0001468174false00014681742024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 9, 2024

HYATT HOTELS CORPORATION

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34521 | | 20-1480589 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 150 North Riverside Plaza | | | | |

| 8th Floor | Chicago, | Illinois | | | | | 60606 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (312) 750-1234

Former Name or Former Address, if Changed Since Last Report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered | |

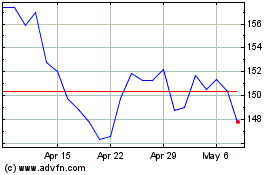

| Class A Common Stock, $0.01 par value | | H | | New York Stock Exchange | |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 |

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for |

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02. Results of Operations and Financial Condition.

On May 9, 2024, Hyatt Hotels Corporation (the "Company") issued a press release announcing its results for its quarter ended March 31, 2024. The full text of the press release is attached as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

The information in this Form 8-K and Exhibit 99.1 attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

On May 9, 2024, the Company published a supplemental investor presentation which may be accessed through the Company's investor relations website. A copy of the supplemental presentation is furnished herewith as Exhibit 99.2 and is incorporated herein by reference.

The information furnished under Item 7.01 and Exhibit 99.2 in this Form 8-K shall not be deemed "filed" for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act, except as set forth by specific reference in such filing.

Item 8.01. Other Events.

On May 9, 2024, the Company announced that its Board of Directors has authorized the repurchase of up to an additional $1 billion of the Company’s common stock. These repurchases may be made from time to time in the open market, in privately negotiated transactions, or otherwise, including pursuant to a Rule 10b5-1 plan or an accelerated share repurchase transaction, at prices that the Company deems appropriate and subject to market conditions, applicable law and other factors deemed relevant in the Company's sole discretion. The common stock repurchase authorization applies to the Company's Class A common stock and/or the Company's Class B common stock. The common stock repurchase authorization does not obligate the Company to repurchase any dollar amount or number of shares of common stock and the authorization may be suspended or discontinued at any time.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| |

| 99.1 | | | |

| 99.2 | | | |

| 101 | | | Interactive Data File - XBRL tags are embedded within the Inline XBRL document |

| 104 | | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | Hyatt Hotels Corporation |

| | |

Date: May 9, 2024 | | By: | /s/ Joan Bottarini |

| | | Joan Bottarini |

| | | Executive Vice President, Chief Financial Officer |

HYATT REPORTS FIRST QUARTER 2024 RESULTS

CHICAGO (May 9, 2024) - Hyatt Hotels Corporation ("Hyatt" or the "Company") (NYSE: H) today reported first quarter 2024 results. Highlights include:

•Comparable system-wide hotels RevPAR increased 5.5% compared to the same period in 2023

•Comparable system-wide all-inclusive resorts Net Package RevPAR increased 11.0% compared to the same period in 2023

•Net Rooms Growth was approximately 5.5%

•Net Income was $522 million and Adjusted Net Income was $75 million

•Diluted EPS was $4.93 and Adjusted Diluted EPS was $0.71

•Adjusted EBITDA was $252 million

•Pipeline of executed management or franchise contracts was approximately 129,000 rooms

•Repurchased approximately 2.5 million shares of Class A and Class B common stock for an aggregate purchase price of $388 million

•Full year comparable system-wide hotels RevPAR is projected to increase 3% to 5% on a constant currency basis compared to full year 2023

•Full year Net Income is projected between $1,135 million and $1,195 million

•Full year Adjusted EBITDA is projected between $1,150 million and $1,190 million and is in line with previously provided 2024 Outlook when adjusting for $30 million of reduced Adjusted EBITDA due to transactions

•Full year Capital Returns to Shareholders is projected between $800 million and $850 million

Mark S. Hoplamazian, President and Chief Executive Officer of Hyatt, said, "The year is off to a great start with gross fee revenue reaching a record of $262 million in the quarter. Our pipeline also reached a new record, expanding 10% year-over-year to 129,000 rooms, and we realized net rooms growth of 5.5%. World of Hyatt membership has grown by 22%, reaching a new record of 46 million members. Significant progress on asset dispositions is further expanding our asset-light earnings mix, reflecting our execution to permanently reduce owned real estate."

Refer to the table on page A-7 of the schedules for a summary of special items impacting Adjusted Net Income and Adjusted Diluted EPS for the three months ended March 31, 2024.

Note: All RevPAR and ADR percentage changes are in constant dollars. All Net Package RevPAR and Net Package ADR percentage changes are in reported dollars. This release includes references to non-GAAP financial measures. Refer to the non-GAAP reconciliations included in the schedules and the definitions of the non-GAAP measures presented beginning on page A-5.

Segment Results and Highlights | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Three Months Ended March 31, | | | |

| | 2024 | | 2023 | | Change (%) | |

| Management and franchising | | $ | 203 | | | $ | 184 | | | 10.2 | % | |

| Owned and leased | | 60 | | | 71 | | | (16.5) | % | |

| Distribution | | 39 | | | 58 | | | (31.7) | % | |

| Overhead | | (51) | | | (46) | | | (9.0) | % | |

| Eliminations | | 1 | | | 1 | | | (33.0) | % | |

| Adjusted EBITDA | | $ | 252 | | | $ | 268 | | | (5.9) | % | |

•Management and franchising: Results in the first quarter were driven by solid demand across all customer segments. Regional highlights include strong outbound travel from Greater China, benefiting markets such as Japan, Thailand, and South Korea. Leisure demand was strong in Mexico and the Caribbean for hotels and all-inclusive resorts. European all-inclusive properties produced impressive Net Package RevPAR growth driven by high demand for resorts in the Canary Islands. In the United States, RevPAR was up approximately 2%, excluding the impact of Easter, reflecting normalized growth.

•Owned and leased: Adjusted EBITDA in the first quarter decreased by 9% compared to the first quarter of 2023, when adjusted for asset dispositions. The decline was driven by difficult comparisons to 2023, including the Super Bowl in Phoenix, higher real estate taxes, higher wages, and transaction costs related to asset sales in process.

•Distribution: The segment performance was impacted by challenging year-over-year comparisons particularly due to ALG Vacations which lapped a strong quarter in the previous year.

Openings and Development

In the first quarter, 12 new hotels (or 2,425 rooms) joined Hyatt's portfolio. Notable openings included Thompson Houston, Secrets Tides Punta Cana, Secrets Playa Blanca Costa Mujeres, five UrCove properties in China, and Hyatt Regency Nairobi Westlands, marking the first hotel in Kenya.

As of March 31, 2024, the Company had a pipeline of executed management or franchise contracts for approximately 670 hotels (approximately 129,000 rooms).

Transactions and Capital Strategy

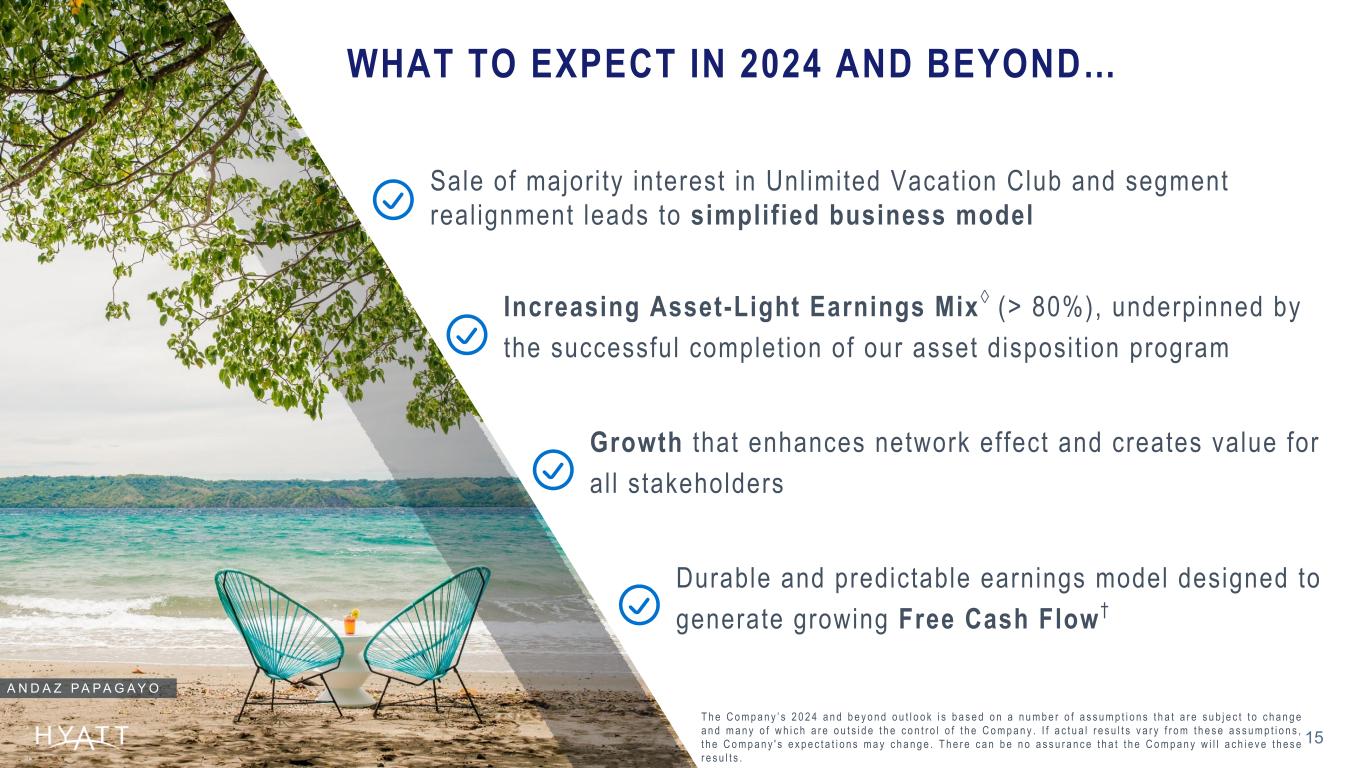

In addition to the completion of the transaction that resulted in the Company selling 80% of the entity that owns the Unlimited Vacation Club business (the "UVC Transaction") and the closing on the sale of Hyatt Regency Aruba Resort Spa and Casino, which were previously announced, the Company is sharing the following updates:

•Sold Park Hyatt Zurich on April 4, 2024, Hyatt Regency San Antonio Riverwalk on April 23, 2024, and Hyatt Regency Green Bay on May 1, 2024 to unrelated third parties for combined proceeds of $535 million at a 14.7x multiple. The Company entered into long-term management agreements for Park Hyatt Zurich and Hyatt Regency San Antonio Riverwalk, and a long-term franchise agreement for Hyatt Regency Green Bay. In connection with the Park Hyatt Zurich transaction, the Company provided approximately $45 million of seller financing.

