Current Report Filing (8-k)

September 08 2022 - 9:21AM

Edgar (US Regulatory)

00014825120001496264false 0001482512 2022-09-08 2022-09-08 0001482512 hpp:HudsonPacificPropertiesLpMember 2022-09-08 2022-09-08 0001482512 us-gaap:CommonStockMember 2022-09-08 2022-09-08 0001482512 us-gaap:CumulativePreferredStockMember 2022-09-08 2022-09-08

SECURITIES AND EXCHANGE COMMISSION

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Date of earliest event reported)

Hudson Pacific Properties, Inc.

Hudson Pacific Properties, L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Hudson Pacific Properties, Inc. |

|

|

|

|

|

|

Hudson Pacific Properties, L.P. |

|

|

|

|

|

|

| |

|

(State or other jurisdiction

of incorporation) |

|

|

|

(IRS Employer

Identification No.) |

|

|

|

11601 Wilshire Blvd., Ninth Floor |

|

|

(Address of principal executive offices) |

|

|

Registrant’s telephone number, including area code: (310)

445-5700

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of each exchange

on which registered |

Hudson Pacific Properties, Inc. |

|

Common Stock, $0.01 par value |

|

|

|

|

Hudson Pacific Properties, Inc. |

|

4.750% Series C Cumulative Redeemable Preferred Stock |

|

|

|

|

Emerging growth company

|

|

|

| Hudson Pacific Properties, Inc. |

|

☐ |

| |

|

| Hudson Pacific Properties, L.P. |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

|

| Hudson Pacific Properties, Inc. |

|

☐ |

| |

|

| Hudson Pacific Properties, L.P. |

|

☐ |

This Current Report on Form

8-K

is filed by Hudson Pacific Properties, Inc., a Maryland corporation (the “Company”), and Hudson Pacific Properties, L.P., a Maryland limited partnership (the “Operating Partnership”), of which the Company serves as the sole general partner. Unless otherwise indicated or unless the context requires otherwise, references to “we” and “our” refer to the Company, the Operating Partnership and any other subsidiaries thereof.

Item 8.01. Other Events.

Revolving Credit Facility Borrowings

As of September 7, 2022, we had approximately $605 million outstanding under our revolving credit facility, which includes the approximately $200.0 million of borrowings that were used to finance the initial consideration for the Quixote acquisition.

Northview Center Disposition

On August 31, 2022, we completed the sale of our

Northview

Center property in Lynnwood, Washington to a third party for $46 million, before closing costs.

As of June 30, 2022, our portfolio included office properties, comprising an aggregate of approximately 15.8 million square feet, and studio properties, comprising approximately 1.5 million square feet of sound-stage, office and supporting production facilities. We also own undeveloped density rights for approximately 4.1 million square feet of future office and residential space.

We employ a conservative approach to development and redevelopment. Development and redevelopment projects have only represented approximately 20% of our capital allocation since our initial public offering in 2010 and estimated project costs as a percentage of our Company’s share of market capitalization have averaged approximately 6.7% over the preceding eight quarters. Estimated project costs are based on management estimates and exclude capitalized interest, personnel costs and operating expenses. Gross assets represents the sum of total assets calculated in accordance with United States generally accepted accounting principles, or GAAP, plus accumulated depreciation and amortization.

We also have a diverse concentration of tenants. The table below presents our top fifteen office tenants as of June 30, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Company’s Share (1) |

