- Amended Statement of Ownership (SC 13G/A)

February 02 2010 - 4:48PM

Edgar (US Regulatory)

Schedule 13G Page _____ of _____ Pages

1 6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. ___)*

25

HELMERICH & PAYNE, INC.

(Name of Issuer)

COMMON SHARES

(Title of Class of Securities)

423452101

(Cusip Number)

12/31/2009

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this

Schedule is filed:

[X] Rule 13d-1(b)

[ ] Rule 13d-1(c)

[ ] Rule 13d-1(d)

*The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class

of securities, and for any subsequent amendment containing information

which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not

be deemed to be "filed" for the purpose of Section 18 of the Securities

Exchange Act of 1934 ("Act") or otherwise subject to the liabilities

of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

Schedule 13G Page _____ of _____ Pages

2 6

CUSIP No. ___423452101 ___

___________________________________________________

1. Name of Reporting Person and I.R.S. Identification No.:

State Farm Mutual Automobile Insurance Company 37-0533100

___________________________________________________

2. Check the appropriate box if a Member of a Group

(a) _____

(b) __X__

___________________________________________________

3. SEC USE ONLY:

___________________________________________________

4. Citizenship or Place of Organization: Illinois

___________________________________________________

Number of 5. Sole Voting Power: 8,257,200

Shares ___________________________________________________

Beneficially 6. Shared Voting Power: 0

Owned by ___________________________________________________

Each 7. Sole Dispositive Power: 8,257,200

Reporting ___________________________________________________

Person With 8. Shared Dispositive Power: 0

___________________________________________________

9. Aggregate Amount Beneficially Owned by each Reporting Person: 8,257,200

___________________________________________________

10. Check Box if the Aggregate Amount in Row 9 excludes Certain Shares: ____

___________________________________________________

11. Percent of Class Represented by Amount in Row 9: 7.81 %

___________________________________________________

12. Type of Reporting Person: IC

Schedule 13G Page _____ of _____ Pages

3 6

Item 1(a) and (b). Name and Address of Issuer & Principal Executive Offices:

_________________________________________________________

HELMERICH & PAYNE, INC.

1437 SOUTH BOULDER AVE.

TULSA, OK 74119-3623

Item 2(a). Name of Person Filing: State Farm Mutual Automobile Insurance

_____________________

Company and related entities; See Item 8

and Exhibit A

Item 2(b). Address of Principal Business Office: One State Farm Plaza

____________________________________

Bloomington, IL 61710

Item 2(c). Citizenship: United States

___________

Item 2(d) and (e). Title of Class of Securities and Cusip Number: See above.

_____________________________________________

Item 3. This Schedule is being filed, in accordance with 240.13d-1(b).

_____________________________________________________________

See Exhibit A attached.

Item 4(a). Amount Beneficially Owned: 8,257,200 shares

_________________________

Item 4(b). Percent of Class: 7.81 percent pursuant to Rule 13d-3(d)(1).

________________

Item 4(c). Number of shares as to which such person has:

____________________________________________

(i) Sole Power to vote or to direct the vote: 8,257,200

(ii) Shared power to vote or to direct the vote: 0

(iii) Sole Power to dispose or to direct disposition of: 8,257,200

(iv) Shared Power to dispose or to direct disposition of:0

Item 5. Ownership of Five Percent or less of a Class: Not Applicable.

____________________________________________

Item 6. Ownership of More than Five Percent on Behalf of Another Person: N/A

_______________________________________________________________

Item 7. Identification and Classification of the Subsidiary Which Acquired

__________________________________________________________________

the Security being Reported on by the Parent Holding Company: N/A

______________________________________________________________

Item 8. Identification and Classification of Members of the Group:

_________________________________________________________

See Exhibit A attached.

Item 9. Notice of Dissolution of Group: N/A

______________________________

Schedule 13G Page _____ of _____ Pages

4 6

Item 10. Certification. By signing below I certify that, to the best of

my knowledge and belief, the securities referred to above were

acquired in the ordinary course of business and were not acquired

for the purpose of and do not have the effect of changing or

influencing the control of the issuer of such securities and were

not acquired in connection with or as a participant in any

transaction having such purpose or effect.

Signature

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true,

complete and correct.

