2nd UPDATE: Hershey 3Q Profit Up 30%, Beats Expectations

October 22 2009 - 10:51AM

Dow Jones News

Hershey Co.'s (HSY) third-quarter earnings rose 30% and exceeded

expectations amid charges absorbed in the year-earlier period, but

sales fell as higher prices hurt volumes.

The candy maker said it expects the economic environment for

consumers in the U.S. and international markets to remain

challenging. For this year, Hershey gave a full-year earnings

outlook above Wall Street's current estimates.

Third-quarter earnings were $162 million, or 71 cents a share,

compared with $124.5 million, or 54 cents a share, a year earlier.

The latest period included charges of 2 cents a share compared with

10 cents a year earlier for a supply chain program. Sales fell to

$1.48 billion from $1.49 billion a year ago. Analysts polled by

Thomson Reuters expected earnings of 67 cents a share on revenue of

$1.5 billion.

Hershey's brands--which range from its namesake Kisses chocolate

to Twizzlers--have held up reasonably well during the recession as

consumers have turned away from premium chocolate to more

moderately priced fare. For the full year the company projected

earnings in the range of $2.12 to $2.14 a share, excluding items.

Analysts currently expect earnings of $2.08 a share.

On a conference call, Hershey executives said retail customer

Halloween orders are roughly on track with their expectations so

far.

Hershey has come into focus in recent weeks after Kraft Foods

Inc. (KFT) unveiled an offer for Cadbury PLC (CBY). That move

raised speculation that Hershey might consider a counterbid.

But Hershey remained stymied in its ability to assemble a bid

for Cadbury, The Wall Street Journal reported at the end of

September. Hershey has no financing or strategic plan for a bid as

of the time of the Journal report, according to people familiar

with the matter.

Hershey is controlled by the Hershey Trust, which does

charitable work and is a trustee of a school for children in need.

That trust has said it will retain its controlling interest in the

chocolate company, essentially indicating that it won't be open to

any kind of a deal that would involve the company giving up its

independence.

On Thursday's conference call Hershey said it wouldn't comment

on industry merger and acquisition matters. Chief Executive David

West instead said that macroeconomic pressures and commodity

fluctuations are the biggest issues driving the category right now.

"The biggest impacts are really macroeconomic," he said. "Obviously

we continue to monitor competitors...We continue to come back to

what our strengths are in our U.S. market."

For 2010, Hershey said it expects sales growth to be within the

range of 3% to 5% and earnings excluding items to rise 6% to 8%,

both within its long-term goals. The 2010 forecast could be viewed

as disappointing, wrote Stifel Nicolaus analyst Chris Growe. At

present, his $2.29 estimate for 2010 assumes about 9% growth in

per-share earnings.

-By Anjali Cordeiro, Dow Jones Newswires; 212-416-2200;

anjali.cordeiro@dowjones.com

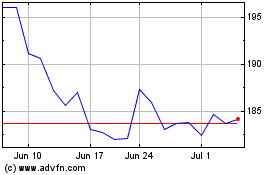

Hershey (NYSE:HSY)

Historical Stock Chart

From Sep 2024 to Oct 2024

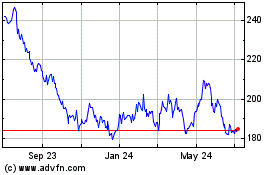

Hershey (NYSE:HSY)

Historical Stock Chart

From Oct 2023 to Oct 2024