|

|

|

Total

Occupied

Square Feet |

|

|

Total

Occupied

Square Feet |

|

|

Percent of

Rentable

Square Feet |

|

|

Annualized

Base

Rent (3) |

|

|

Percent of

Annualized

Base Rent |

|

|

|

|

1,224,726 |

|

|

|

1,060,117 |

|

|

|

8.2 |

% |

|

$ |

76,805,005 |

|

|

|

12.7 |

% |

|

|

|

990,788 |

|

|

|

694,171 |

|

|

|

5.4 |

|

|

|

25,501,028 |

|

|

|

4.2 |

|

|

|

|

722,305 |

|

|

|

368,376 |

|

|

|

2.8 |

|

|

|

24,688,276 |

|

|

|

4.1 |

|

|

|

|

425,056 |

|

|

|

425,056 |

|

|

|

3.3 |

|

|

|

18,463,879 |

|

|

|

3.1 |

|

|

|

|

284,037 |

|

|

|

284,037 |

|

|

|

2.2 |

|

|

|

18,399,922 |

|

|

|

3.0 |

|

Qualcomm |

|

|

376,817 |

|

|

|

376,817 |

|

|

|

2.9 |

|

|

|

15,387,699 |

|

|

|

2.5 |

|

|

|

|

265,394 |

|

|

|

265,394 |

|

|

|

2.1 |

|

|

|

14,501,587 |

|

|

|

2.4 |

|

|

|

|

469,056 |

|

|

|

257,981 |

|

|

|

2.0 |

|

|

|

13,338,551 |

|

|

|

2.2 |

|

Uber Technologies, Inc. (10) |

|

|

325,445 |

|

|

|

178,995 |

|

|

|

1.4 |

|

|

|

9,904,829 |

|

|

|

1.6 |

|

|

|

|

172,975 |

|

|

|

172,975 |

|

|

|

1.3 |

|

|

|

9,746,873 |

|

|

|

1.6 |

|

|

|

|

167,606 |

|

|

|

167,606 |

|

|

|

1.3 |

|

|

|

8,447,342 |

|

|

|

1.4 |

|

Company 3 Method, Inc. (13) |

|

|

193,307 |

|

|

|

129,641 |

|

|

|

1.0 |

|

|

|

7,091,346 |

|

|

|

1.2 |

|

WeWork Companies, Inc. (14) |

|

|

318,208 |

|

|

|

146,743 |

|

|

|

1.1 |

|

|

|

7,035,088 |

|

|

|

1.2 |

|

|

|

|

92,450 |

|

|

|

92,450 |

|

|

|

0.7 |

|

|

|

6,879,679 |

|

|

|

1.1 |

|

|

|

|

131,701 |

|

|

|

131,701 |

|

|

|

1.0 |

|

|

|

5,819,433 |

|

|

|

1.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

6,159,871 |

|

|

|

4,752,060 |

|

|

|

36.7 |

% |

|

$ |

262,010,537 |

|

|

|

43.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Company’s Share is a non-GAAP financial measure calculated as the consolidated amount, in accordance with GAAP, plus the Company’s share of the amount from the Company’s unconsolidated joint ventures (calculated based upon the Company’s percentage ownership interest), minus the Company’s partners’ share of the amount from the Company’s consolidated joint ventures (calculated based upon the partners’ percentage ownership interests). Management believes that presenting the “Company’s Share” of these measures provides useful information to investors regarding the Company’s financial condition and/or results of operations because the Company has several significant joint ventures and in some cases, the Company exercises significant influence over, but does not control, the joint venture, in which case GAAP requires that the Company account for the joint venture entity using the equity method of accounting and the Company does not consolidate it for financial reporting purposes. In other cases, GAAP requires that the Company consolidate the venture even though the Company’s partner(s) owns a significant percentage interest. As a result, management believes that presenting the Company’s Share of various financial measures in this manner can help investors better understand the Company’s financial condition and/or results of operations after taking into account its true economic interest in these joint ventures. |

| (2) |

Presented in order of Company’s Share of annualized base rent. |

| (3) |

Annualized base rent is calculated by multiplying (i) base rental payments (defined as cash base rents (before abatements)) under commenced leases as of June 30, 2022, by (ii) 12. Annualized base rent does not reflect tenant reimbursements. |

| (4) |

Google, Inc. expirations by square footage and property: (i) 182,672 square feet at Foothill Research Center expiring on February 28, 2025, (ii) 208,843 square feet at Rincon Center expiring on February 29, 2028, (iii) 207,857 square feet at 3400 Hillview expiring on November 30, 2028, (iv) 41,354 square feet at Ferry Building expiring on October 31, 2029 and (v) 584,000 square feet at One Westside expiring on November 30, 2036. We own 55% of the ownership interest in the consolidated joint venture that owns Ferry Building and 75% of the ownership interest in the consolidated joint venture that owns One Westside. Google, Inc. may elect to exercise its early termination right at Rincon Center for 166,460 square feet effective April 15, 2025 by delivering written notice on or before January 15, 2024. Google, Inc. may elect to exercise its early termination right at 3400 Hillview for 207,857 square feet effective no earlier than February 1, 2025 and no later than February 1, 2027 by delivering written notice at least 12 months prior to the early termination date. |

| (5) |

Amazon expirations by square footage and property: (i) 139,824 square feet at Met Park North expiring on November 30, 2023, (ii) 659,150 square feet at 1918 Eighth expiring on September 30, 2030 and (iii) 191,814 square feet at 5th & Bell expiring on May 31, 2031. We own 55% of the ownership interest in the consolidated joint venture that owns 1918 Eighth. |

| (6) |

Netflix, Inc. expirations by square footage and property: (i) 326,792 square feet at ICON expiring on September 30, 2031, (ii) 301,127 square feet at EPIC expiring on September 30, 2031 and (iii) 94,386 square feet at CUE expiring on September 30, 2031. We own 51% of the ownership interest in the consolidated joint venture that owns ICON, EPIC and CUE. |

| (7) |

Nutanix, Inc. expirations by square footage and property: (i) 67,070 square feet at Metro Plaza expiring on December 31, 2022, (ii) 41,540 square feet at Metro Plaza expiring on May 31, 2023, (iii) 117,001 square feet at Concourse expiring on May 31, 2024 and (iv) 199,445 square feet at 1740 Technology expiring on May 31, 2030. At 1740 Technology, Nutanix, Inc. is expected to take possession of an additional 16,412 square feet during third quarter 2022. |

| (8) |

Riot Games, Inc. may elect to exercise its early termination right for the entire premises effective February 28, 2025 by delivering written notice on or before February 29, 2024. |

| (9) |

Salesforce.com expirations by square footage: (i) 83,016 square feet at Rincon Center expiring on July 31, 2025, (ii) 83,372 square feet at Rincon Center expiring on April 30, 2027, (iii) 93,028 square feet at Rincon Center expiring on October 31, 2028 and (iv) 5,978 square feet of storage space at Rincon Center. Salesforce.com subleased 259,416 square feet at Rincon Center to Twilio Inc. during third quarter 2018. Effective January 30, 2019, we entered into an agreement to reimburse Salesforce.com approximately $6.3 million for costs incurred in connection with the sublease. We are entitled to recoup this cost from amounts paid pursuant to the sublease commencing February 1, 2019, of which we have been fully reimbursed as of March 31, 2020. Thereafter, Salesforce.com has paid us 50% of any amounts received pursuant to the sublease, such that we began receiving an average of $340,000 per month of sublease cash rents starting June 2020, with annual growth thereafter. |

| (10) |

We own 55% of the ownership interest in the consolidated joint venture that owns 1455 Market. |

| (11) |

Dell EMC Corporation expirations by square footage and property: (i) 42,954 square feet at 505 First expiring on December 31, 2023, (ii) 83,549 square feet at 875 Howard expiring on June 30, 2026 and (iii) 46,472 square feet at 505 First expiring on January 31, 2027. Dell EMC Corporation may elect to exercise its early termination right at 505 First for 46,472 square feet effective January 31, 2025 by delivering written notice on or before January 31, 2024. |

| (12) |

NFL Enterprises by square footage and property: (i) 157,687 square feet at 10950 Washington expiring on December 31, 2022 and (ii) 9,919 square feet at 10900 Washington expiring on December 31, 2022. NFL Enterprises elected to exercise its early termination right for the entire premises effective December 31, 2022. |