•Signed a purchase and sale agreement for an asset that, upon closing, would generate gross proceeds that exceed the remaining portion of the Company's $2.0 billion asset sell-down commitment.

•As previously disclosed, another asset remains in the marketing process.

As of May 9, 2024, the Company has realized $1.5 billion of gross proceeds from the net disposition of real estate at a 13.3x multiple and remains committed to successfully executing plans to realize $2.0 billion of gross proceeds from the sale of real estate, net of acquisitions, by the end of 2024 as part of its expanded asset disposition commitment announced in August 2021.

On February 28, 2024, Juniper Hotels, one of the Company's unconsolidated hospitality ventures in India, completed an initial public offering ("IPO") on the BSE Limited and National Stock Exchange of India. The Company holds approximately 86 million equity shares and following the IPO, retained a 38.8% ownership interest in the unconsolidated hospitality venture. The Company's shares were valued at approximately $536 million at March 31, 2024.

Balance Sheet and Liquidity

As of March 31, 2024, the Company reported the following:

•Total debt of $3,055 million.

•Pro rata share of unconsolidated hospitality venture debt of $457 million, substantially all of which is non-recourse to Hyatt and a portion of which Hyatt guarantees pursuant to separate agreements.

•Total liquidity of approximately $2.3 billion with $794 million of cash and cash equivalents and short-term investments, and borrowing availability of $1,496 million under Hyatt's revolving credit facility, net of letters of credit outstanding.

During the first quarter, the Company repurchased a total of 528,427 shares of Class A common stock for approximately $76 million and 1,987,229 shares of Class B common stock for approximately $312 million. The Company's board of directors has authorized the repurchase of up to an additional $1 billion of the Company's common stock. These repurchases may be made from time to time in the open market, in privately negotiated transactions, or otherwise, including pursuant to a Rule 10b5-1 plan or an accelerated share repurchase transaction, at prices that the Company deems appropriate and subject to market conditions, applicable law and other factors deemed relevant in the Company's sole discretion. The share repurchase authorization applies to the Company's Class A common stock and/or Class B common stock, does not obligate the Company to repurchase any dollar amount or number of shares of common stock, and may be suspended or discontinued at any time. As of May 9, 2024, the Company has approximately $1.8 billion remaining under the share repurchase authorization.

The Company's board of directors has declared a cash dividend of $0.15 per share for the second quarter of 2024. The dividend is payable on June 11, 2024 to Class A and Class B stockholders of record as of May 29, 2024.

2024 Outlook

The Company is providing the following outlook for the 2024 fiscal year reflecting the sales of Park Hyatt Zurich, Hyatt Regency San Antonio Riverwalk, Hyatt Regency Green Bay, and the UVC Transaction. Full year 2024 outlook for Adjusted EBITDA remains in line with previously provided outlook when adjusted for $30 million reduction attributed to these transactions. Free Cash Flow remains in line with previously provided outlook including the $30 million reduction to Adjusted EBITDA and $25 million of cash tax payments related to the three asset sales.

| | | | | | | | |

| | Full Year 2024 vs. 2023 |

System-Wide Hotels RevPAR1 | | 3% to 5% |

| Net Rooms Growth | | 5.5% to 6.0% |

| (in millions) | | Full Year 2024 |

| Net Income | | $1,135 - $1,195 |

| Gross Fees | | $1,100 - $1,130 |

Adjusted G&A Expenses2 | | $425 - $435 |

Adjusted EBITDA2 | | $1,150 - $1,190 |

| Capital Expenditures | | Approx. $170 |

Free Cash Flow2 | | $575 - $625 |

Capital Returns to Shareholders3 | | $800 - $850 |

1 RevPAR is based on constant currency whereby previous periods are translated based on the current period exchange rate. RevPAR percentage for 2024 vs. 2023 is based on comparable hotels.

2 Refer to the tables on schedule A-9 for a reconciliation of estimated Net Income attributable to Hyatt Hotels Corporation to Adjusted EBITDA, G&A expenses to Adjusted G&A Expenses, and net cash provided by operating activities to Free Cash Flow.

3 The Company expects to return capital to shareholders through a combination of cash dividends on its common stock and share repurchases.

No disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2024 Outlook. The Company's 2024 Outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that Hyatt will achieve these results.

Conference Call Information

The Company will hold an investor conference call this morning, May 9, 2024, at 9:00 a.m. CT.

Participants are encouraged to listen to a simultaneous webcast of the conference call, which may be accessed through the Company's website at investors.hyatt.com. Alternatively, participants may access the live call by dialing: 800.715.9871 (U.S. Toll-Free) or 646.307.1963 (International Toll Number) using conference ID# 2303828 approximately 15 minutes prior to the scheduled start time.

A replay of the call will be available for one week beginning on Thursday, May 9, 2024, at 11:00 a.m. CT by dialing: 800.770.2030 (U.S. Toll-Free) or 609.800.9909 (International Toll Number) using conference ID# 2303828. An archive of the webcast will be available on the Company's website for 90 days.

Investor Contacts

•Adam Rohman, 312.780.5834, adam.rohman@hyatt.com

•Tara Atwood, 312.780.5713, tara.atwood@hyatt.com

Media Contact

•Franziska Weber, 312.780.6106, franziska.weber@hyatt.com

Forward-Looking Statements

Forward-Looking Statements in this press release, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements about our plans, strategies, outlook, occupancy, the amount by which the Company intends to reduce its real estate asset base, the expected amount of gross proceeds from the sale of such assets, and the anticipated timeframe for such asset dispositions, the number of properties we expect to open in the future, pace and booking trends, the expected timing and payment of dividends, RevPAR trends, our expected Adjusted G&A Expense, our expected capital expenditures, our expected net rooms growth, our expected system-wide RevPAR, our expected one-time integration-related expenses, financial performance, prospects or future events and involve known and unknown risks that are difficult to predict. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "continue," "likely," "will," "would" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: general economic uncertainty in key global markets and a worsening of global economic conditions or low levels of economic growth; the rate and pace of economic recovery following economic downturns; global supply chain constraints and interruptions, rising costs of construction-related labor and materials, and increases in costs due to inflation or other factors that may not be fully offset by increases in revenues in our business; risks affecting the luxury, resort, and all-inclusive lodging segments; levels of spending in business, leisure, and group segments, as well as consumer confidence; declines in occupancy and average daily rate; limited visibility with respect to future bookings; loss of key personnel; domestic and international political and geopolitical conditions, including political or civil unrest or changes in trade policy; hostilities, or fear of hostilities, including future terrorist attacks, that affect travel; travel-related accidents; natural or man-made disasters, weather and climate-related events, such as earthquakes, tsunamis, tornadoes, hurricanes, droughts, floods, wildfires, oil spills, nuclear incidents, and global outbreaks of pandemics or contagious diseases, or fear of such outbreaks; our ability to successfully achieve certain levels of operating profits at hotels that have performance tests or guarantees in favor of our third-party owners; the impact of hotel renovations and redevelopments; risks associated with our capital allocation plans, share repurchase program, and dividend payments, including a reduction in, or elimination or suspension of, repurchase activity or dividend payments; the seasonal and cyclical nature of the real estate and hospitality businesses; changes in distribution arrangements, such as through internet travel intermediaries; changes in the tastes and preferences of our customers; relationships with colleagues and labor unions and changes in labor laws; the financial condition of, and our relationships with, third-party owners, franchisees, and hospitality venture partners; the possible inability of third-party owners, franchisees, or development partners to access the capital necessary to fund current operations or implement our plans for growth; risks associated with potential acquisitions and dispositions and our ability to successfully integrate completed acquisitions with existing operations; failure to successfully complete proposed transactions (including the failure to satisfy closing conditions or obtain required approvals); our ability to successfully execute our strategy to expand our management and hotels services and franchising business while at the same time reducing our real estate asset base within targeted timeframes and at expected values; our ability to maintain effective internal control over financial reporting and disclosure controls and procedures; declines in the value of our real estate assets; unforeseen terminations of our management and hotels services or franchise agreements; changes in federal, state, local, or foreign tax law; increases in interest rates, wages, and other operating costs; foreign exchange rate fluctuations or currency restructurings; risks associated with the introduction of new brand concepts, including lack of acceptance of new brands or innovation; general volatility of the capital markets and our ability to access such markets; changes in the competitive environment in our industry, industry consolidation, and the markets where we operate; our ability to successfully grow the World of Hyatt loyalty program and Unlimited Vacation Club paid membership program; cyber incidents and information technology failures; outcomes of legal or administrative proceedings; and violations of regulations or laws related to our franchising business and licensing businesses and our international operations; and other risks discussed in the Company's filings with the SEC, including our annual reports on Form 10-K and quarterly reports on Form 10-Q, which filings are available from the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this press release. We do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

Non-GAAP Financial Measures

The Company refers to certain financial measures that are not recognized under U.S. generally accepted accounting principles (GAAP) in this press release, including: Adjusted Net Income; Adjusted Diluted EPS; Adjusted EBITDA; Adjusted G&A Expenses; and Free Cash Flow. See the schedules to this earnings release, including the "Definitions" section, for additional information and reconciliations of such non-GAAP financial measures.

