Kraft Agrees To Pay GBP11.9 Billion For Cadbury, 60% In Cash

January 19 2010 - 4:59AM

Dow Jones News

Cadbury PLC (CBY) Tuesday accepted a GBP11.9 billion takeover

offer from Kraft Foods Inc. (KFT) of the U.S., a deal that ends a

four-month acrimonious battle and nearly 200-years of independence

for the U.K.'s largest confectionery company.

The U.S. food giant, which makes Toblerone and Milka chocolate

as well as processed cheese and ready meals, said it has agreed to

pay 840 pence a share for the company as well as a 10 pence

dividend, sweetening the original offer and significantly

increasing the cash element.

Kraft has agreed to pay 500 pence in cash for each Cadbury share

as well as 0.1874 new Kraft shares, up from its original offer of

300 pence in cash and 0.2589 new Kraft shares. The original hostile

bid had been rejected by Cadbury for being "derisory" and had been

criticized by some shareholders for offering too little in

cash.

"Kraft Foods believes that the final offer represents a

compelling opportunity for Cadbury Securityholders, providing the

ability to receive approximately 60% of their consideration in cash

and long-term value creation potential," it said.

Kraft's decision to raise the cash part of the bid and lower the

stock element will appease Kraft's largest shareholder Warren

Buffett, who warned the company earlier this month against issuing

too much new Kraft stock to pay for a deal.

The recommendation from Cadbury's board effectively signals the

end of Cadbury's 186-years as an independent company. While Kraft

could still theoretically be outbid by a rival offer--the U.K.

takeover authorities have set a deadline of Jan 26 for any rival

offers to be put forward--it is now certain that Cadbury will lose

its independence.

However, people close to U.S. chocolate maker Hershey Co. (HSY),

which had been mulling a counterbid for Cadbury, told the Wall

Street Journal Monday that Hershey would likely drop out of the

running if Cadbury and Kraft agreed a deal.

Jeffries International analyst Simon Marshall-Lockyer said that

given the level of Tuesday's bid, "the chances of a counterbid from

Hershey seems remote."

Kraft's original offer was worth about 762 pence a share.

Analysts have said consistently said the offer would need to be

raised above 800 pence a share to have any chance of success.

-By Michael Carolan, Dow Jones Newswires; 44-20-7842-9278;

michael.carolan@dowjones.com

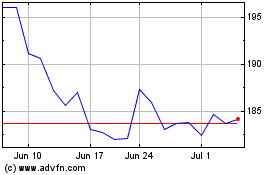

Hershey (NYSE:HSY)

Historical Stock Chart

From Oct 2024 to Nov 2024

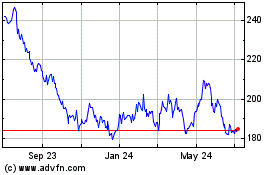

Hershey (NYSE:HSY)

Historical Stock Chart

From Nov 2023 to Nov 2024