| (13) |

Company 3 Method, Inc. expirations by square footage and property: (i) 63,376 square feet at 3401 Exposition expiring on September 30, 2026, (ii) 59,646 square feet at Harlow expiring on October 31, 2032 and (iii) 70,285 square feet at Harlow expiring on March 31, 2033. Company 3 Method, Inc. may elect to exercise its early termination right at Harlow for 59,646 square feet effective November 30, 2029, December 31, 2029, January 31, 2030 or February 28, 2030 by delivering written notice on or before November 1, 2028. We own 51% of the ownership interest in the consolidated joint venture that owns Harlow. |

| (14) |

WeWork Companies Inc. expirations by square footage and property: (i) 54,336 square feet at Hill7 expiring on January 31, 2030, (ii) 51,205 square feet at Maxwell expiring on June 30, 2031, (iii) 66,056 square feet at 1455 Market expiring on October 31, 2031 and (iv) 146,611 square feet at Bentall Centre expiring on October 31, 2033. We own 55% of the ownership interest in the consolidated joint ventures that own Hill7 and 1455 Market, and 20% of the ownership interest in the unconsolidated joint venture that owns Bentall Centre. |

| (15) |

GitHub Inc. expirations by square footage and property: (i) 57,120 square feet at 275 Brannan expiring on June 30, 2025 and (ii) 35,330 square feet at 625 Second expiring on June 30, 2025. |

| (16) |

Paypal, Inc. may elect to exercise its early termination right for the entire premises effective July 17, 2026 by delivering written notice on or before July 17, 2025. |

The table below presents our office portfolio tenant industry diversification as of June 30, 2022.

|

|

|

|

|

|

|

|

|

| |

|

Company’s Share (1) |

|

|

|

Total Square

Feet (3)(4) |

|

|

Annualized Base Rent

as of Percent of

Total (5) |

|

|

|

|

4,347,805 |

|

|

|

40.8 |

% |

Media and Entertainment (7) |

|

|

1,340,417 |

|

|

|

13.7 |

|

Legal |

|

|

684,835 |

|

|

|

8.3 |

|

|

|

|

829,118 |

|

|

|

7.5 |

|

|

|

|

1,083,624 |

|

|

|

7.2 |

|

Financial Services |

|

|

763,340 |

|

|

|

7.0 |

|

Other |

|

|

1,674,351 |

|

|

|

15.5 |

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

10,723,490 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

| (1) |

Company’s Share is a non-GAAP financial measure calculated as the consolidated amount, in accordance with GAAP, plus the Company’s share of the amount from the Company’s unconsolidated joint ventures (calculated based upon the Company’s percentage ownership interest), minus the Company’s partners’ share of the amount from the Company’s consolidated joint ventures (calculated based upon the partners’ percentage ownership interests). |

| (2) |

Industries and sectors are determined by management using Thompson Reuters Business Classification and are presented in order of Company’s Share of annualized base rent. |

| (3) |

Excludes signed leases not commenced. |

| (4) |

Excludes 181,687 square feet occupied by Hudson Pacific Properties, Inc. |

| (5) |

Annualized base rent is calculated by multiplying (i) base rental payments (defined as cash base rents (before abatements)) under commenced leases as of June 30, 2022, by (ii) 12. Annualized base rent does not reflect tenant reimbursements. |

| (6) |

Our diverse set of technology tenants largely consist of public and other well-established companies. As a percentage of annualized base rent, the businesses of our technology tenants consist of online services (40%), software (24%), hardware & tech equipment (17%), business support services (11%) and other (8%) as of June 30, 2022. In addition, as a percent of total annualized base rent of technology tenants, 84% is attributable to public companies, 11% is attributable to private companies in business for more than 10 years and 5% is attributable to private companies in business for less than 10 years, as of June 30, 2022. |

| (7) |

As a percentage of annualized base rent, the businesses of our media & entertainment tenants consist of production & service (63%), gaming (30%) and advertising & marketing (7%) as of June 30, 2022. |

| (8) |

Includes 298,915 square feet occupied by co-working tenants (represents 2.6% of the Company’s Share of total annualized base rent). |

| (9) |

Includes 304,617 square feet of storefront retail (represents 2.0% of the Company’s Share of total annualized base rent). |

The table below presents certain information regarding our portfolio by

market

as of June 30, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Company’s Share (1) |

|

Market |

|

Total Square Feet (2) |

|

|

Annualized

Base Rent (3) |

|

|

Annualized Rent as a

Percent

of Total |

|

Office: |

|

|

|

|

|

|

|

|

|

|

|

|

Silicon Valley |

|

|

6,450,249 |

|

|

$ |

293,919,200 |

|

|

|

46.8 |

% |

San Francisco |

|

|

2,560,706 |

|

|

|

112,868,515 |

|

|

|

18.0 |

|

Los Angeles |

|

|

4,875,747 |

|

|

|

132,696,315 |

|

|

|

21.1 |

|

Seattle |

|

|

2,909,979 |

|

|

|

56,074,312 |

|

|

|

8.9 |

|

Vancouver |

|

|

1,957,814 |

|

|

|

8,424,225 |

|

|

|

1.4 |

|

Studio: |

|

|

|

|

|

|

|

|

|

|

|

|

Los Angeles |

|

|

1,496,698 |

|

|

|

23,572,742 |

|

|

|

3.8 |

|

Greater London |

|

|

1,167,347 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

21,418,540 |

|

|

$ |

627,555,309 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Company’s Share is a non-GAAP financial measure calculated as the consolidated amount, in accordance with GAAP, plus the Company’s share of the amount from the Company’s unconsolidated joint ventures (calculated based upon the Company’s percentage ownership interest), minus the Company’s partners’ share of the amount from the Company’s consolidated joint ventures (calculated based upon the partners’ percentage ownership interests). |

| (3) |

Annualized base rent for the office properties is calculated by multiplying (i) base rental payments (defined as cash base rents (before abatements)) under commenced leases as of June 30, 2022, by (ii) 12. Annualized base rent for the studio properties reflects actual base rent for the 12 months ended June 30, 2022. Annualized base rent does not reflect tenant reimbursements. |