Availability of Information on Hyatt's Website and Social Media Channels

Investors and others should note that Hyatt routinely announces material information to investors and the marketplace using U.S. Securities and Exchange Commission (SEC) filings, press releases, public conference calls, webcasts and the Hyatt Investor Relations website. The Company uses these channels as well as social media channels (e.g., the Hyatt Facebook account (facebook.com/hyatt); the Hyatt Instagram account (instagram.com/hyatt/); the Hyatt X account (twitter.com/hyatt); the Hyatt LinkedIn account (linkedin.com/company/hyatt/); and the Hyatt YouTube account (youtube.com/user/hyatt)) as a means of disclosing information about the Company's business to our guests, customers, colleagues, investors, and the public. While not all of the information that the Company posts to the Hyatt Investor Relations website or on the Company's social media channels is of a material nature, some information could be deemed to be material. Accordingly, the Company encourages investors, the media, and others interested in Hyatt to review the information that it shares at the Investor Relations link located at the bottom of the page on hyatt.com and on the Company's social media channels. Users may automatically receive email alerts and other information about the Company when enrolling an email address by visiting "Investor Email Alerts" in the "Resources" section of Hyatt's website at investors.hyatt.com. The contents of these websites are not incorporated by reference into this press release or any report or document Hyatt files with the SEC, and any references to the websites are intended to be inactive textual references only.

About Hyatt Hotels Corporation

Hyatt Hotels Corporation, headquartered in Chicago, is a leading global hospitality company guided by its purpose – to care for people so they can be their best. As of March 31, 2024, the Company's portfolio included more than 1,300 hotels and all-inclusive properties in 78 countries across six continents. The Company's offering includes brands in the Timeless Collection, including Park Hyatt®, Grand Hyatt®, Hyatt Regency®, Hyatt®, Hyatt Vacation Club®, Hyatt Place®, Hyatt House®, Hyatt Studios, and UrCove; the Boundless Collection, including Miraval®, Alila®, Andaz®, Thompson Hotels®, Dream® Hotels, Hyatt Centric®, and Caption by Hyatt®; the Independent Collection, including The Unbound Collection by Hyatt®, Destination by Hyatt®, and JdV by Hyatt®; and the Inclusive Collection, including Impression by Secrets, Hyatt Ziva®, Hyatt Zilara®, Zoëtry® Wellness & Spa Resorts, Secrets® Resorts & Spas, Breathless Resorts & Spas®, Dreams® Resorts & Spas, Hyatt Vivid Hotels & Resorts, Alua Hotels & Resorts®, and Sunscape® Resorts & Spas. Subsidiaries of the Company operate the World of Hyatt® loyalty program, ALG Vacations®, Mr & Mrs Smith™, Unlimited Vacation Club®, Amstar DMC destination management services, and Trisept Solutions® technology services. For more information, please visit www.hyatt.com.

Hyatt Hotels Corporation

Table of Contents

Financial Information

(unaudited)

| | | | | |

| Schedule | Page |

| A - 1 |

| A - 2 |

| A - 4 |

| A - 5 |

| A - 8 |

| A - 9 |

| A - 10 |

Percentages on the following schedules may not recompute due to rounding. Not meaningful percentage changes are presented as "NM".

Hyatt Hotels Corporation

Condensed Consolidated Statements of Income

(unaudited)

| | | | | | | | | | | | | | | |

(in millions, except per share amounts) | Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| REVENUES: | | | | | | | |

| Base management fees | $ | 98 | | | $ | 91 | | | | | |

| Incentive management fees | 64 | | | 57 | | | | | |

| Franchise and other fees | 100 | | | 83 | | | | | |

| Gross fees | 262 | | | 231 | | | | | |

| Contra revenue | (13) | | | (10) | | | | | |

| Net fees | 249 | | | 221 | | | | | |

| Owned and leased | 309 | | | 314 | | | | | |

| Distribution | 319 | | | 328 | | | | | |

| Other revenues | 35 | | | 88 | | | | | |

| Revenues for reimbursed costs | 802 | | | 729 | | | | | |

| Total revenues | 1,714 | | | 1,680 | | | | | |

| | | | | | | |

| DIRECT AND GENERAL AND ADMINISTRATIVE EXPENSES: | | | | | | | |

| General and administrative | 172 | | | 157 | | | | | |

| Owned and leased | 250 | | | 240 | | | | | |

| Distribution | 274 | | | 258 | | | | | |

| Other direct costs | 45 | | | 98 | | | | | |

| Integration costs | 4 | | | 4 | | | | | |

| Depreciation and amortization | 92 | | | 98 | | | | | |

| Reimbursed costs | 836 | | | 749 | | | | | |

| Total direct and general and administrative expenses | 1,673 | | | 1,604 | | | | | |

| | | | | | | |

| Net gains (losses) and interest income from marketable securities held to fund rabbi trusts | 24 | | | 18 | | | | | |

| Equity earnings (losses) from unconsolidated hospitality ventures | 75 | | | (2) | | | | | |

| Interest expense | (38) | | | (33) | | | | | |

| Gains on sales of real estate and other | 403 | | | — | | | | | |

| Asset impairments | (17) | | | (2) | | | | | |

| Other income (loss), net | 53 | | | 48 | | | | | |

| Income before income taxes | 541 | | | 105 | | | | | |

| | | | | | | |

| Provision for income taxes | (19) | | | (47) | | | | | |

| Net income | 522 | | | 58 | | | | | |

| Net income attributable to noncontrolling interests | — | | | — | | | | | |

| Net income attributable to Hyatt Hotels Corporation | $ | 522 | | | $ | 58 | | | | | |

| | | | | | | |

| EARNINGS PER CLASS A AND CLASS B SHARE: | | | | | | | |

| Net income attributable to Hyatt Hotels Corporation—Basic | $ | 5.08 | | | $ | 0.55 | | | | | |

| Net income attributable to Hyatt Hotels Corporation—Diluted | $ | 4.93 | | | $ | 0.53 | | | | | |

| | | | | | | |

| Basic weighted-average shares outstanding | 102.8 | | 106.4 | | | | |

| Diluted weighted-average shares outstanding | 105.9 | | 108.9 | | | | |

Hyatt Hotels Corporation

Hotel Operating Statistics by Geography

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in constant $) | Three Months Ended March 31, |

| RevPAR | | Occupancy | | ADR |

| 2024 | vs. 2023 | | 2024 | vs. 2023 | | 2024 | vs. 2023 |

| System-wide hotels (a) | $ | 131.86 | | 5.5 | % | | 65.2 | % | 2.2 | % pts | | $ | 202.33 | | 2.0 | % |

| United States | $ | 132.68 | | 0.2 | % | | 64.6 | % | 0.4 | % pts | | $ | 205.41 | | (0.4) | % |

| Americas (excluding United States) | $ | 198.77 | | 12.3 | % | | 69.7 | % | 3.7 | % pts | | $ | 285.30 | | 6.4 | % |

| Greater China | $ | 87.90 | | 11.5 | % | | 65.8 | % | 4.9 | % pts | | $ | 133.65 | | 3.3 | % |

| Asia Pacific (excluding Greater China) | $ | 146.58 | | 21.4 | % | | 70.0 | % | 7.3 | % pts | | $ | 209.54 | | 8.9 | % |

| Europe | $ | 115.57 | | 10.2 | % | | 56.8 | % | 2.8 | % pts | | $ | 203.39 | | 4.7 | % |

| Middle East & Africa | $ | 149.52 | | 5.7 | % | | 67.3 | % | (0.4) | % pts | | $ | 222.04 | | 6.3 | % |

| | | | | | | | |

| Owned and leased hotels (b) | $ | 178.04 | | 0.1 | % | | 67.0 | % | (0.9) | % pts | | $ | 265.57 | | 1.4 | % |

| | | | | | | | |

| (in reported $) | Net Package RevPAR | | Occupancy | | Net Package ADR |

| 2024 | vs. 2023 | | 2024 | vs. 2023 | | 2024 | vs. 2023 |

| System-wide all-inclusive resorts (c) | $ | 311.95 | | 11.0 | % | | 81.3 | % | 3.9 | % pts | | $ | 383.79 | | 5.7 | % |

| Americas (excluding United States) | $ | 351.71 | | 10.3 | % | | 81.2 | % | 3.8 | % pts | | $ | 433.28 | | 5.2 | % |

| Europe (d) | $ | 131.69 | | 24.5 | % | | 81.8 | % | 4.5 | % pts | | $ | 161.06 | | 17.7 | % |

| | | | | | | | |

| |

| | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(a) Consists of hotels that the Company manages, franchises, owns, leases, or provides services to, excluding all-inclusive properties.

(b) Excludes unconsolidated hospitality ventures and all-inclusive leased properties.

(c) Consists of all-inclusive properties that the Company manages, franchises, leases, or provides services to.

(d) Certain resorts in Europe operate under a hybrid all-inclusive model, which includes various all-inclusive package options as well as rooms-only options.

