2nd UPDATE: Ferrero, Hershey Mull Cadbury Bid Possibilities - Sources

November 20 2009 - 10:36AM

Dow Jones News

Italian candy-to-chocolate maker Ferrero International SA and

Hershey Co (HSY) of the U.S. are considering an all-cash bid for a

large part of U.K. confectioner Cadbury (CBY) rather than trying to

buy the whole company as one possible option to thwart Kraft Foods

Inc. (KFT), people with knowledge of the situation told Dow Jones

Newswires Friday.

The people said talks are ongoing and all options are under

discussion, but the two companies want to strike a friendly deal

with Cadbury, the people said. The options include launching a bid

for the whole of Cadbury or buying a large enough stake to prevent

Kraft from buying the British company.

"This is a developing story and all the details are under

discussion at the moment," one person said.

Ferrero didn't respond to email requests or phone calls.

The Italian company, which counts Ferrero Rocher, Tic-Tac and

Nutella among its products, has well over EUR2 billion in cash

available for a Cadbury offer, the people said. Ferrero's advisors

value the Italian company's share of any deal at over EUR5 billion,

they added.

Italian bank Mediobanca (MB.MI) and Rothschild are advising

Ferrero on the potential deal, and are working on a plan that could

split Cadbury's chocolate and gum businesses with Hershey, another

person involved in the talks said. Both Ferrero and Hershey are

interested in Cadbury's chocolate operations, the person added.

Meetings between members of the Ferrero family and its advisors

will continue in coming days, the people said.

According to press reports, Intesa Sanpaolo SpA (ISP.MI) and

UniCredit SpA (UCG.MI) could be involved in working on a deal in

the future.

Mediobanca, UniCredit and Intesa Sanpaolo all declined to

comment.

Pennsylvania-based candymaker Hershey, emboldened by improving

financial markets, and Ferrero separately said Wednesday that they

were reviewing their options regarding Cadbury.

Hershey Chief Executive David West in the last two weeks has

spoken with Ferrero bankers at least twice about teaming up to buy

Cadbury, one person familiar with the matter told the Wall Street

Journal earlier this week.

Cadbury has rejected an hostile cash-and shares offer from

Kraft, which currently values the British company at GBP9.9

billion, or 723 pence a share. Cadbury says Kraft's bid undervalues

the company, but has said it would consider any bid that it feels

offers value to its shareholders.

Analysts say a bid would have to be above 800 pence a share, and

at 1422 GMT Friday, Cadbury's shares were trading up 4 pence, or

0.6%, at 796 pence.

Cadbury has in the past looked into a possible merger with

Hershey, only for the plans to be scuppered by the Hershey Trust,

the charitable organization that controls the Pennsylvania

chocolate company. Hershey would struggle to buy Cadbury on its own

but could do so with help from Ferrero, while insuring The Hershey

Trust doesn't lose overall control of the group.

-By Sabrina Cohen, Dow Jones Newswires, +39 02 5821 9906;

sabrina.cohen@dowjones.com

(Gilles Castonguay contributed to this article.)

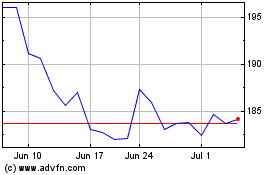

Hershey (NYSE:HSY)

Historical Stock Chart

From Sep 2024 to Oct 2024

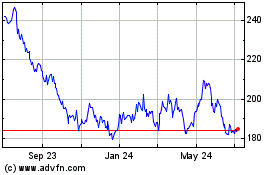

Hershey (NYSE:HSY)

Historical Stock Chart

From Oct 2023 to Oct 2024