The table below presents certain information regarding our

in-service

office properties by market as of various acquisition dates and June 30, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market |

|

Percent

Leased at

Acquisition

Date |

|

|

Percent

Leased at

June 30,

2022 (1) |

|

|

Annualized Base

Rent (2) at

Acquisition

Date per

square foot |

|

|

Annualized

Base Rent at

June 30, 2022

per square foot |

|

Office: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silicon Valley |

|

|

85.8 |

% |

|

|

89.8 |

% |

|

$ |

41.42 |

|

|

$ |

58.21 |

|

San Francisco |

|

|

83.0 |

|

|

|

94.2 |

|

|

$ |

30.53 |

|

|

$ |

64.52 |

|

Los Angeles |

|

|

32.8 |

|

|

|

99.0 |

|

|

$ |

34.51 |

|

|

$ |

58.92 |

|

Seattle |

|

|

85.8 |

|

|

|

85.3 |

|

|

$ |

28.58 |

|

|

$ |

38.13 |

|

Vancouver |

|

|

98.2 |

|

|

|

95.7 |

|

|

$ |

25.55 |

|

|

$ |

29.60 |

|

| (1) |

Includes signed leases not commenced. |

| (2) |

Annualized base rent for office properties is calculated by multiplying (i) base rental payments (defined as cash base rents (before abatements)) under commenced leases as of June 30, 2022, by (ii) 12. Annualized base rent per square foot for the office properties is calculated as (i) annualized base rent divided by (ii) square footage under commenced leases as of June 30, 2022. Annualized base rent does not reflect tenant reimbursements. |

The table below presents certain information regarding the performance of our stabilized

and

in-service

office properties relative to the broader markets in which our properties are located as of March 31, 2020 and June 30, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market |

|

Market Percent

Leased at

March 31,

|

|

|

Our Percent

Leased at

March 31,

|

|

|

Market Percent

Leased at

June 30,

|

|

|

Our Percent

Leased at

June 30,

|

|

Office: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silicon Valley |

|

|

95.0 |

% |

|

|

91.3 |

% |

|

|

90.4 |

% |

|

|

89.8 |

% |

San Francisco |

|

|

96.9 |

|

|

|

98.4 |

|

|

|

84.4 |

|

|

|

94.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Los Angeles |

|

|

88.1 |

|

|

|

96.9 |

|

|

|

83.9 |

|

|

|

99.0 |

|

Seattle |

|

|

94.3 |

|

|

|

94.4 |

|

|

|

83.8 |

|

|

|

85.3 |

|

Vancouver |

|

|

98.2 |

|

|

|

99.5 |

|

|

|

94.7 |

|

|

|

95.7 |

|

| (1) |

Source: CBRE Research, Q1 2020. |

| (2) |

Includes signed leases not commenced. |

| (3) |

Source: CBRE Research, Q2 2022. |

The table below sets forth the Company’s Share of debt and market capitalization as of June 30, 2022 (in thousands except percentages):

|

|

|

|

|

|

|

|

|

| |

|

Shares/Units |

|

|

Aggregate

Principal

Amount or $

Equivalent |

|

Unsecured revolving credit facility |

|

|

|

|

|

$ |

485,000 |

|

Unsecured private placement |

|

|

|

|

|

|

625,000 |

|

Unsecured registered senior notes |

|

|

|

|

|

|

1,300,000 |

|

Secured debt |

|

|

|

|

|

|

1,744,200 |

|

|

|

|

|

|

|

|

|

|

Total consolidated unsecured and secured debt (1) |

|

|

|

|

|

$ |

4,154,200 |

|

Add: Series A preferred units |

|

|

392,598 |

|

|

|

9,815 |

|

|

|

|

|

|

|

|

|

|

Total consolidated debt (2) |

|

|

|

|

|

$ |

4,164,015 |

|

Less: Cash and cash equivalents |

|

|

|

|

|

|

(266,538 |

) |

|

|

|

|

|

|

|

|

|

Total consolidated debt, net (3) |

|

|

|

|

|

$ |

3,897,477 |

|

Add: Company’s Share of unconsolidated real estate entities’ debt (4) |

|

|

|

|

|

|

110,206 |

|

Less: Partners’ share of consolidated debt (5) |

|

|

|

|

|

|

(793,564 |

) |

Less: Company’s Share of unconsolidated real estate entities’ cash and cash equivalents (4) |

|

|

|

|

|

|

(9,454 |

) |

Add: Partners’ share of cash and cash equivalents (5) |

|

|

|

|

|

|

60,254 |

|

|

|

|

|

|

|

|

|

|

Company’s Share of debt, net (6) |

|

|

|

|

|

$ |

3,264,919 |

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

Series C cumulative redeemable preferred stock |

|

|

17,000,000 |

|

|

$ |

425,000 |

|

Common stock |

|

|

141,609,336 |

|

|

|

2,101,483 |

|

Operating Partnership units |

|

|

1,846,264 |

|

|

|

27,399 |

|

Restricted stock and units |

|

|

1,199,718 |

|

|

|

17,804 |

|

|

|

|

1,557,950 |

|

|

|

23,120 |

|

|

|

|

|

|

|

|

|

|

Total equity |

|

|

163,213,268 |

|

|

$ |

2,594,806 |

|

Consolidated market capitalization (9) |

|

|

|

|

|

$ |

6,758,821 |

|

Company’s Share of market capitalization (10) |

|

|

|

|

|

$ |

6,075,463 |

|

Consolidated debt, net / consolidated market capitalization |

|

|

|

|

|

|

57.7 |

% |

Company’s Share of debt, net / Company’s Share of market capitalization |

|

|

|

|

|

|

53.7 |

% |

| (1) |

Consolidated unsecured and secured debt excludes in-substance defeased debt related to our Hudson Pacific/Macerich joint venture and unamortized deferred financing costs and unamortized loan discounts/premiums related to our registered senior debt. The full amount of debt related to the Hill7, Hollywood Media Portfolio and 1918 Eighth joint ventures is included. |