Hyatt Hotels Corporation

Hotel Operating Statistics by Brand

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in constant $) | Three Months Ended March 31, |

| RevPAR | | Occupancy | | ADR |

| 2024 | vs. 2023 | | 2024 | vs. 2023 | | 2024 | vs. 2023 |

| Composite Luxury (a) | $ | 199.21 | | 8.5 | % | | 66.4 | % | 3.3% pts | | $ | 300.03 | | 3.0 | % |

| Andaz | $ | 234.37 | | 4.3 | % | | 68.5 | % | 3.5% pts | | $ | 341.90 | | (1.1) | % |

| Grand Hyatt | $ | 179.23 | | 8.1 | % | | 69.5 | % | 2.9% pts | | $ | 257.74 | | 3.5 | % |

| Park Hyatt | $ | 291.69 | | 15.3 | % | | 66.2 | % | 3.8% pts | | $ | 440.95 | | 8.7 | % |

| The Unbound Collection by Hyatt | $ | 142.27 | | 2.8 | % | | 54.6 | % | 1.1% pts | | $ | 260.42 | | 0.7 | % |

| | | | | | | | |

| Composite Upper-Upscale (b) | $ | 125.02 | | 5.2 | % | | 63.8 | % | 2.4% pts | | $ | 196.10 | | 1.3 | % |

| Hyatt Centric | $ | 147.93 | | 11.8 | % | | 71.0 | % | 7.1% pts | | $ | 208.32 | | 0.6 | % |

| Hyatt Regency | $ | 125.82 | | 4.2 | % | | 63.4 | % | 1.7% pts | | $ | 198.42 | | 1.4 | % |

| JdV by Hyatt | $ | 82.04 | | 5.1 | % | | 54.4 | % | 2.0% pts | | $ | 150.88 | | 1.2 | % |

| | | | | | | | |

| Composite Upscale & Upper Midscale (c) | $ | 93.79 | | 1.7 | % | | 66.3 | % | 0.9% pts | | $ | 141.45 | | 0.2 | % |

| Hyatt House | $ | 109.23 | | 1.9 | % | | 68.8 | % | 1.2% pts | | $ | 158.67 | | 0.1 | % |

| Hyatt Place | $ | 92.34 | | 1.4 | % | | 65.5 | % | 0.6% pts | | $ | 140.96 | | 0.4 | % |

| UrCove | $ | 40.30 | | 6.1 | % | | 67.3 | % | 4.4% pts | | $ | 59.87 | | (0.8) | % |

| | | | | | | | |

| (in reported $) | Net Package RevPAR | | Occupancy | | Net Package ADR |

| 2024 | vs. 2023 | | 2024 | vs. 2023 | | 2024 | vs. 2023 |

| Composite All-inclusive (d)(e) | $ | 311.95 | | 11.0% | | 81.3 | % | 3.9% pts | | $ | 383.79 | | 5.7% |

| Dreams Resorts & Spas | $ | 283.24 | | 14.5% | | 81.5 | % | 5.0% pts | | $ | 347.46 | | 7.4% |

| Secrets Resorts & Spas | $ | 373.05 | | 7.9% | | 79.7 | % | 3.9% pts | | $ | 468.07 | | 2.6% |

| Alua Hotels & Resorts | $ | 88.12 | | 19.3% | | 83.5 | % | 1.0% pts | | $ | 105.56 | | 17.8% |

| | | | | | | | |

| |

| | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(a) Includes Alila, Andaz, Destination by Hyatt, Grand Hyatt, Miraval, Park Hyatt, The Unbound Collection by Hyatt, and Thompson Hotels.

(b) Includes Hyatt, Hyatt Centric, Hyatt Regency, and JdV by Hyatt.

(c) Includes Caption by Hyatt, Hyatt House, Hyatt Place, and UrCove.

(d) Includes Alua Hotels & Resorts, Breathless Resorts & Spas, Dreams Resorts & Spas, Hyatt Zilara, Hyatt Ziva, Impressions by Secrets, Secrets Resorts & Spas, Sunscape Resorts & Spas, and Zoëtry Wellness & Spa Resorts.

(e) Certain resorts in Europe operate under a hybrid all-inclusive model, which includes various all-inclusive package options as well as rooms-only options.

Hyatt Hotels Corporation

Properties and Rooms by Geography and Brand

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 |

| Managed (a) | | Franchised | | Owned and Leased (b) | | Total |

| Geography: | Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms |

| United States | 171 | | 61,494 | | 510 | | 86,079 | | 18 | | 9,278 | | 699 | | 156,851 |

| Americas (excluding United States) | 33 | | 9,543 | | 36 | | 5,660 | | 4 | | 1,196 | | 73 | | 16,399 |

| Greater China | 101 | | 30,937 | | 57 | | 10,286 | | — | | | — | | | 158 | | 41,223 |

| Asia Pacific (excluding Greater China) | 117 | | 30,040 | | 11 | | 2,954 | | — | | | — | | | 128 | | 32,994 |

| Europe | 46 | | 11,005 | | 65 | | 10,962 | | 5 | | 1,197 | | 116 | | 23,164 |

| Middle East & Africa | 42 | | 10,112 | | 1 | | 250 | | — | | | — | | | 43 | | 10,362 |

| System-wide hotels (c) | 510 | | 153,131 | | 680 | | 116,191 | | 27 | | 11,671 | | 1,217 | | 280,993 |

| | | | | | | | | | | | | | | |

| Americas (excluding United States) | 71 | | 26,777 | | 8 | | 3,153 | | — | | | — | | | 79 | | 29,930 |

| Europe (d) | 39 | | 11,207 | | — | | | — | | | 6 | | 1,275 | | 45 | | 12,482 |

| System-wide all-inclusive resorts | 110 | | 37,984 | | 8 | | 3,153 | | 6 | | 1,275 | | 124 | | 42,412 |

| | | | | | | | | | | | | | | |

| System-wide (e) | 620 | | 191,115 | | 688 | | 119,344 | | 33 | | 12,946 | | 1,341 | | 323,405 |

| | | | | | | | | | | | | | | |

| Brand: | | | | | | | | | | | | | | | |

| Alila | 16 | | 1,758 | | — | | | — | | | — | | | — | | | 16 | | 1,758 |

| Andaz | 26 | | 5,910 | | 1 | | 715 | | 2 | | 507 | | 29 | | 7,132 |

| Destination by Hyatt | 11 | | 2,210 | | 6 | | 3,596 | | — | | | — | | | 17 | | 5,806 |

| Grand Hyatt | 57 | | 30,305 | | 3 | | 1,331 | | 2 | | 903 | | 62 | | 32,539 |

| Miraval | — | | | — | | | — | | | — | | | 3 | | 383 | | 3 | | 383 |

| Park Hyatt | 41 | | 7,688 | | — | | | — | | | 4 | | 686 | | 45 | | 8,374 |

| The Unbound Collection by Hyatt | 17 | | 3,329 | | 27 | | 4,970 | | — | | | — | | | 44 | | 8,299 |

| Thompson Hotels | 16 | | 3,280 | | 3 | | 662 | | — | | | — | | | 19 | | 3,942 |

| Dream Hotels | 4 | | 808 | | 1 | | 178 | | — | | | — | | | 5 | | 986 |

| Hyatt | 6 | | 1,087 | | 6 | | 969 | | 1 | | 1,298 | | 13 | | 3,354 |

| Hyatt Centric | 28 | | 5,879 | | 30 | | 5,895 | | 1 | | 138 | | 59 | | 11,912 |

| Hyatt Regency | 170 | | 70,936 | | 61 | | 20,260 | | 10 | | 6,962 | | 241 | | 98,158 |

| JdV by Hyatt | 14 | | 2,132 | | 45 | | 7,151 | | — | | | — | | | 59 | | 9,283 |

| Caption by Hyatt | 1 | | 136 | | — | | | — | | | — | | | — | | | 1 | | 136 |

| Hyatt House | 23 | | 3,268 | | 113 | | 16,011 | | — | | | — | | | 136 | | 19,279 |

| Hyatt Place | 79 | | 13,605 | | 344 | | 48,423 | | 4 | | 794 | | 427 | | 62,822 |

| UrCove | — | | | — | | | 40 | | 6,030 | | — | | | — | | | 40 | | 6,030 |

| Breathless Resorts & Spas | 6 | | 2,311 | | — | | | — | | | — | | | — | | | 6 | | 2,311 |

| Dreams Resorts & Spas | 29 | | 12,308 | | — | | | — | | | — | | | — | | | 29 | | 12,308 |

| | | | | | | | | | | | | | | |

| Hyatt Zilara | 1 | | 291 | | 3 | | 919 | | — | | | — | | | 4 | | 1,210 |

| Hyatt Ziva | 1 | | 438 | | 5 | | 2,234 | | — | | | — | | | 6 | | 2,672 |

| Impression by Secrets | 2 | | 323 | | — | | | — | | | — | | | — | | | 2 | | 323 |

| Secrets Resorts & Spas | 26 | | 9,697 | | — | | | — | | | — | | | — | | | 26 | | 9,697 |

| Zoëtry Wellness & Spa Resorts | 7 | | 541 | | — | | | — | | | — | | | — | | | 7 | | 541 |

| Sunscape Resorts & Spas | 9 | | 4,242 | | — | | | — | | | — | | | — | | | 9 | | 4,242 |

| Alua Hotels & Resorts | 29 | | 7,833 | | — | | | — | | | 6 | | 1,275 | | 35 | | 9,108 |

| Other | 1 | | 800 | | — | | | — | | | — | | | — | | | 1 | | 800 |

| System-wide (e)(f) | 620 | | 191,115 | | 688 | | 119,344 | | 33 | | 12,946 | | 1,341 | | 323,405 |

| | | | | | | | | | | | | | | |

| Hyatt Vacation Club | | | | | | | | | | | | | 22 | | 1,997 |

| Residential | | | | | | | | | | | | | 39 | | 4,323 |

(a) Includes properties that the Company manages or provides services to.

(b) Figures do not include unconsolidated hospitality ventures.

(c) Figures do not include all-inclusive properties.

(d) Certain resorts in Europe operate under a hybrid all-inclusive model, which includes various all-inclusive package options as well as rooms-only options.

(e) Figures do not include vacation and residential units.

(f) Includes six properties that Hyatt currently intends to rebrand to the respective brand at a future date and four non-branded managed properties.

