Together, ICE transforms,

streamlines and automates industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here . Key Information Documents for

certain products covered by the EU Packaged Retail and

Insurance-based Investment Products Regulation can be accessed on

the relevant exchange website under the heading “Key Information

Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Category: EXCHANGES

ICE- CORP

Source: Intercontinental Exchange

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240517052593/en/

ICE Media Contact: Jess Tatham jess.tatham@ice.com

+44 7377 947136 ICE Investor Contact: Katia Gonzalez

katia.gonzalez@ice.com (678) 981-3882

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From May 2024 to Jun 2024

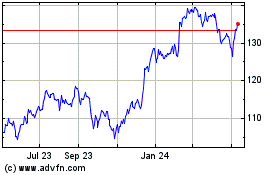

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Jun 2023 to Jun 2024