| (2) |

Consolidated debt is equal to the sum of (i) unsecured and secured debt and (ii) Series A preferred units. |

| (3) |

Consolidated debt, net is equal to consolidated debt, less consolidated cash and cash equivalents. |

| (4) |

Amount is calculated based on our percentage ownership interest in the unconsolidated joint venture entities. Amounts denominated in CAD and GBP have been converted to USD using the foreign currency exchange rates as of June 30, 2022. |

| (5) |

Amount is calculated based on the outside partners’ percentage ownership interest in the consolidated joint venture entities. |

| (6) |

Company’s Share of debt, net is equal to the sum of (i) unsecured and secured debt, including the Company’s Share of unconsolidated joint venture debt, and the Company’s Share of unconsolidated joint venture cash and cash equivalents, and excluding partners’ share of consolidated joint venture partner debt and partners’ share of consolidated joint venture cash and cash equivalents; and (ii) Series A preferred units. |

| (7) |

Dilutive shares represents shares of common stock outstanding (including unvested restricted shares), operating partnership units outstanding and an estimate for our dilutive Performance Stock Units (“PSU”), including stock grants under our 2020, 2021 and 2022 PSU Plans. |

| (8) |

Value of common stock, operating partnership units, restricted stock and units and dilutive shares is calculated based on June 30, 2022 closing price of $14.84 per share of common stock. |

| (9) |

Consolidated market capitalization is equal to the sum of (i) consolidated unsecured and secured debt, (ii) Series A preferred units, (iii) Series C cumulative redeemable preferred stock and (iv) common equity capitalization. Common equity capitalization represents the total shares of common stock/units outstanding at end of period multiplied by the closing price at quarter end. |

| (10) |

Company’s Share of market capitalization is equal to consolidated market capitalization, except it includes the Company’s Share of debt. |

The following tables present and reconcile the Company’s Share of net debt and debt for the periods presented (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net Debt & Total Unsecured / Secured Debt ($ in Thousands) |

|

| |

|

Q2 2010 |

|

|

Q4 2010 |

|

|

Q4 2011 |

|

|

Q4 2012 |

|

|

Q4 2013 |

|

|

Q4 2014 |

|

|

Q4 2015 |

|

|

Q4 2016 |

|

|

Q4 2017 |

|

|

Q4 2018 |

|

|

Q4 2019 |

|

|

Q4 2020 |

|

|

Q4 2021 |

|

|

Q2 2022 |

|

Total Unsecured and secured debt, net |

|

$ |

94,020 |

|

|

$ |

342,060 |

|

|

$ |

399,871 |

|

|

$ |

582,085 |

|

|

$ |

931,308 |

|

|

$ |

918,059 |

|

|

$ |

2,260,716 |

|

|

$ |

2,688,010 |

|

|

$ |

2,421,380 |

|

|

$ |

2,623,835 |

|

|

$ |

2,817,910 |

|

|

$ |

3,399,492 |

|

|

$ |

3,733,903 |

|

|

$ |

4,129,034 |

|

Unamortized deferred financing cost |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

19,039 |

|

|

|

19,829 |

|

|

|

17,209 |

|

|

|

15,898 |

|

|

|

26,235 |

|

|

|

31,599 |

|

|

|

29,915 |

|

|

|

24,174 |

|

Unamortized loan cost, net |

|

|

280 |

|

|

|

(643 |

) |

|

|

(1,965 |

) |

|

|

(1,201 |

) |

|

|

(5,320 |

) |

|

|

(3,056 |

) |

|

|

(1,310 |

) |

|

|

— |

|

|

|

722 |

|

|

|

648 |

|

|

|

1,314 |

|

|

|

1,185 |

|

|

|

1,056 |

|

|

|

992 |

|

Debt related to held for sale property |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

42,449 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Company’s Share of unconsolidated joint venture debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

97,053 |

|

|

|

99,973 |

|

|

|

105,275 |

|

|

|

110,206 |

|

Partner’s share of consolidated joint venture debt |

|

|

— |

|

|

|

(51,940 |

) |

|

|

— |

|

|

|

(2,257 |

) |

|

|

(76,139 |

) |

|

|

(75,747 |

) |

|

|

(75,330 |

) |

|

|

(121,050 |

) |

|

|

(45,450 |

) |

|

|

(45,450 |

) |

|

|

(46,862 |

) |

|

|

(654,403 |

) |

|

|

(786,232 |

) |

|

|

(793,564 |

) |

Total Company’s Share of unsecured and secured debt |

|

$ |

94,300 |

|

|

$ |

289,477 |

|

|

$ |

397,906 |

|

|

$ |

578,627 |

|

|

$ |

849,849 |

|

|

$ |

881,705 |

|

|

$ |

2,203,115 |

|

|

$ |

2,586,789 |

|

|

$ |

2,393,861 |

|

|

$ |

2,594,931 |

|

|

$ |

2,895,650 |

|

|

$ |

2,877,846 |

|

|

$ |

3,083,917 |

|

|

$ |

3,470,842 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q2 2010 |

|

|

Q4 2010 |

|

|

Q4 2011 |

|

|

Q4 2012 |

|

|

Q4 2013 |

|

|

Q4 2014 |

|

|

Q4 2015 |

|

|

Q4 2016 |

|

|

Q4 2017 |

|

|

Q4 2018 |

|

|

Q4 2019 |

|

|

Q4 2020 |

|

|

Q4 2021 |

|

|

Q2 2022 |

|

Cash and cash equivalents |

|

$ |

(84,509 |

) |

|

$ |

(48,875 |

) |

|

$ |

(13,705 |

) |

|

$ |

(18,904 |

) |

|

$ |

(30,356 |

) |

|

$ |

(17,753 |

) |

|

$ |

(53,551 |

) |

|

$ |

(83,015 |

) |

|

$ |

(78,922 |

) |

|

$ |

(53,740 |

) |

|

$ |

(46,224 |

) |

|

$ |

(113,686 |

) |

|

$ |

(96,555 |

) |

|

$ |

(266,538 |

) |

Company’s Share of unconsolidated real estate entity cash and cash equivalents |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,690 |