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Financial Measure: Reconciliation of Net Income Attributable to Hyatt Hotels Corporation to Adjusted EBITDA

| | | | | | | | | | | | | | | |

(in millions) | Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Net income attributable to Hyatt Hotels Corporation | $ | 522 | | | $ | 58 | | | | | |

| Interest expense | 38 | | | 33 | | | | | |

| Provision for income taxes | 19 | | | 47 | | | | | |

| Depreciation and amortization | 92 | | | 98 | | | | | |

| Contra revenue | 13 | | | 10 | | | | | |

| Revenues for reimbursed costs | (802) | | | (729) | | | | | |

| Reimbursed costs | 836 | | | 749 | | | | | |

| Equity (earnings) losses from unconsolidated hospitality ventures | (75) | | | 2 | | | | | |

| Stock-based compensation expense | 31 | | | 32 | | | | | |

| Gains on sales of real estate and other | (403) | | | — | | | | | |

| Asset impairments | 17 | | | 2 | | | | | |

| Other (income) loss, net | (53) | | | (48) | | | | | |

| Pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA | 17 | | | 14 | | | | | |

| Adjusted EBITDA | $ | 252 | | | $ | 268 | | | | | |

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Financial Measure: G&A Expenses to Adjusted G&A Expenses

Results of operations as presented on the condensed consolidated statements of income include expenses recognized with respect to deferred compensation plans funded through rabbi trusts. Certain of these expenses are recognized in G&A expenses and are completely offset by the corresponding net gains (losses) and interest income from marketable securities held to fund rabbi trusts, thus having no net impact to our earnings (losses). G&A expenses also include expenses related to stock-based compensation. Below is a reconciliation of this measure excluding the impact of our rabbi trust investments and stock-based compensation expense.

| | | | | | | | | | | | | | | |

(in millions) | Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| G&A expenses | $ | 172 | | | $ | 157 | | | | | |

| Less: Rabbi trust impact | (22) | | | (16) | | | | | |

| Less: Stock-based compensation expense | (29) | | | (31) | | | | | |

| Adjusted G&A Expenses | $ | 121 | | | $ | 110 | | | | | |

The table below provides a segment breakdown for Adjusted G&A Expenses:

| | | | | | | | | | | | | | | |

(in millions) | Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Management and franchising | $ | 63 | | | $ | 53 | | | | | |

| Owned and leased | 5 | | | 4 | | | | | |

| Distribution | 6 | | | 11 | | | | | |

| Overhead | 47 | | | 42 | | | | | |

| Adjusted G&A Expenses | $ | 121 | | | $ | 110 | | | | | |

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Financial Measure: Net Income Attributable to Hyatt Hotels Corporation and Diluted Earnings per Class A and Class B Share to Adjusted Net Income Attributable to Hyatt Hotels Corporation and Adjusted Diluted Earnings per Class A and Class B Share - Three Months Ended March 31, 2024 and March 31, 2023

| | | | | | | | | | | | | | | |

| (in millions, except per share amounts) | Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Net income attributable to Hyatt Hotels Corporation | $ | 522 | | | $ | 58 | | | | | |

| Diluted earnings per share | $ | 4.93 | | | $ | 0.53 | | | | | |

| Special items: | | | | | | | |

| Gains on sales of real estate and other (a) | (403) | | | — | | | | | |

| Unconsolidated hospitality ventures (b) | (79) | | | — | | | | | |

| Unrealized gains (c) | (13) | | | (43) | | | | | |

| Contingent consideration liability fair value adjustment (d) | (4) | | | — | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Transaction costs (e) | 1 | | | 7 | | | | | |

| Utilization of Avendra and other proceeds (f) | 6 | | | 4 | | | | | |

| Asset impairments (g) | 17 | | | 2 | | | | | |

| Fund deficits (h) | 20 | | | 11 | | | | | |

| Other | — | | | 1 | | | | | |

| Special items - pre-tax | (455) | | | (18) | | | | | |

| Income tax benefit for special items | 8 | | | 5 | | | | | |

| Total special items - after-tax | $ | (447) | | | $ | (13) | | | | | |

| Special items impact per diluted share | $ | (4.22) | | | $ | (0.12) | | | | | |

| Adjusted net income attributable to Hyatt Hotels Corporation | $ | 75 | | | $ | 45 | | | | | |

| Adjusted diluted earnings per share | $ | 0.71 | | | $ | 0.41 | | | | | |

| | | | | | | |

(a) During the three months ended March 31, 2024 (Q1 2024), we recognized pre-tax gains related to the UVC Transaction ($231 million) and the sale of Hyatt Regency Aruba Resort Spa and Casino ($172 million) in gains on sales of real estate and other on our condensed consolidated statements of income.

(b) During Q1 2024, we recognized a $79 million non-cash pre-tax gain related to the dilution of our ownership interest in an unconsolidated hospitality venture in India in equity earnings (losses) from unconsolidated hospitality ventures on our condensed consolidated statements of income.

(c) During Q1 2024 and the three months ended March 31, 2023 (Q1 2023), we recognized unrealized gains due to the change in fair value of our marketable securities in other income (loss), net on our condensed consolidated statements of income.

(d) During Q1 2024, we recognized a $4 million fair value adjustment related to the Dream Hotel Group contingent consideration liability in other income (loss), net on our condensed consolidated statements of income.

(e) During Q1 2023, we recognized $7 million of transaction costs related to the acquisition of Dream Hotel Group in other income (loss), net on our condensed consolidated statements of income.

(f) During Q1 2024 and Q1 2023, we recognized expenses related to the partial utilization of the Avendra LLC sale proceeds for the benefit of our hotels in reimbursed costs and depreciation and amortization expenses on our condensed consolidated statements of income. The gain recognized in conjunction with the sale of Avendra LLC was included as a special item during the year ended December 31, 2017.

(g) During Q1 2024, we recognized a $15 million goodwill impairment charge in connection with the sale of Hyatt Regency Aruba Resort Spa and Casino in asset impairments on our condensed consolidated statements of income.

(h) During Q1 2024 and Q1 2023, we recognized net deficits, which we intend to recover in future periods, on certain funds due to the timing of revenue and expense recognition in revenues for reimbursed costs and other income (loss), net on our condensed consolidated statements of income.

Hyatt Hotels Corporation

Impact of Sold Hotels to Owned and Leased Segment Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(in millions) | Fiscal Year 2024 |

| First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter | | Year to Date |

| Owned and leased hotels | $ | 43 | | | | | | | | | $ | 43 | |

| Less: Contribution from sold owned and leased hotels (a) | (12) | | | | | | | | | (12) | |

| Owned and leased hotels less contribution from sold hotels (b) | $ | 31 | | | | | | | | | $ | 31 | |

| | | | | | | | | |

| Pro rata share of unconsolidated hospitality ventures | $ | 17 | | | | | | | | | $ | 17 | |

| Less: Contribution from sold unconsolidated hospitality ventures (c) (d) (e) | (1) | | | | | | | | | (1) | |

| Pro rata share of unconsolidated hospitality ventures less contribution from sold unconsolidated hospitality ventures (f) | $ | 16 | | | | | | | | | $ | 16 | |

| | | | | | | | | |

| Fiscal Year 2023 |

| First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter | | Full Year 2023 |

| Owned and leased hotels | $ | 57 | | | $ | 66 | | | $ | 57 | | | $ | 69 | | | $ | 249 | |

| Less: Contribution from sold owned and leased hotels (a) | (19) | | | (15) | | | (15) | | | (16) | | | (65) | |

| Owned and leased hotels less contribution from sold hotels (b) | $ | 38 | | | $ | 51 | | | $ | 42 | | | $ | 53 | | | $ | 184 | |

| | | | | | | | | |

| Pro rata share of unconsolidated hospitality ventures | $ | 14 | | | $ | 17 | | | $ | 14 | | | $ | 19 | | | $ | 64 | |

| Less: Contribution from sold unconsolidated hospitality ventures (c) (d) (e) | (1) | | | (1) | | | — | | | (1) | | | (3) | |

| Pro rata share of unconsolidated hospitality ventures less contribution from sold unconsolidated hospitality ventures (f) | $ | 13 | | | $ | 16 | | | $ | 14 | | | $ | 18 | | | $ | 61 | |

(a) Contribution from sold owned and leased hotels represents the Adjusted EBITDA contribution in each period for hotels that have been sold as of May 8, 2024 and entered into long-term management or franchise agreements, and excludes fee income retained upon sale. Hotels that have been sold include Hyatt Regency Aruba Resort Spa and Casino (1Q24), Park Hyatt Zurich (2Q24), Hyatt Regency San Antonio Riverwalk (2Q24), Hyatt Regency Green Bay (2Q24).

(b) Owned and leased hotels less contribution from sold hotels represents the Adjusted EBITDA contribution from all owned and leased hotels that remain in Hyatt's portfolio as of May 8, 2024.

(c) Contribution from sold unconsolidated hospitality ventures represents Hyatt's pro rata share of unconsolidated hospitality ventures' Adjusted EBITDA contribution in each period for unconsolidated hospitality ventures that have been sold as of May 8, 2024. Unconsolidated hospitality ventures that have been sold include Hyatt Place Panama City / Downtown (1Q23).

(d) Contribution from sold unconsolidated hospitality ventures includes the pro rata share of unconsolidated hospitality ventures' Adjusted EBITDA contribution from one property for which the operating lease was terminated during the three months ended March 31, 2023.

(e) Contribution from sold unconsolidated hospitality ventures includes the net impact to pro rata share of unconsolidated hospitality ventures' Adjusted EBITDA contribution from one of our unconsolidated hospitality ventures in India, for which our ownership percentage was diluted from 50.0% to 38.8% as a result of its initial public offering.

(f) Pro rata share of unconsolidated hospitality ventures less contribution from sold unconsolidated hospitality ventures represents Hyatt's pro rata share of unconsolidated hospitality ventures' Adjusted EBITDA contribution from all unconsolidated hospitality ventures that remain in Hyatt's portfolio as of May 8, 2024.

