Risk, Reward Balance Noble - Analyst Blog

June 03 2011 - 1:28PM

Zacks

We maintain our Neutral recommendation for Noble

Corporation (NE) as disappointing first quarter results

and the effect of the drilling ban in the Gulf of Mexico (GoM) were

balanced by rising commodity prices as well as improvements in

international jackup markets.

Noble registered depressed first quarter 2011 earnings due to

lingering concerns related to GoM drill ban last year and thereby

experienced lower utilization and dayrate.

Again, Noble's existing fleet is fairly challenged with several

older, less capable assets facing a tough demand environment. On

the arrival of newbuild rigs into the market, many of the company’s

older rigs, floaters as well as numerous jackups will face the

threat of departure, resulting in a risk of earnings dilution from

the retirement of older spec rigs. Hence, Noble’s old and less

efficient fleet in a cutthroat environment could prove

detrimental.

However, offshore drillers are enjoying improved market

conditions with an uptrend in oil prices and better bidding

activity. Importantly, the recovery in the international jackup

market is coinciding with a return to the GoM, which we believe

bodes well for Noble.

With continued increase in tender activity as well as the influx

of contracts globally, management remains optimistic about broader

recovery in jackup demand, led by the North Sea, Mexico, Southeast

Asia and the Middle East. Notably, Noble believes that North Sea

jackup dayrates will soon exceed $100,000 due to the building

backlog and strong bidding activity for 2012.

Like other offshore contract drillers, Noble has also initiated

to evaluate its existing fleet to determine the future of non-core

assets. The company is aggressively upgrading its fleet through

newbuilds and acquisitions, which will add to its earnings

power.

With a strong balance sheet and low debt (last quarter’s

debt-to-capitalization ratio stood at 29.2%), we believe the

company can easily fund the current newbuild program. We also

expect the deepwater market segment to deliver strong growth for

the foreseeable future. With the company’s strong backlog position

(approximately $13.1 billion), Noble’s earnings and cash flow

visibility will be more promising in the near to medium term.

The company, like its competitors Diamond Offshore

Drilling Inc. (DO) and Helmerich & Payne

Inc. (HP), holds a Zacks #3 Rank, which translates to a

short-term Hold rating.

DIAMOND OFFSHOR (DO): Free Stock Analysis Report

HELMERICH&PAYNE (HP): Free Stock Analysis Report

NOBLE CORP (NE): Free Stock Analysis Report

Zacks Investment Research

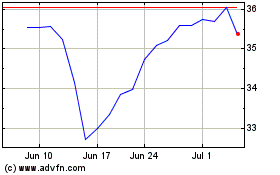

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Apr 2024 to May 2024

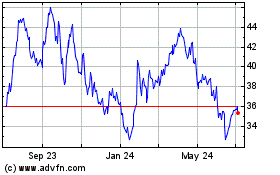

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From May 2023 to May 2024