) |

|

|

(3,060 |

) |

|

|

(8,126 |

) |

|

|

(9,454 |

) |

Partner’s share of cash and cash equivalents |

|

|

— |

|

|

|

2,030 |

|

|

|

— |

|

|

|

1 |

|

|

|

1,865 |

|

|

|

1,664 |

|

|

|

3,251 |

|

|

|

9,285 |

|

|

|

1,594 |

|

|

|

7,659 |

|

|

|

8,846 |

|

|

|

17,002 |

|

|

|

24,056 |

|

|

|

60,254 |

|

Company’s Share of net debt (excluding Series A preferred units) |

|

$ |

9,791 |

|

|

$ |

242,632 |

|

|

$ |

384,201 |

|

|

$ |

559,724 |

|

|

$ |

821,358 |

|

|

$ |

865,616 |

|

|

$ |

2,152,815 |

|

|

$ |

2,513,059 |

|

|

$ |

2,316,533 |

|

|

$ |

2,548,850 |

|

|

$ |

2,855,582 |

|

|

$ |

2,778,102 |

|

|

$ |

3,003,292 |

|

|

$ |

3,255,104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q2 2010 |

|

|

Q4 2010 |

|

|

Q4 2011 |

|

|

Q4 2012 |

|

|

Q4 2013 |

|

|

Q4 2014 |

|

|

Q4 2015 |

|

|

Q4 2016 |

|

|

Q4 2017 |

|

|

Q4 2018 |

|

|

Q4 2019 |

|

|

Q4 2020 |

|

|

Q4 2021 |

|

|

Q2 2022 |

|

Unsecured Debt |

|

|

— |

|

|

|

111,117 |

|

|

|

— |

|

|

|

55,000 |

|

|

|

155,000 |

|

|

|

280,000 |

|

|

|

1,555,000 |

|

|

|

2,025,000 |

|

|

|

1,975,000 |

|

|

|

2,275,000 |

|

|

|

2,475,000 |

|

|

|

1,925,000 |

|

|

|

2,050,000 |

|

|

|

2,410,000 |

|

Secured Debt |

|

|

94,300 |

|

|

|

178,360 |

|

|

|

397,906 |

|

|

|

523,627 |

|

|

|

694,849 |

|

|

|

601,705 |

|

|

|

648,115 |

|

|

|

561,789 |

|

|

|

418,861 |

|

|

|

319,931 |

|

|

|

420,650 |

|

|

|

952,846 |

|

|

|

1,033,917 |

|

|

|

1,060,842 |

|

Total Company’s Share of debt |

|

$ |

94,300 |

|

|

$ |

289,477 |

|

|

$ |

397,906 |

|

|

$ |

578,627 |

|

|

$ |

849,849 |

|

|

$ |

881,705 |

|

|

$ |

2,203,115 |

|

|

$ |

2,586,789 |

|

|

$ |

2,393,861 |

|

|

$ |

2,594,931 |

|

|

$ |

2,895,650 |

|

|

$ |

2,877,846 |

|

|

$ |

3,083,917 |

|

|

$ |

3,470,842 |

|

The following table presents and reconciles the Company’s Share of gross assets for the periods presented (in thousands).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of (Actual) |

|

| |

|

Q2 2010 |

|

|

Q4 2010 |

|

|

Q4 2011 |

|

|

Q4 2012 |

|

|

Q4 2013 |

|

|

Q4 2014 |

|

|

Q4 2015 |

|

|

Q4 2016 |

|

|

Q4 2017 |

|

|

Q4 2018 |

|

|

Q4 2019 |

|

|

Q4 2020 |

|

|

Q4 2021 |

|

|

Q2 2022 |

|

Total assets, net |

|

$ |

621,780 |

|

|

$ |

1,004,576 |

|

|

$ |

1,152,791 |

|

|

$ |

1,559,690 |

|

|

$ |

2,131,274 |

|

|

$ |

2,340,885 |

|

|

$ |

6,254,035 |

|

|

$ |

6,678,998 |

|

|

$ |

6,622,070 |

|

|

$ |

7,070,879 |

|

|

$ |

7,466,568 |

|

|

$ |

8,350,202 |

|

|

$ |

8,990,189 |

|

|

$ |

9,050,638 |

|

Accumulated depreciation |

|

|

21,442 |

|

|

|

27,113 |

|

|

|

53,329 |

|

|

|

85,184 |

|

|

|

116,342 |

|

|

|

134,657 |

|

|

|

269,074 |

|

|

|

419,368 |

|

|

|

533,498 |

|

|

|

695,631 |

|

|

|

898,279 |

|

|

|

1,102,748 |

|

|

|

1,283,774 |

|

|

|

1,413,526 |

|

Accumulated depreciation related to assets held for sale |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,904 |