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Financial Measures: Outlook: Net Income to Adjusted EBITDA; G&A Expenses to Adjusted G&A Expenses; and Net cash provided by operating activities to Free Cash Flow

No additional disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2024 Outlook. The Company's 2024 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that the Company will achieve these results. Results of operations as presented on the condensed consolidated statements of income include expenses recognized with respect to deferred compensation plans funded through rabbi trusts. Certain of these expenses are recognized in G&A expenses and are completely offset by the corresponding net gains (losses) and interest income from marketable securities held to fund rabbi trusts, thus having no net impact to our earnings (losses). G&A expenses also include expenses related to stock-based compensation. Below is a reconciliation of this forecasted measure excluding the impact of our rabbi trust investments and forecasted stock-based compensation expense.

| | | | | | | | | | | |

(in millions) | Year Ended

December 31, 2024

Outlook Range |

| Low Case | | High Case |

| Net income attributable to Hyatt Hotels Corporation | $ | 1,135 | | | $ | 1,195 | |

| Interest expense | 151 | | | 151 | |

| Provision for income taxes | 149 | | | 179 | |

| Depreciation and amortization | 340 | | | 340 | |

| Contra revenue | 54 | | | 54 | |

| Reimbursed costs, net of revenues for reimbursed costs | 106 | | | 86 | |

| Equity (earnings) losses from unconsolidated hospitality ventures | (50) | | | (70) | |

| Stock-based compensation expense | 72 | | | 72 | |

| (Gains) losses on sales of real estate | (760) | | | (765) | |

| Asset impairments | 17 | | | 17 | |

| Other (income) loss, net | (133) | | | (143) | |

| Pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA | 69 | | | 74 | |

| Adjusted EBITDA | $ | 1,150 | | | $ | 1,190 | |

| | | |

| Year Ended

December 31, 2024

Outlook Range |

| Low Case | | High Case |

| G&A expenses | $ | 494 | | | $ | 504 | |

| Less: Rabbi trust impact | — | | | — | |

| Less: Stock-based compensation expense | (69) | | | (69) | |

| Adjusted G&A Expenses | $ | 425 | | | $ | 435 | |

| | | |

| Year Ended

December 31, 2024

Outlook Range |

| Low Case | | High Case |

| Net cash provided by operating activities | $ | 745 | | | $ | 795 | |

| Capital expenditures | (170) | | | (170) | |

| Free Cash Flow | $ | 575 | | | $ | 625 | |

Definitions

Adjusted Earnings Before Interest Expense, Taxes, Depreciation, and Amortization ("Adjusted EBITDA")

We use the term Adjusted EBITDA throughout this earnings release. Adjusted EBITDA, as we define it, is a measure that is not recognized in accordance with accounting principles generally accepted in the United States of America ("GAAP"). We define consolidated Adjusted EBITDA as net income (loss) attributable to Hyatt Hotels Corporation plus our pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA based on our ownership percentage of each owned and leased venture, adjusted to exclude the following items:

•interest expense;

•benefit (provision) for income taxes;

•depreciation and amortization;

•amortization of management and hotel services agreement and franchise agreement assets and performance cure payments, which constitute payments to customers ("Contra revenue");

•revenues for reimbursed costs;

•reimbursed costs that we intend to recover over the long term;

•equity earnings (losses) from unconsolidated hospitality ventures;

•stock-based compensation expense;

•gains (losses) on sales of real estate and other;

•asset impairments; and

•other income (loss), net.

We calculate consolidated Adjusted EBITDA by adding the Adjusted EBITDA of each of our reportable segments and eliminations to overhead Adjusted EBITDA.

Our board of directors and executive management team focus on Adjusted EBITDA as one of the key performance and compensation measures both on a segment and on a consolidated basis. Adjusted EBITDA assists us in comparing our performance over various reporting periods on a consistent basis because it removes from our operating results the impact of items that do not reflect our core operations both on a segment and on a consolidated basis. Our President and Chief Executive Officer, who is our chief operating decision maker, also evaluates the performance of each of our reportable segments and determines how to allocate resources to those segments, in part, by assessing the Adjusted EBITDA of each segment. In addition, the compensation committee of our board of directors determines the annual variable compensation for certain members of our management based in part on consolidated Adjusted EBITDA, segment Adjusted EBITDA, or some combination of both.

We believe Adjusted EBITDA is useful to investors because it provides investors with the same information that we use internally for purposes of assessing our operating performance and making compensation decisions and facilitates our comparison of results with results from other companies within our industry.

Adjusted EBITDA excludes certain items that can vary widely across different industries and among companies within the same industry, including interest expense and benefit (provision) for income taxes, which are dependent on company specifics, including capital structure, credit ratings, tax policies, and jurisdictions in which they operate; depreciation and amortization, which are dependent on company policies including how the assets are utilized as well as the lives assigned to the assets; Contra revenue, which is dependent on company policies and strategic decisions regarding payments to hotel owners; and stock-based compensation expense, which varies among companies as a result of different compensation plans companies have adopted. We exclude revenues for reimbursed costs and reimbursed costs which relate to the reimbursement of payroll costs and for system-wide services and programs that we operate for the benefit of our hotel owners as contractually we do not provide services or operate the related programs to generate a profit over the terms of the respective contracts. Over the long term, these programs and services are not designed to impact our economics, either positively or negatively. Therefore, we exclude the net impact when evaluating period-over-period changes in our operating results. Adjusted EBITDA includes reimbursed costs related to system-wide services and

programs that we do not intend to recover from hotel owners. Finally, we exclude other items that are not core to our operations, such as asset impairments and unrealized and realized gains and losses on marketable securities.

Adjusted EBITDA is not a substitute for net income (loss) attributable to Hyatt Hotels Corporation, net income (loss), or any other measure prescribed by GAAP. There are limitations to using non-GAAP measures such as Adjusted EBITDA. Although we believe that Adjusted EBITDA can make an evaluation of our operating performance more consistent because it removes items that do not reflect our core operations, other companies in our industry may define Adjusted EBITDA differently than we do. As a result, it may be difficult to use Adjusted EBITDA or similarly named non-GAAP measures that other companies may use to compare the performance of those companies to our performance. Because of these limitations, Adjusted EBITDA should not be considered as a measure of the income (loss) generated by our business. Our management compensates for these limitations by referencing our GAAP results and using Adjusted EBITDA supplementally.

Adjusted General and Administrative ("G&A") Expenses

Adjusted G&A Expenses, as we define it, is a non-GAAP measure. Adjusted G&A Expenses exclude the impact of deferred compensation plans funded through rabbi trusts and stock-based compensation expense. Adjusted G&A Expenses assist us in comparing our performance over various reporting periods on a consistent basis because it removes from our operating results the impact of items that do not reflect our core operations, both on a segment and consolidated basis.

Adjusted Net Income (Loss) and Adjusted Diluted Earnings (Losses) per Class A and Class B Share ("EPS")

Adjusted Net Income (Loss) and Adjusted Diluted EPS, as we define them, are non-GAAP measures. We define Adjusted Net Income (Loss) as net income (loss) attributable to Hyatt Hotels Corporation excluding special items, which are those items deemed not to be reflective of ongoing operations. We define Adjusted Diluted EPS as Adjusted Net Income (Loss) per diluted share. We consider Adjusted Net Income (Loss) and Adjusted Diluted EPS to be an indicator of operating performance because excluding special items allows for period-over-period comparisons of our ongoing operations.

Adjusted Net Income (Loss) and Adjusted Diluted EPS are not a substitute for Net Income (Loss) attributable to Hyatt Hotels Corporation, net income (loss), diluted earnings (losses) per share, or any other measure prescribed by GAAP. There are limitations to using non-GAAP measures such as Adjusted net income (loss) and Adjusted Diluted EPS. Although we believe that Adjusted Net Income (Loss) and Adjusted Diluted EPS can make an evaluation of our operating performance more consistent because they remove special items that are deemed not to be reflective of ongoing operations, other companies in our industry may define Adjusted Net Income (Loss) and Adjusted Diluted EPS differently than we do. As a result, it may be difficult to use Adjusted Net Income (Loss) or Adjusted Diluted EPS or similarly named non-GAAP measures that other companies may use to compare the performance of those companies to our performance. Because of these limitations, Adjusted Net Income (Loss) and Adjusted Diluted EPS should not be considered as measures of the income (loss) and earnings (losses) per share generated by our business. Our management compensates for these limitations by reference to its GAAP results and using Adjusted Net Income (Loss) and Adjusted Diluted EPS supplementally.