01/29/2010 STATE FARM MUTUAL AUTOMOBILE

_________________________________

Date INSURANCE COMPANY

STATE FARM LIFE INSURANCE COMPANY

STATE FARM FIRE AND CASUALTY

COMPANY

STATE FARM INSURANCE COMPANIES STATE FARM INVESTMENT MANAGEMENT

EMPLOYEE RETIREMENT TRUST CORP.

STATE FARM INSURANCE COMPANIES STATE FARM ASSOCIATES FUNDS

SAVINGS AND THRIFT PLAN FOR TRUST - STATE FARM GROWTH FUND

U.S. EMPLOYEES

STATE FARM ASSOCIATES FUNDS

TRUST - STATE FARM BALANCED

FUND

STATE FARM MUTUAL FUND TRUST

_________________________________ /s/ Paul N. Eckley

_________________________________

Paul N. Eckley, Fiduciary of Paul N. Eckley, Vice President

each of the above of each of the above

Schedule 13G Page _____ of _____ Pages

5 6

EXHIBIT A

This Exhibit lists the entities affiliated with State Farm Mutual

Automobile Insurance Company ("Auto Company") which might be deemed to

constitute a "group" with regard to the ownership of shares reported

herein.

Auto Company, an Illinois-domiciled insurance company, is the parent

company of multiple wholly owned insurance company subsidiaries,

including State Farm Life Insurance Company, and State Farm Fire and

Casualty Company. Auto Company is also the parent company of State

Farm Investment Management Corp. ("SFIMC"), which is a registered

transfer agent under the Securities Exchange Act of 1934 and a

registered investment advisor under the Investment Advisers Act of

1940. SFIMC serves as transfer agent and investment adviser to State

Farm Associates' Funds Trust, State Farm Variable Product Trust, and

State Farm Mutual Fund Trust, three Delaware Business Trusts that are

registered investment companies under the Investment Company Act of

1940. Auto Company also sponsors two qualified retirement plans for

the benefit of its employees, which plans are named the State Farm

Insurance Companies Employee Retirement Trust and the State Farm

Insurance Companies Savings and Thrift Plan for U.S. Employees

(collectively the "Qualified Plans").

As part of its corporate structure, Auto Company has established an

Investment Department. The Investment Department is directly or

indirectly responsible for managing or overseeing the management of

the investment and reinvestment of assets owned by each person that

has joined in filing this Schedule 13G. Moreover, the Investment

Department is responsible for voting proxies or overseeing the voting

of proxies related to issuers the shares of which are held by one or

more entities that have joined in filing this report. Each insurance

company included in this report and SFIMC have established an

Investment Committee that oversees the activities of the Investment

Department in managing the firm's assets. The Trustees of the

Qualified Plans perform a similar role in overseeing the investment of

each plan's assets.

Pursuant to Rule 13d-4 each person listed in the table below

expressly disclaims "beneficial ownership" as to all shares as to

which such person has no right to receive the proceeds of sale of the

security and disclaims that it is part of a "group".

Schedule 13G Page _____ of _____ Pages

6 6

Number of

Shares based

Classification on Proceeds

Name Under Item 3 of Sale

____ ______________ ____________

State Farm Mutual Automobile Insurance Company IC 8,257,200 shares

State Farm Life Insurance Company IC 0 shares

State Farm Fire and Casualty Company IC 0 shares

State Farm Investment Management Corp. IA 0 shares

State Farm Associates Funds Trust - State

Farm Growth Fund IV 0 shares

State Farm Associates Funds Trust - State

Farm Balanced Fund IV 0 shares

State Farm International Life Insurance

Company Ltd. IV 0 shares

State Farm Insurance Companies Employee

Retirement Trust EP 0 shares

State Farm Insurance Companies Savings and

Thrift Plan for U.S. Employees EP

Equities Account 0 shares

Balanced Account 0 shares

State Farm Mutual Fund Trust IV 0 shares

-----------------

8,257,200 shares

|

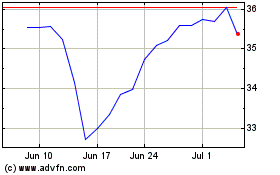

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From May 2024 to Jun 2024

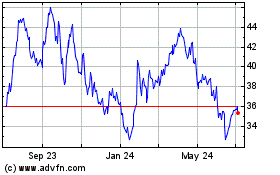

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Jun 2023 to Jun 2024