|

|

|

3,650 |

|

|

|

4,582 |

|

|

|

15,913 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

55,406 |

|

|

|

54,940 |

|

Partner’s share of gross assets |

|

|

— |

|

|

|

(94,606 |

) |

|

|

— |

|

|

|

(3,897 |

) |

|

|

(127,795 |

) |

|

|

(128,740 |

) |

|

|

(194,809 |

) |

|

|

(289,075 |

) |

|

|

(163,559 |

) |

|

|

(406,815 |

) |

|

|

(453,722 |

) |

|

|

(1,421,834 |

) |

|

|

(1,536,226 |

) |

|

|

(1,540,656 |

) |

Accumulated amortization – deferred leasing costs and intangible assets |

|

|

8,287 |

|

|

|

13,509 |

|

|

|

33,881 |

|

|

|

55,638 |

|

|

|

70,547 |

|

|

|

49,769 |

|

|

|

136,252 |

|

|

|

164,303 |

|

|

|

158,034 |

|

|

|

137,980 |

|

|

|

154,698 |

|

|

|

146,630 |

|

|

|

145,502 |

|

|

|

161,278 |

|

Accumulated depreciation – non-real estate assets |

|

|

222 |

|

|

|

275 |

|

|

|

467 |

|

|

|

499 |

|

|

|

629 |

|

|

|

207 |

|

|

|

431 |

|

|

|

2,232 |

|

|

|

4,097 |

|

|

|

5,987 |

|

|

|

7,487 |

|

|

|

8,933 |

|

|

|

15,675 |

|

|

|

17,990 |

|

Partner’s share of accumulated amortization |

|

|

— |

|

|

|

(229 |

) |

|

|

(3,928 |

) |

|

|

(5,581 |

) |

|

|

(7,199 |

) |

|

|

(5,381 |

) |

|

|

(6,809 |

) |

|

|

(8,000 |

) |

|

|

(3,841 |

) |

|

|

(5,380 |

) |

|

|

(7,965 |

) |

|

|

(10,629 |

) |

|

|

(17,790 |

) |

|

|

(19,947 |

) |

Investment in unconsolidated joint ventures |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(64,926 |

) |

|

|

(82,105 |

) |

|

|

(154,731 |

) |

|

|

(161,845 |

) |

Company’s Share of unconsolidated gross assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

172,818 |

|

|

|

199,121 |

|

|

|

274,124 |

|

|

|

288,287 |

|

Company’s Share of Gross Assets |

|

$ |

651,731 |

|

|

$ |

950,638 |

|

|

$ |

1,236,540 |

|

|

$ |

1,691,533 |

|

|

$ |

2,183,798 |

|

|

$ |

2,399,301 |

|

|

$ |

6,461,824 |

|

|

$ |

6,972,408 |

|

|

$ |

7,166,212 |

|

|

$ |

7,498,282 |

|

|

$ |

8,173,237 |

|

|

$ |

8,293,066 |

|

|

$ |

9,055,923 |

|

|

$ |

9,264,211 |

|

We evaluate performance based upon, among other things, EBITDA, EBITDAre and Adjusted EBITDAre. EBITDA represents net income before interest, income taxes, depreciation and amortization. EBITDAre represents EBITDA before the Company’s Share interest and depreciation from unconsolidated real estate entities. Adjusted EBITDAre represents EBITDAre as further adjusted to eliminate the impact of certain

non-cash

items and items that we do not consider indicative of our ongoing performance. We believe that EBITDA, EBITDAre and Adjusted EBITDAre are useful because they allow investors and management to evaluate and compare our performance from period to period in a meaningful and consistent manner, in addition to standard financial measurements under GAAP. EBITDA, EBITDAre and Adjusted EBITDAre are not measurements of financial performance under GAAP and should not be considered as alternatives to income attributable to common shareholders, as indicators of operating performance or any measure of performance derived in accordance with GAAP. Our calculation of EBITDA, EBITDAre and Adjusted EBITDAre may be different from the calculation used by other companies and, accordingly, comparability may be limited.

The table below presents a reconciliation of net income to EBITDA, EBITDAre and Adjusted EBITDAre for the three months ended June 30, 2022 (in thousands except annualization factor):

|

|

|

|

|

| |

|

Three Months

Ended

June 30, 2022 |

|

Net income |

|

$ |

3,546 |

|

Adjustments: |

|

|

|

|

Interest income-consolidated |

|

|

(920 |

) |

Interest expense-consolidated |

|

|

33,719 |

|

Depreciation and amortization-consolidated |

|

|

91,438 |

|

|

|

|

|

|

|

|

$ |

127,783 |

|

Unconsolidated real estate entities depreciation and amortization |

|

|

1,320 |

|

Unconsolidated real estate entities interest expense |

|

|

858 |

|

|

|

|

|

|

|

|

$ |

129,961 |

|

Impairment loss |

|

|

3,250 |

|

Unrealized loss on non-real estate investments |

|

|

1,818 |

|

Other income |

|

|

(742 |

) |

Transaction-related expenses |

|

|

1,126 |

|

Non-cash compensation expense |

|

|

5,993 |

|

Straight-line receivables, net |

|

|

(12,300 |

) |

Non-cash amortization of above-market and below-market leases, net |

|

|

(1,953 |

) |

Non-cash amortization of above-market and below-market ground leases, net |

|

|

687 |

|

Amortization of lease incentive costs |

|

|

431 |

|

|

|

|

|

|

|

|

$ |

128,271 |

|

One-time prior period net property tax adjustment |

|

|

682 |

|

|

|

|

|

|

Adjusted EBITDAre (excluding specified items) |

|

$ |

128,953 |

|

Studio cash net operating income |

|

|

(8,323 |

) |

|

|

|

|

|

Office property Adjusted EBITDAre |

|

$ |

120,630 |

|

xAnnualization factor |

|

|

4.0x |

|

|

|

|

|

|

Annualized office property Adjusted EBITDAre |

|

$ |

482,520 |

|

Trailing 12-months studio cash net operating income |

|

|

32,312 |

|

|

|

|

|

|

Cash Adjusted EBITDAre for selected ratios |

|

$ |

514,832 |

|

Less: Partners’ share of Cash Adjusted EBITDAre |

|

|

(77,485 |

) |

|

|

|

|

|

Company’s Share of cash Adjusted EBITDAre |

|

$ |

437,347 |

|

| (1) |

EBITDA represents net income before interest, income taxes, depreciation and amortization. EBITDAre represents EBITDA before the Company’s Share interest and depreciation from unconsolidated real estate entities. Adjusted EBITDAre represents EBITDAre as further adjusted to eliminate the impact of certain non-cash items and items that we do not consider indicative of our ongoing performance. |

We also evaluate performance based upon, among other things, funds from operations (“FFO”). We calculate FFO in accordance with the White Paper issued in December 2018 on FFO approved by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”). The White Paper defines FFO as net income or loss calculated in accordance with GAAP, excluding gains and losses from sales of depreciable real estate and impairment write-downs associated with depreciable real estate, plus real estate-related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of

non-real

estate assets) and after adjustment for unconsolidated partnerships and joint ventures. The calculation of FFO includes the amortization of deferred revenue related to tenant-funded tenant improvements and excludes the depreciation of the related tenant improvement assets. In the December 2018 White Paper, NAREIT provided an option to include value changes in

equity securities in the calculation of FFO. We elected this option retroactively during the fourth quarter of 2018.