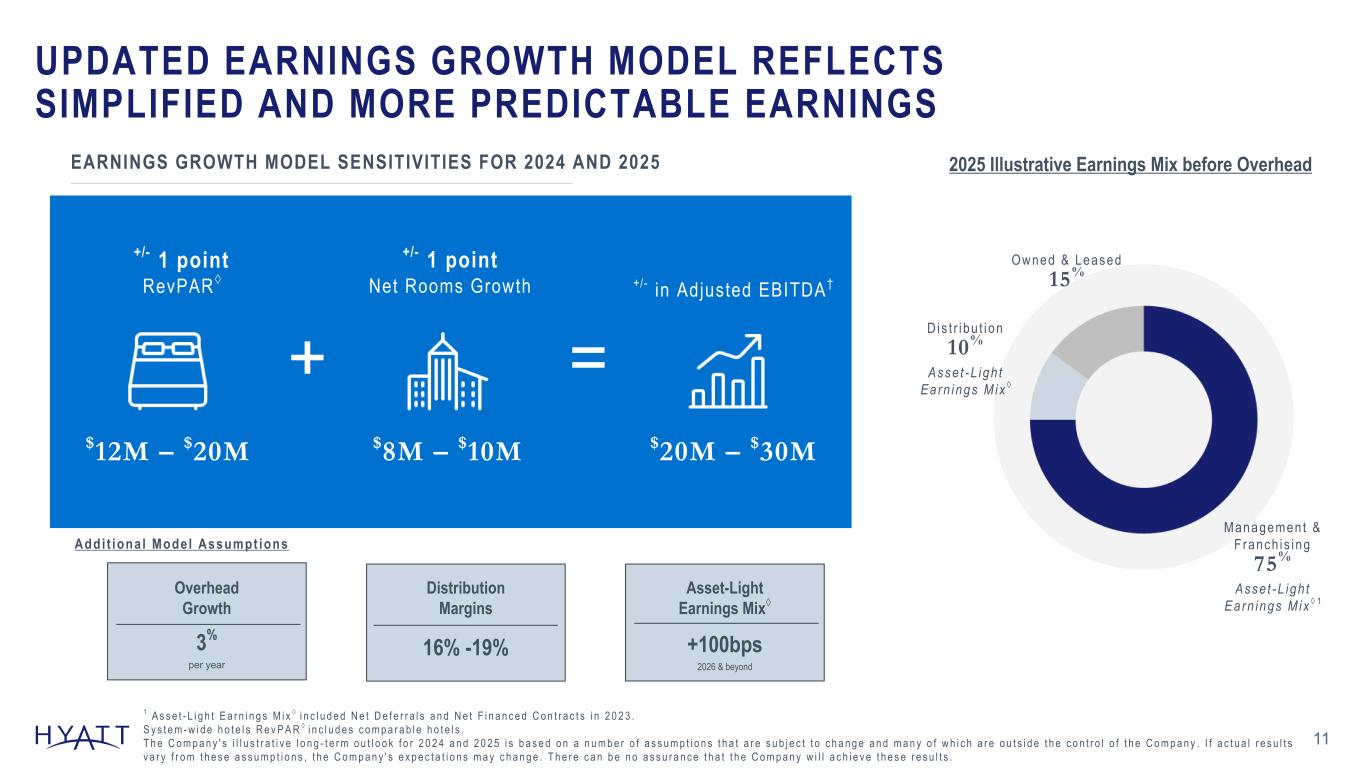

Asset-Light Earnings Mix

Asset-Light Earnings Mix is calculated as Adjusted EBITDA from the management and franchising segment and distribution segment divided by Adjusted EBITDA, excluding overhead and eliminations. Our management uses this calculation to assess the composition of the Company's earnings.

Average Daily Rate ("ADR")

ADR represents hotel room revenues, divided by the total number of rooms sold in a given period. ADR measures the average room price attained by a hotel and ADR trends provide useful information concerning the pricing environment and the nature of the customer base of a hotel or group of hotels. ADR is a commonly used performance measure in our industry, and we use ADR to assess the pricing levels that we are able to generate by customer group, as changes in rates have a different effect on overall revenues and incremental profitability than changes in occupancy, as described below.

Comparable system-wide and Comparable owned and leased

"Comparable system-wide" represents all properties we manage, franchise, or provide services to, including owned and leased properties, that are operated for the entirety of the periods being compared and that have not sustained substantial damage, business interruption, or undergone large scale renovations during the periods being compared. Comparable system-wide also excludes properties for which comparable results are not available. We may use variations of comparable system-wide to specifically refer to comparable system-wide hotels, including our wellness resorts, or our all-inclusive resorts, for those properties that we manage, franchise, or provide services to within the management and franchising segment. "Comparable owned and leased" represents all properties we own or lease that are operated and consolidated for the entirety of the periods being compared and have not sustained substantial damage, business interruption, or undergone large-scale renovations during the periods being compared. Comparable owned and leased also excludes properties for which comparable results are not available. We may use variations of comparable owned and leased to specifically refer to comparable owned and leased hotels, including our wellness resorts, or our all-inclusive resorts, for those properties that we own or lease within the owned and leased segment. Comparable system-wide and comparable owned and leased are commonly used as a basis of measurement in our industry. "Non-comparable system-wide" or "non-comparable owned and leased" represent all properties that do not meet the respective definition of "comparable" as defined above.

Constant Dollar Currency

We report the results of our operations both on an as-reported basis, as well as on a constant dollar basis. Constant Dollar Currency, which is a non-GAAP measure, excludes the effects of movements in foreign currency exchange rates between comparative periods. We believe constant dollar analysis provides valuable information regarding our results as it removes currency fluctuations from our operating results. We calculate Constant Dollar Currency by restating prior-period local currency financial results at the current period's exchange rates. These restated amounts are then compared to our current period reported amounts to provide operationally driven variances in our results.

Free Cash Flow

Free Cash Flow represents net cash provided by operating activities less capital expenditures. We believe Free Cash Flow to be a useful liquidity measure to us and investors to evaluate the ability of our operations to generate cash for uses other than capital expenditures and, after debt service and other obligations, our ability to grow our business through acquisitions and investments, as well as our ability to return cash to shareholders through dividends and share repurchases. Free Cash Flow is not necessarily a representation of how we will use excess cash. Free Cash Flow is not a substitute for net cash provided by operating activities or any other measure prescribed by GAAP. There are limitations to using non-GAAP measures such as Free Cash Flow and management compensates for these limitations by referencing our GAAP results and using Free Cash Flow supplementally.

Net Package ADR

Net Package ADR represents net package revenues divided by the total number of rooms sold in a given period. Net package revenues generally include revenue derived from the sale of package revenue at all-inclusive resorts comprised of rooms revenue, food and beverage, and entertainment, net of compulsory tips paid to employees. Net Package ADR measures the average room price attained by a hotel, and Net Package ADR trends provide useful information concerning the pricing environment and the nature of the customer base of a hotel or group of hotels. Net Package ADR is a commonly used performance measure in our industry, and we use Net Package ADR to assess the pricing levels that we are able to generate by customer group, as changes in rates have a different effect on overall revenues and incremental profitability than changes in occupancy, as described above.

Net Package Revenue per Available Room ("RevPAR")

Net Package RevPAR is the product of the Net Package ADR and the average daily occupancy percentage. Net Package RevPAR generally includes revenue derived from the sale of package revenue comprised of rooms revenue, food and beverage, and entertainment, net of compulsory tips paid to employees. Our management uses Net Package RevPAR to identify trend information with respect to room revenues from comparable properties and to evaluate hotel performance on a regional and segment basis. Net Package RevPAR is a commonly used performance measure in our industry.

Occupancy

Occupancy represents the total number of rooms sold divided by the total number of rooms available at a hotel or group of hotels. Occupancy measures the utilization of a hotel's available capacity. We use occupancy to gauge demand at a specific hotel or group of hotels in a given period. Occupancy levels also help us determine achievable ADR levels as demand for hotel rooms increases or decreases.

RevPAR

RevPAR is the product of the ADR and the average daily occupancy percentage. RevPAR does not include non-room revenues, which consist of ancillary revenues generated by a hotel property, such as food and beverage, parking, and other guest service revenues. Our management uses RevPAR to identify trend information with respect to room revenues from comparable properties and to evaluate hotel performance on a regional and segment basis. RevPAR is a commonly used performance measure in our industry.

RevPAR changes that are driven predominantly by changes in occupancy have different implications for overall revenue levels and incremental profitability than do changes that are driven predominantly by changes in average room rates. For example, increases in occupancy at a hotel would lead to increases in room revenues and additional variable operating costs, including housekeeping services, utilities, and room amenity costs, and could also result in increased ancillary revenues, including food and beverage. In contrast, changes in average room rates typically have a greater impact on margins and profitability as average room rate changes result in minimal impacts to variable operating costs.

S E C R E T S P L A Y A B L A N C A C O S T A M U J E R E S N E W L Y O P E N E D Q 1 2 0 2 4 Investor Deck Hyatt FIRST QUARTER 2024 H Y A T T A N D R E L A T E D M A R K S A R E T R A D E M A R K S O F H Y A T T C O R P O R A T I O N O R I T S A F F I L I A T E S . © 2 0 2 4 H Y A T T C O R P O R A T I O N . A L L R I G H T S R E S E R V E D .

Disclaimers 2 Forward-Looking Statements in this presentation, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements about Hyatt Hotels Corporation’s (the “Company”) plans, strategies, outlook, the amount by which the Company intends to reduce its real estate asset base, the expected amount of gross proceeds from the sale of such assets, and the anticipated timeframe for such asset dispositions, the number of properties we expect to open in the future, our growth model, our credit rating expectations, our capital allocation plans, our expected Adjusted G&A Expense, our expected capital expenditures, our expected net income and Adjusted EBITDA, our expected net rooms growth, our expected system-wide RevPAR, our expected Free Cash Flow, financial performance, prospects or future events and involve known and unknown risks that are difficult to predict. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "continue," "likely," "will," "would" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: general economic uncertainty in key global markets and a worsening of global economic conditions or low levels of economic growth; the rate and pace of economic recovery following economic downturns; global supply chain constraints and interruptions, rising costs of construction-related labor and materials, and increases in costs due to inflation or other factors that may not be fully offset by increases in revenues in our business; risks affecting the luxury, resort, and all-inclusive lodging segments; levels of spending in business, leisure, and group segments, as well as consumer confidence; declines in occupancy and average daily rate; limited visibility with respect to future bookings; loss of key personnel; domestic and international political and geopolitical conditions, including political or civil unrest or changes in trade policy; hostilities, or fear of hostilities, including future terrorist attacks, that affect travel; travel-related accidents; natural or man-made disasters, weather and climate-related events, such as earthquakes, tsunamis, tornadoes, hurricanes, droughts, floods, wildfires, oil spills, nuclear incidents, and global outbreaks of pandemics or contagious diseases, or fear of such outbreaks; our ability to successfully achieve certain levels of operating profits at hotels that have performance tests or guarantees in favor of our third-party owners; the impact of hotel renovations and redevelopments; risks associated with our capital allocation plans, share repurchase program, and dividend payments, including a reduction in, or elimination or suspension of, repurchase activity or dividend payments; the seasonal and cyclical nature of the real estate and hospitality businesses; changes in distribution arrangements, such as through internet travel intermediaries; changes in the tastes and preferences of our customers; relationships with colleagues and labor unions and changes in labor laws; the financial condition of, and our relationships with, third-party owners, franchisees, and hospitality venture partners; the possible inability of third-party owners, franchisees, or development partners to access the capital necessary to fund current operations or implement our plans for growth; risks associated with potential acquisitions and dispositions and our ability to successfully integrate completed acquisitions with existing operations; failure to successfully complete proposed transactions (including the failure to satisfy closing conditions or obtain required approvals); our ability to successfully execute our strategy to expand our management and hotels services and franchising business while at the same time reducing our real estate asset base within targeted timeframes and at expected values; our ability to maintain effective internal control over financial reporting and disclosure controls and procedures; declines in the value of our real estate assets; unforeseen terminations of our management and hotels services or franchise agreements; changes in federal, state, local, or foreign tax law; increases in interest rates, wages, and other operating costs; foreign exchange rate fluctuations or currency restructurings; risks associated with the introduction of new brand concepts, including lack of acceptance of new brands or innovation; general volatility of the capital markets and our ability to access such markets; changes in the competitive environment in our industry, industry consolidation, and the markets where we operate; our ability to successfully grow the World of Hyatt loyalty program and Unlimited Vacation Club paid membership program; cyber incidents and information technology failures; outcomes of legal or administrative proceedings; and violations of regulations or laws related to our franchising business and licensing businesses and our international operations; and other risks discussed in the Company's filings with the SEC, including our annual reports on Form 10-K and quarterly reports on Form 10-Q, which filings are available from the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this presentation. We do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. Forward-Looking Statements Non-GAAP Financial Measures This presentation includes references to certain financial measures, each identified with the symbol “†”, that are not calculated or presented in accordance with generally accepted accounting principles in the United States (“GAAP”). These non -GAAP financial measures have important limitations and should not be considered in isolation or as a substitute for measures of the Company’s financial performance prepared in accordance with GAAP. In addition, these non -GAAP financial measures, as presented, may not be comparable to similarly titled measures of other companies due to varying methods of calculations. Key Business Metrics This presentation includes references to certain key business metrics used by the Company, each identified with the symbol “◊”.

