CORRECT: AT A GLANCE: Cadbury Accepts Raised Bid From Kraft

January 19 2010 - 8:10AM

Dow Jones News

Cadbury PLC (CBY) Tuesday accepted an GBP11.9 billion takeover

offer from Kraft Foods Inc. (KFT) of the U.S., a deal that ends a

four-month acrimonious battle and nearly 200-years of independence

for the U.K.'s largest confectionery company.

THE DEAL:

Kraft has agreed to pay 500 pence in cash for each Cadbury share

as well as 0.1874 new Kraft shares for each Cadbury share, up from

its original offer of 300 pence in cash and 0.2589 new Kraft

shares. The original hostile bid had been rejected by Cadbury for

being "derisory" and had been criticized by some shareholders for

offering too little in cash.

The new offer values Cadbury at GBP11.9 billion, compared with

the original value of GBP10.2 billion.

THE RATIONALE:

Kraft says the takeover, creating a global confectionary giant

with more than 40 confectionary brands and annual sales above $100

million. will result in "meaningful" cost savings and revenue

synergies.

The U.S. company also says the deal gives Cadbury scale, an

improved delivery infrastructure, and a leading position in

developing markets including Brazil, Russia, India, China and

Mexico.

WHAT NEXT:

A rival bidder could emerge for Cadbury, although this now seems

unlikely. People close to U.S. chocolate maker Hershey Co. (HSY),

which had been mulling a counterbid for Cadbury, told the Wall

Street Journal Monday that Hershey would likely drop out of the

running if Cadbury and Kraft agreed a deal.

Cadbury has also agreed to pay a break fee of GBP117.7 million

if it ever decides to recommend a competing offer--lessening the

chance of a successful Hershey bid.

The U.K. takeover authorities have set a Jan. 25 deadline for

Hershey, or Italian chocolate maker Ferrero--which had also been

considering its options but is believed to have dropped out--to

make final offers.

THE BACKGROUND:

Kraft first went public with an informal cash-and-stock bid for

Cadbury on Sep. 7, but Cadbury has consistently rejected its

approach, saying the takeover offer was "derisory" and Cadbury's

shareholders shouldn't swap the company's growth prospects for

Kraft's "low-growth, conglomerate" model.

Carr had also been critical of Kraft's management, saying they

had "a long track record for over-praising and under

delivering."

It's unclear what persuaded Carr and Cadbury Chief Executive

Todd Stitzer to turn to recommend Kraft's new offer, but the U.S.

company went a long way to meeting the demands of shareholders, who

had requested a higher offer and more cash.

Kraft's offer should appease Kraft's largest shareholder Warren

Buffett, who warned the company earlier this month against issuing

too much new Kraft stock to pay for a deal.

WHAT THEY SAID:

"We are supportive of the (Cadbury) management's decision

although the achieved price is slightly light of our stated

target." - David Cumming, head of UK Equities at Standard Life

Investments, a Cadbury shareholder with less than 1% of the

stock.

"We believe the offer represents good value for Cadbury

shareholders and are pleased with the commitment that Kraft Foods

has made to our heritage, values and people throughout the world.

We will now work with the Kraft Foods' management to ensure the

continued success and growth of the business for the benefit of our

customers, consumers and employees." - Cadbury Chairman Roger

Carr

"For Kraft Foods shareholders (the deal) transforms the

portfolio, accelerates long-term growth and delivers highly

attractive returns, while maintaining financial discipline." -

Kraft Foods Chairman and CEO Irene Rosenfeld.

-By Michael Carolan and Steve McGrath, Dow Jones Newswires;

44-20-7842-9284; steve.mcgrath@dowjones.com

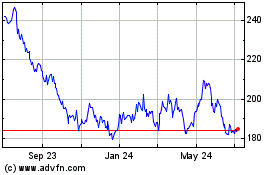

Hershey (NYSE:HSY)

Historical Stock Chart

From Sep 2024 to Oct 2024

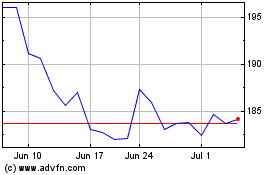

Hershey (NYSE:HSY)

Historical Stock Chart

From Oct 2023 to Oct 2024