We believe that FFO is a useful supplemental measure of our operating performance. The exclusion from FFO of gains and losses from the sale of operating real estate assets allows investors and analysts to readily identify the operating results of the assets that form the core of our activity and assists in comparing those operating results between periods. Also, because FFO is generally recognized as the industry standard for reporting the operations of REITs, it facilitates comparisons of operating performance to other REITs. However, other REITs may use different methodologies to calculate FFO, and accordingly, our FFO may not be comparable to all other REITs.

Implicit in historical cost accounting for real estate assets in accordance with GAAP is the assumption that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, many industry investors and analysts have considered presentations of operating results for real estate companies using historical cost accounting alone to be insufficient. Because FFO excludes depreciation and amortization of real estate assets, we believe that FFO along with the required GAAP presentations provides a more complete measurement of our performance relative to our competitors and a more appropriate basis on which to make decisions involving operating, financing and investing activities than the required GAAP presentations alone would provide. We use FFO per share to calculate annual cash bonuses for certain employees.

However, FFO should not be viewed as an alternative measure of our operating performance because it does not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, which are significant economic costs and could materially impact our results from operations.

The table below presents a reconciliation of net (loss) income to FFO for the years ended December 31, 2011, 2020 and 2021 and the three months ended June 30, 2022 (in thousands except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, |

|

|

Three

Months

Ended

June 30, |

|

| |

|

2011 |

|

|

2020 |

|

|

2021 |

|

|

2022 |

|

Net (loss) income |

|

$ |

(2,238 |

) |

|

$ |

16,430 |

|

|

$ |

29,012 |

|

|

$ |

3,546 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization—Consolidated |

|

|

44,660 |

|

|

|

299,682 |

|

|

|

343,614 |

|

|

|

91,438 |

|

Depreciation and estate assets |

|

|

— |

|

|

|

(2,286 |

) |

|

|

(7,719 |

) |

|

|

(4,485 |

) |

Depreciation and amortization—Company’s share from unconsolidated real estate entities |

|

|

— |

|

|

|

5,605 |

|

|

|

6,020 |

|

|

|

1,320 |

|

Impairment loss – real estate assets |

|

|

— |

|

|

|

— |

|

|

|

2,762 |

|

|

|

3,250 |

|

Unrealized loss (gain) on non-real estate investments |

|

|

— |

|

|

|

2,463 |

|

|

|

(16,571 |

) |

|

|

1,818 |

|

Tax impact of unrealized gain on non-real estate investment |

|

|

— |

|

|

|

— |

|

|

|

3,849 |

|

|

|

— |

|

FFO attributable to non-controlling interests |

|

|

(1,297 |

) |

|

|

(37,644 |

) |

|

|

(64,388 |

) |

|

|

(18,687 |

) |

FFO attributable to preferred units |

|

|

(8,108 |

) |

|

|

(612 |

) |

|

|

(2,893 |

) |

|

|

(5,200 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO to common stockholders and unitholders |

|

$ |

33,017 |

|

|

$ |

283,638 |

|

|

$ |

293,686 |

|

|

$ |

73,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specified items impacting FFO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction-related expenses |

|

|

1,693 |

|

|

|

440 |

|

|

|

8,911 |

|

|

|

1,126 |

|

One-time tax reassessment management cost |

|

|

— |

|

|

|

5,500 |

|

|

|

— |

|

|

|

— |

|

One-time straight line rent reserve |

|

|

— |

|

|

|

2,620 |

|

|

|

— |

|

|

|

— |

|

One-time prior period net property tax adjustment – Company’s Share |

|

|

— |

|

|

|

(937 |

) |

|

|

(581 |

) |

|

|

477 |

|

One-time debt extinguishment cost-Company’s Share |

|

|

— |

|

|

|

2,654 |

|

|

|

3,187 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO (excluding specified items) to common stockholders and unitholders |

|

$ |

34,710 |

|

|

$ |

293,915 |

|

|

$ |

305,203 |

|

|

$ |

74,603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common stock/units outstanding—diluted |

|

|

32,004 |

|

|

|

154,084 |

|

|

|

153,332 |

|

|

|

146,344 |

|

FFO (excluding specified items) per common stock/unit—diluted |

|

$ |

1.08 |

|

|

$ |

1.91 |

|

|

$ |

1.99 |

|

|

$ |

0.51 |

|

FFO (excluding specified items) per common stock/unit—diluted, annualized |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

2.04 |

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused

this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Hudson Pacific Properties, Inc. |

| |

|

By: |

|

|

|

|

|

|

|

|

| |

Hudson Pacific Properties, L.P. |

| |

|

By: |

|

Hudson Pacific Properties, Inc. |

|

|

|

| |

|

By: |

|

|

|

|

|

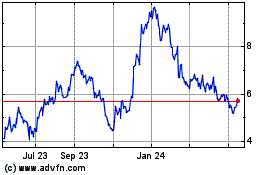

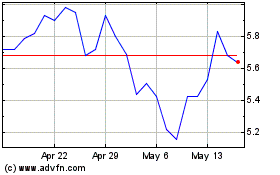

Hudson Pacific Properties (NYSE:HPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hudson Pacific Properties (NYSE:HPP)

Historical Stock Chart

From Jul 2023 to Jul 2024