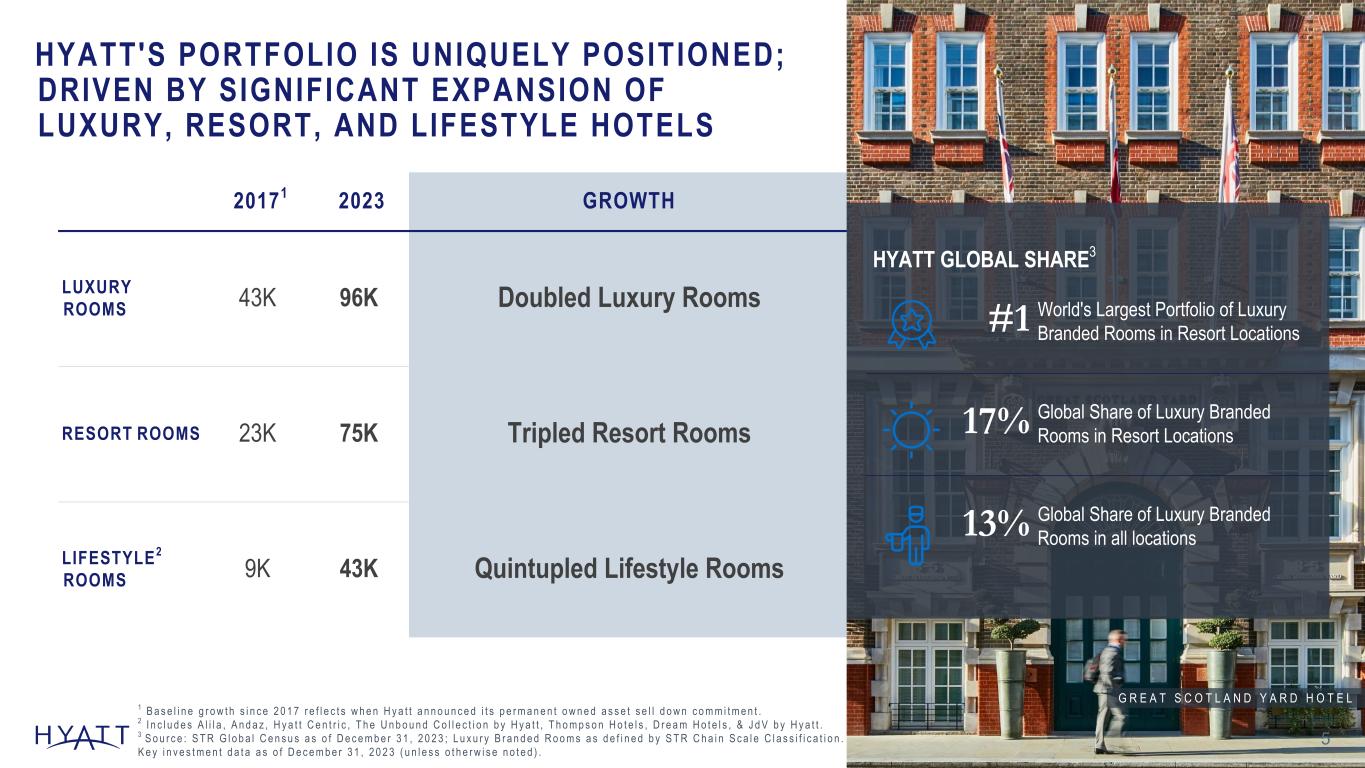

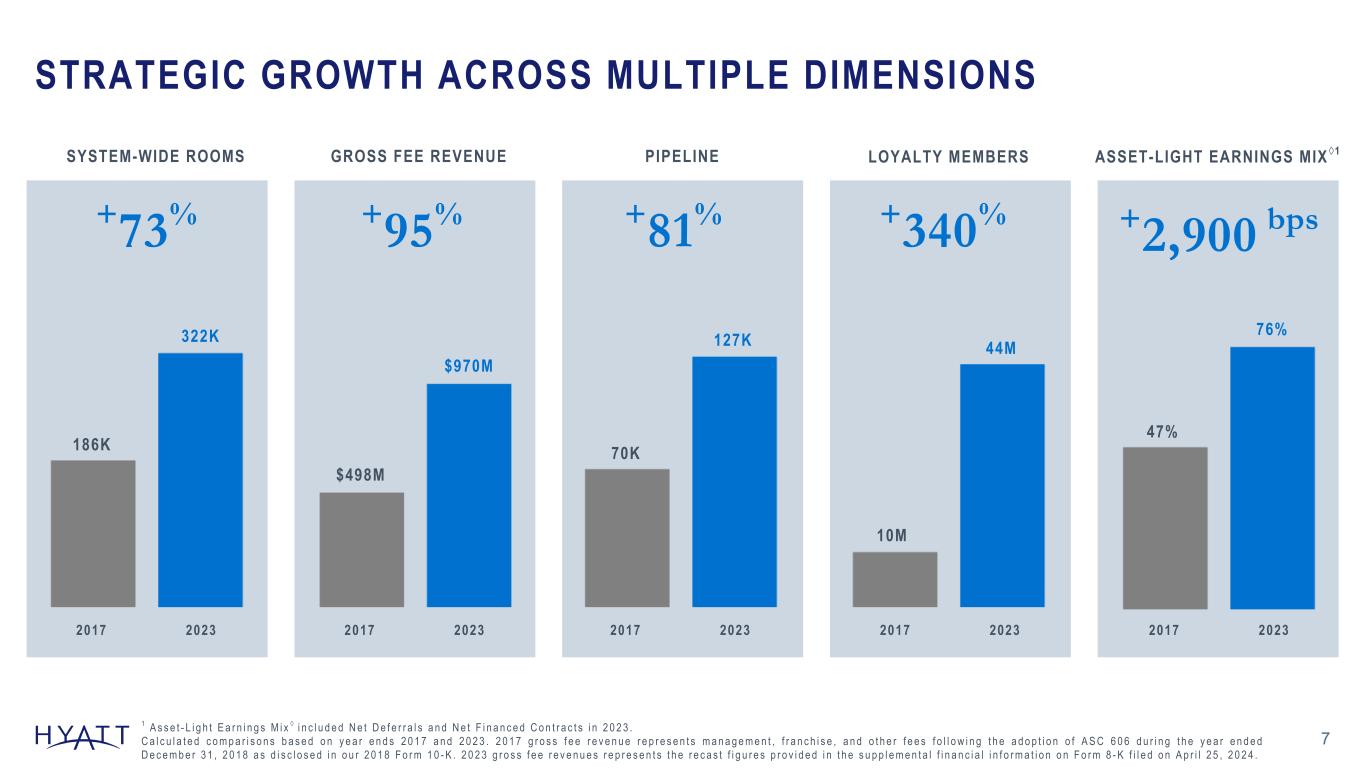

3 A L I L A K O T H A I F A R U M A L D I V E S GLOBAL HOSPITALITY COMPANY FOCUSED ON SERVING THE HIGH-END TRAVELER 78 Countr ies Around the World and 6 Cont inents 323,405 Rooms 29 Global Brands1 1,341 Hotels and Al l - Inclusive Propert ies F i g u r e s a s o f M a r c h 3 1 , 2 0 2 4 . 1 G l o b a l B r a n d s b a s e d o n I n v e n t o r y a s o f M a r c h 3 1 , 2 0 2 4 , w i t h a d d i t i o n o f H y a t t S t u d i o s . 2 S o u r c e : S T R G l o b a l C e n s u s a s o f M a r c h 3 1 , 2 0 2 4 ; L u x u r y B r a n d e d R o o m s a s d e f i n e d b y S T R C h a i n S c a l e C l a s s i f i c a t i o n . #1 World’s Largest Port fo l io of Luxury Branded Rooms in Resort Locat ions 2 ~129,000 Rooms in Pipel ine A Company Record